NVDA: What Do You Pay for Growth?

NVDA: What Do You Pay for Growth?

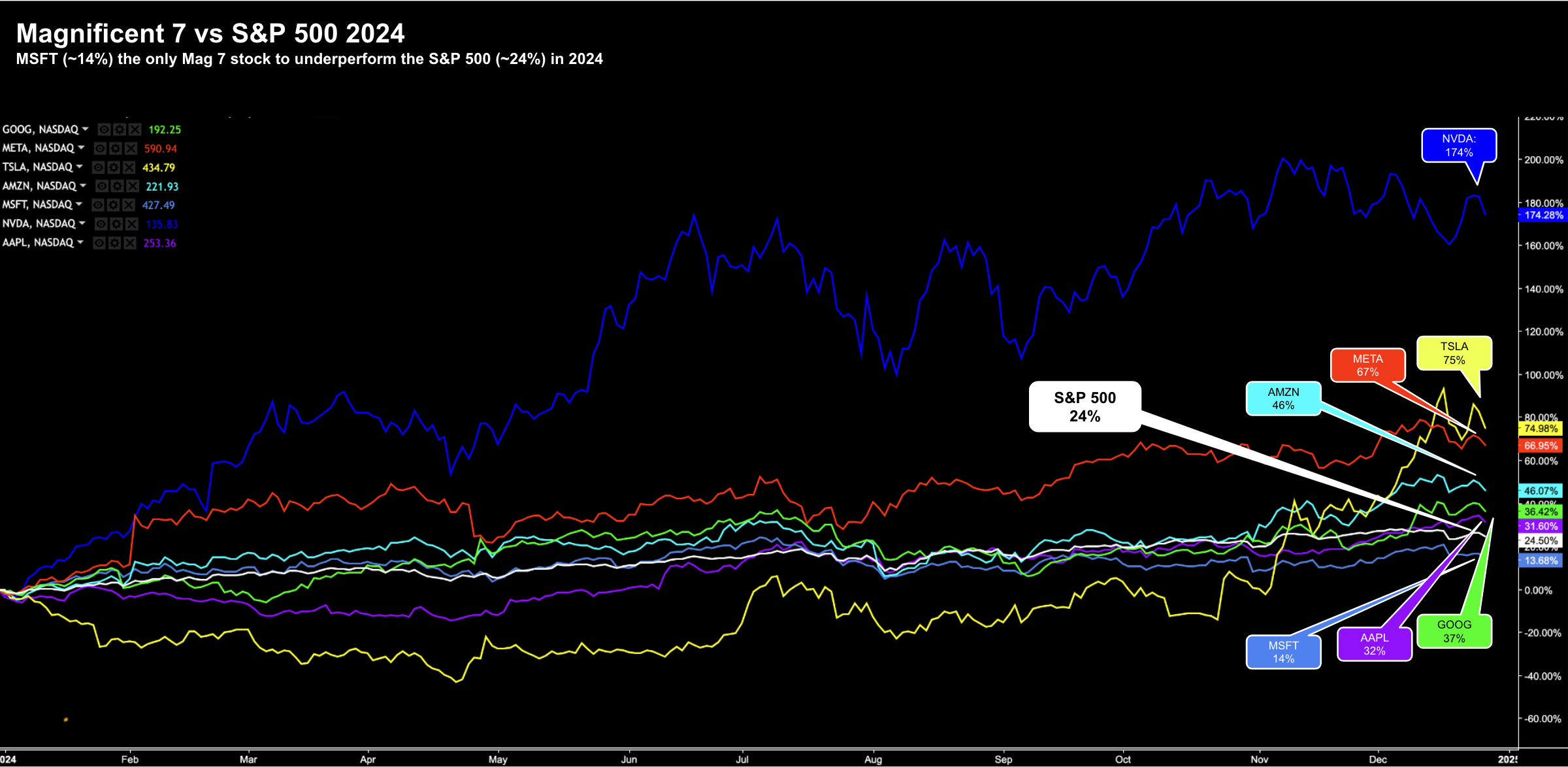

2024 will go down as another great year for stocks in the trader's almanack. However, what won't be recorded is just seven stocks comprised ~54% of the S&P 500 total gains (~24% with two trading days remaining). It's a bit like golf - you only need to record the final score - not how you did it. However, the how matters (not just the 'what'). This post will address the question of what to pay for one the most popular stocks today - Nvidia (NVDA). The asking price is $137 at 32x forward earnings. But does that represent great value given its growth assumptions?