Patience Alone Doesn’t Get it Done

Patience Alone Doesn’t Get it Done

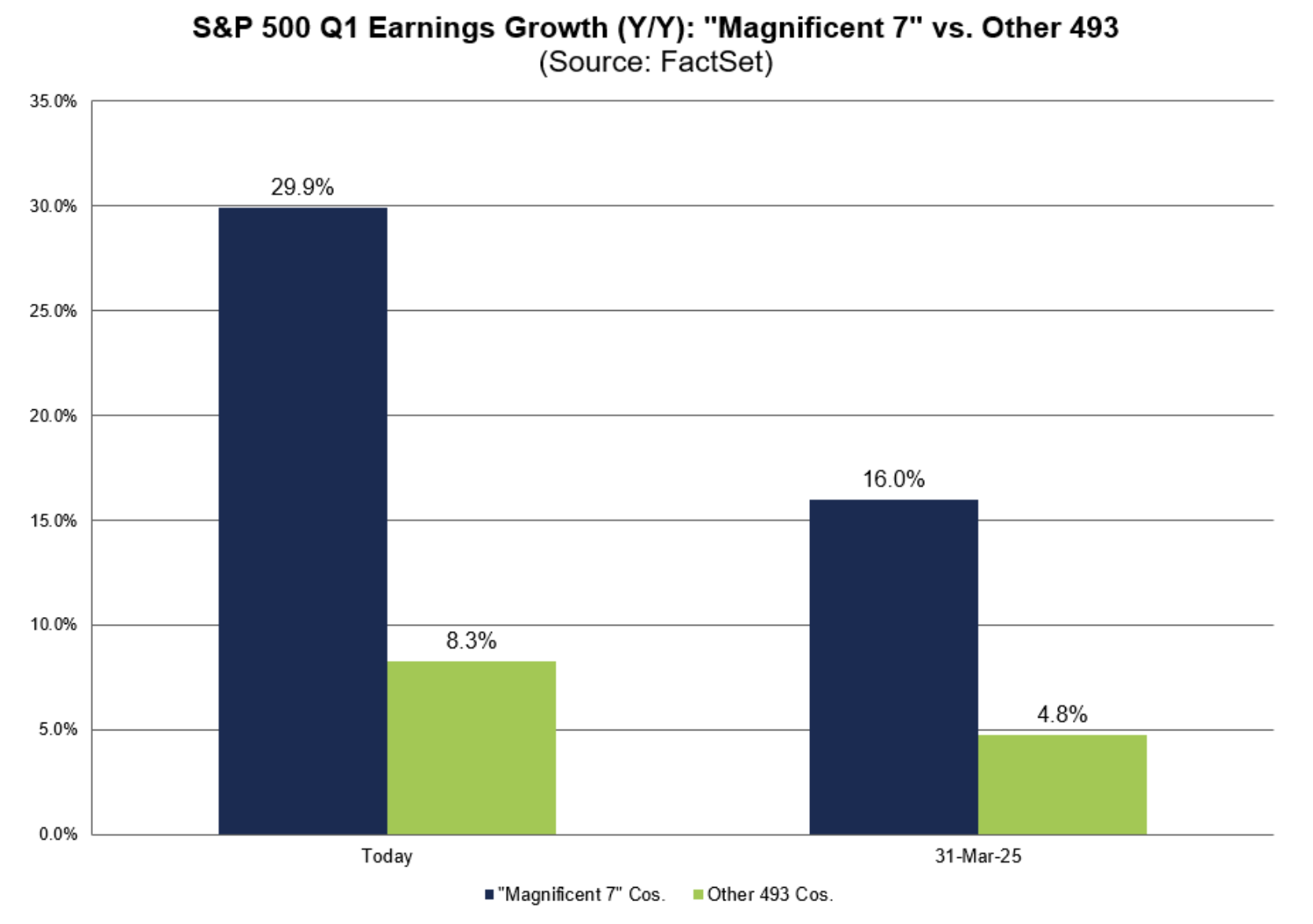

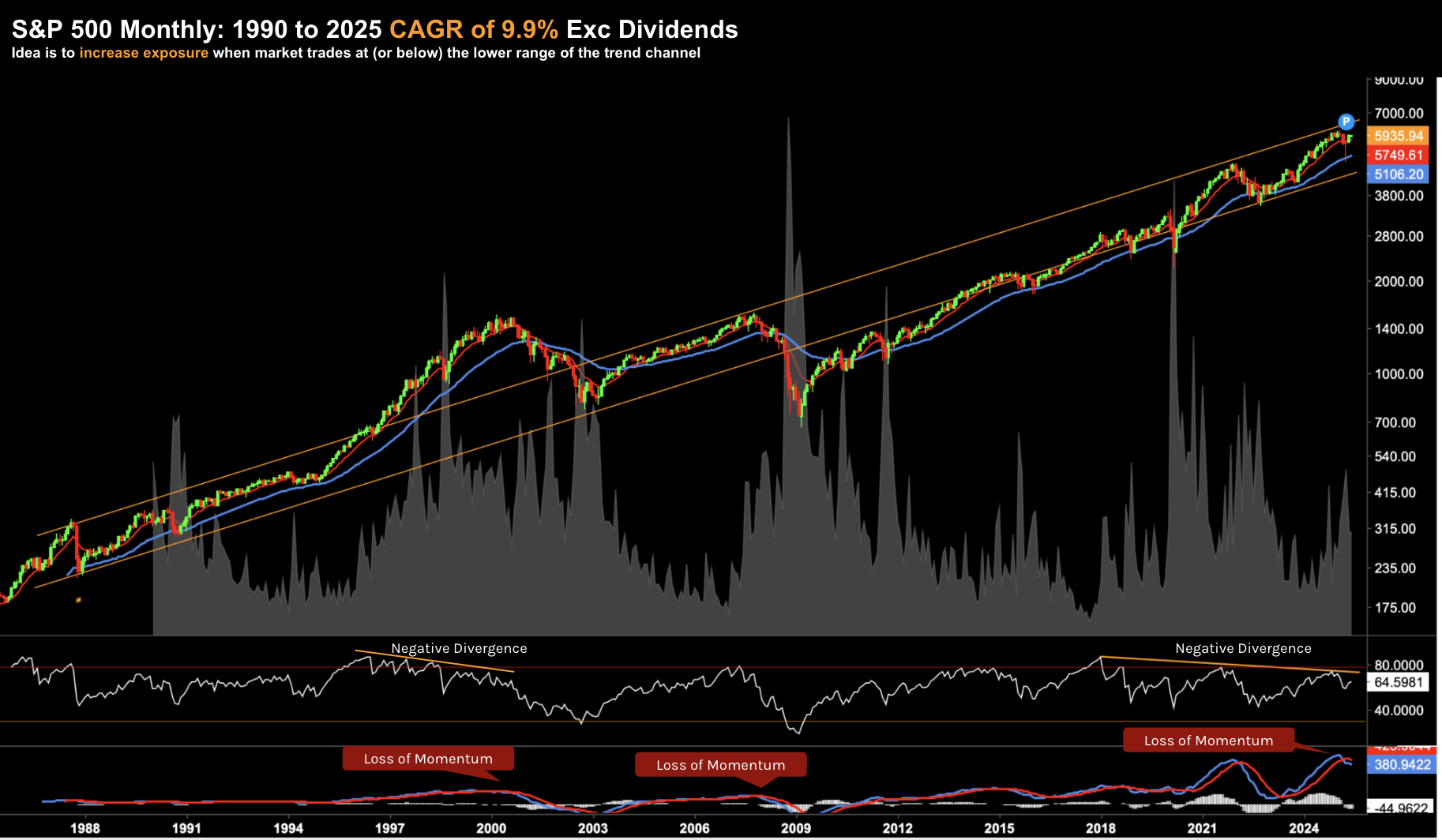

Over the past ~40+ years - the S&P 500 Index has returned an average of ~9.3% annually exc. dividends (i.e., 171.6 Jan 1985 to 5,979.5 Jan 2025). If we limit that to the past decade (from 2015) - that avg annual return increases to 11.4% (excluding dividends). But what matters most is (a) the price you pay; and (b) when you get out. Sitting tight for 10 years does not guarantee a 10% return...