A Very Complacent Market…

A Very Complacent Market…

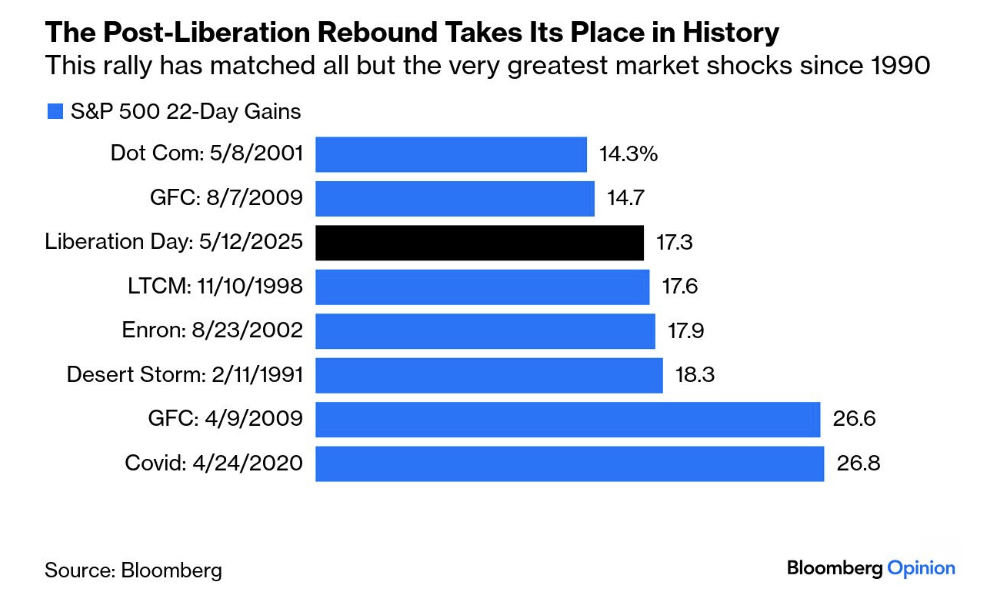

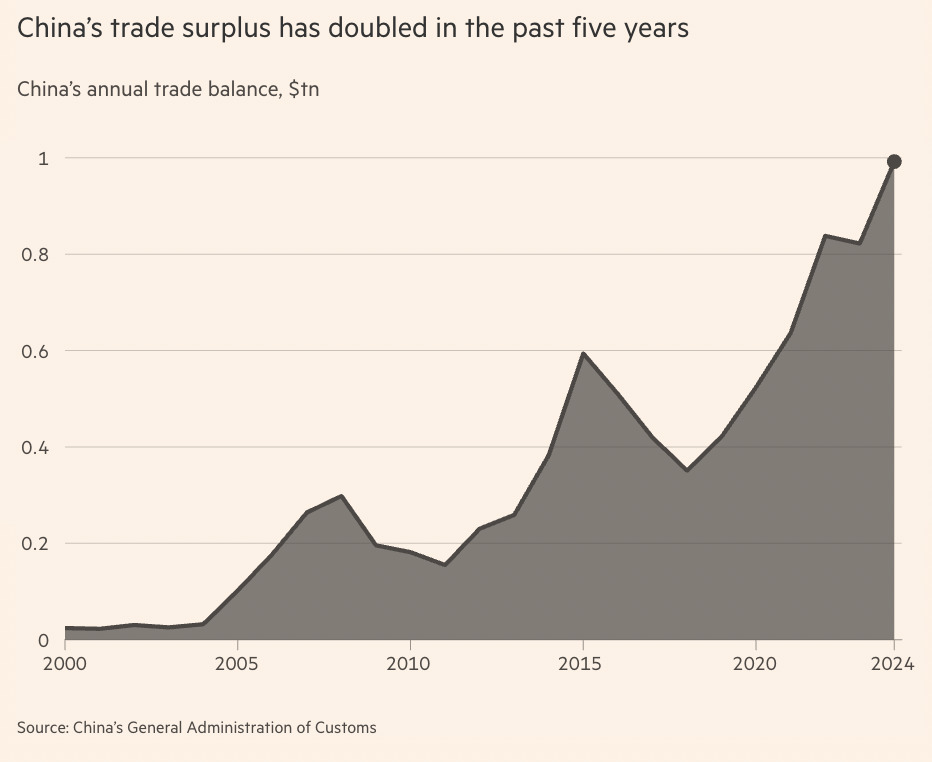

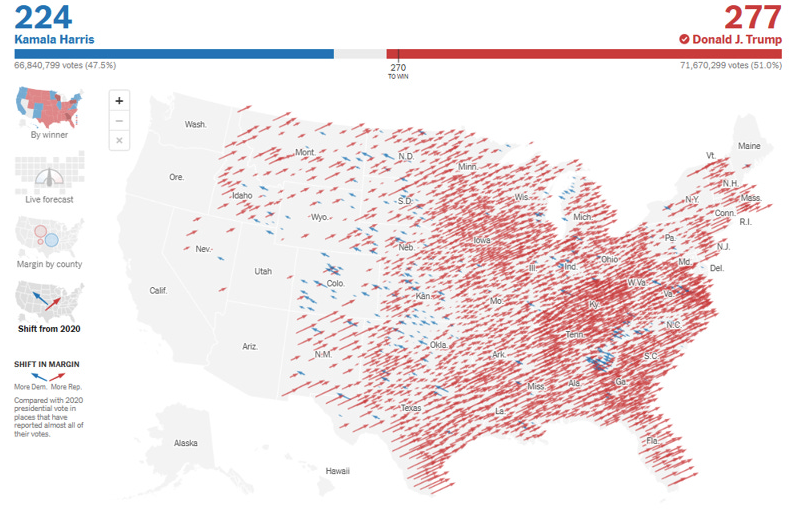

Recent developments in Trump's draconian trade policies — marked by steep tariffs, fluctuating commodity markets and geopolitical maneuvers — present a highly complex and uncertain landscape. Despite dramatic announcements and headline-grabbing tariff threats, markets have remained oddly resilient, while underlying forces quietly shift. For e.g., Trump's imposition of steep tariffs—such as 200% on pharmaceuticals and 50% on copper—has less to do with traditional economic rationale and more with political leverage