One Big Beautiful Inflation Bill

One Big Beautiful Inflation Bill

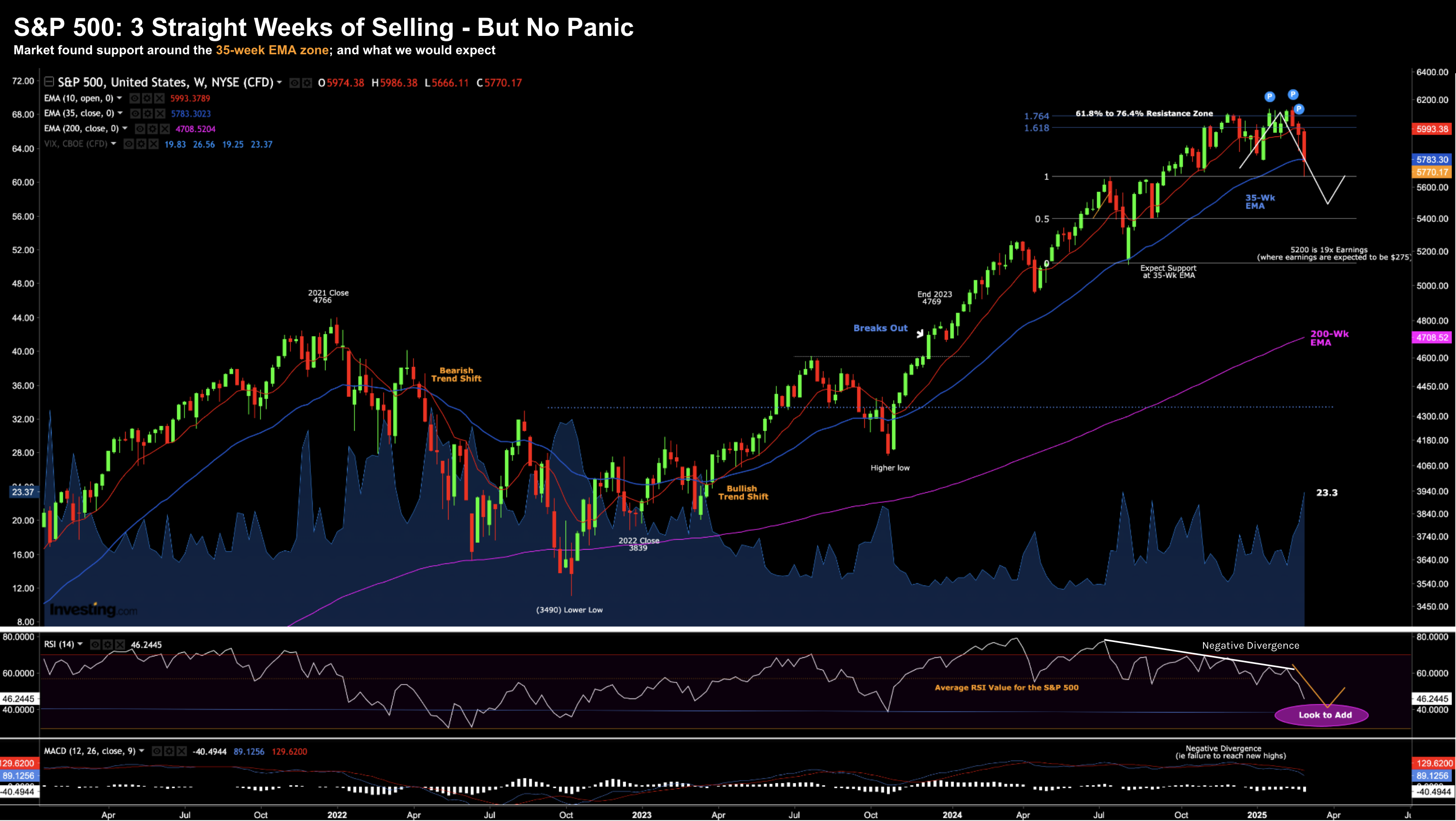

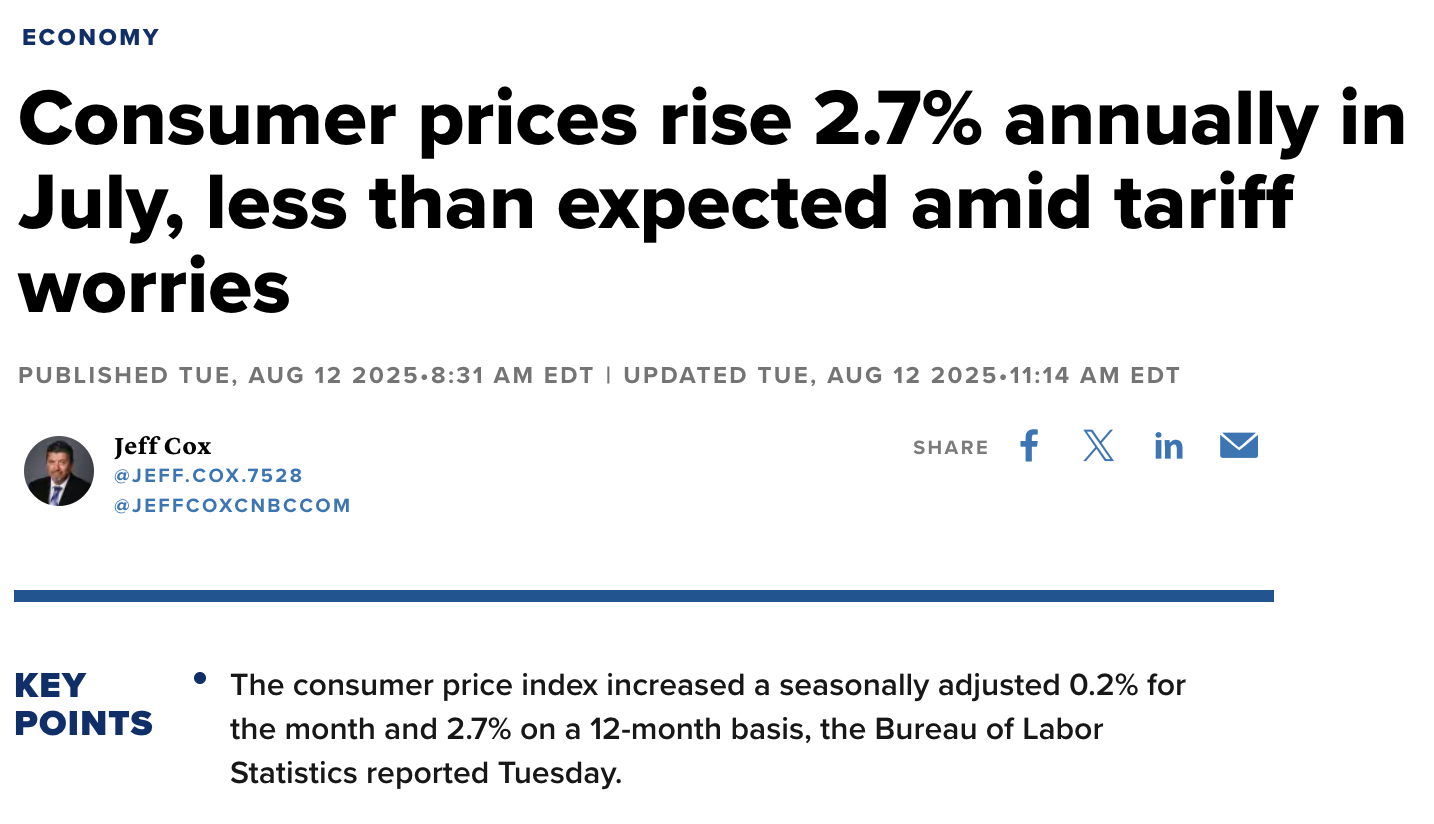

Market speculators held their breath for the latest inflation data, betting on a "soft" reading that would pave the way for a long-awaited rate cut. With stocks at record highs, their hopes were clearly pinned on a favorable outcome. While the headline CPI number was lower than expected, the Fed's preferred measure of core inflation, which excludes food and energy, continues to creep higher. This suggests that prices for most goods and services are still on the rise. Meanwhile, a chorus of voices, including political appointees, are urging the Fed to cut rates.