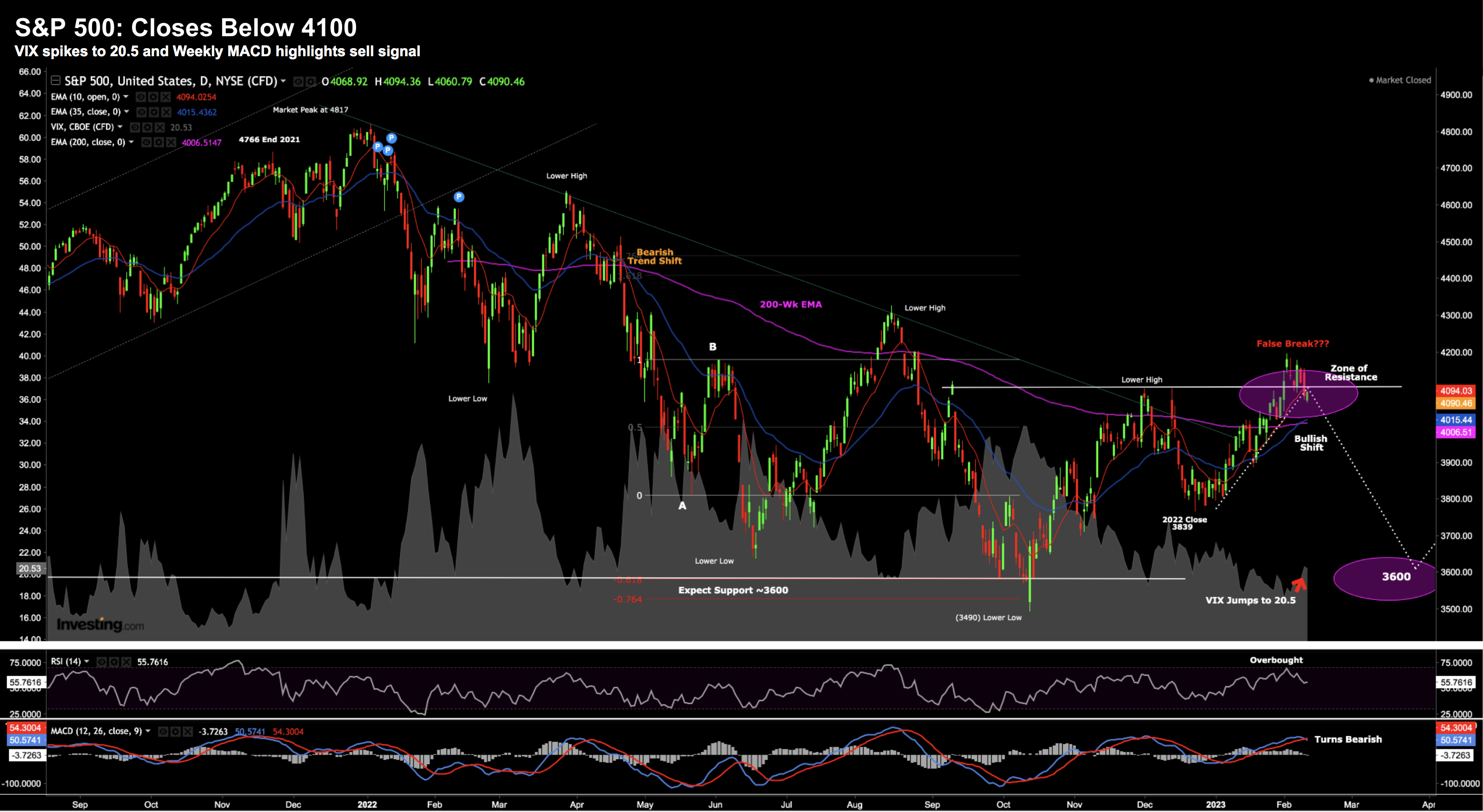

S&P 500: ‘False Break’ Warns of Pullback

S&P 500: ‘False Break’ Warns of Pullback

This week the S&P 500 performed a 'false break' of its previous 4100 high. Technicians see this as a reliable reversal signal. However, on the other hand, there are bullish arguments we can make. The mix of bullish and bearish technical signals make shorter-term 'tactical' trading very difficult (that's not my game). Here's how I'm thinking about it...