Winners & Losers Post Big Tech Earnings

Winners & Losers Post Big Tech Earnings

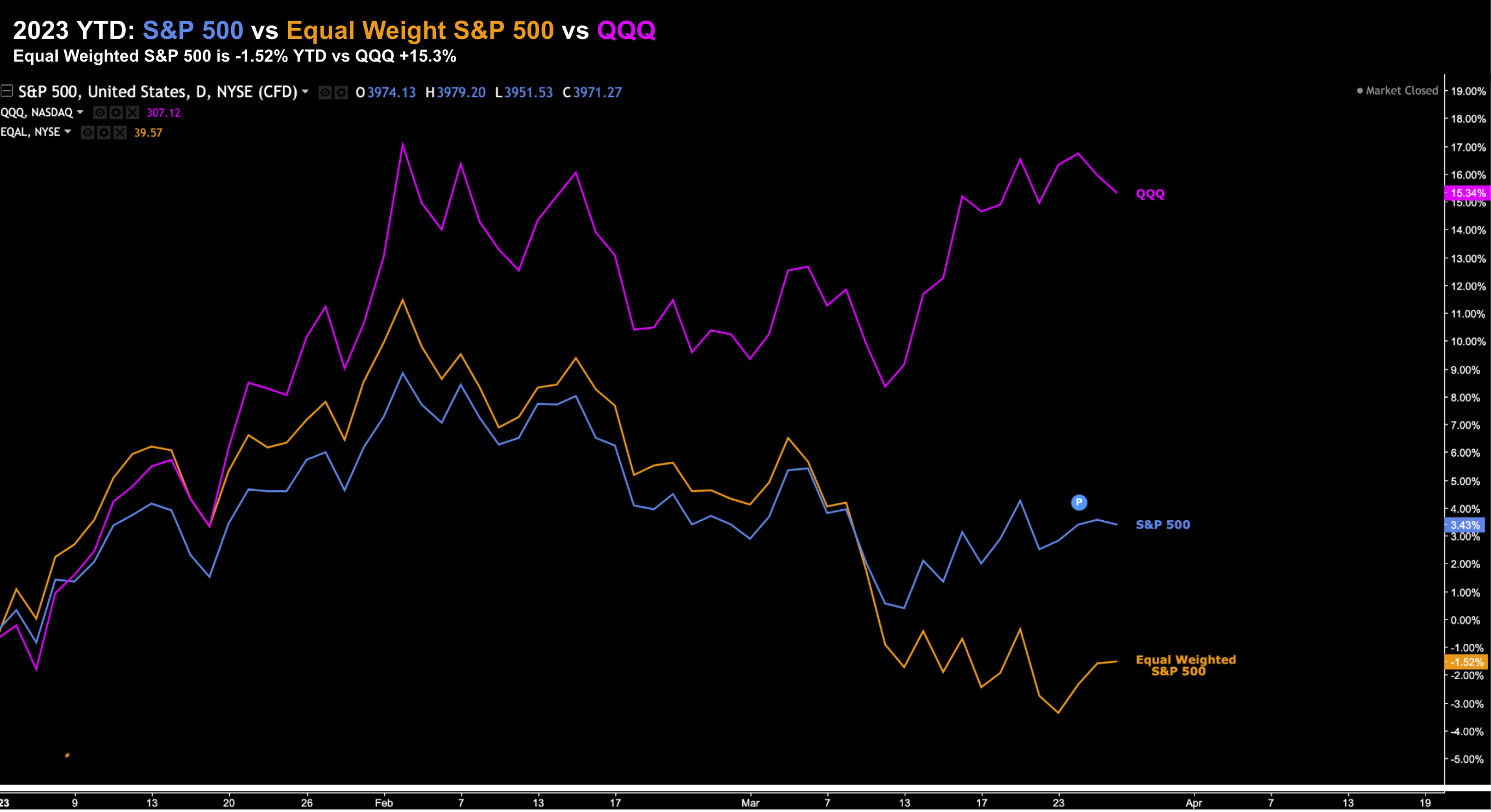

What did we learn from big-tech earnings this week? In short, their earnings were "better than feared". However, they were far from stellar. The 'best of the best' could only muster single digit growth (Google was negative). The Search giant also disappointed on expense management. Amazon offered very soft guidance - with AWS growth expected to fall to deliver only 11% growth next quarter. That's a long way from its 40% growth a year ago. In summary, the challenges are not over for the sector - however investors are paying lofty premiums.