Reverse Goldilocks Coming?

Reverse Goldilocks Coming?

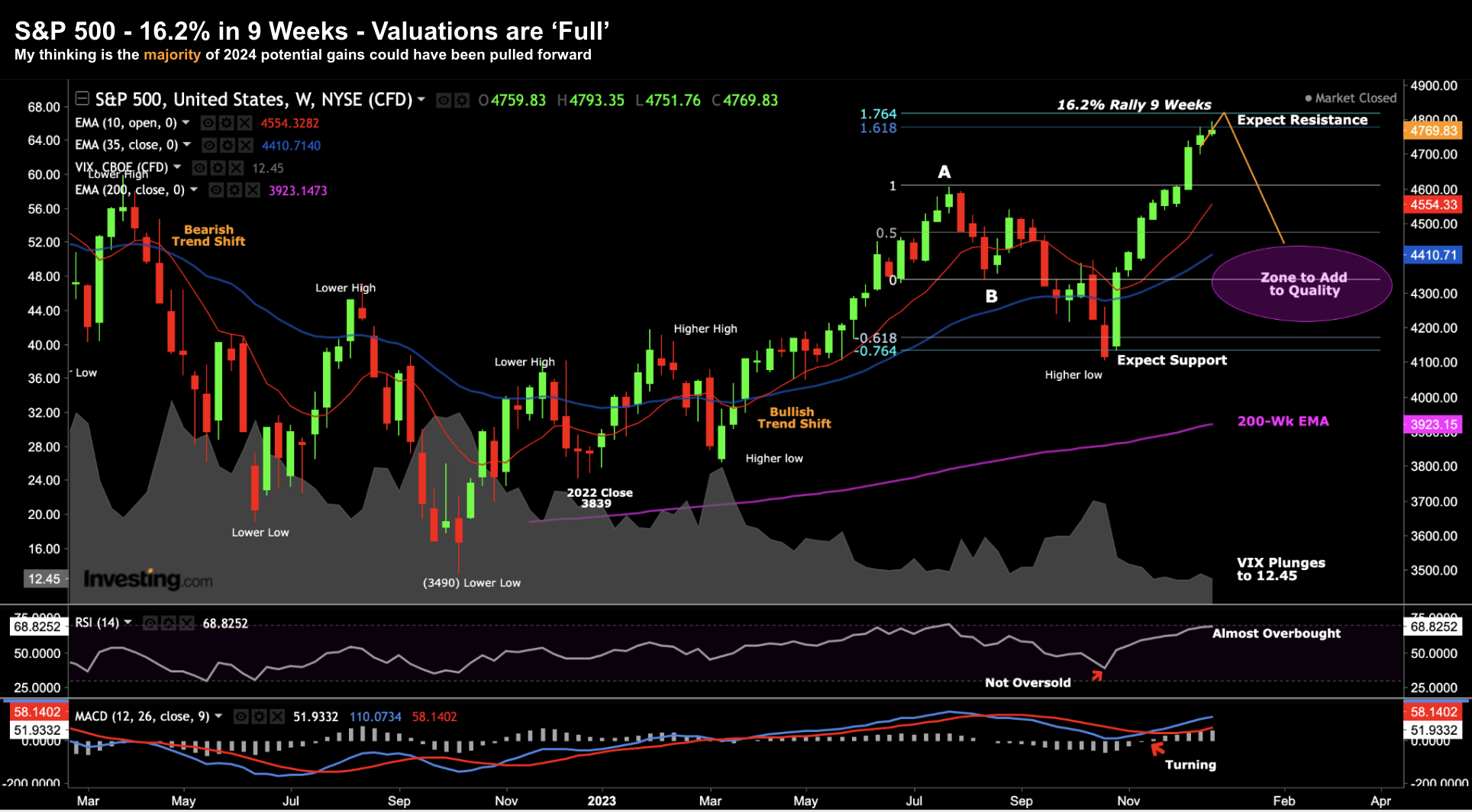

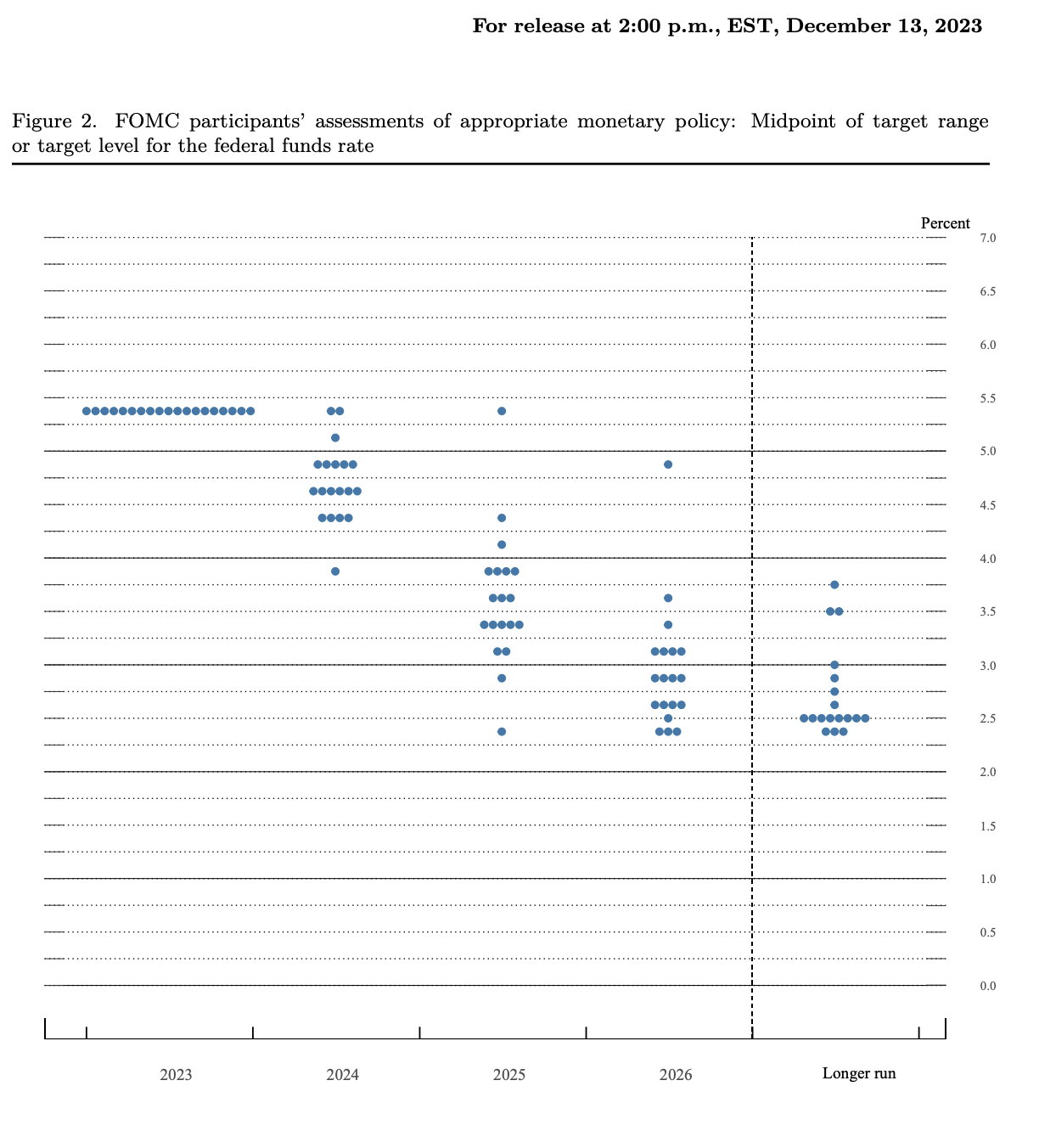

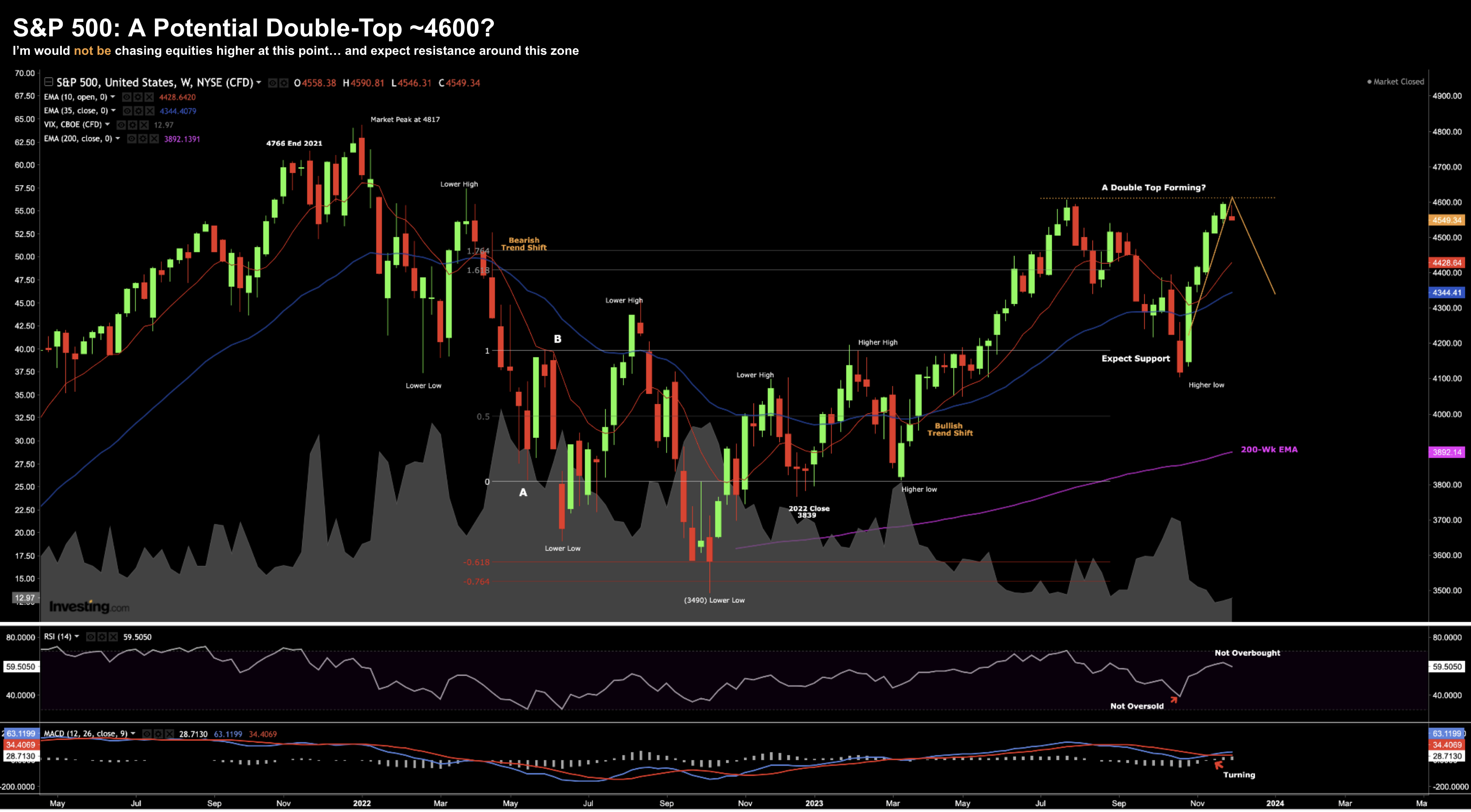

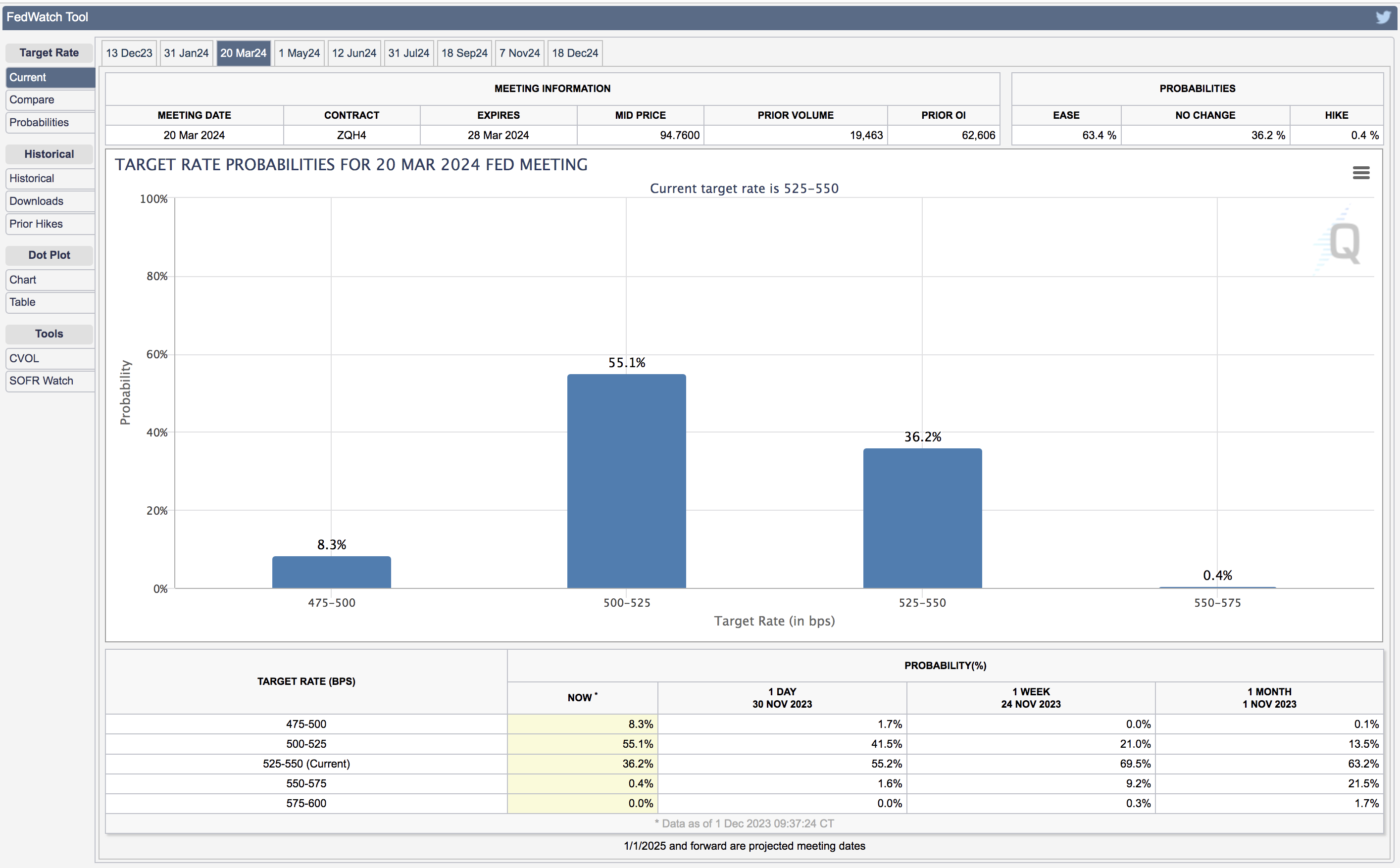

2024 has not started the way we ended 2023. From mine, late last year feels a lot like what we saw at the end of 2021 (and early 2022). At the time, investors chased momentum in fear of missing out ('FOMO') - pushing multiples into what I considered 'higher risk' territory (i.e., above 20x forward). It was a time to lower exposure. As we start the new year - stocks are taking a pause. And it's not unexpected given the sharp run higher. However it begs the question... could it be something more than a pause? Of course we don't know the answer (no-one does). Where there is uncertainty - all we have are probabilities.