Thoughts on 2026…

Words:2,436 Time:10 Minutes

- Three years of spectacular gains – will it be four?

- Five market moving investing themes for 2026

- A quick recap for 2025

Before we get started – here"s wishing everyone a happy, healthy and prosperous 2026 – and thank you for reading.

2025 is now in the books.

And whilst history will show it was another banner year for equity investors – it was far from smooth sailing.

Markets began shakily with the April tariff scare, a largely self-inflicted policy shock that briefly rattled risk assets before being rapidly walked back (TACO) — reinforcing the market"s growing belief that political volatility no longer guarantees lasting damage.

AI-bubble fears resurfaced as capital spending surged faster than productivity gains, while employment softened at the margin, raising questions about whether efficiency gains were masking underlying demand fatigue (more on both of these topics shortly).

Equity leadership was as concentrated as we"ve seen in 25 years — with 7 mega-cap tech names commanding some 35% of the total index weight.

Meanwhile, gold had its best year in 50 years – a hedge against policy error and fiscal excess, while Bitcoin"s sharp correction reminded investors that speculative liquidity is cyclical, not permanent.

Persistent Fed uncertainty—rates higher for longer, but cuts always "next quarter"—kept volatility elevated until the last quarter.

Yet despite these cross-currents, markets repeatedly snapped back – as retail investors continued to believe in a "buy the dip" strategy (something they have been trained post 2008)

For me, the defining themes of 2025 were (a) fear without capitulation; and (b) pessimism without collapse.

And put together – those themes made it challenging for some investors to match the returns of the Index.

Three Years of Spectacular Gains

The S&P 500 posted its third straight year of strong gains… for a total yearly return (inclusive of dividends) of ~17%.

That is some 7% higher than its 100-year average.

However, if we take a 4-year view – the Index"s CAGR is ~9.4% – more inline with its long term average of ~10% (inclusive of dividends).

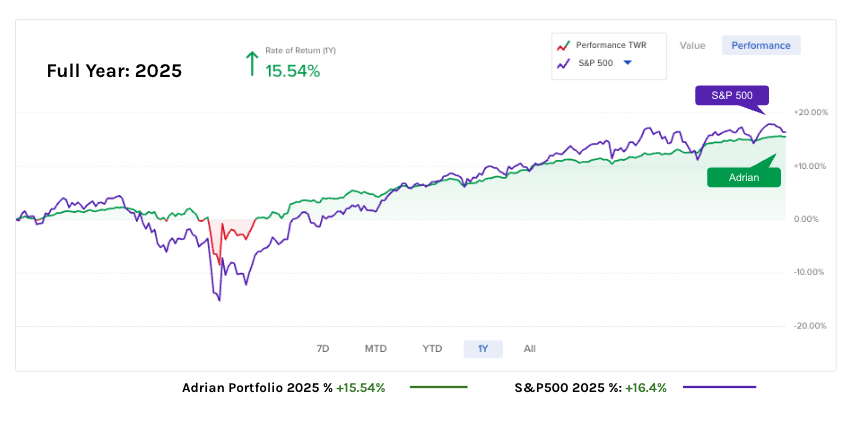

As for my own performance in 2025 – I maintained exposure to high quality stocks (where Google was my largest position) – however exercised some caution by remaining in ~35% cash and cash equivalents.

My (above average) cash position saw me slightly underperform the Index by ~0.9%

~35% cash equivalents is what I considered insurance – especially with valuations fully extended.

For my risk profile – choosing to be "80%+ invested" came with excessive downside risk (something I wanted to reduce).

My strategy is always to avoid losing capital vs chasing high returns.

Put another way – I look down before I look up (i.e, what could I lose from this investment vs what I could make)

That said, a near 16% annual return is I what I consider both a sustainable and acceptable return for the level of risk taken.

Let"s turn to 2026 and how I"m thinking about themes which could shape the year.

Major Themes for 2026

From mine there are five key themes I will be watching this year:

- Unemployment;

- Inflation;

- Monetary policy;

- Return on invested capital; and

- Longer-term bond yields

This list is not meant to be exhaustive – as there are always other "unknown unknown" risks (e.g., geopolitical events come to mind).

But these are what I call "known unknowns"… where each could have a large bearing on the performance of equities.

1. Unemployment

What we see with employment is perhaps the single biggest risk to the growth assumptions for next year.

Last year was a low-hire and low-fire year…. with some cracks in the market.

Companies were reluctant to make large scale layoffs – but they were not looking to aggressively hire either.

What"s more – most people choose to stay in their job as a result (vs looking for a better one).

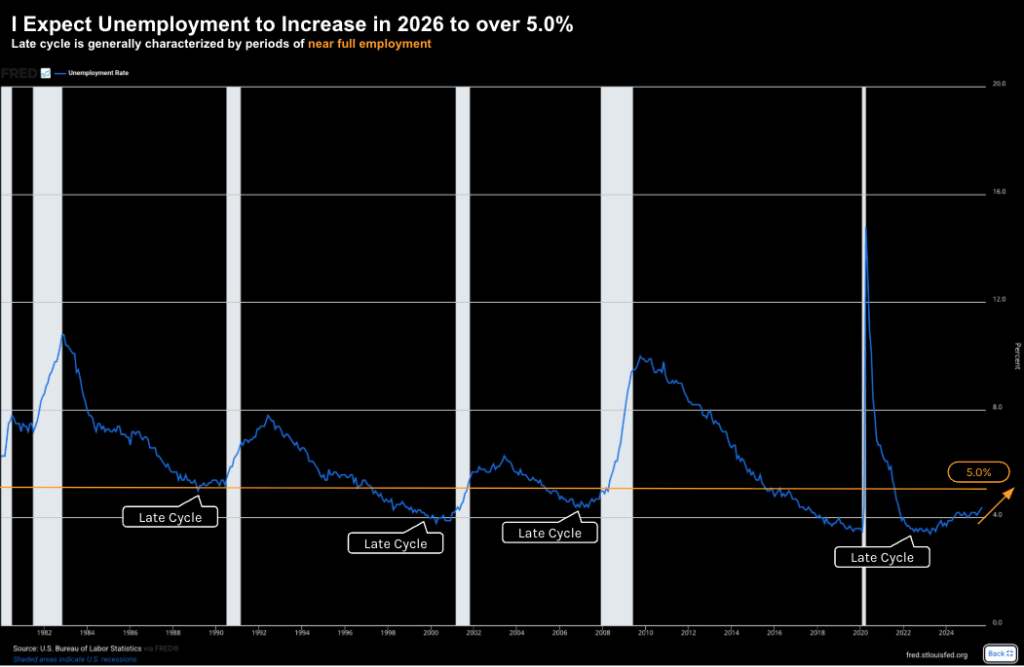

Let"s start with the yearly trend in unemployment (vs noisy weeks or months)

Unemployment has gradually ticked higher from "full employment" a couple of years ago.

So far, Trump"s MAGA policies have done nothing to stop the trend from rising.

Today the unemployment rate is ~4.6% (a healthy number)

However, my expectation is this will be above 5.0% by the end of 2026 – which I rate as a 80% chance.

That said, 5.0% unemployment is not a disaster (the orange line).

However, it will start to become uncomfortable for policy markers – as demographics start to push the figure higher.

It"s what I like to call an inverted demographic pyramid.

That is, people are living longer (mostly thanks to medications and treatment options) – however we are having far fewer children than we did 30 or 40 years ago (mostly due to the rising costs associated with housing, health, education etc).

As a result, we have an aging population which is now outnumbering the younger generation.

The problem of course is its the younger generation which are tax producing (the older generation are tax consuming).

As an aside – ~10% of the US workforce are between the age of 55 to 65 (and why I am very bullish on the health care industry)

Now older people tend to save more and spend less (deflationary); whereas younger people do the opposite (inflationary).

Younger people buy homes, expand families, put their kids in schools etc etc.

But when your existing tax base struggles to support those who are aging (the tip of the pyramid) – you have a growth problem (i.e., Japan and Europe are examples of inverted demographic pyramids).

If we see the unemployment rate tick above 5.0% (or worse inch towards 5.25%) – you can be sure the word "recession" will surface.

But when I listen to mainstream today – very few people are talking about a possible recession in 2026 (beyond the standard 20% risk which exists in any year)

It"s not unlike 2006 – when no-one was talking about a recession for 2007.

In 2006 the unemployment rate was also 4.4% (i.e., full employment). By the end of 2007 – it was 5.0%. We know what happened next…

From mine, if we see unemployment tick above 5.0% this year – you can revise down your growth forecasts (more on this below when I talk to bond yields).

2. Inflation

Almost every mainstream commentator believes inflation risks are done and dusted.

I am less convinced. My primary concerns are three-fold:

- The coming impacts of tariffs (which are yet to bite)

- The rising costs of health care; and

- The rising costs of utilities (such as energy – expected to rise 5%)

On the subject of tariffs – I think the impact is grossly underestimated.

For example, businesses that can pass along more (tariff) costs will. They are the ones with pricing power (e.g. Apple, Coke etc). Those who are commodity plays will have to absorb the cost through margin pressures.

But on the whole – most companies have depleted what inventories that were exempt from tariffs – therefore costs will now be passed on.

That"s coming to a store near you…

With health care – most forecasts show continued above-average cost growth. For example:

- Projections indicate U.S. health care cost increases around 8–10% next year, still well above general inflation. WTW

- Employer-sponsored health benefit costs are expected to rise by roughly 6.5%, the highest in 15 years.

Mercer; and finally - Some employers project median increases near 9% before plan design changes

And last but not least – energy:

- The U.S. Energy Information Administration (EIA) projects that retail electricity prices will continue rising through 2026, having already climbed faster than inflation since 2022.

- American Public Power Association Average U.S. residential prices are expected to increase about 4-5% — extending the trend of gradual year-over-year increases.

- U.S. electricity consumption is forecast to grow in 2025 and 2026, driven by industrial and commercial usage, electrification, and data center expansion

Put together, the Fed"s goal of 2.0% inflation will not be achieved in 2026.

For example, health care alone will add perhaps as much as 1.5% to 2.0% to PCE (the Fed"s preferred measure of inflation).

Now assuming the economy doesn"t collapse next year (in turn destroying demand) — the Fed could struggle to justify cutting rates several times with inflation above 3.0%

Which is a good segue to my next concern…

3. Monetary Policy

The market is convinced they will get at least two or three rate cuts next year.

In turn, this sees equity investors front running the Fed.

But what if the Fed is not in a position to cut rates given an uncomfortably higher inflation picture?

What then?

Rate cuts are central to a bullish thesis for next year.

For example, if you think the stock market is likely to gain another "10%" – then you need the Fed to be cutting.

This is largely why equities remain elevated (and why we saw some broadening in the market towards the end of the year).

Personally, I think there is a greater than 50% risk the Fed may only cut once next year (which will be before Powell ends his term).

That said, Trump will appoint his new Fed Chair with explicit instructions to cut rates.

But they could have a hard time justifying aggressive rate cuts if growth remains solid (above 3.0%) and inflation above 3.0%

4. AI Capex Bubble

The market gains in 2025 were mostly led by large-cap tech.

We did see some broadening towards the end (e.g., where small caps and Dow components rallied) – however it was tech which led the market.

The market is excited about the AI trade and "profits" they believe will come.

As I"ve said throughout the year – it reminds me a lot of the period of 1996 to 1998 (the internet mania came in 1999).

Just swap out "AI" for "Internet".

However, in the short term investors should be concerned about the amount of capex to build the infrastructure at the expense of cash flow – without any strong signs of real return.

Will that come in 2026?

I don"t think so but I am happy to be wrong. I wrote about this at length here.

The takeaway is should the AI investment bubble start to unwind – this will have a large bearing on the overall market"s returns next year.

Two metrics I will be keeping a very close eye on (especially with respect to the Mag 7 names)

- ROIC (return on invested capital); and

- FCF (free cash flows)

The Mag 7 have been terrific bets the past decade or so – boasting ROIC"s in excess of 20% and incredible free cash flows.

They were cash printing machines.

However, they were far less "asset heavy".

Today many of their business models are changing (with the exception of Apple – who has not participated in the AI capex bubble) – as they scale infrastructure for the expected AI demand.

What"s more, I"m also noticing their business models are starting to look very similar to each other (another concern).

Before it was easy to see how each of these differentiated. They each "owned" a clear segment of the market.

For example, Google owned Search. Meta owned social. Amazon owned Cloud and Retail. Microsoft owned Enterprise. And Apple owned the device (they still do!)

With AI – they are all chasing a similar pathway – one that feels like it will race towards being a commoditised play very quickly.

If that"s the case (and they fail to differentiate) – then watch the impact on margins and overall profitability.

As an aside, in terms of AI investment — I would look towards the application layer for the winners. Put another way – I would exercise caution in both infrastructure and platform layers.

Those two layers will be commoditized (i.e., very little differentiation).

By way of example – this is why Meta paid $2B for AI startup Manus – it"s at the application layer – to show some returns on its massive investment (which it is yet to do).

In closing, I own a healthy amount of large-cap tech. It was responsible for a chunk of my gains in 2025. But I am very wary of the excessive valuations and what returns on incremental capital we will see looking ahead.

I don"t think they will resemble what we"ve seen the past decade.

5. Bond Yields

The market has become overly complacent on what we see with the long-end of the curve (i.e., 10-year and 30-year bond yields).

Whilst the 2-year is a proxy for what the Fed are doing – we should be paying for more attention to what the Fed does not control.

It"s the long end which matters more – not the short-tend.

I think we will see the long-end (10-year) push towards 4.50% this year – even as the short-end declines

Why?

Look no further than deteriorating fiscal debts and deficits.

That said, I also feel the market is okay with a 10-year yield trading between 4.0% and 4.50%.

However, if we are to get above 4.5%, this will present a big problem for a bullish thesis.

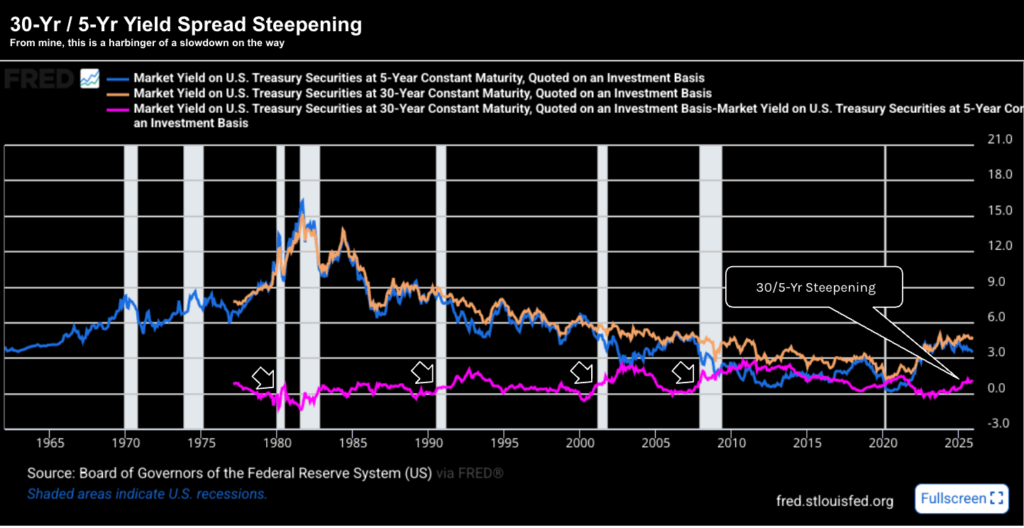

In terms of the yield curve – my focus is on the spread between the 5-year treasury and the 30-year.

The market has a fixation for "2s and 10s" – but I think it"s too noisy – where you don"t get a clear signal (for reasons I will explain below)

I get a much clearer view using the 30 / 5-yr spread.

For those less familiar – the 30-year Treasury embed long-term growth expectations; long-run inflation credibility; term premium; and fiscal sustainability risk

The 5-year Treasury is anchored much more towards the expected path of Fed policy over the next 1–2 cycles; near-term growth and inflation expectations.

Therefore, the 30/5 spread (pink line) isolates "long-term reality vs. medium-term policy."

When it steepens sharply (as we are seeing today) it usually means:

- The market thinks the Fed will have to ease materially because growth is rolling over; however

- Long-term inflation, debt, or risk premiums are not collapsing with it.

Put together – that is a very recession-adjacent signal.

Again, you just need to look at the white arrows above prior to what we find with the direction of the pink line before recessions.

So why not lean more into the 10/2"s?

From mine, the 2-year is almost a pure Fed funds futures proxy.

When I"m asked what I think the Fed will do at its next meeting – I just point them to the 2-year treasury. The 2-year leads the Fed – not the other way around.

The 10-year is heavily influenced by three things:

- Quantitative Easing and Quantitative Tightening (we"re seeing QE on the short-end now)

- Pension and foreign reserve demand; and

- Regulatory balance-sheet constraints.

Put together – this makes 10/2 vulnerable to policy engineering rather than organic cycle dynamics

On the other hand, the 5-year sits at the heart of the business cycle.

With respect to the 30-year – this is harder to manipulate and reflects genuine regime expectations

The takeaway: 30/5 is less about "what the Fed is saying" and more about "what the economy can actually sustain."

Now the steepening of the 30/5 curve typically occurs when:

- The market prices rate cuts;

- Growth expectations deteriorate;

- Risk premia rise faster than policy rates fall.

That"s why steepening has often occurred just before (and during) recessions, not years ahead of them.

Today the market knows the Fed is about to enter an easing cycle.

However, we must balance this with growing concern over growth; persistent worries about inflation, debts and deficits.

Putting It All Together

I"m often asked if I think the next year will be positive for equities…

My answer is I have no clue.

Probabilities suggest it will be… as equities rise far more often than they fall.

And most analysts on the street have stocks rising in the realm of "7 to 10%" next year (very much in-line with historical trends).

But asking if equities will have a good year is a lazy question…

To begin, one year is an incredibly short period of time.

I don"t know what stocks will do next week, month or year and nor don"t let that interfere with my decision making.

Second, a better approach is to identify quality businesses which trade at fair and reasonable values.

The challenge for me in 2025 was not finding quality (as there are many) – it was valuations.

I found value in some health care names (e.g., UNH, ELV), pharma (PFE); some consumer staples (STZ, KHC) and energy (OXY).

I was able to add to large cap tech during the April tariff panic (Google representing the best value at ~16x fwd PE at the time) – but I am not adding to AI names today given the valuations.

Again, their businesses are excellent. But the asking price is excessive.

If we"re fortunate enough to see a 15-20% decline in 2026 (note – we"ve seen four 20%+ declines over the past 10 years) – have your shopping list of quality names ready.

I know it"s hard to buy when stocks are in free fall (e.g., April this year) – but that"s precisely the time to buy.

On the other hand, you sell when others are greedy (e.g., paying forward PE"s above 25x)

Once again, here"s wishing everyone a happy, healthy and prosperous 2026