Jay Powell: “Stocks are Overvalued”

Jay Powell: “Stocks are Overvalued”

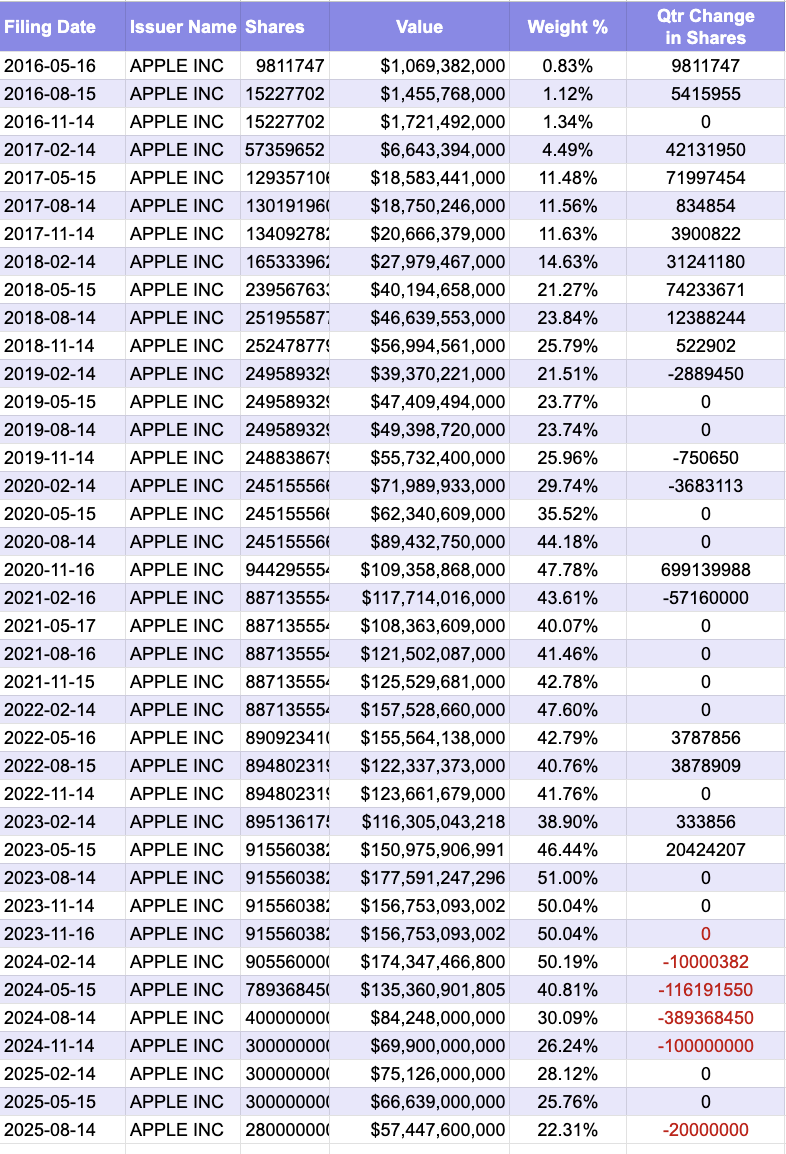

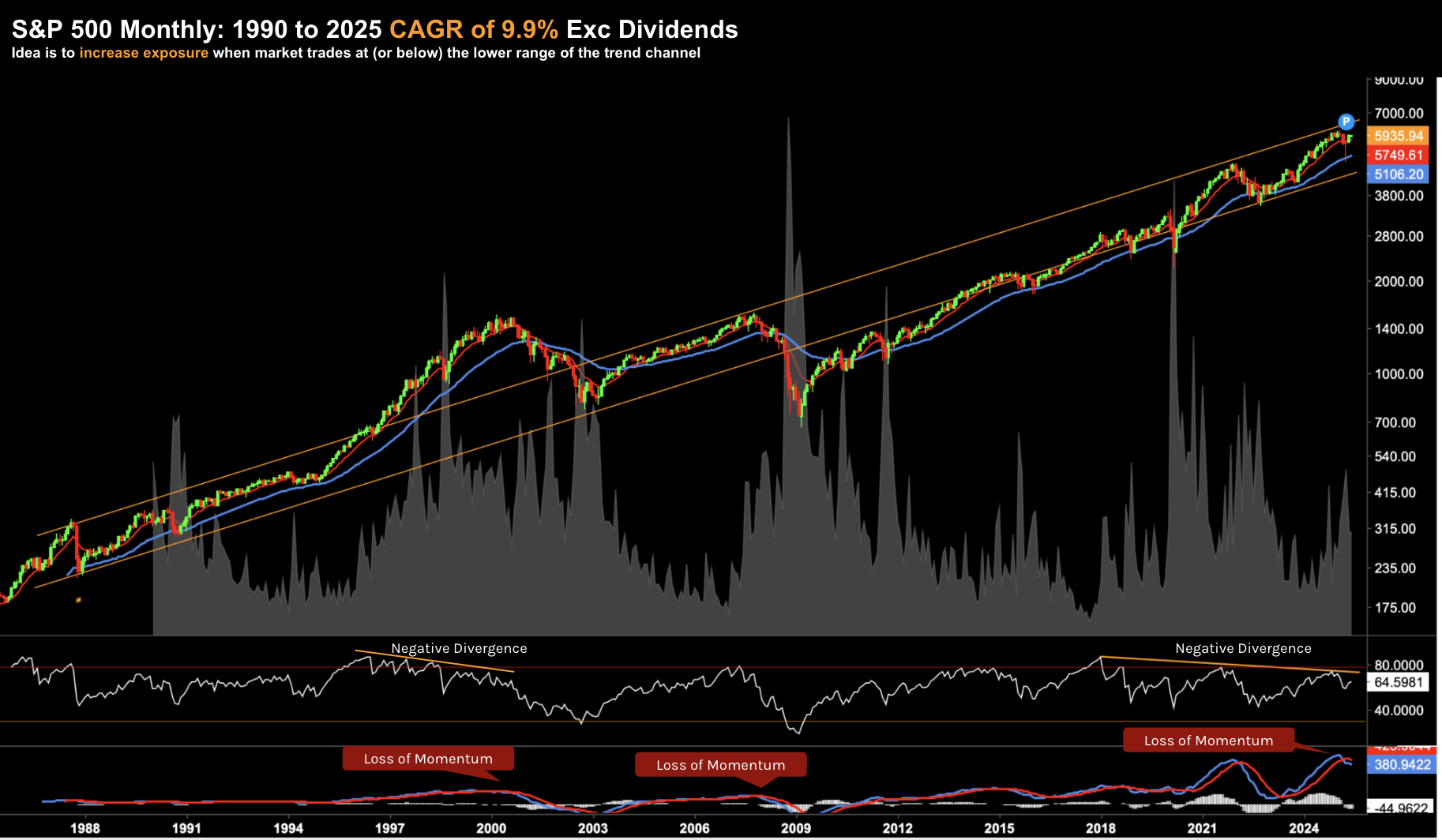

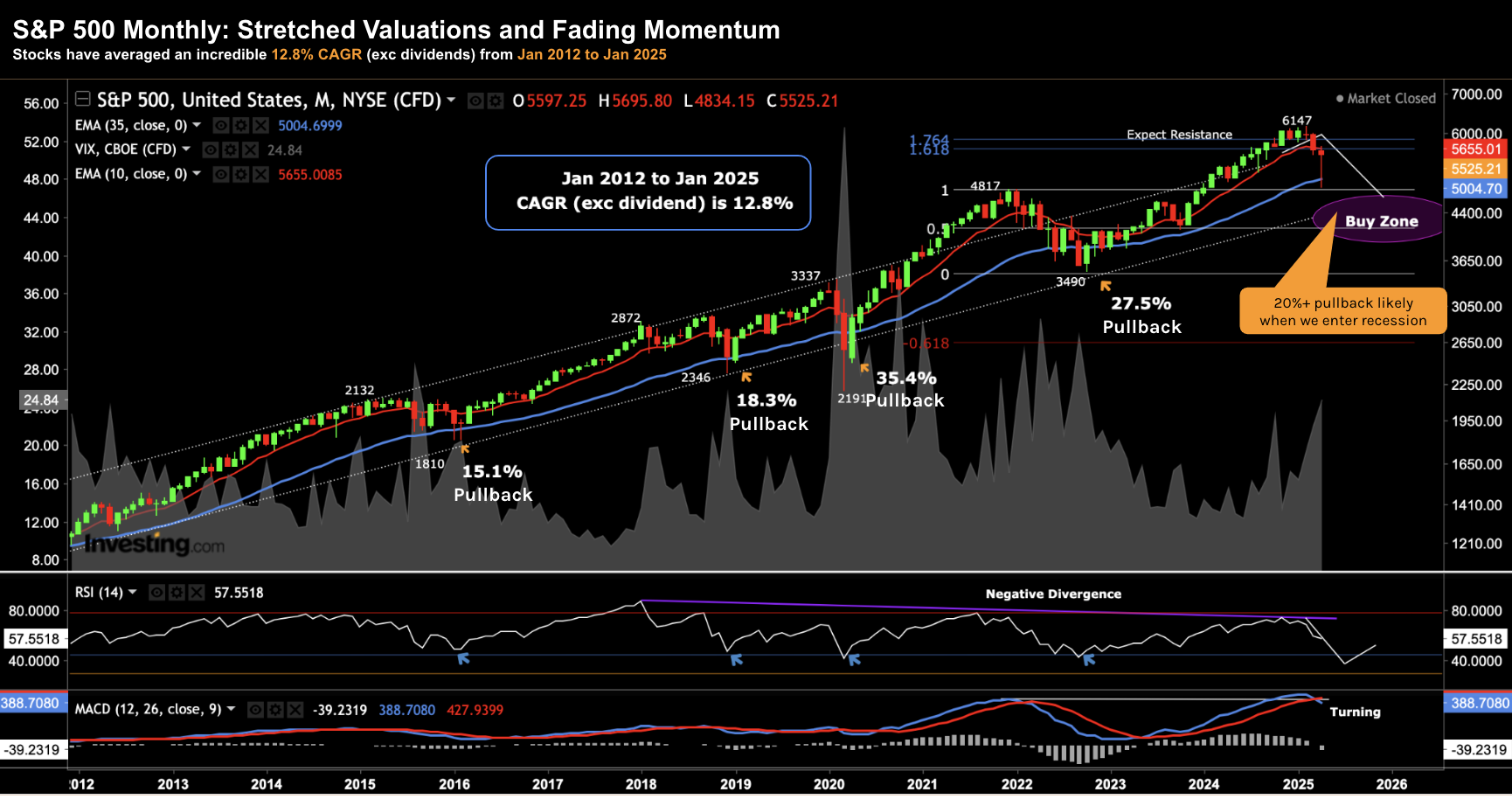

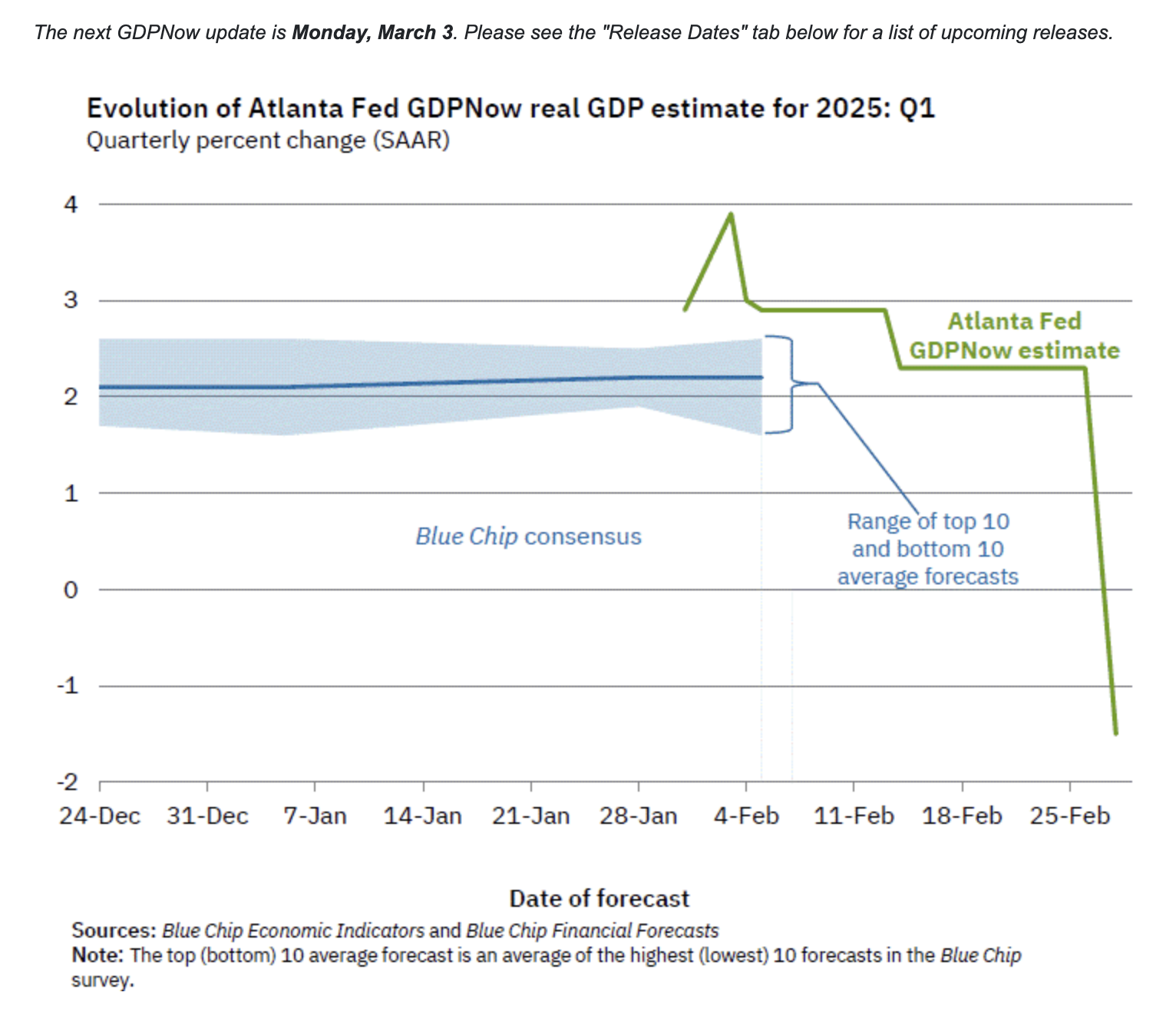

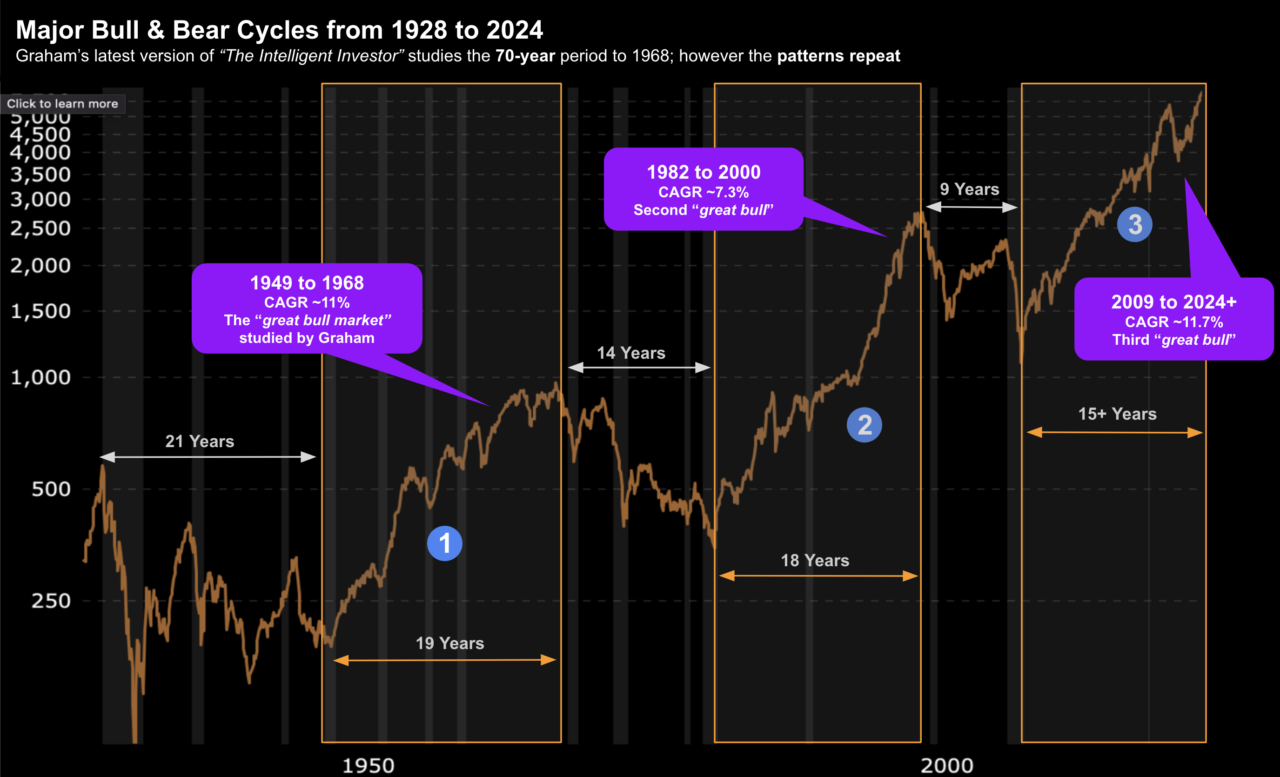

The current market presents a stark contradiction: stocks are high, but the Fed is entering an easing cycle. As billionaire David Tepper notes, he's "constructive on stocks" due to cheapening money but "miserable" because valuations are sky-high. Warren Buffett mirrors this caution, holding a record high of over $344 billion in cash. This balance reflects the core tension: stocks can easily run higher on investor optimism, yet the consensus is that forward earnings multiples are dangerously stretched. Like Buffett in 1969 and 1997, savvy long-term investors are prioritizing capital preservation, maintaining some exposure while waiting for the inevitable mean reversion to bring prices back down to a prudent level.