Bear Market Rally Approaching Resistance

Bear Market Rally Approaching Resistance

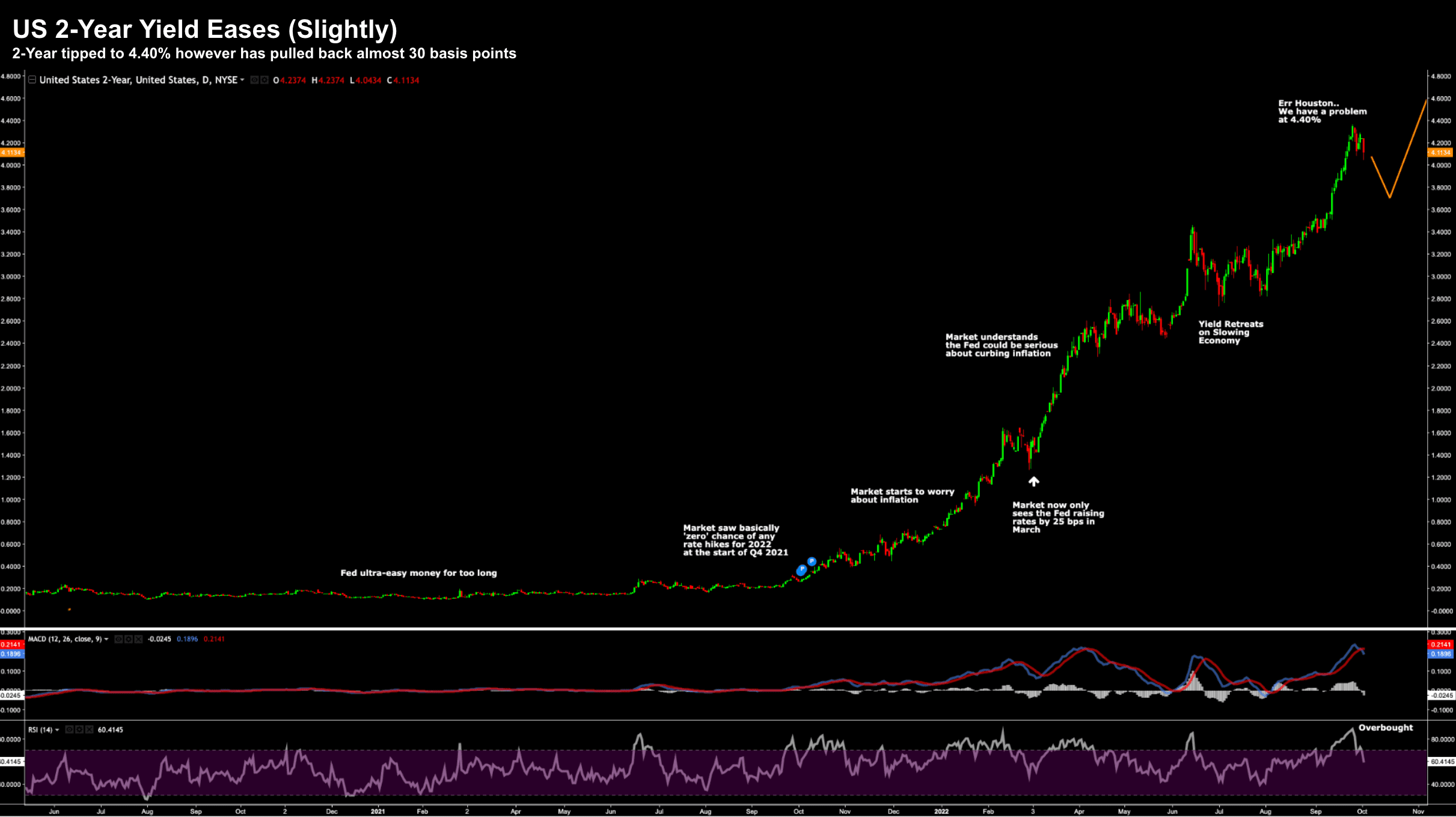

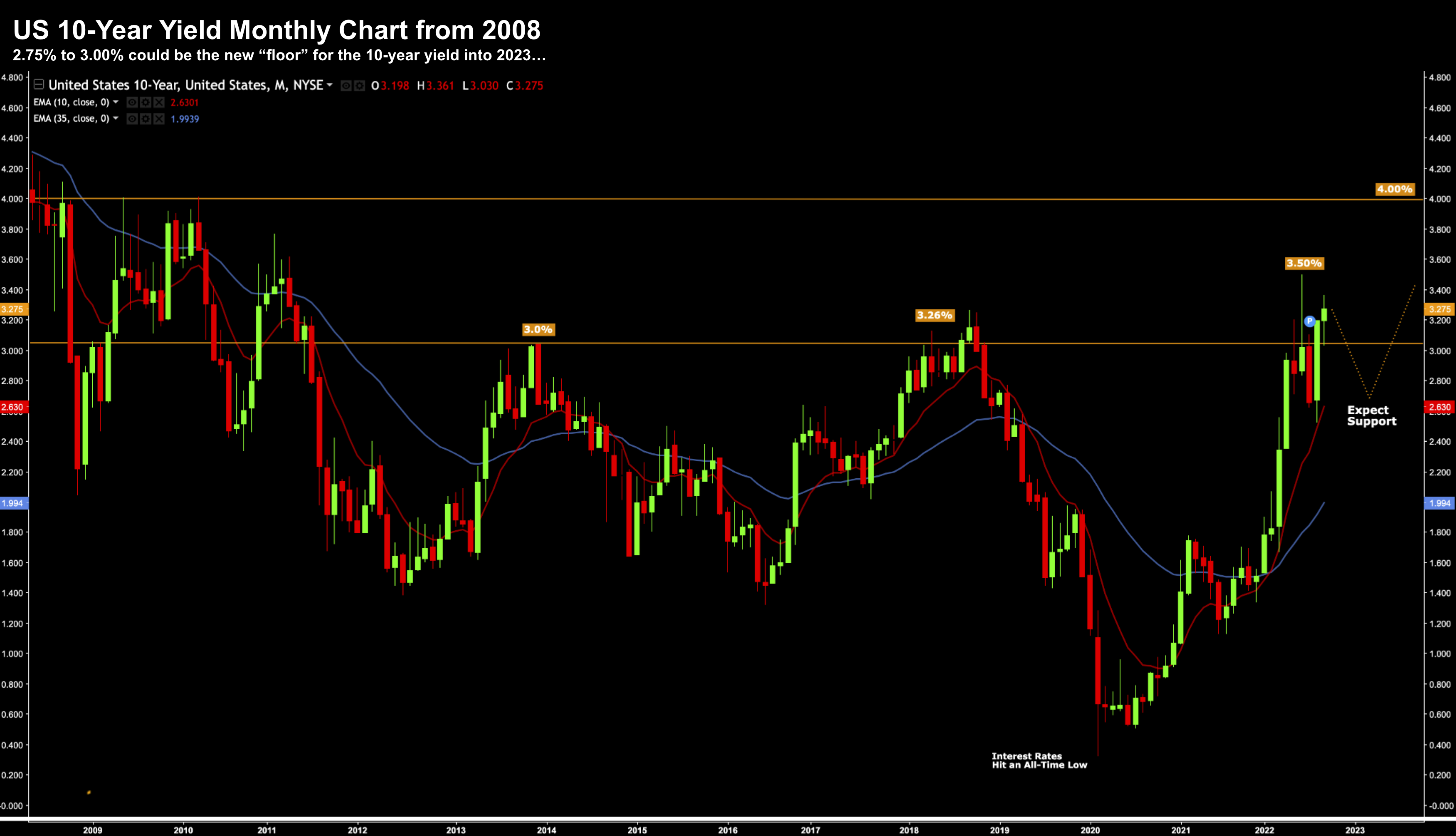

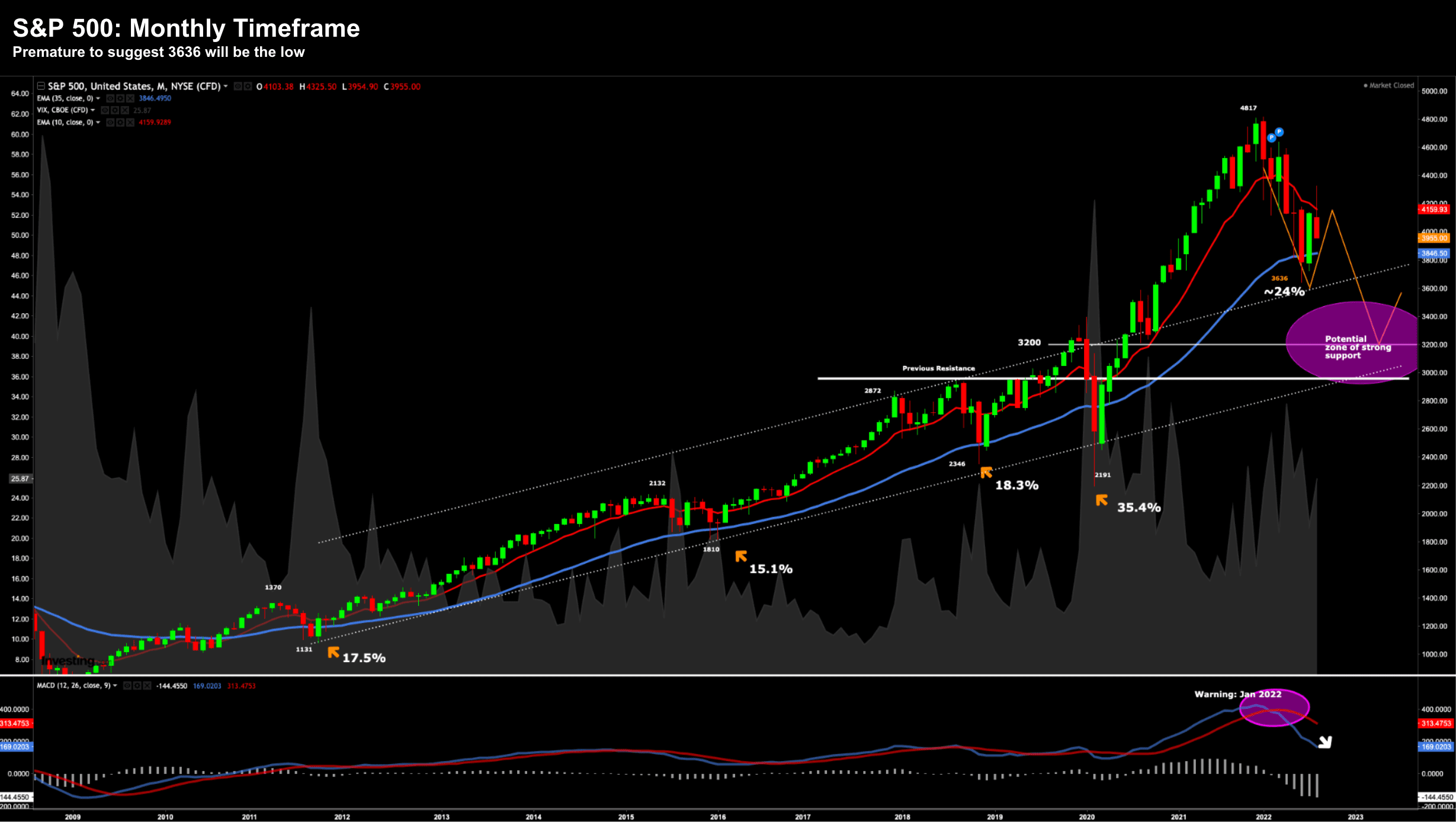

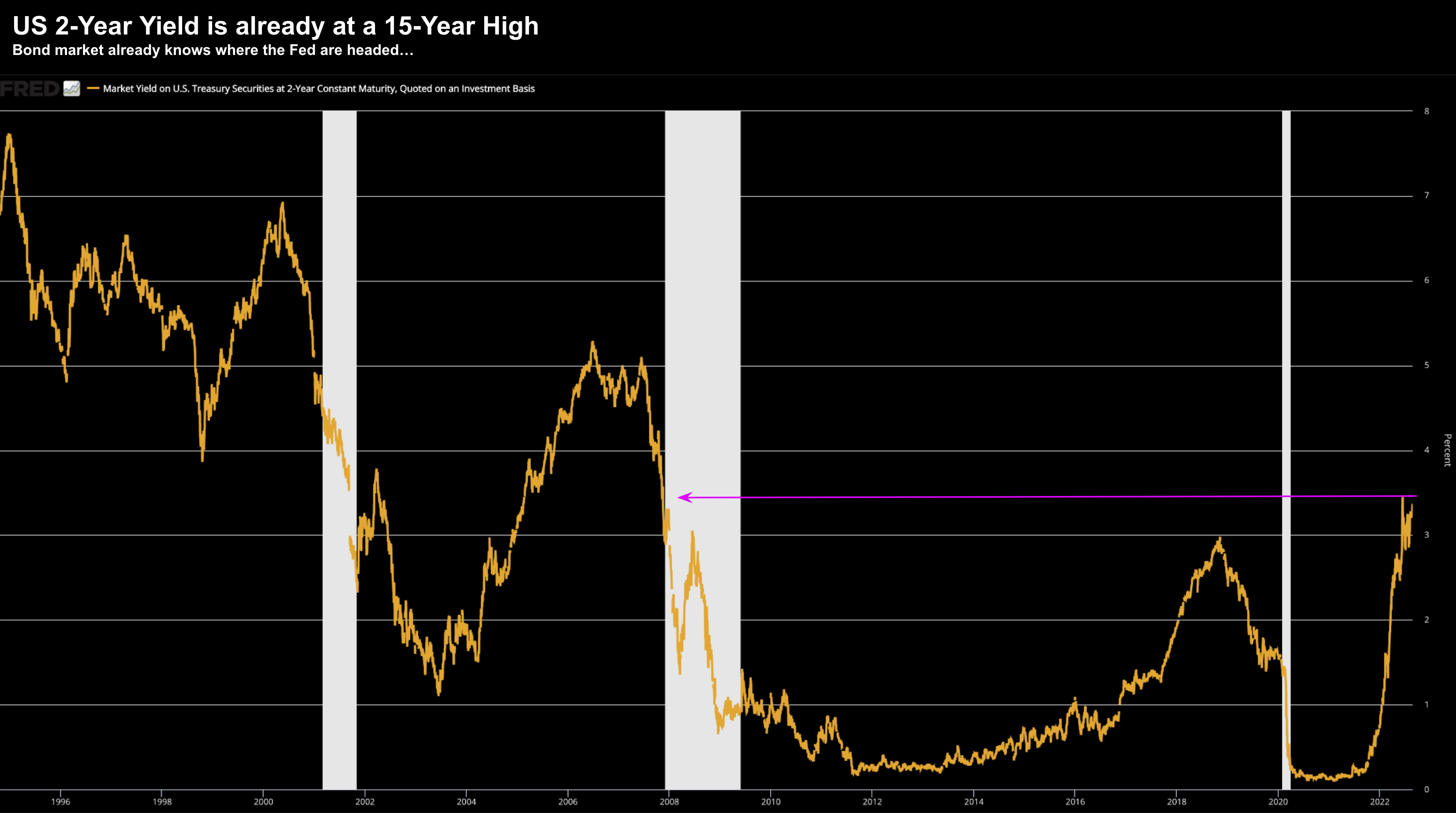

My best guess is the current 11% bear market rally could go a little further yet (e.g. maybe 5-6%). However we are now approaching a technical area of resistance. I also offer a new trade on TLT... on the thesis that yields will reverse course at some point in 2023