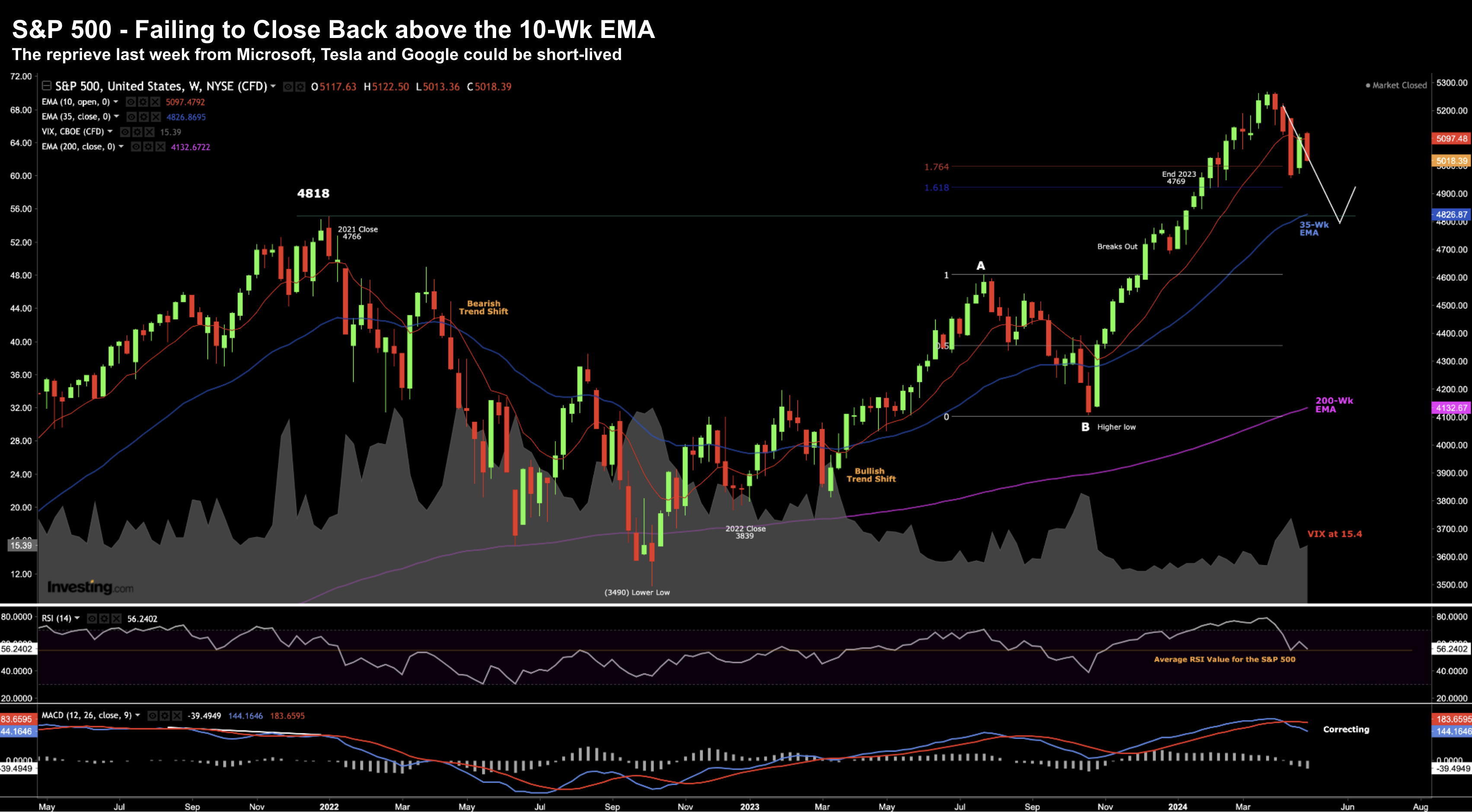

It’s Fed Week… Market Sees Cuts Coming

It’s Fed Week… Market Sees Cuts Coming

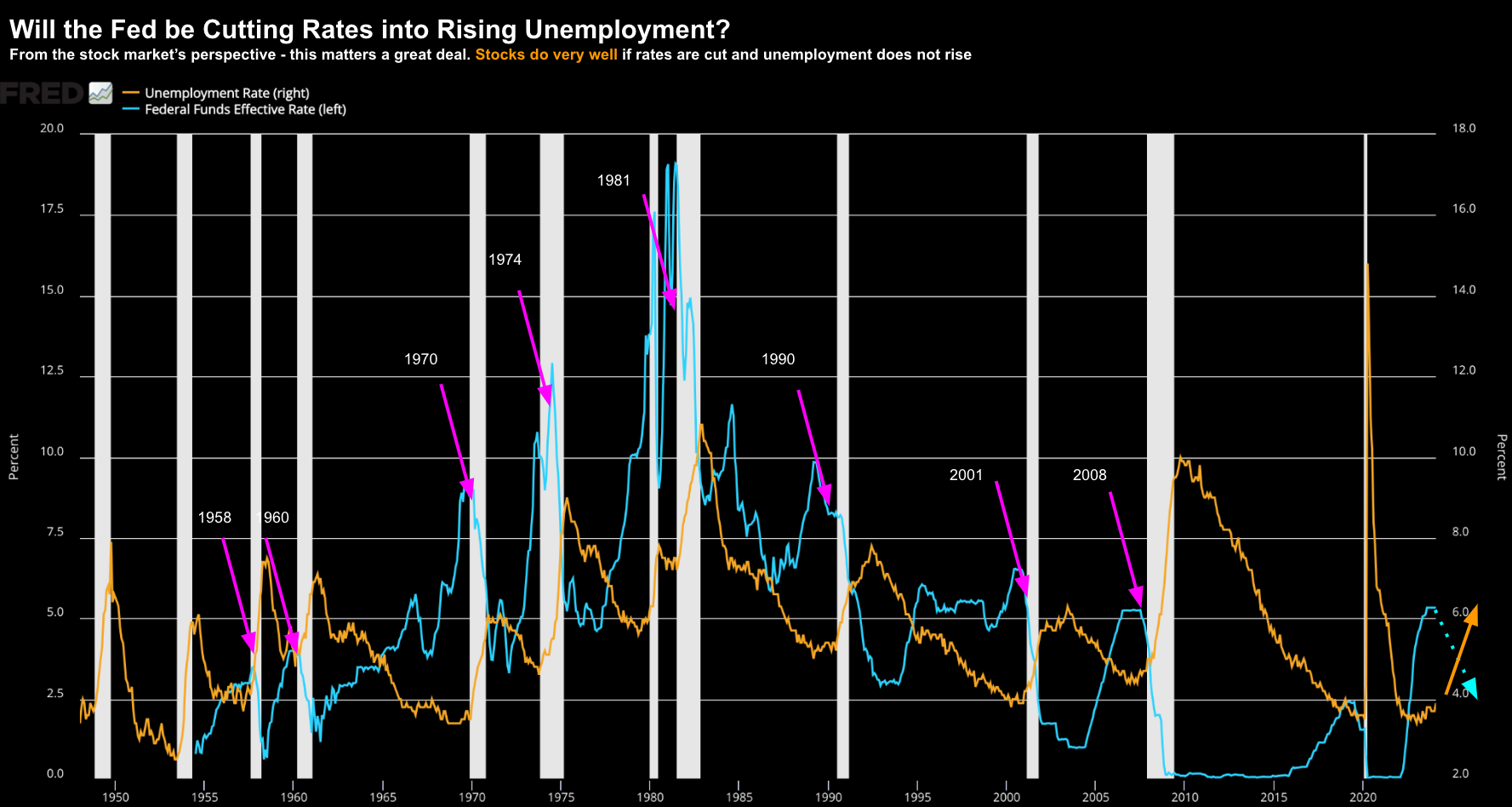

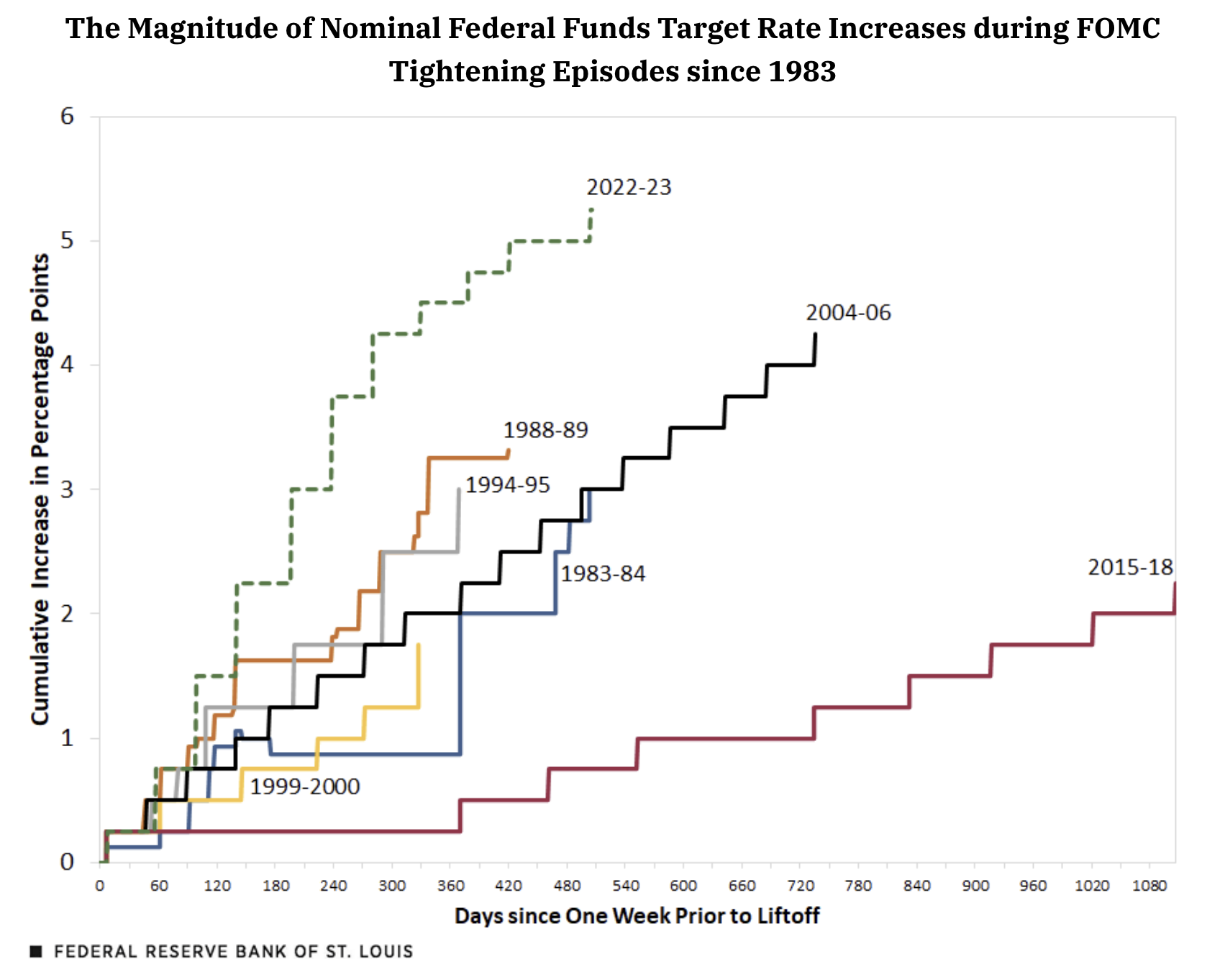

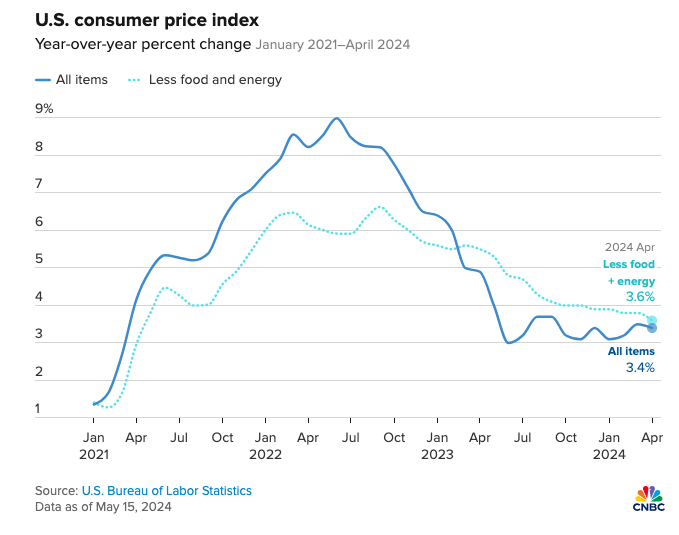

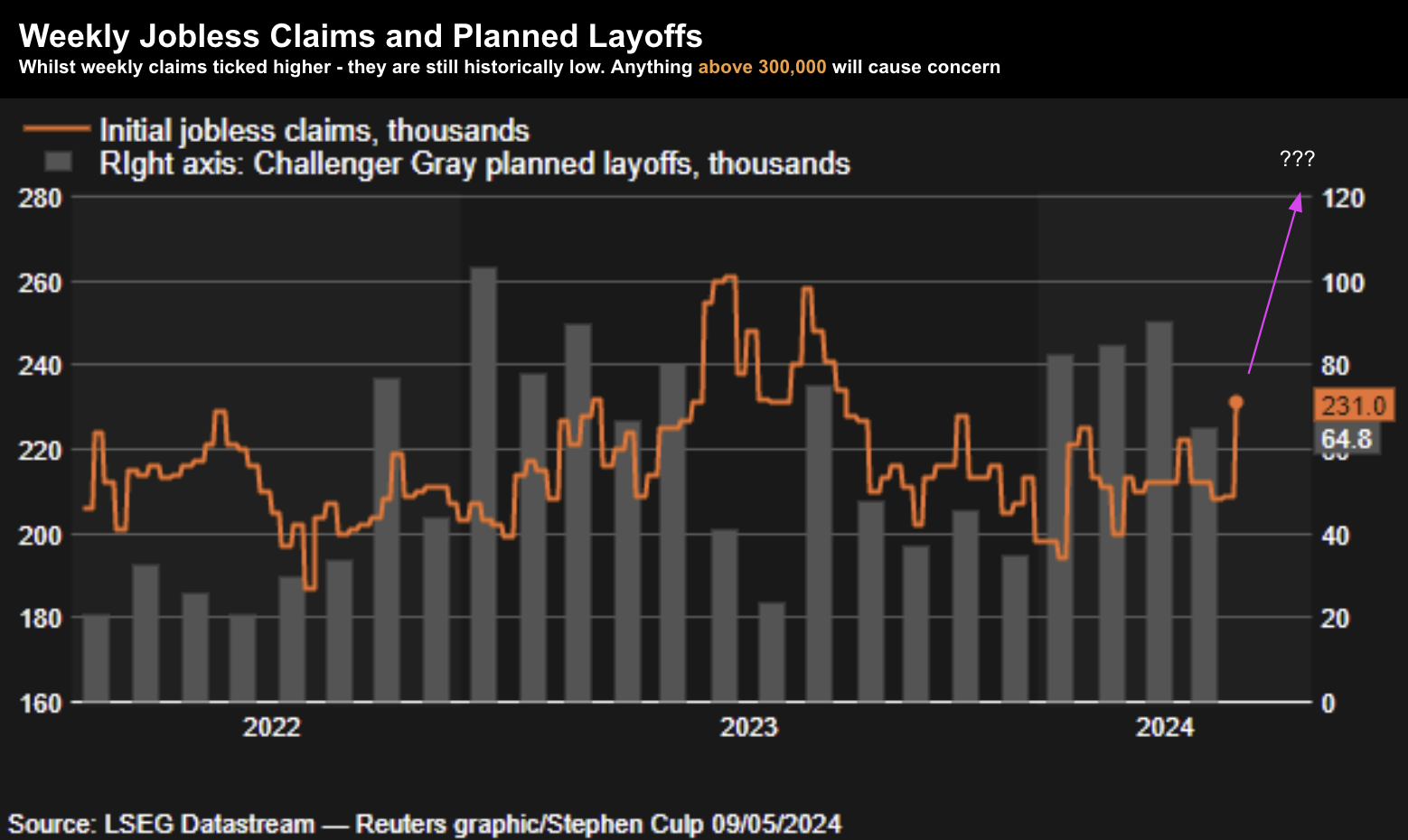

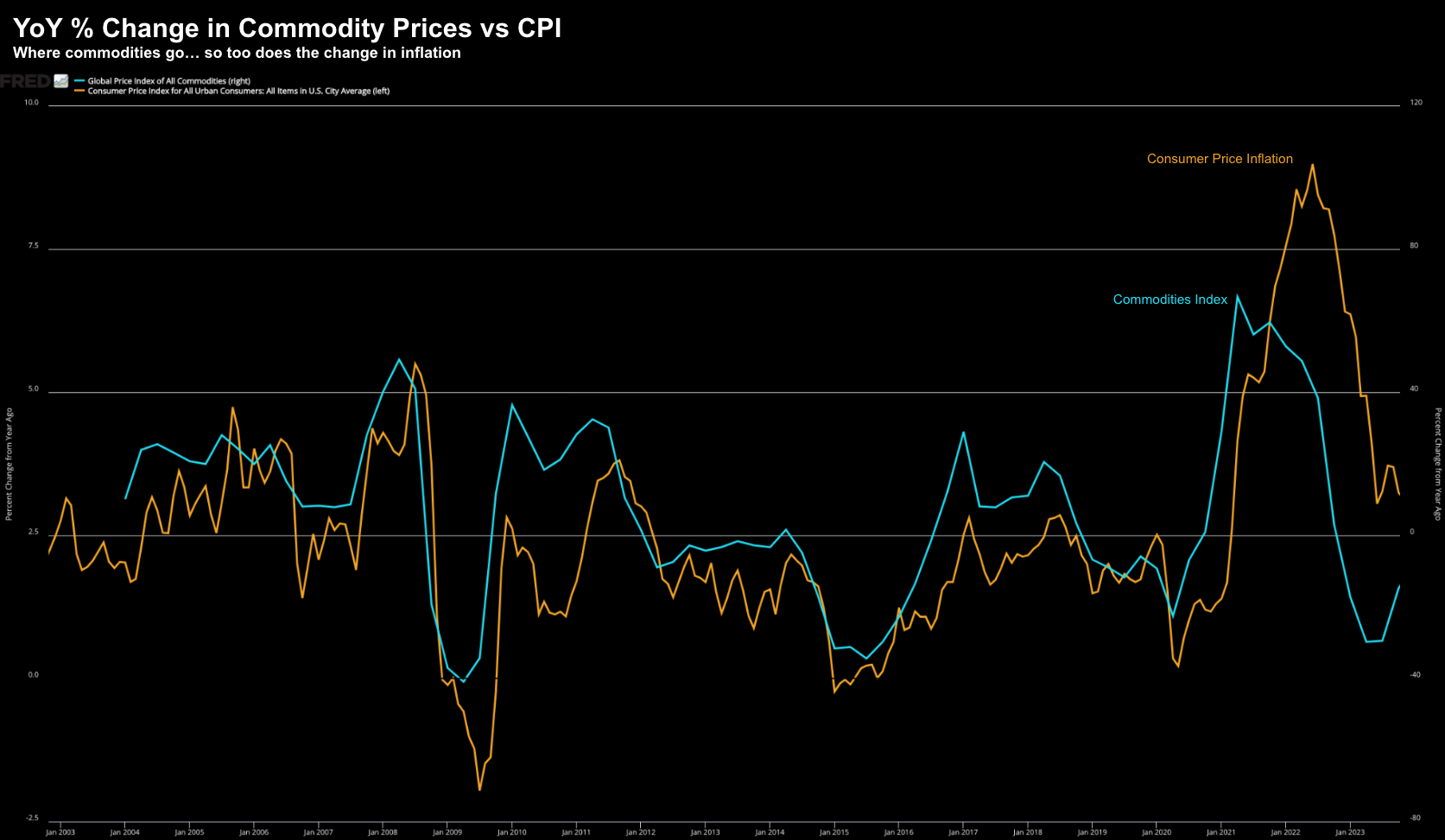

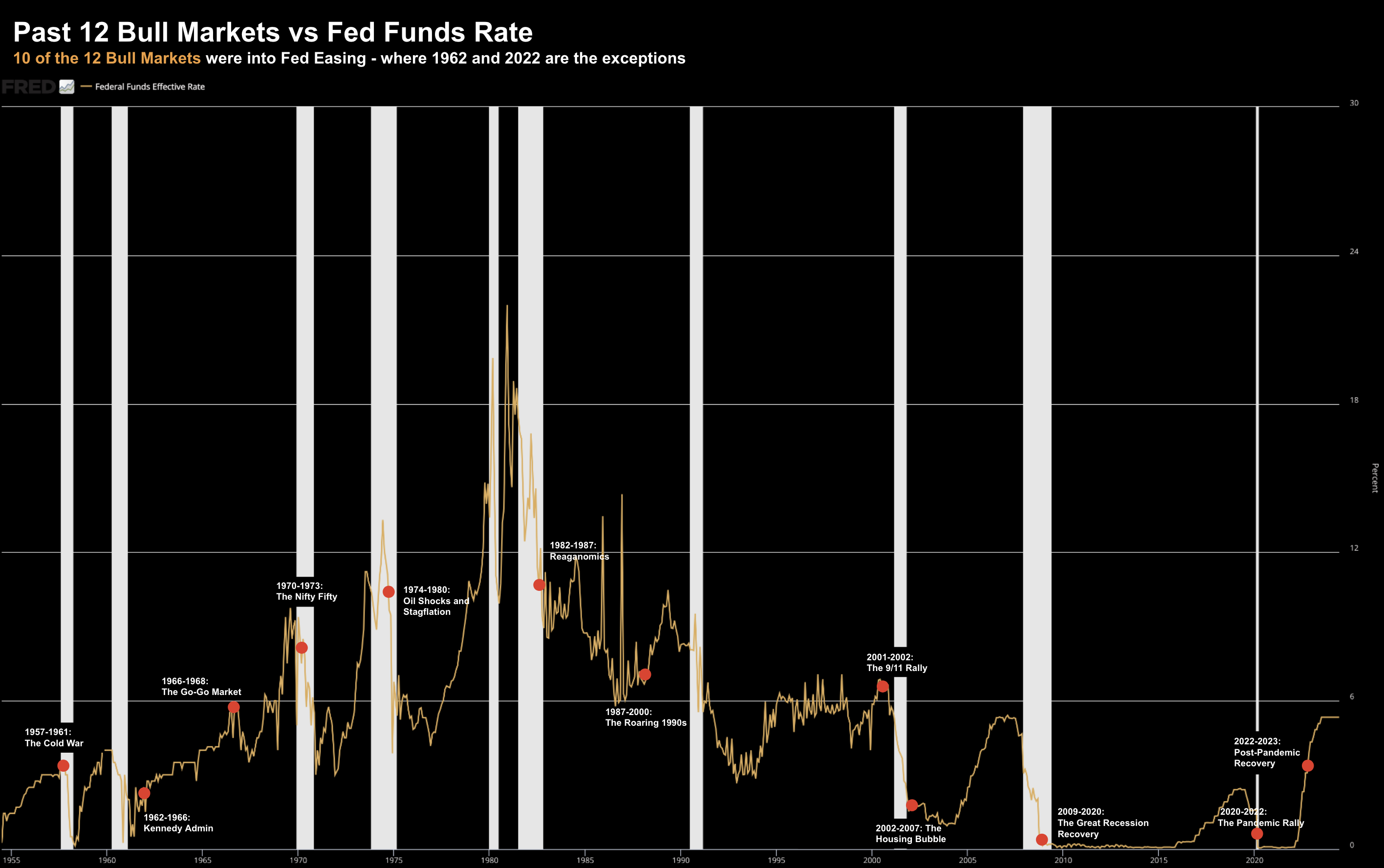

Are rates restrictive? And if they are - how do you know? That's the question the Fed will address tomorrow - but it's not easy to answer. For example, on the one hand there's a (large) cohort who believe the Fed are falling 'behind the curve' - therefore increasing the odds of a recession. They feel that growth risks are to the downside - and do not need to wait for both inflation and employment data to confirm what's ahead. On the other side of the coin - there are those who think we still run the risk of higher inflation if acting too early.