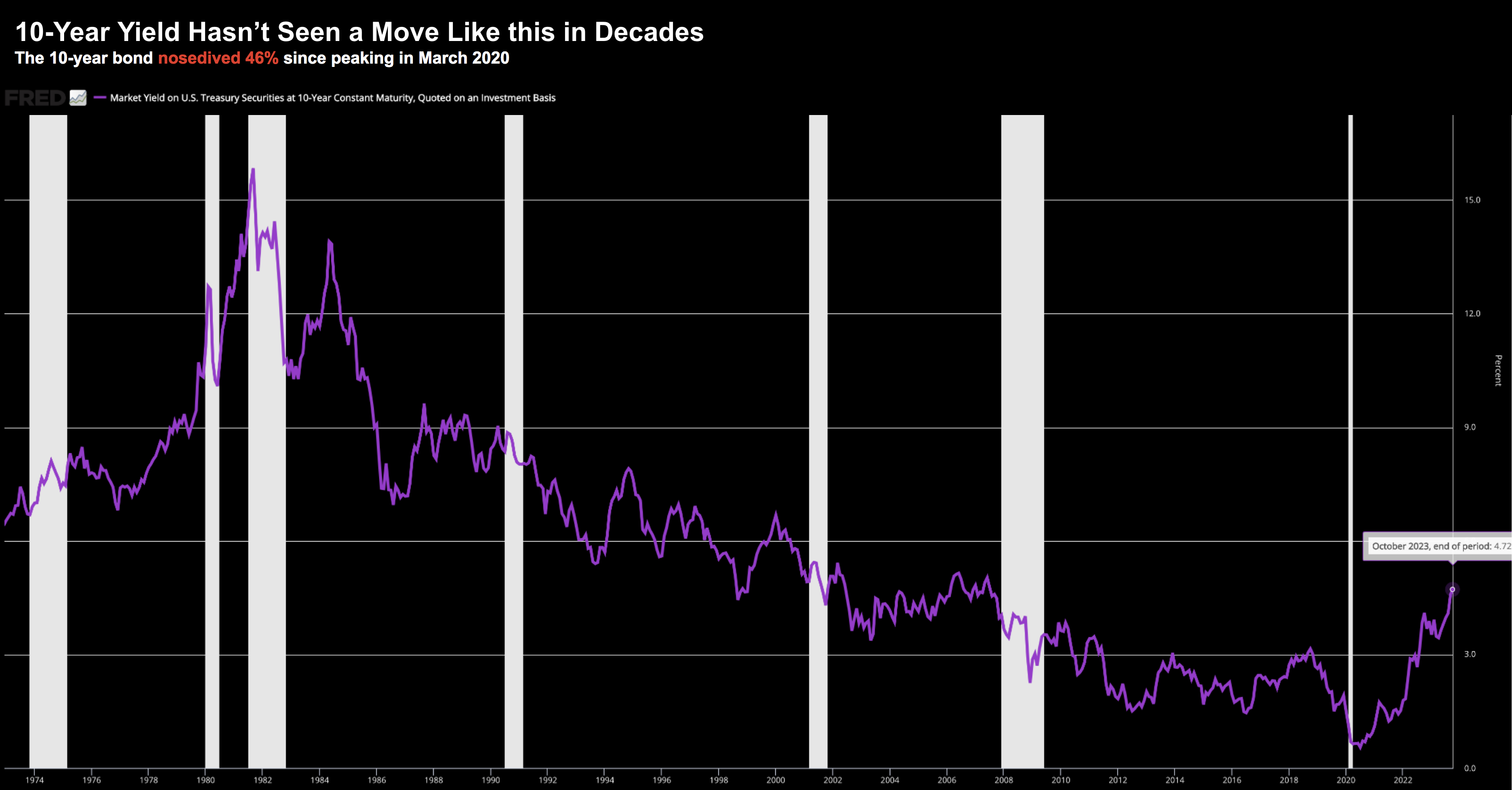

Did Ackman Just ‘Ring the Bell’ on Bond Yields?

Did Ackman Just ‘Ring the Bell’ on Bond Yields?

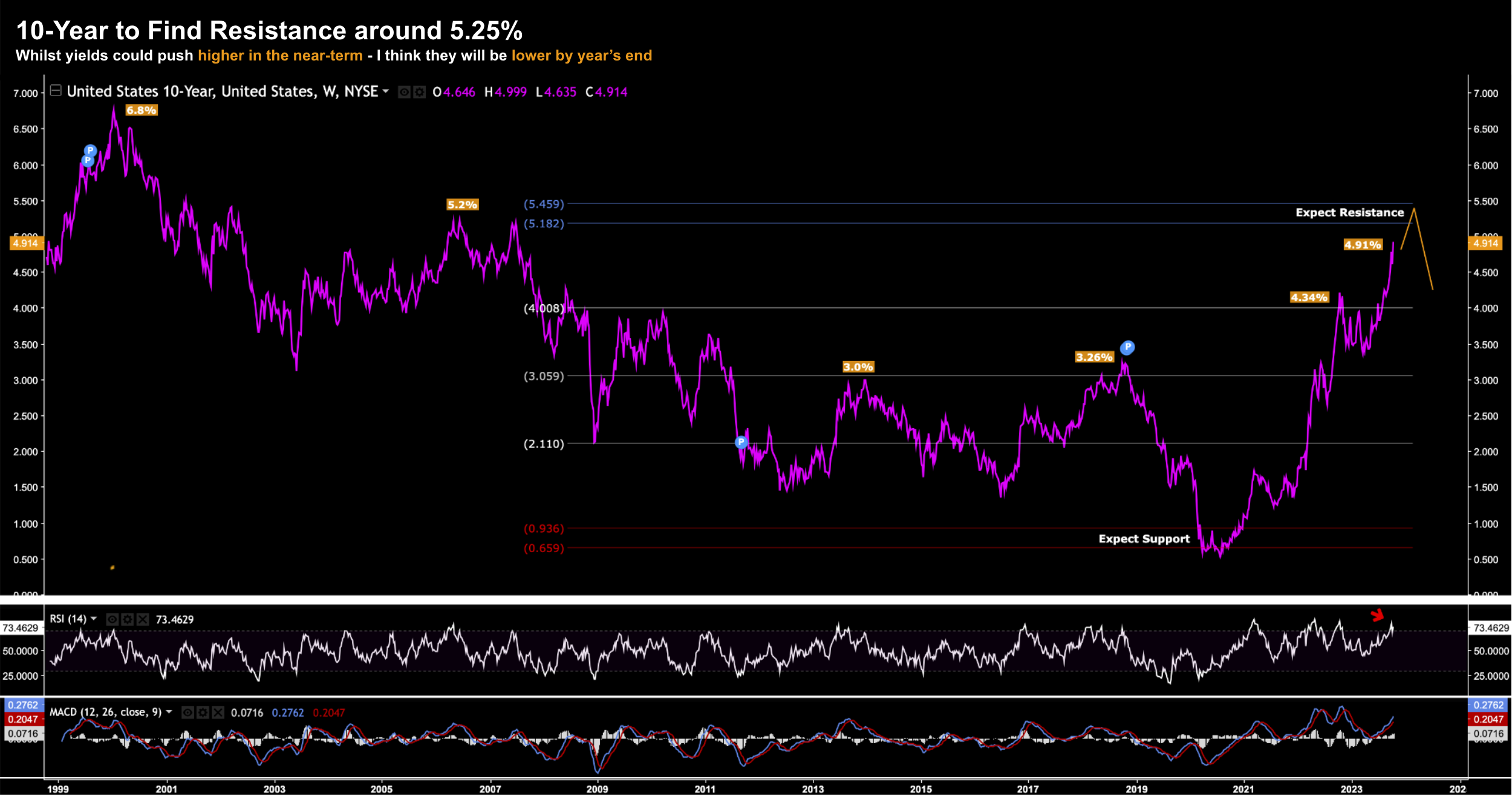

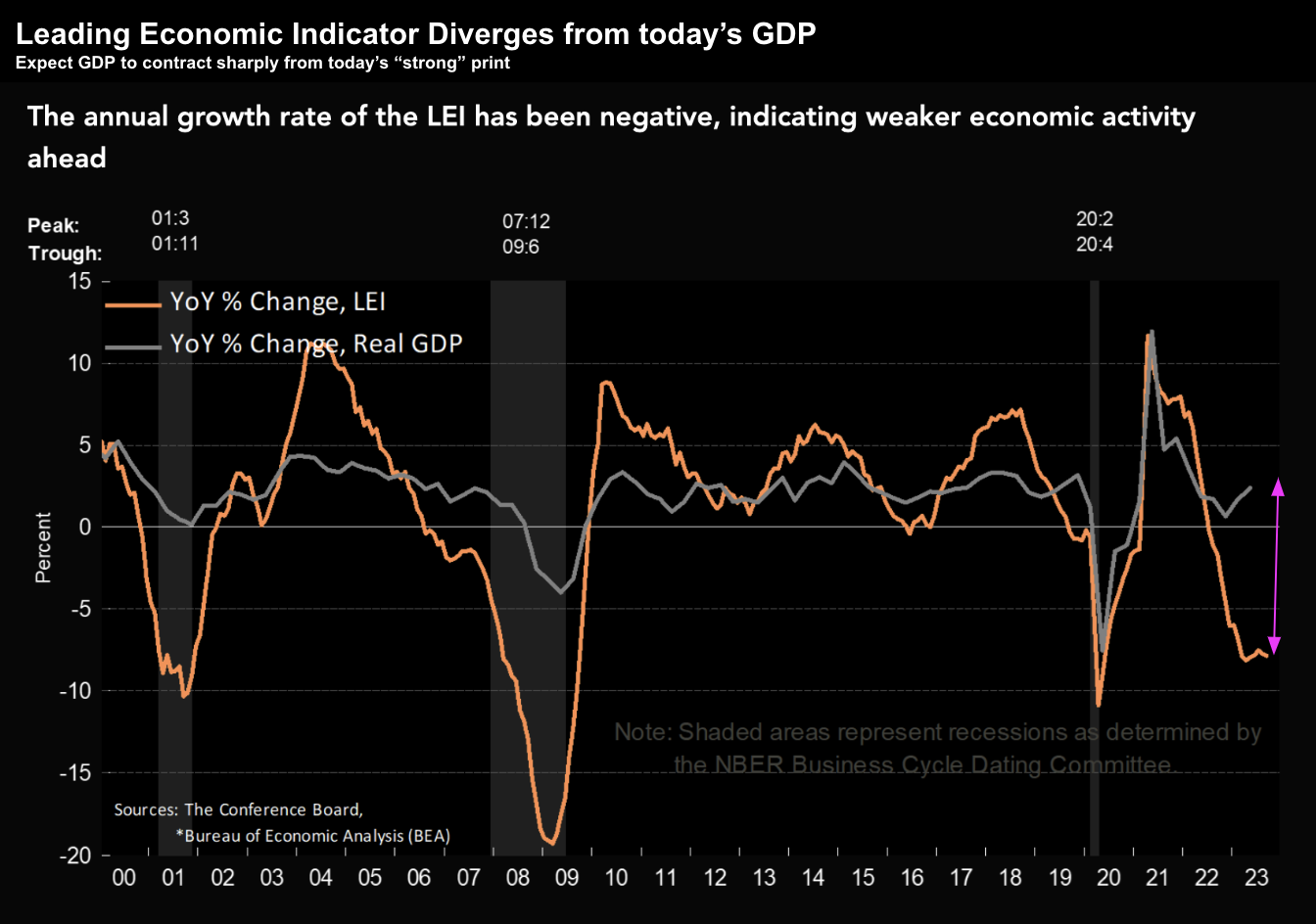

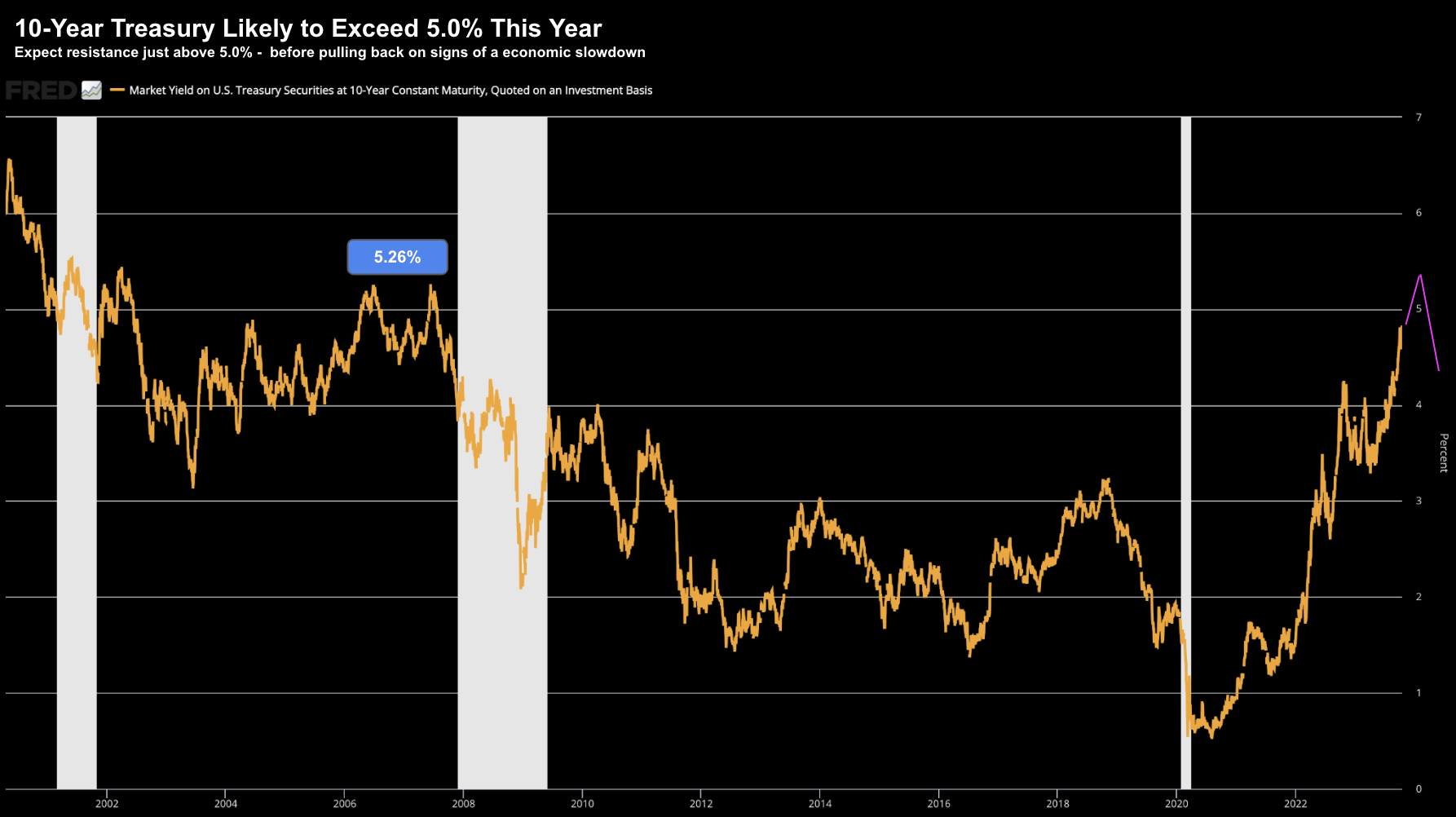

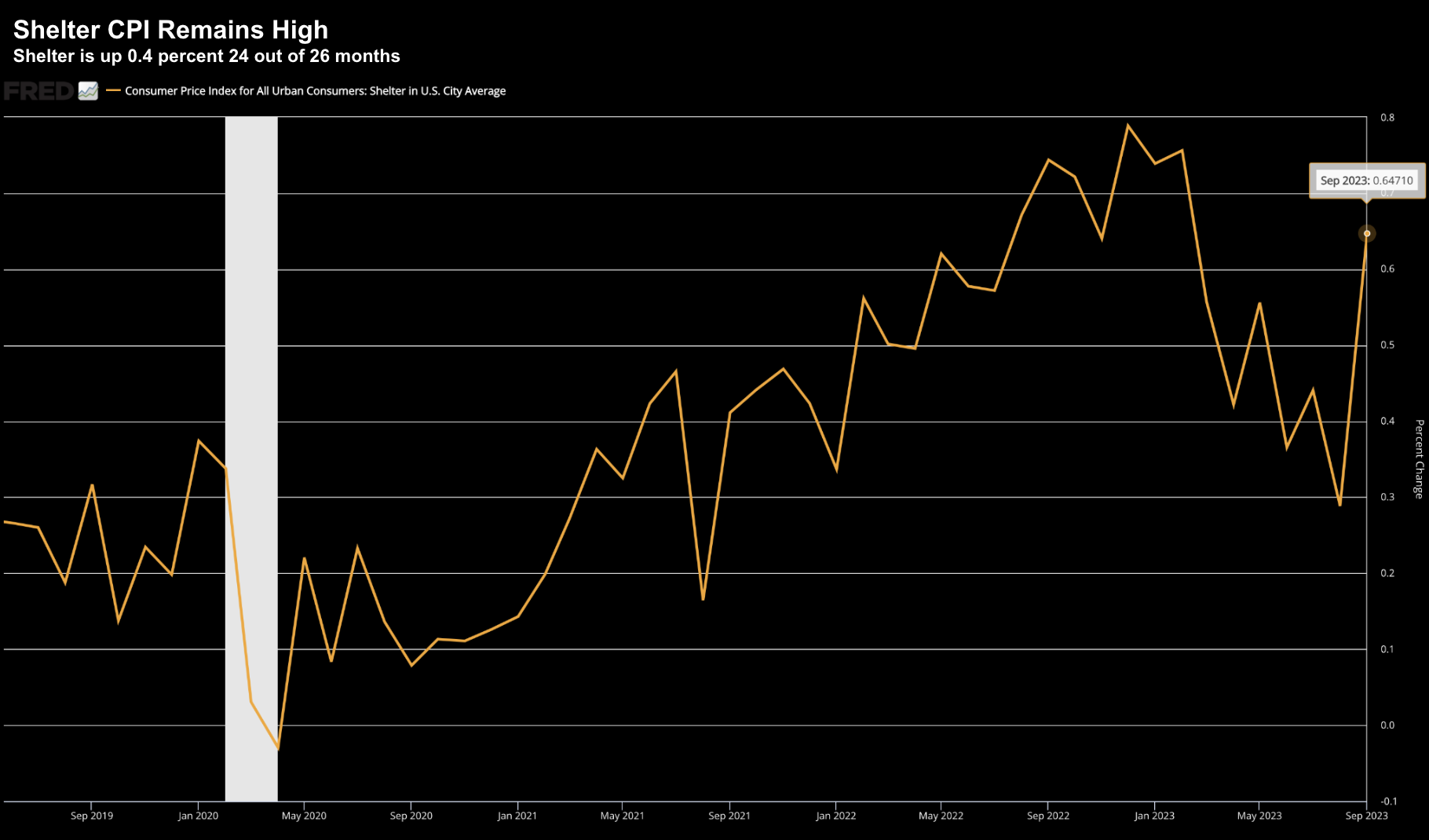

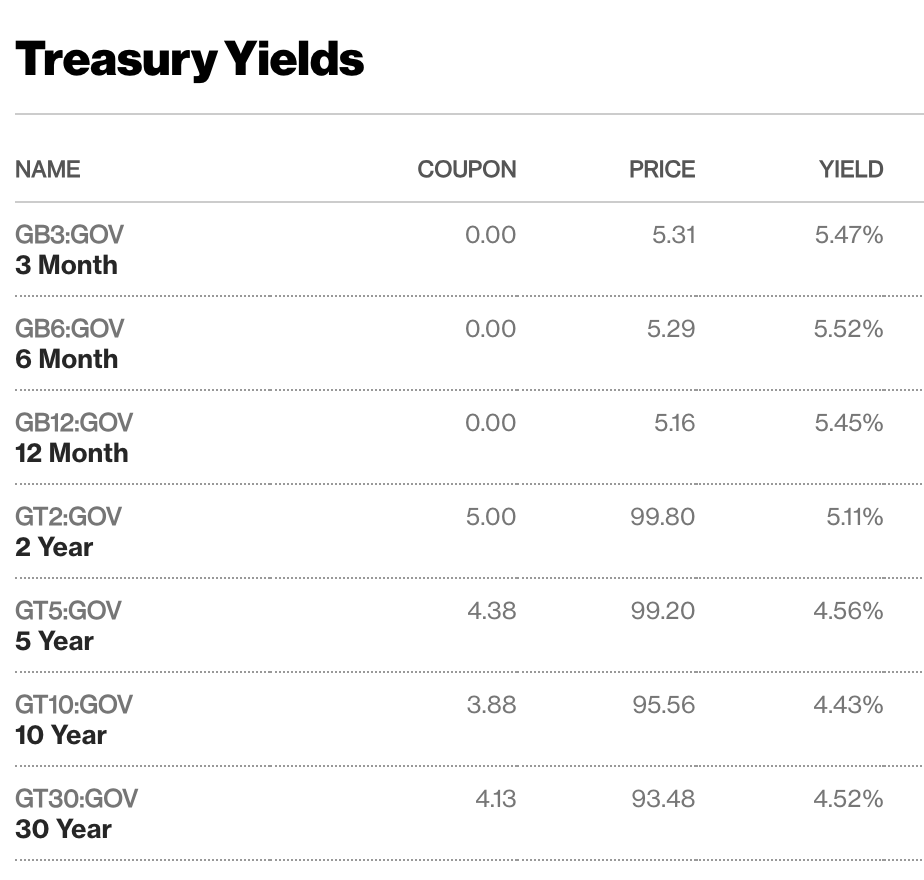

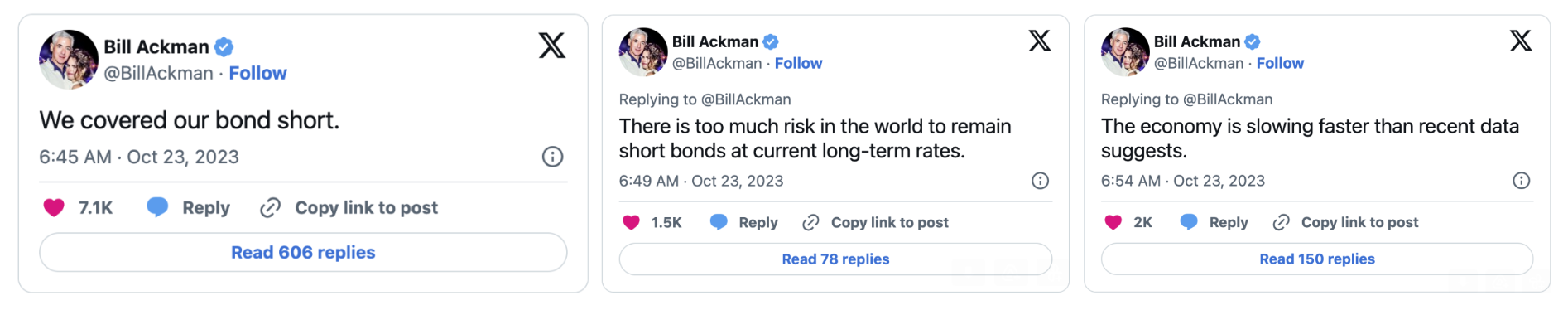

Over the weekend - I made the case for investing in fixed income. I think there's a compelling longer-term opportunity for investors - where fixed income warrants exposure in your portfolio. Turns out, it may not be just me thinking this way. For example, last week I referenced Howard Marks' latest memo. He explained how some are offering equity-like returns for investors (e.g., above 8% for non-investment grade debt). What's more, Warren Buffett said he was increasing his exposure to bonds (at the short and long-end) a couple of months ago. Today billionaire investors Bill Ackman and Bill Gross were sounding the horn. Question: are we getting closer to a near-term peak in long-term yields?