Are Bond Yields and Oil Cracking?

Are Bond Yields and Oil Cracking?

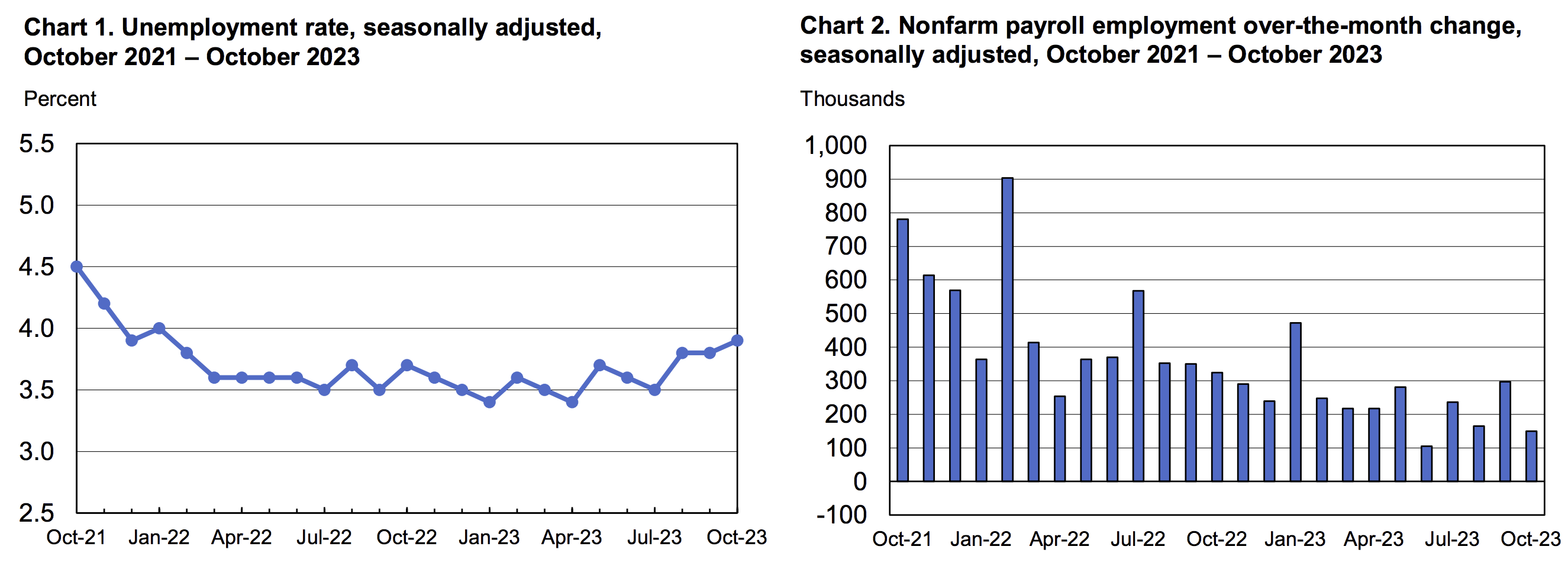

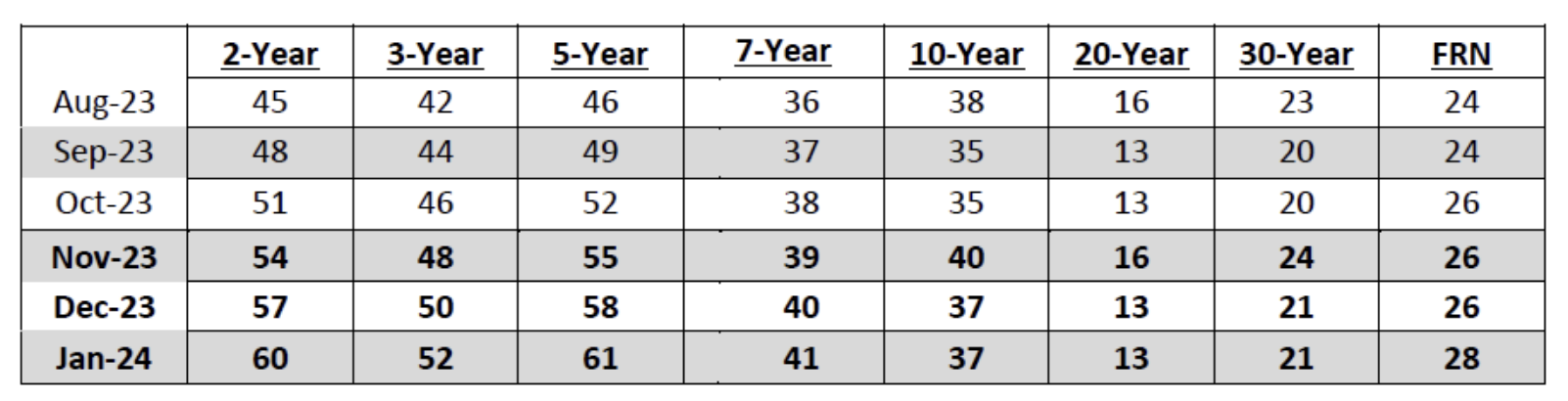

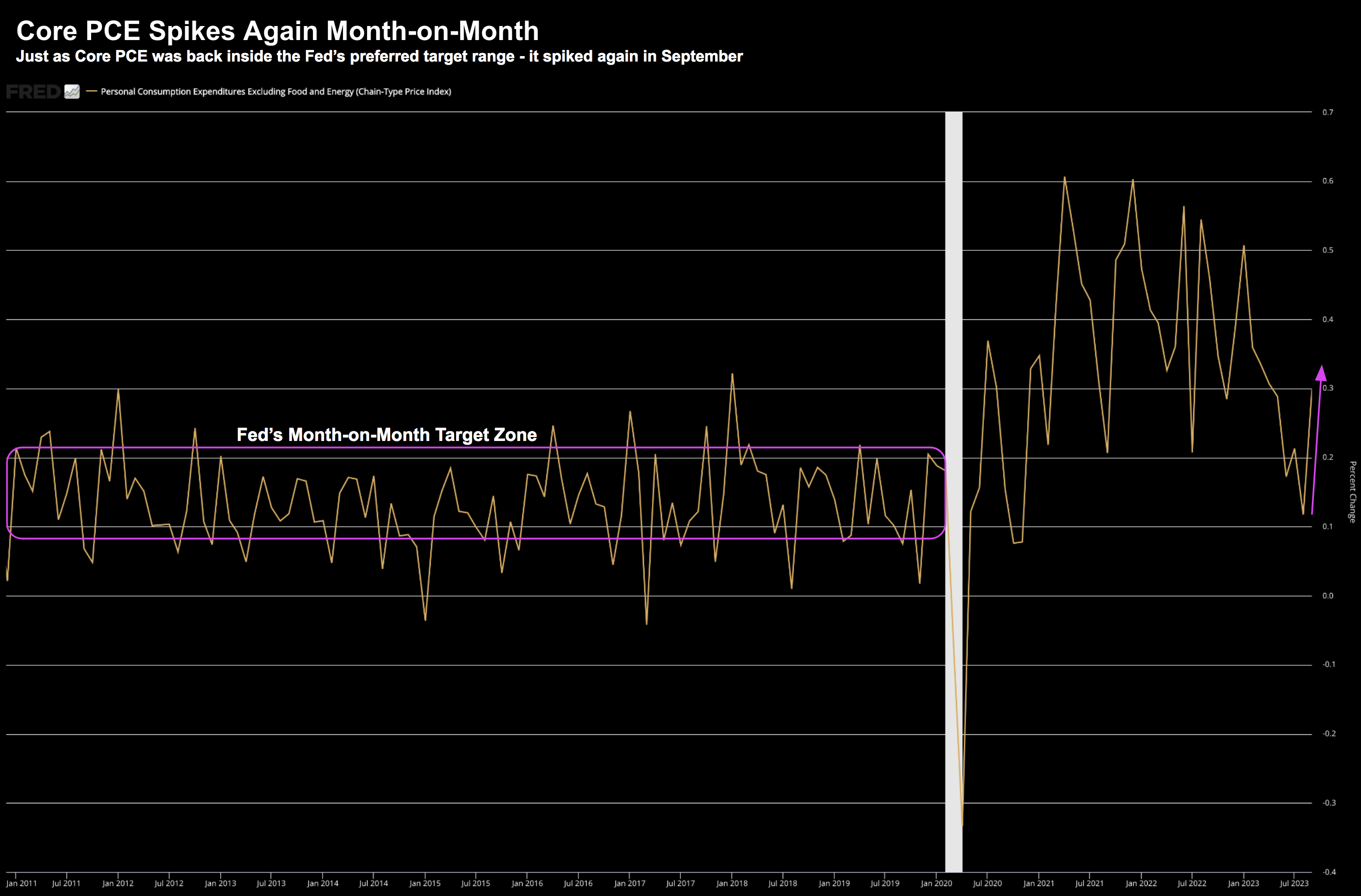

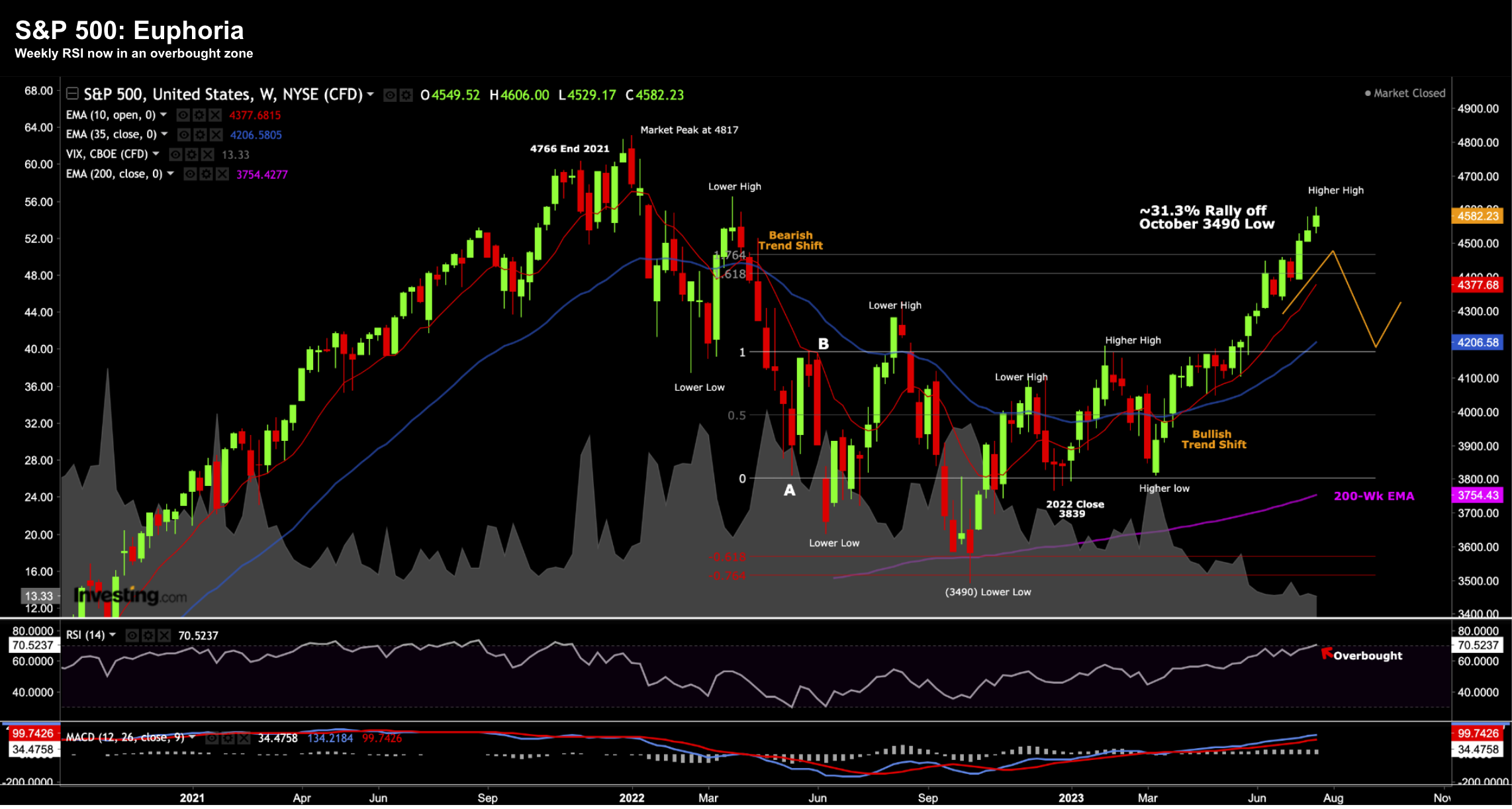

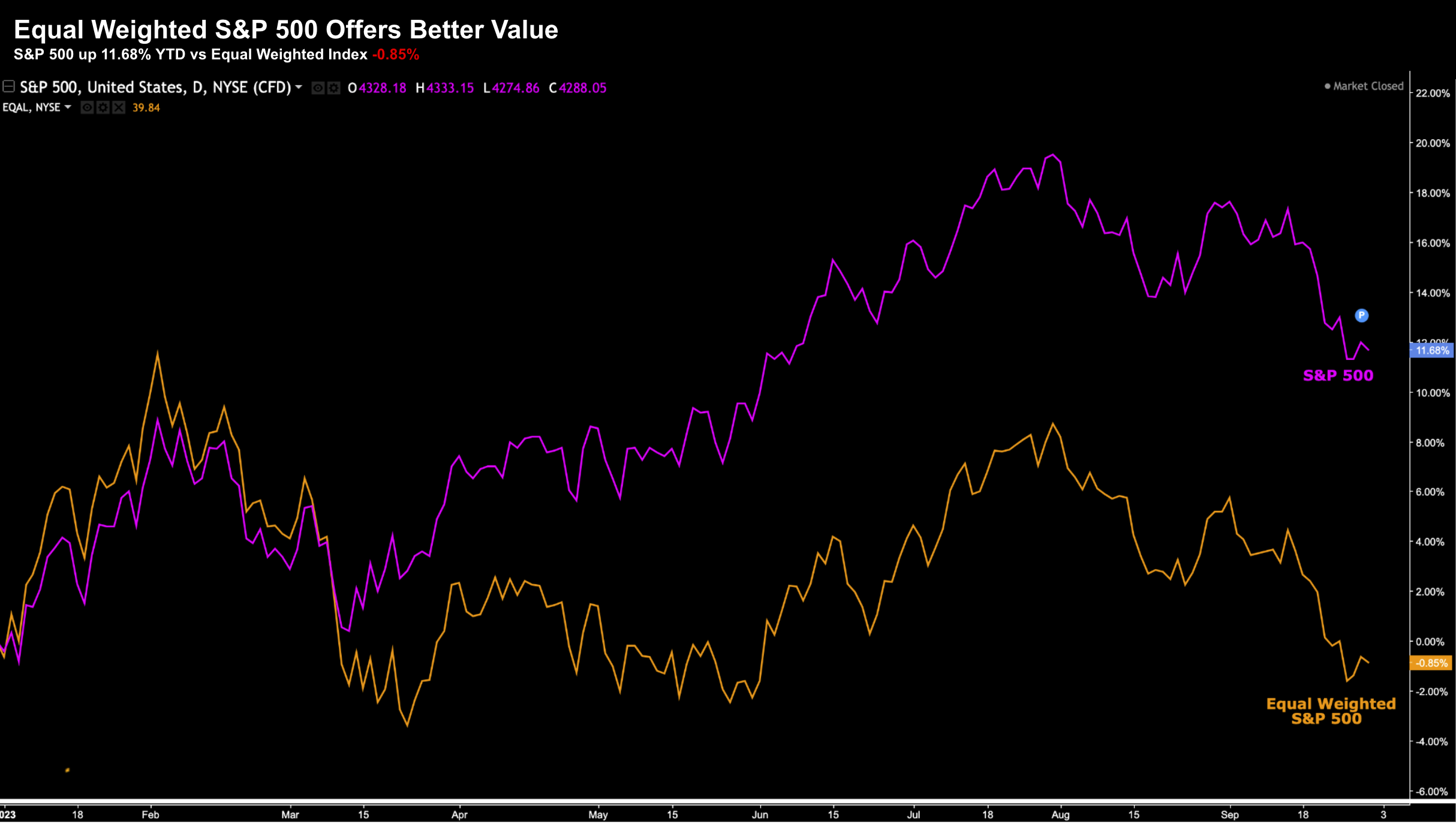

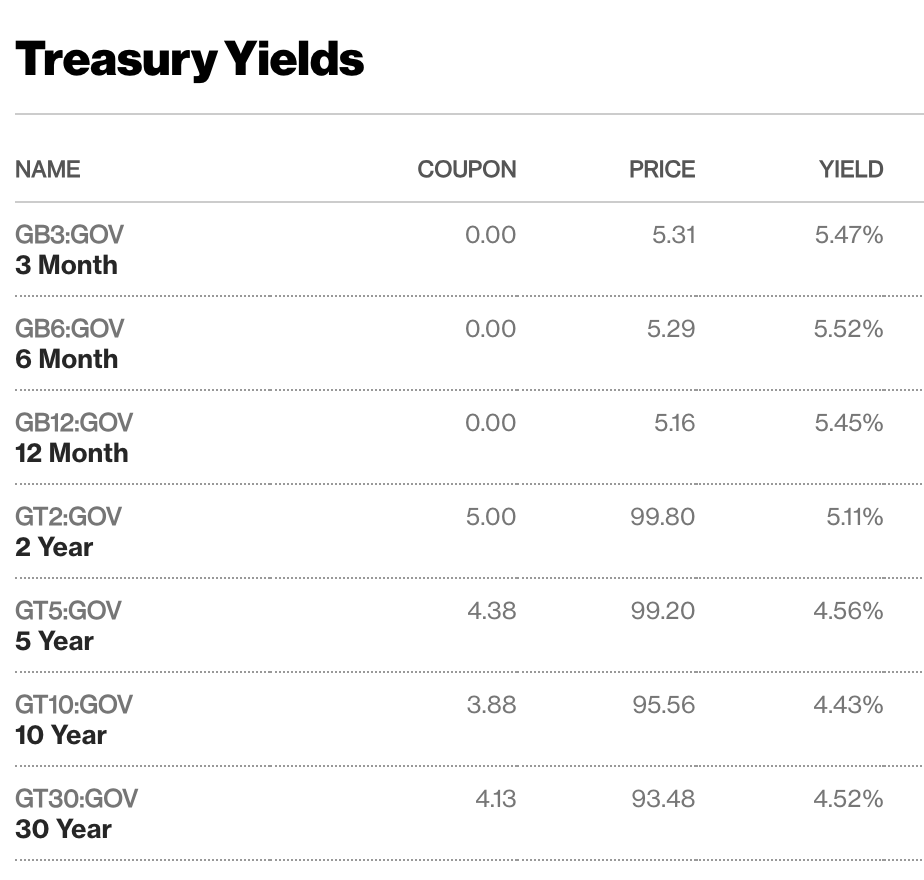

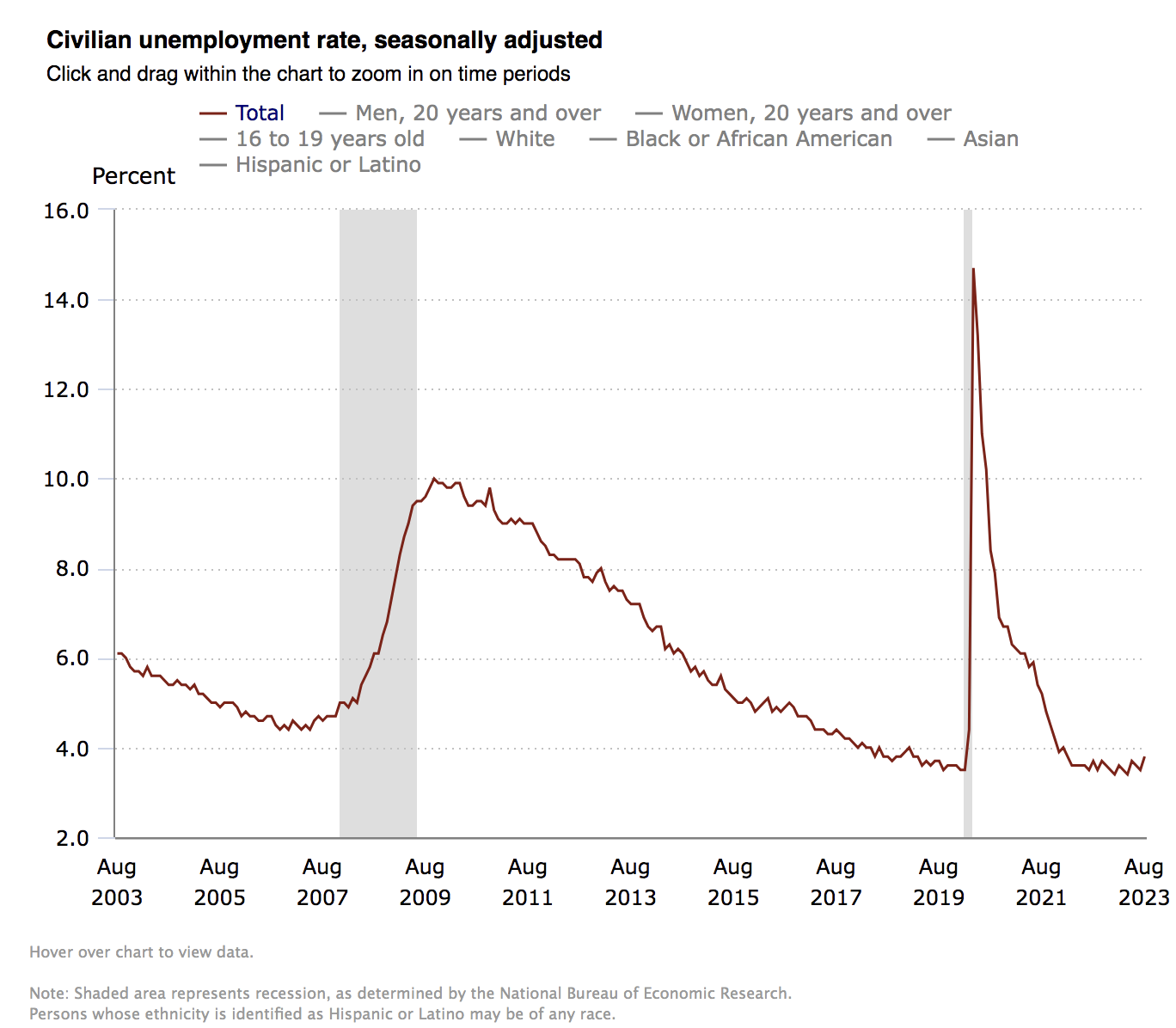

Today was an important day in the bond market. The US Treasury auctioned $40B of 10-Year notes. Coming into the auction - I was worried there would not be a decent bid. For example, if we faced further buyer's strike - these yields were likely to resume their path higher. However, we saw the opposite. The 10-year yield drifted lower. So what does this tell us about future economic growth? Are investors worried? In addition, the price of WTI Crude is also sharply lower... back below US$80/bbl on concerns of weakening demand. Are equities slow to connect the dots - as they are headed in the opposite direction.