Trump Wants Lower Rates – Will He Get It?

Words: 1,900 Time: 8 Minutes

- Are bond yields headed lower or higher?

- A recession will lower rates… but be careful what you wish for

- US Govt needs to refinance $9.2T in debt this year… at what cost?

Trump is demanding the Federal Reserve lower rates.

However, Fed Reserve Chair Jay Powell – is having none of it (and nor should he).

This is setting up another showdown between the President and the world"s top central banker… a repeat of what we saw in 2018.

As we all know Trump is a real-estate guy.

Property is a business that relies heavily on cheap money. And this is the same lens Trump is taking with respect to his growth agenda.

But he may not get what he wants…

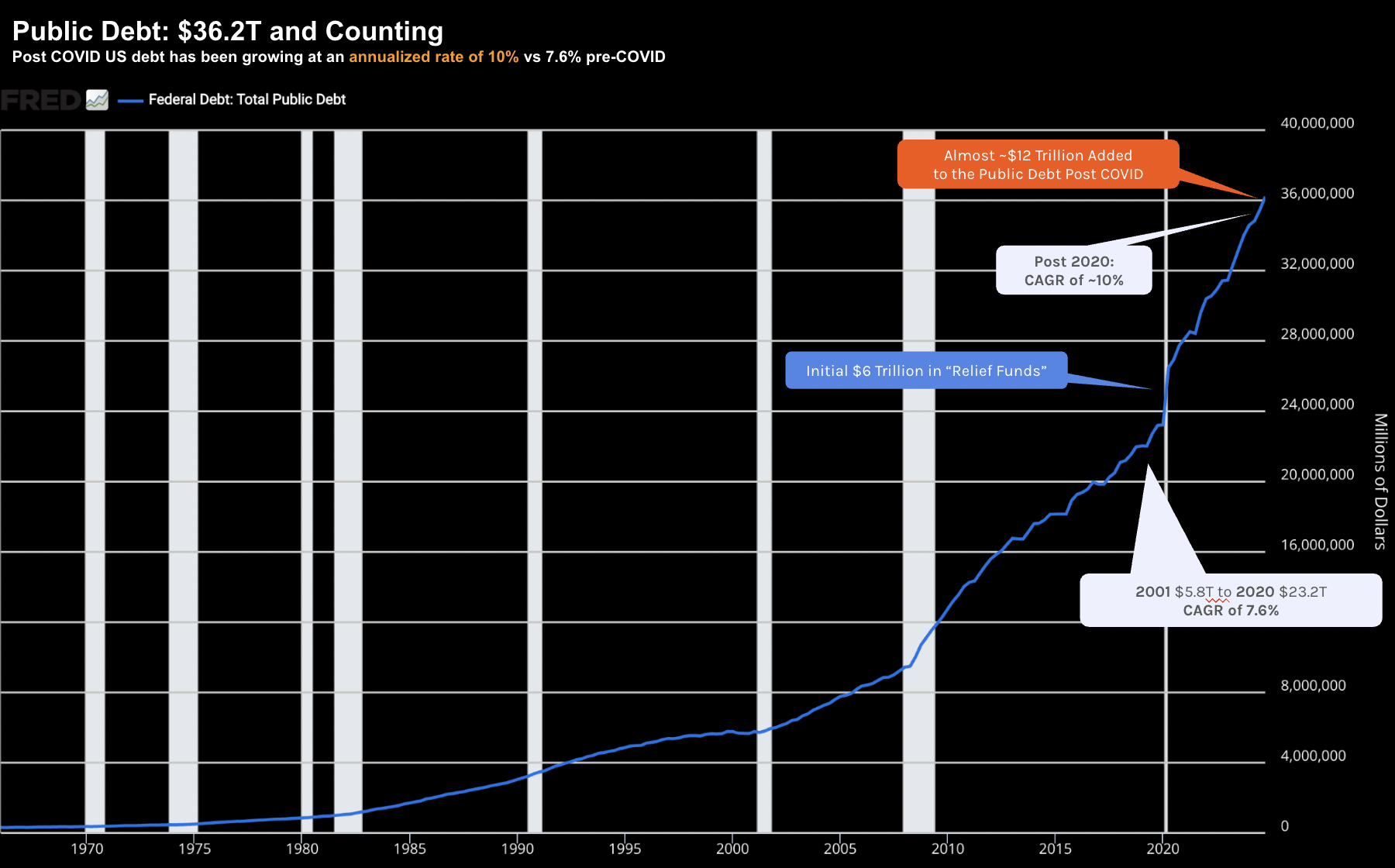

I say this because Uncle Sam is already drowning in debt…. some $36.2 Trillion.

If we then add the current federal deficit of ~$1.9T (or ~6% of GDP) – it looks worse.

April 17 2025

Trump"s draconian tariff policies won"t do much to reduce this (if anything it will make it worse – more on this further below).

As an aside, thoughtful cost cutting might. I like to say the US has a spending problem (i.e., it"s not a revenue problem)

Why this matters is the government needs to refinance ~$9.2 trillion in debt this year – which accounts for 25.4% of the total national debt (or about 31% of GDP)

Around $6.5 trillion is due in the first six months of the year.

Much of that cost (not all) will depend on where we find the US 10-year yield.

That"s the benchmark for determining the cost of funding.

The problem is a lot of the current debt was issued during the near-zero interest rate era.

However, today with the US 10-year trading around 4.32% — the cost of rolling their debt over is soaring.

But here"s the irony:

It"s Trump"s own doing (as investors lose confidence in the quality of US assets) – which is driving yields higher.

Fed Not About to Move

Much to Trump"s angst, Powell has repeatedly told the market the Fed is in no hurry to move on rates.

And the reason for their patience is to wait to see how tariffs and other economic policies of the Trump administration play out.

For example, if Trump"s tariffs stick (even if it"s only the new flat rate of 10%) – then expect prices of all goods and services to rise.

Powell said that the tariffs, and their likely impacts on the economy and inflation, are "significantly larger than expected."

Here"s the Fed Chair:

"Import taxes will probably lead to at least a temporary rise in inflation. It is also possible that the effects could be more persistent."

"Our obligation is to … make certain that a one-time increase in the price level does not become an ongoing inflation problem"

Higher Bond Yields are a Threat

The sharp move in the 10-year yield last week from below 4.0% to around 4.50% could be a sign of investors losing faith in the quality of the US" assets (specifically US government debt)

When investors sell bonds – their yields rise – sending rates higher.

Rising government borrowing costs also filter through to corporate loans and mortgages, meaning what happens in bond markets can cause economic damage to businesses and households.

April 17 2025

From mine, this is the most important chart for the remainder of this year (and maybe beyond).

For example, it will determine such things as (not limited to)

- How much the government can afford to borrow;

- How much businesses will pay to finance their investments;

- Whether households can finance new homes, cars, credit cards, and student loans; and finally

- Whether we are likely to usher in a recession.

Put simply, the US treasury market is the bedrock of the global financial system.

One source of higher rates (i.e., bond selling) has come from hedge funds that had taken on debt-fueled (stock) bets they hand to unwind as brokers demanded they post margins or additional collateral to back their trade.

As a result, they were selling Treasury bonds to raise funds.

This is known as a "basis trade".

This trade relies on selling futures contracts or paying swaps and buying cash Treasuries with borrowed money, with a view to exploiting slight price differences.

However, when the broker starts tightening the screws in terms of asking for more margin or saying that "I can"t lend you more money", hedge funds must sell.

Something to watch is the difference between treasury yields and swap rates.

With yields soaring – they were under significant pressure as a result of the bond selling.

For example, last week that gap exploded to 64 basis points – which is the largest on record.

And as another sign of the pressure in the bond market – US 30-year yields clocked their biggest three-day jump since 1982 .

Higher yields across the curve pose meaningful structural risks to the economy.

And should the 10-year rise above 5.0% — it"s possible we see the Fed re-initiate quantitative easing (i.e., act as a buyer of last resort in the bond market to help bring yields down)

For example, it"s my view that Trump"s (moronic) tariffs are changing the makeup of global trade flows – and over the long term — could lead to sclerosis with foreign buying of U.S. debt.

A Recession will Lower Rates… But…

It"s very difficult to predict whether:

- Long-term bond yields continue to push higher (e.g., due to large amounts of bond selling and likely inflationary pressures from tariffs); or

- Long-term yields fall due to the US entering a recession.

With respect to the latter (which I think is greater than a 50% probability) – long-term interest rates are likely to go down (as annotated on the 10-year chart above).

The "good news" is this would make it cheaper for the US government to refinance the $9.2 Trillion in debt which falls due this year.

But is that something to wish for?

My argument is no.

There is no scenario where one should "wish" for a recession to happen.

In short, whilst you will see lower borrowing costs (which most borrowers will immediately cheer), it comes with negative growth, a loss of jobs and overall lower income.

And if you are a borrower of money – you do not want to lose income.

The same logic applies to the government (not just households).

For example, Torsten Slok from Apollo provided a chart which shows that despite saving money from lower rates – the loss of income puts the government in a worse financial position.

Slok says that if interest rates decline by 2% – this would be more than offset by the deterioration in government finances associated with a recession.

For example, according to Slok, if interest rates decline by 2%, the US government would save around $500 billion in annual interest payments.

But if the US enters a recession, the government will have lower tax collections (i.e., less income) and pay more in unemployment benefits.

For example, the historical deepening of the budget deficit during recessions of around 4% of GDP would correspond to an additional $1.3 trillion erosion of US government finances measured in 2025 dollars.

Slok correctly argues that it"s not possible to improve the budget deficit by creating a recession because during a recession government finances would deteriorate by double the amount saved in interest payments.

In closing, here"s what I say about wanting lower rates:

Be careful what you wish for.

Stocks Not Out of the Woods

Before I close, let"s check in with the weekly chart for the S&P 500.

Last week I felt that the S&P 500 would catch a bid around the 4900 zone (where investors could start adding to high quality stocks and/or the Index itself) – rally up towards ~5700 – before facing renewed selling pressure.

April 17 2025

For the past 9 months (not just the past month) – stocks have traded per the script:

- We rallied up to the zone of ~6100 before finding (expected) resistance (~23x forward earnings)

- Stocks lost momentum (evidenced by negative divergence with the RSI and MACD) and corrected down to around the zone of 5,000

- Once oversold – RSI < 30 – stocks caught a bid rallying back to the ~5500 zone

From a technical lens – not much has changed.

And whilst the VIX is sharply lower at around 29x (down from a level above 45x) — uncertainty remains high.

My best guess from here is any strength will be sold.

For example, the 90-day pause does not give investors (or business) any further clarity; and nor does it give them confidence to make long term decisions.

What"s more, with the probabilities of recession increasing as a result of Trump"s tariffs, investors are unlikely to (aggressively) add to risk. From J.P. Morgan:

- In early April, J.P. Morgan Research raised the probability of a recession occurring in 2025 to 60% — up from 40%.

- The latest unwinding of the Liberation Day tariffs reduces the shock to the global trading order, but the remaining universal 10% tariff is still a material threat to growth and the 145% tariff on China keeps the probability of a recession at 60%.

- J.P. Morgan Research now expects the Fed to start easing in September, with further cuts at every meeting thereafter through January 2026—reaching a 3% policy rate by June 2026

Again, if we are to see a recession, then expect earnings estimates for the S&P 500 of ~$275 per share to come down at least 15% (i.e. in the realm of $230 to $240 per share)

If we apply a multiple of 18x to ~$240 – we get a price of ~4,320 – which is ~16% lower than today.

This is why I"ve labelled the buy zone of ~4,800 to ~5,000 as "initial".

And should we see the S&P 500 drop to levels closer to 4,300 – we can start making these full positions – held for the next 3-4 years.

Putting it All Together

Pending on whether Trump continues to "double down on dumb" with his trade policy – this will heavily influence whether we enter a recession.

That said, I think the damage is now done. In other words, we could already be in recession.

As J.P. Morgan states – even the universal 10% tariff will have material consequences to growth and inflation. They state:

"The ex-ante (pre-substitution) tax hike amounts to nearly $1 trillion, or 3% of GDP — making it the largest tax increase on U.S. households and businesses since World War II"

"While the current positioning of the U.S. and global expansion suggests the imminent downturn could be less severe than the last two downturns, recessions are inherently unpredictable"

"Another important concern is that sustained restrictive trade policies and reduced immigration flow may impose lasting supply costs, which will lower U.S. growth over the long run"

Spot on.

The only question I have is the relative severity of any recession.

The market assumes any downturn will be less severe than what we saw with 2008 and 2001.

And let"s hope that is the case….

However, if the downturn is as severe as what we experienced approx 18 years ago – we could expect stocks to correct as much as 50% from their highs.

Keep an eye on bond yields…. and remain patient if buying equities.