Uncertainty Weighs

Uncertainty Weighs

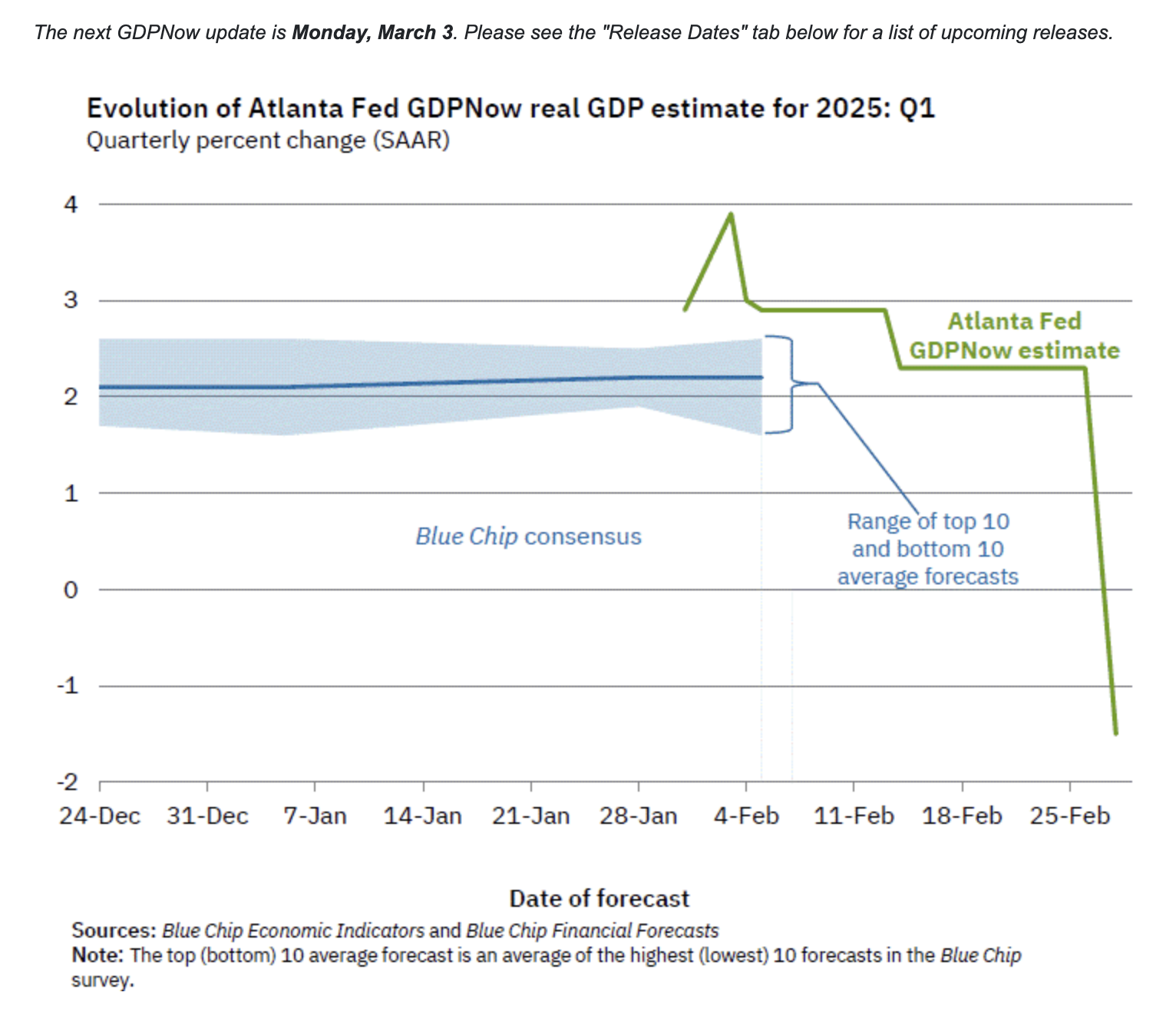

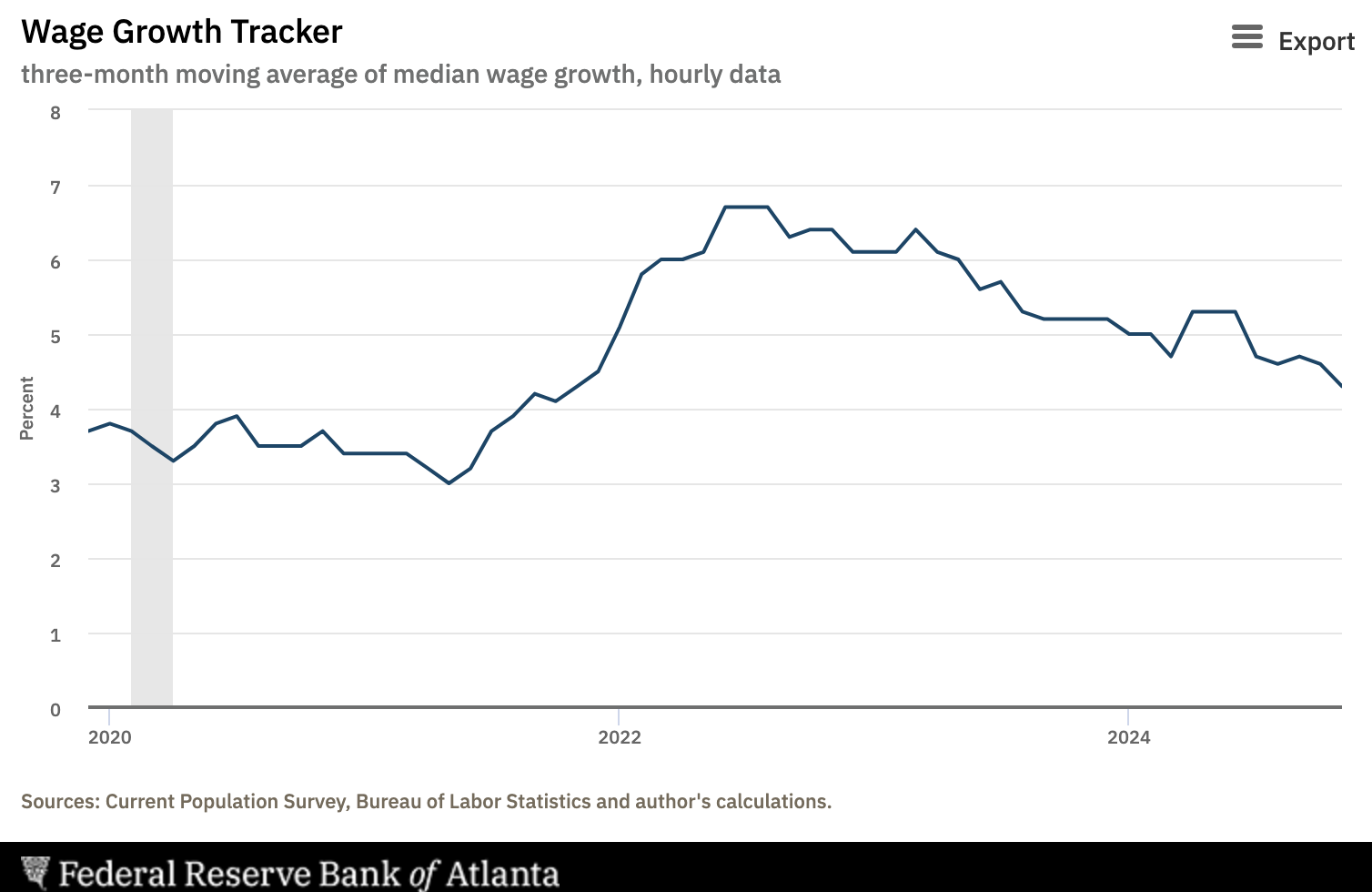

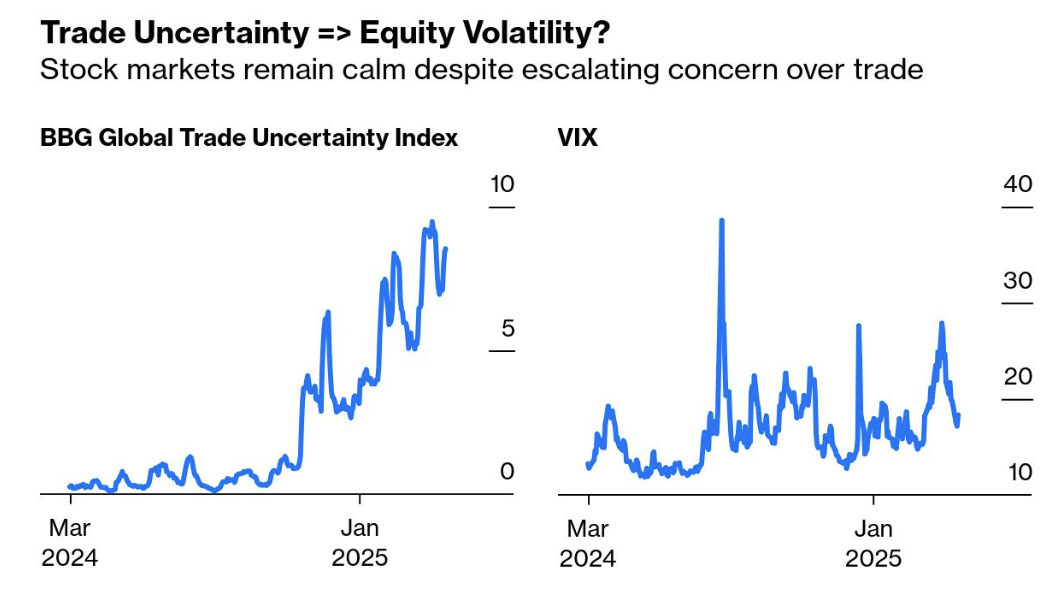

It doesn't take much these days to knock investors off balance. This week it was Trump's 25% on auto tariffs and a slightly hotter-than-expected inflation print. Tariffs are inflationary... a tax on the consumer. And with (services) inflation remaining stubborn... it gives the Fed very little wiggle room to cut rates. In combination with various geopolitical developments and aggressive government spending cuts from the Department of Government Efficiency (DOGE) - this has pushed policy uncertainty to its highest levels since late 2020.