Tobin’s Q-Ratio Trades at Historical Highs

Tobin’s Q-Ratio Trades at Historical Highs

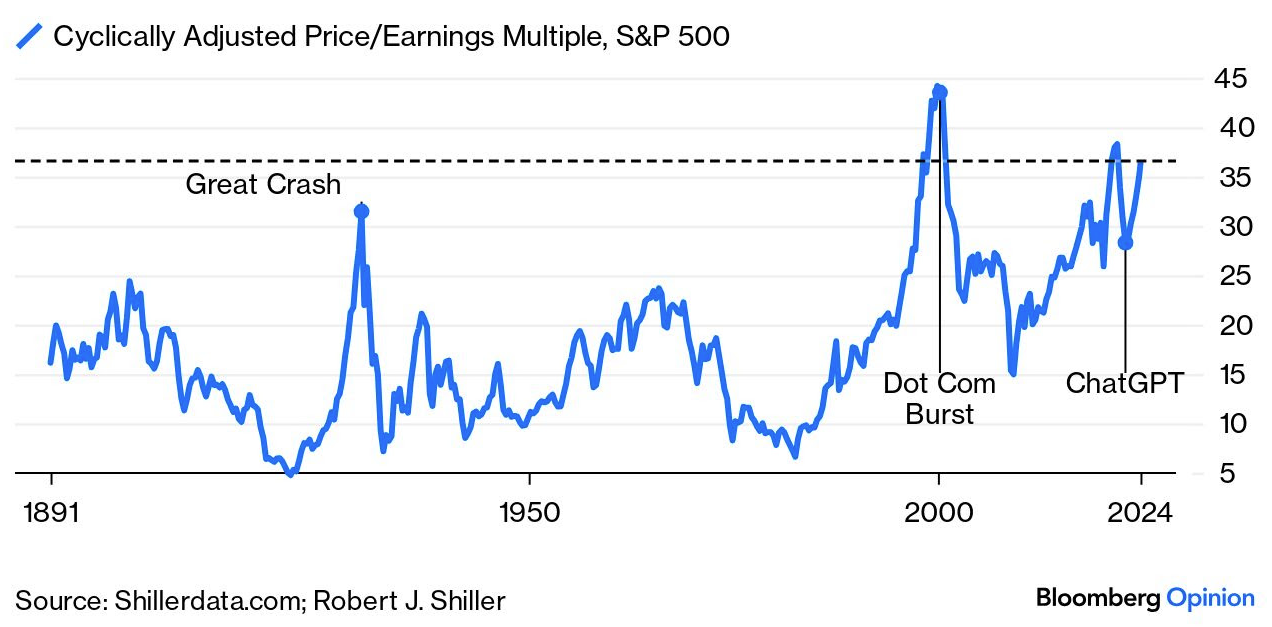

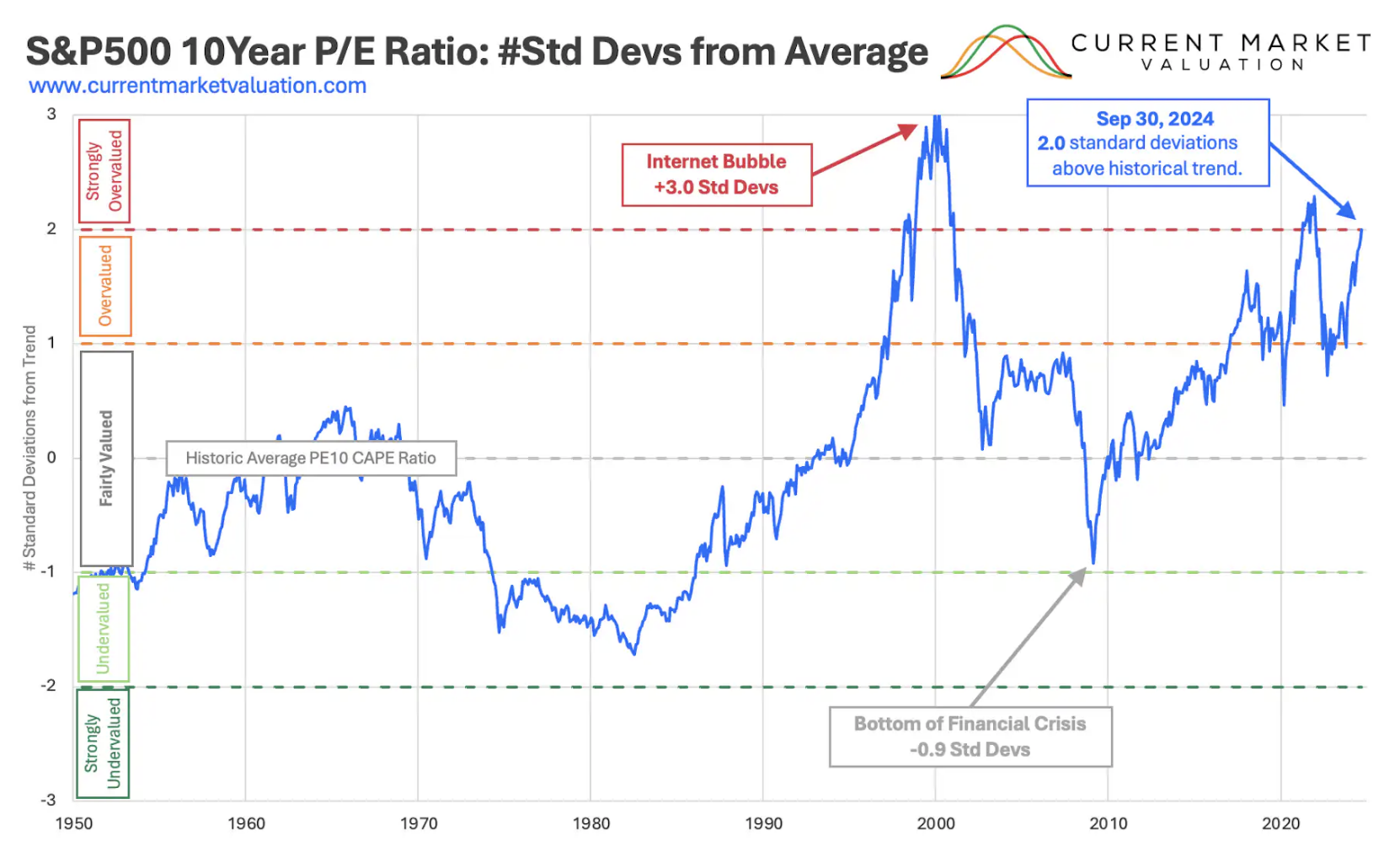

By just about any intrinsic measure - the stock market looks expensive. Ben Graham would be warning investors to heed caution. Now one of the more widely cited metrics is its forward price-to-earnings (PE) ratio - which trades at a very high 22x. However, another intrinsic measure is James Tobin's Q-Ratio - which now trades at a record high - exceeding that of the dot.com bust. And whilst not a great timing tool - it maintains a very reliable record of picking long-term secular highs.