Price vs Value

Price vs Value

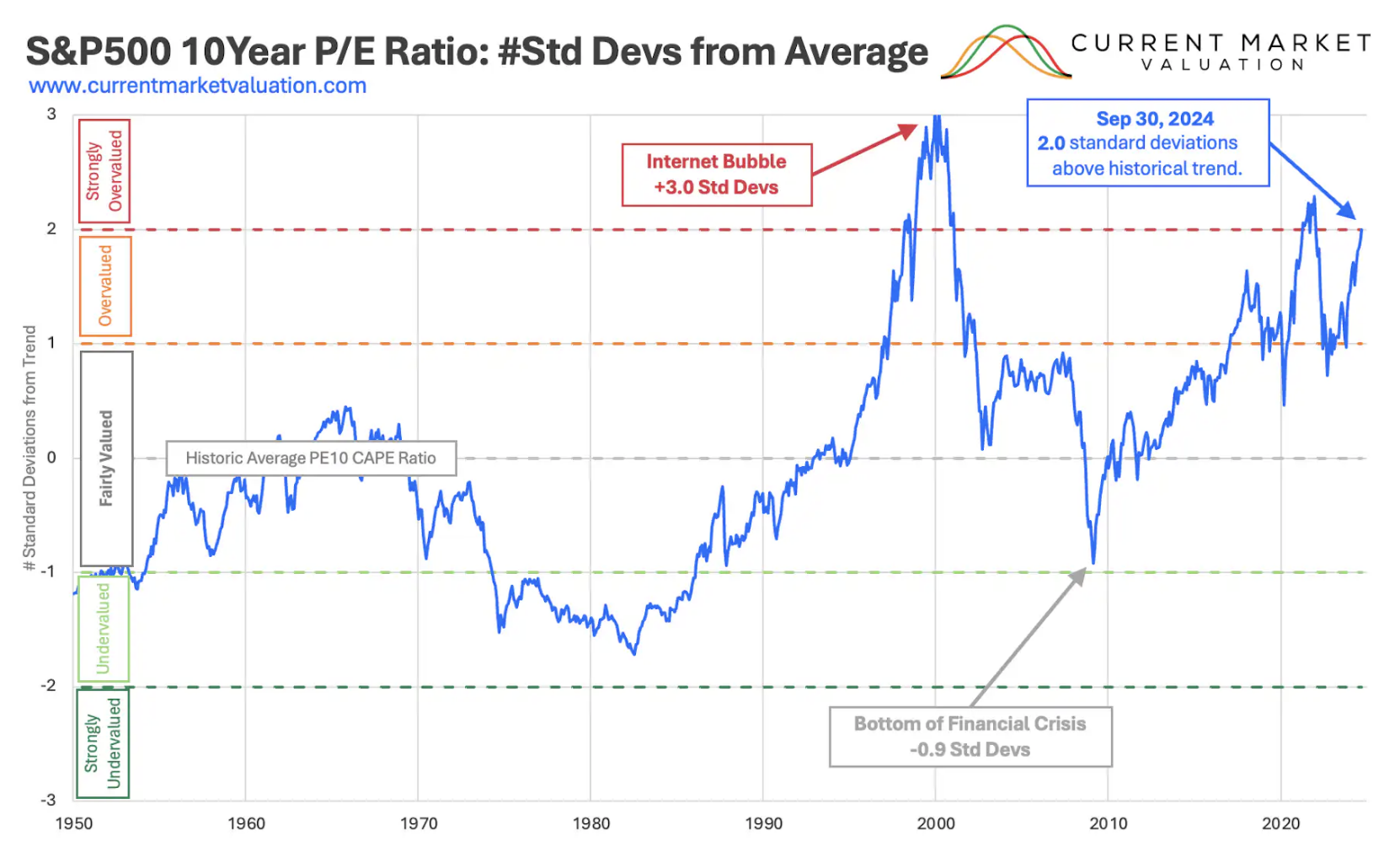

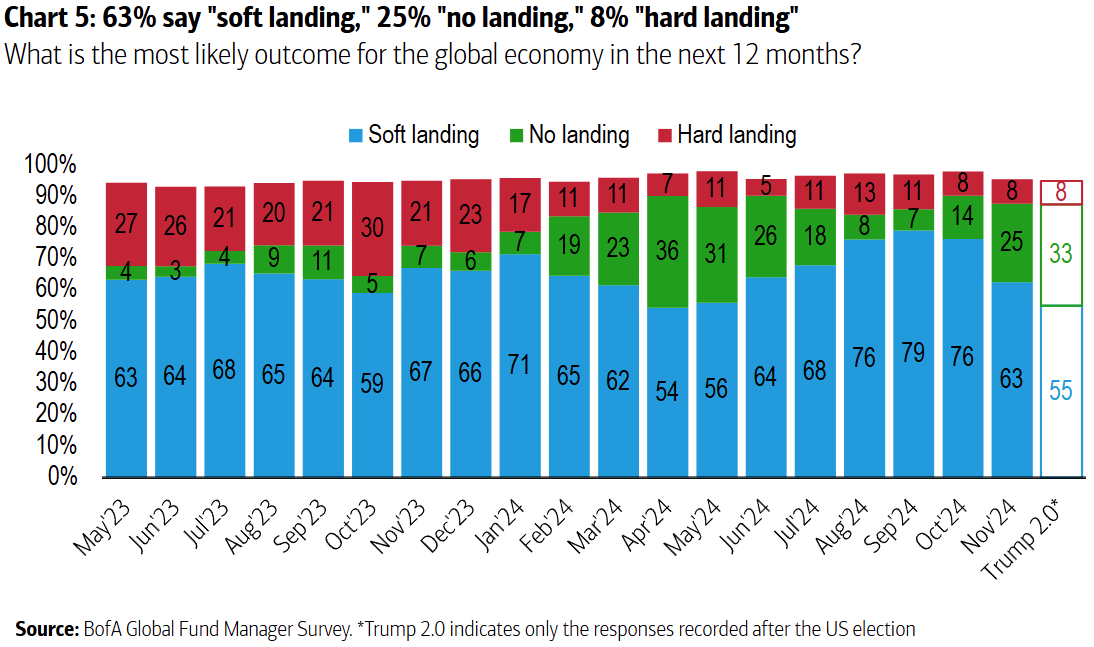

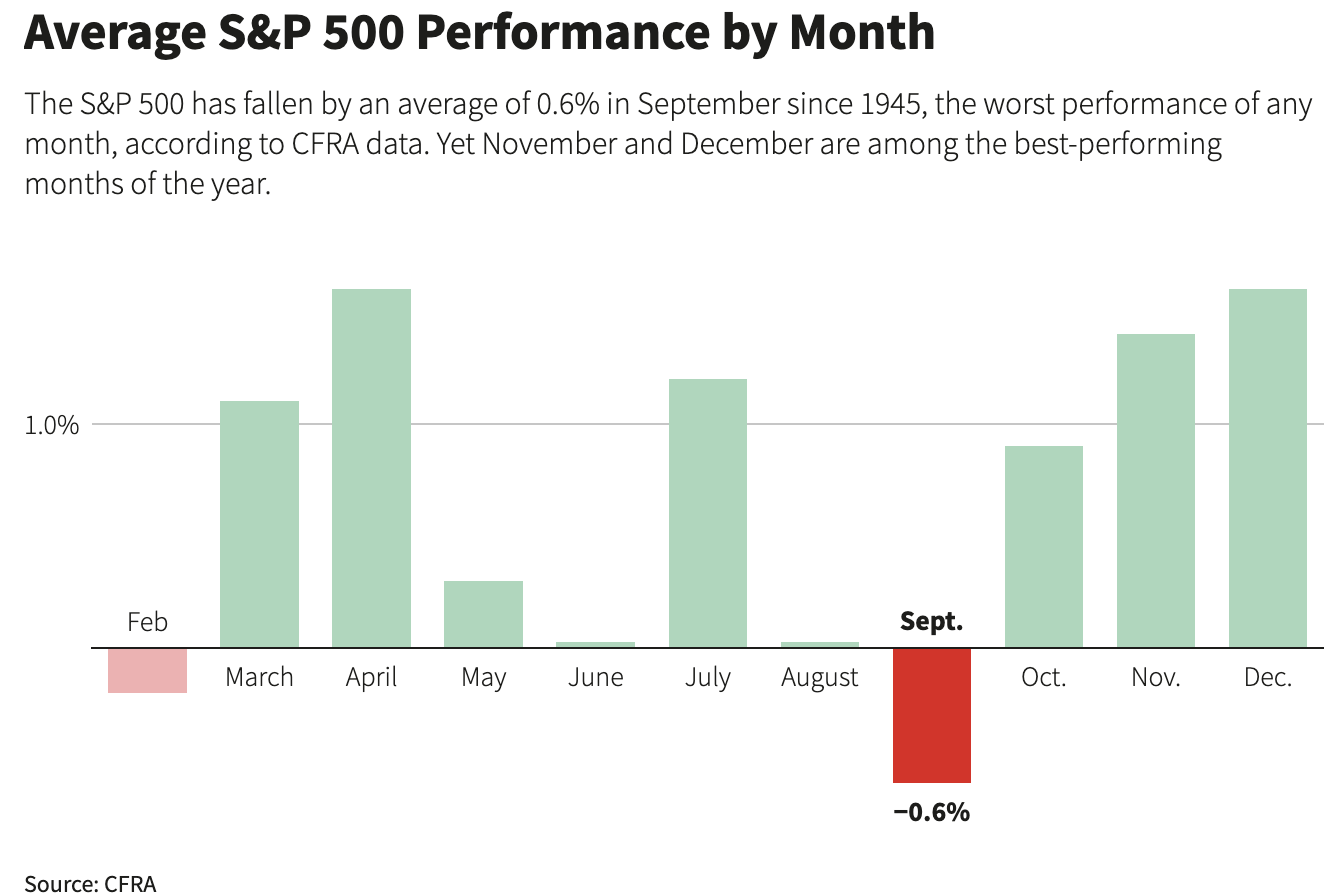

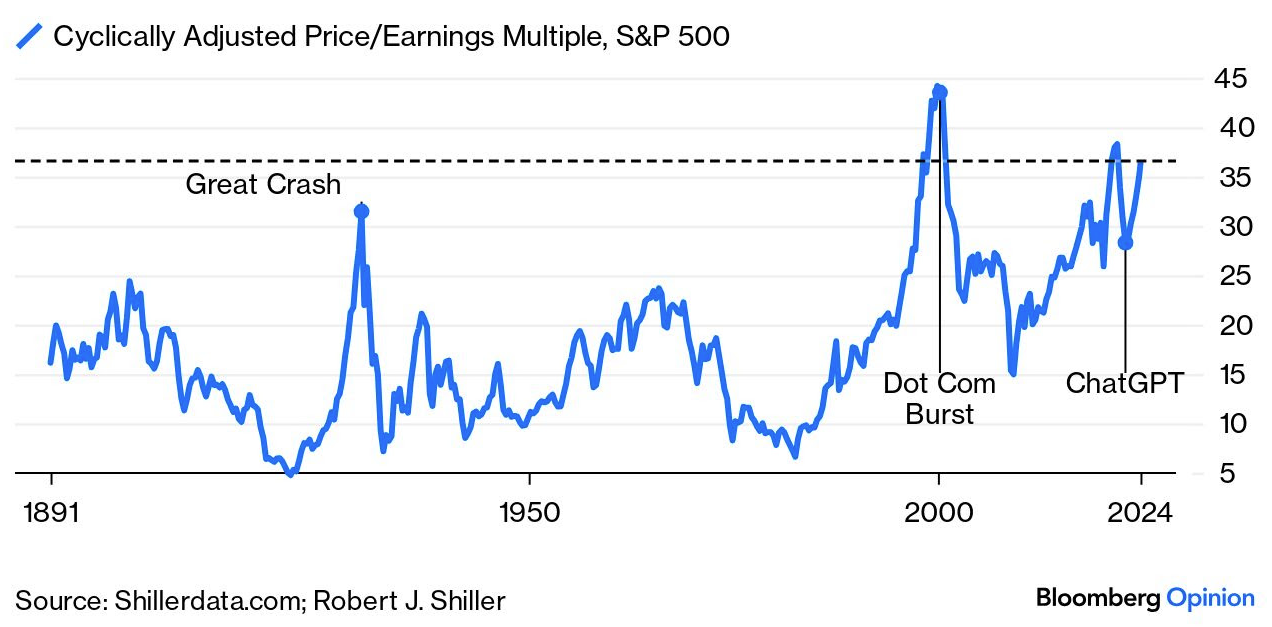

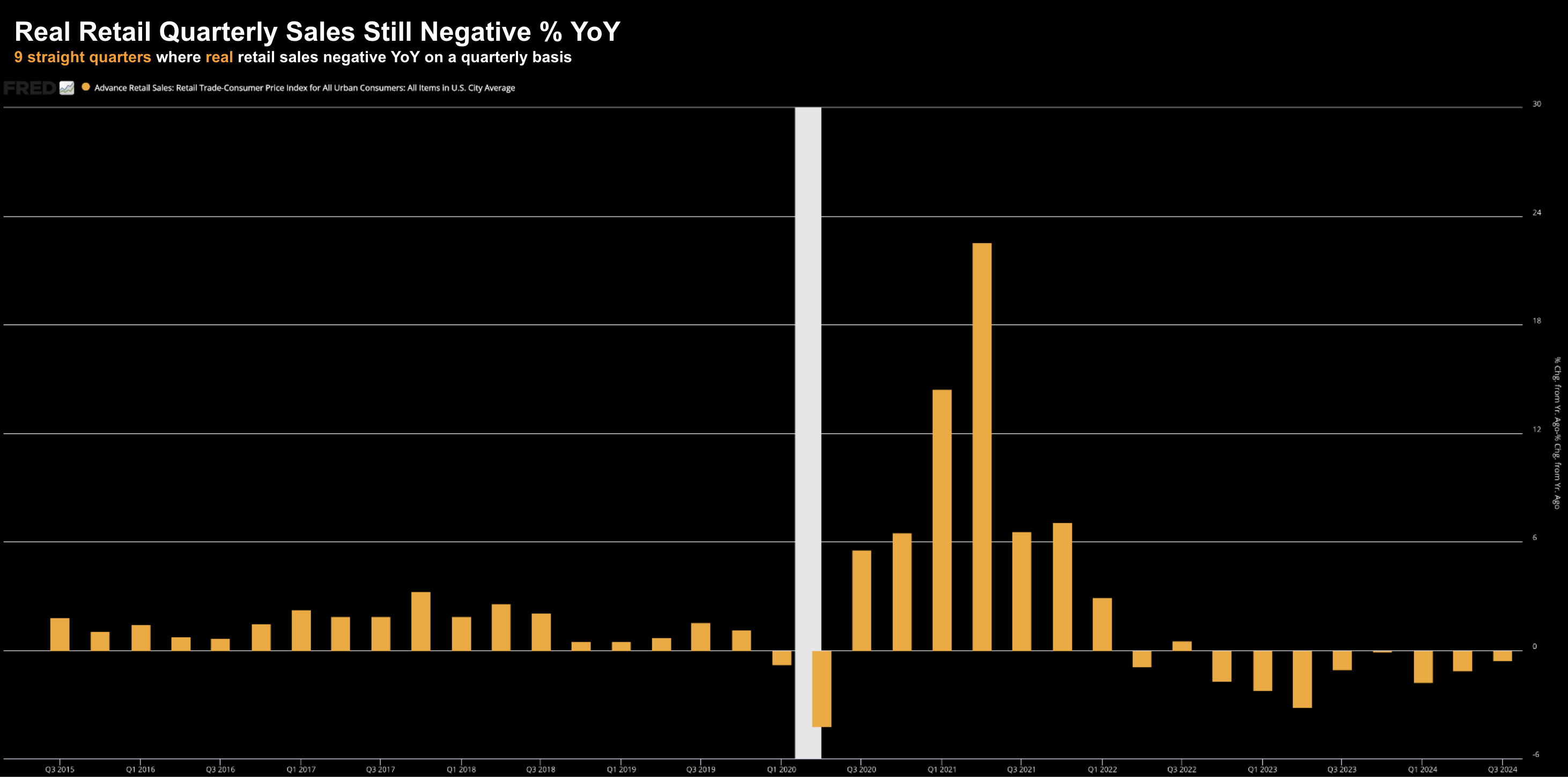

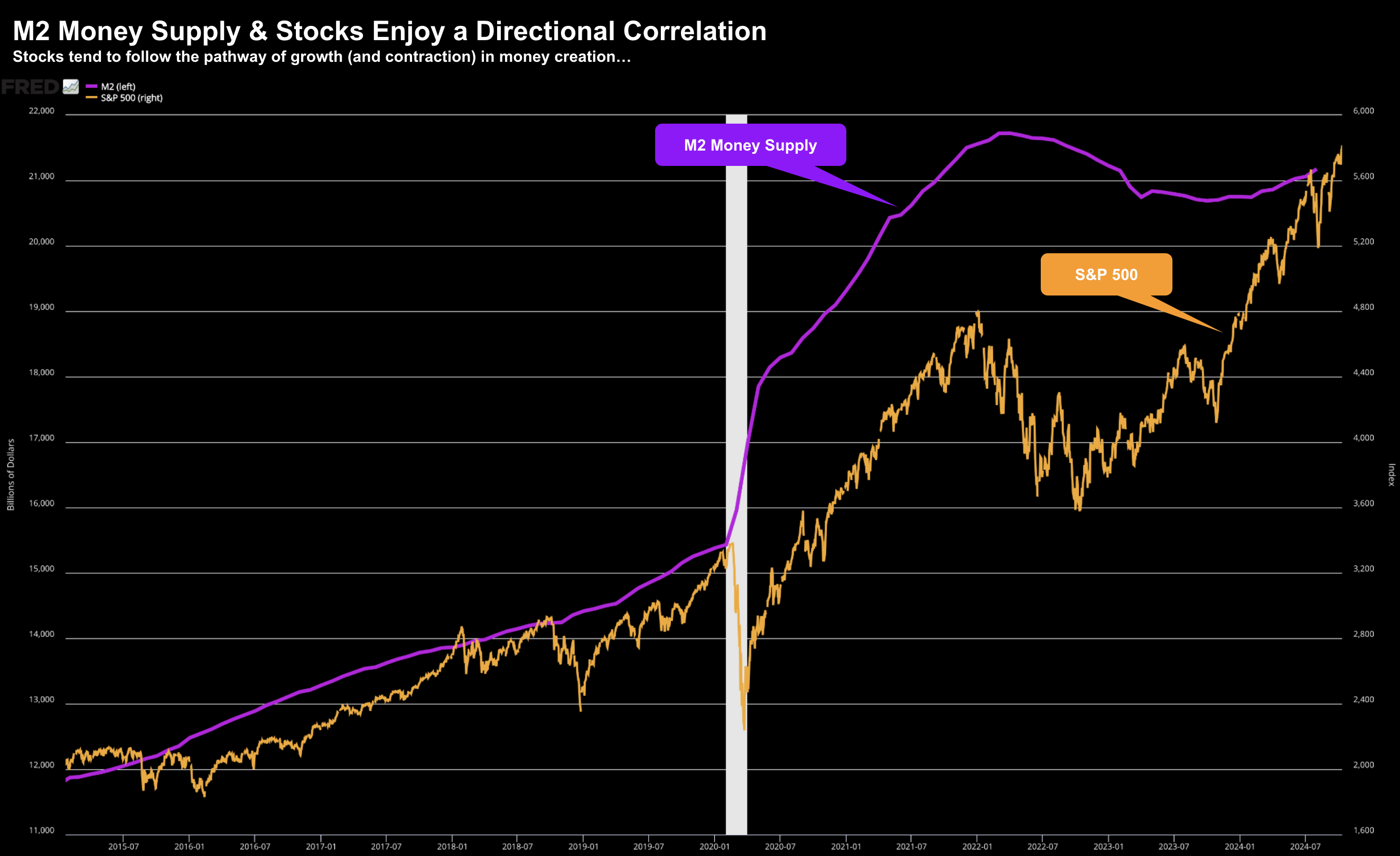

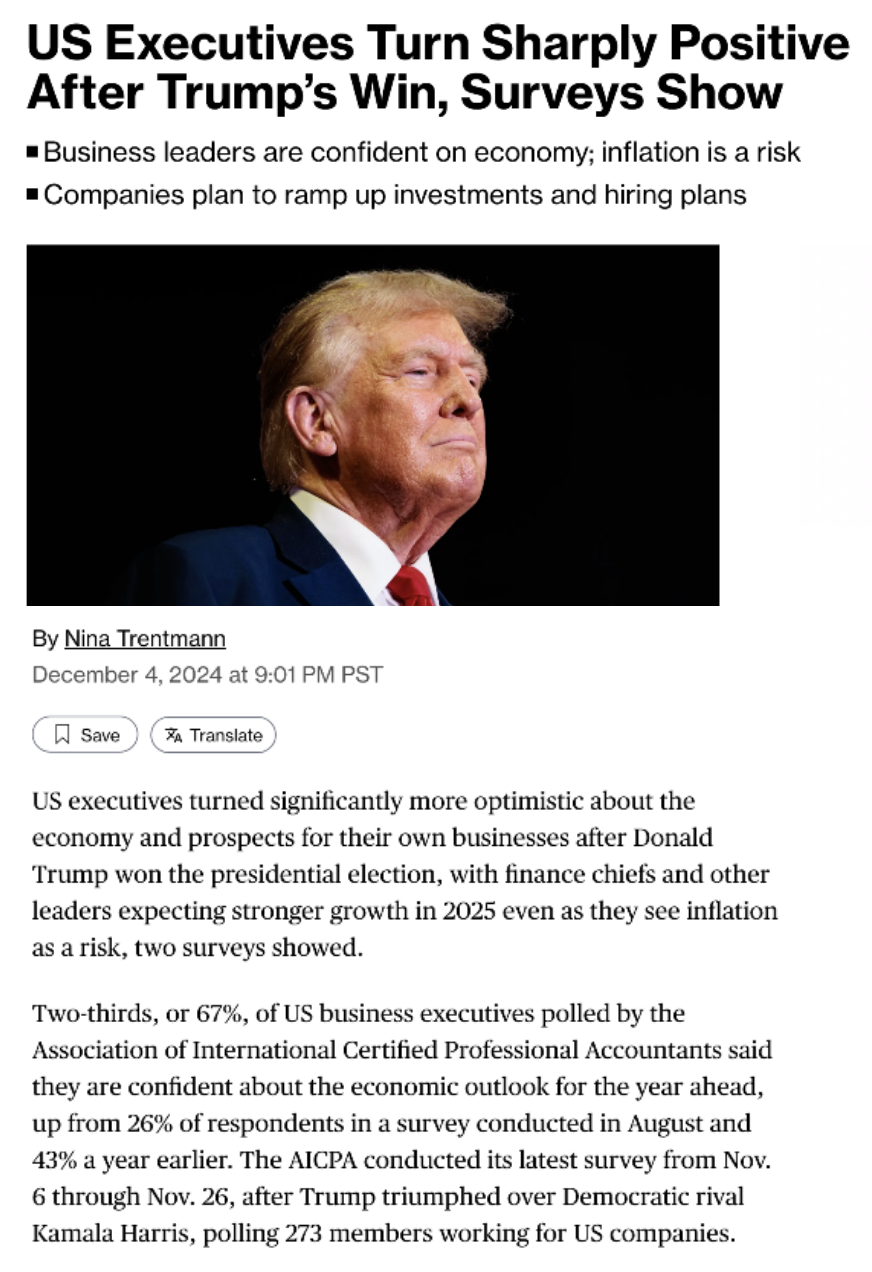

Markets could not be more optimistic about the future. We see it with consumer sentiment, spending and in the stock market. For example, the S&P 500 surged to a new record high 6090 - far exceeding the most bullish of forecasts from 12 months ago. Will analysts be equally bullish about 2025? Post Trump's Nov 5th win - the bulls have found another gear. Trump has painted a compelling vision of a US economic resurgence built on three primary pillars: (i) lower taxes; (ii) sweeping deregulation and government reform; and (iii) an

emphasis on domestic production. Why does this have corporate America very excited?