Buffett is Buying Bonds

Buffett is Buying Bonds

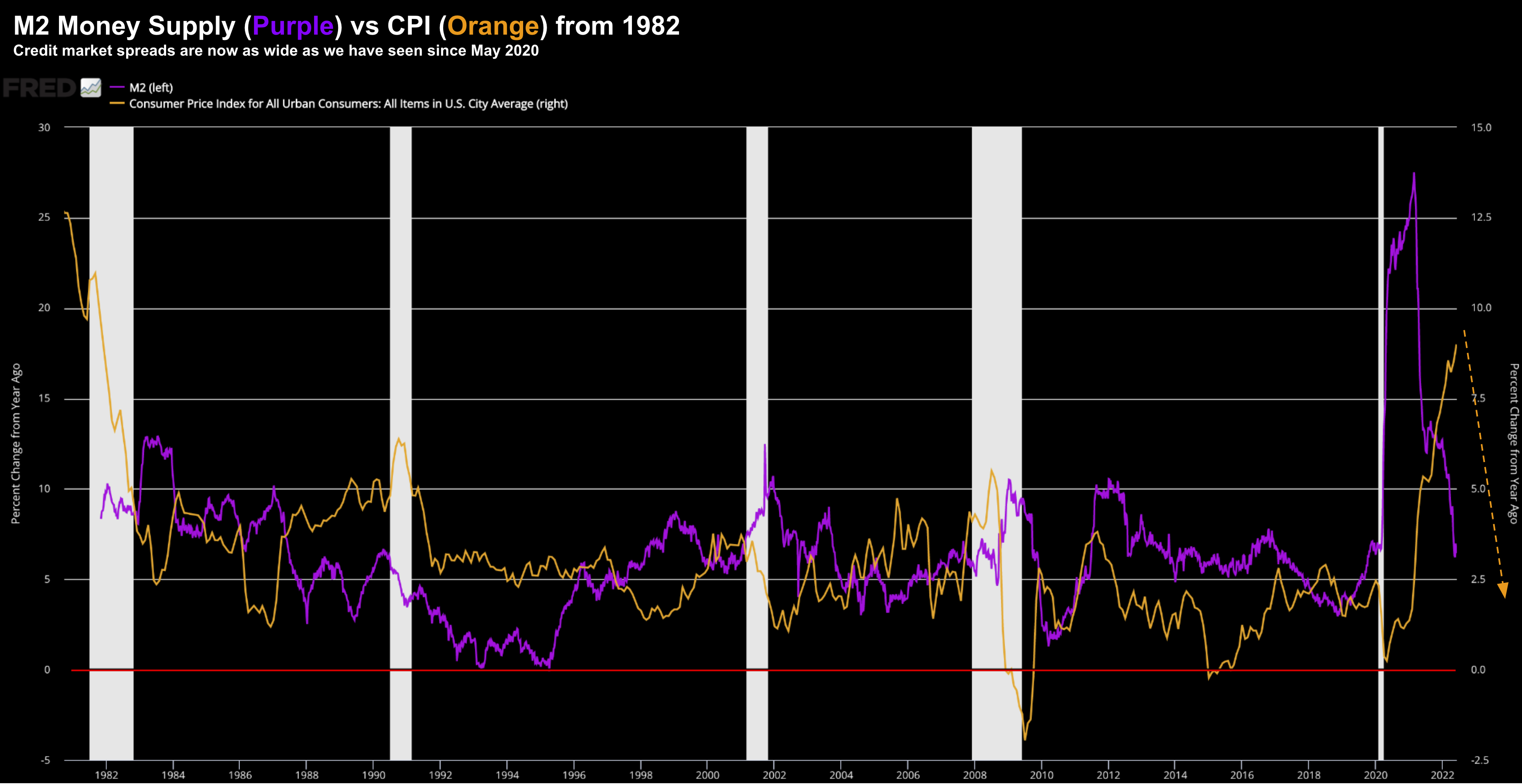

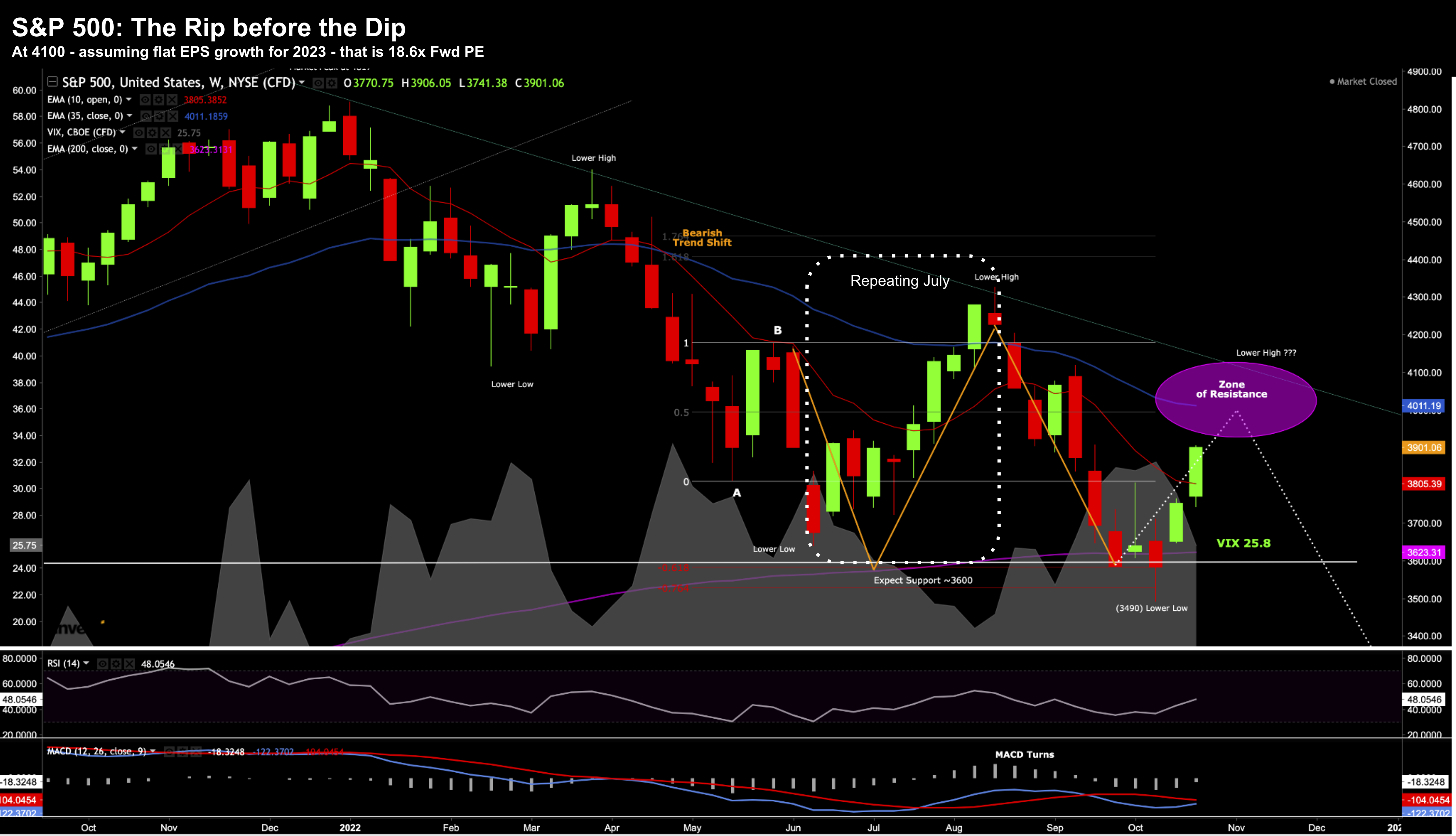

Warren Buffett is pouring tens of billions of Berkshire money into short and longer-term bonds. And I'm not surprised... For e.g., Jul 9th I offered this post "Think About Adding Bonds". Shorter-term bills were offering investors ~5.50% and the longer-date 10-year bond above 4.0%. That's attractive for a number of reasons... this post explains why.