Risk vs Reward

Risk vs Reward

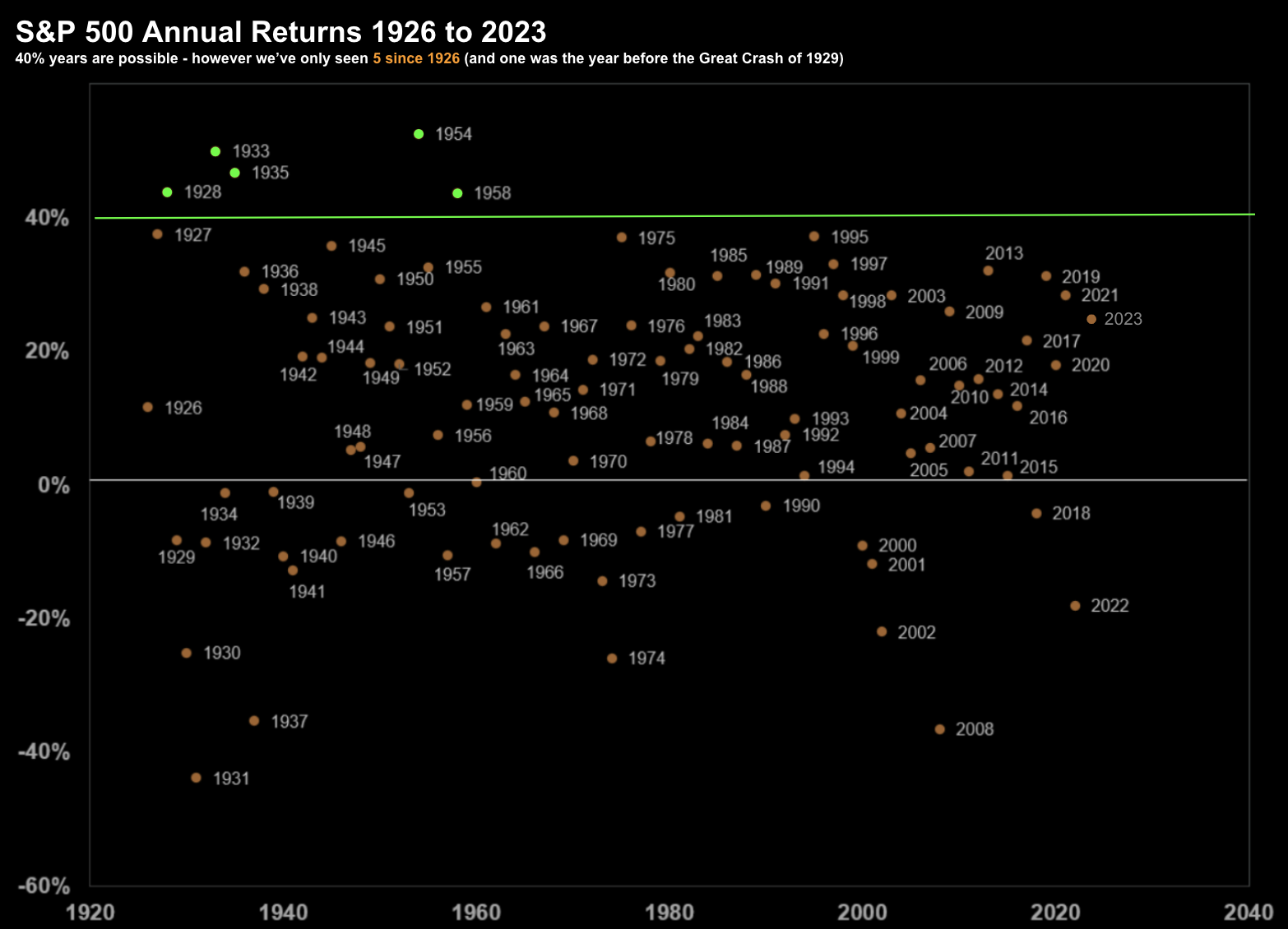

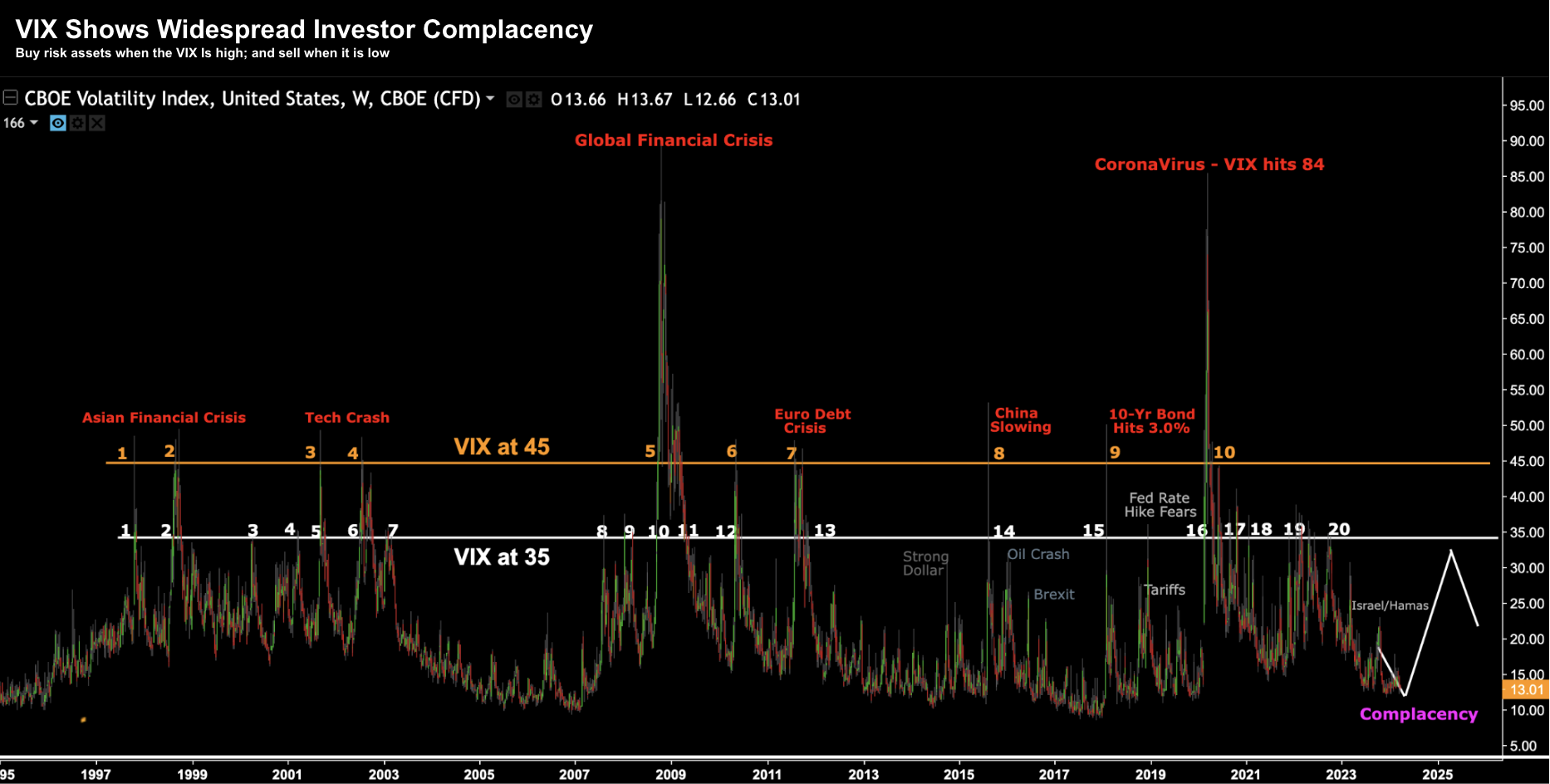

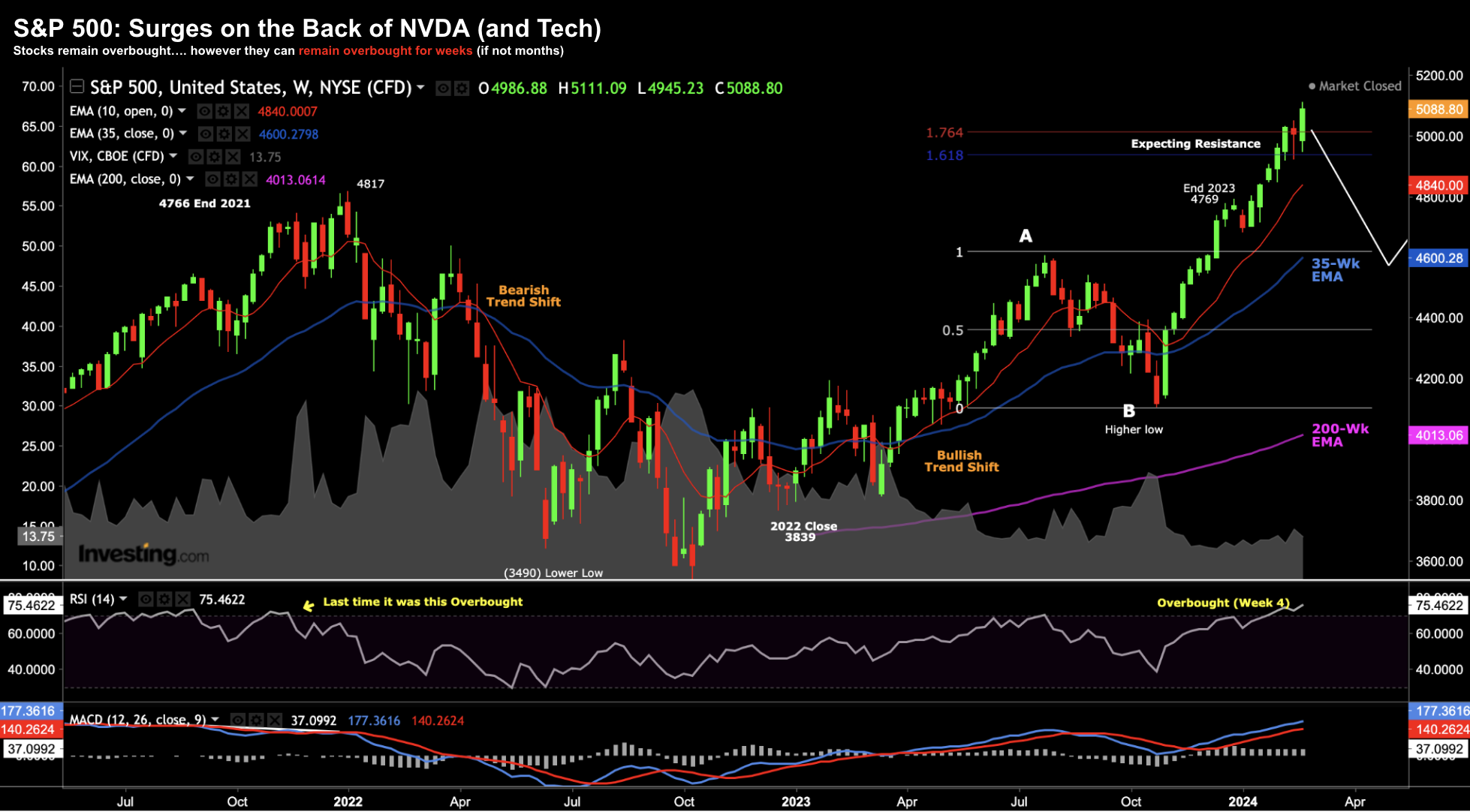

Warren Buffett once told us "the stock market is a device for transferring money from the impatient to the patient”. Which one are you? And while it sounds cliché, the power of patience is real. We need patience for two things: (i) allow our existing investments to work over time; and also (b) if buying, waiting for prices to come to us (eliminating FOMO). For example, some investors may have felt left out the past three months (I certainly did) - as 'hot' momentum stocks like Nvidia, Netflix, Meta and others surged. Fundamentals were not front of mind - where investors thought nothing of paying 40x plus earnings. The momentum trade had taken hold. But as we know - things inevitably revert to the mean.