Uncertainty Weighs

Words: 1,388 Time: 6 Minutes

- Uncertainty at its highest levels since late 2020

- Confidence falling as tariff (and inflation) fears mount

- One Mag 7 stock I added (back to) this week

It doesn"t take much these days to knock investors off balance.

This week it was Trump"s 25% on auto tariffs and a slightly hotter-than-expected inflation print.

Tariffs are inflationary… a tax on the consumer.

And with (services) inflation remaining stubborn… it gives the Fed very little wiggle room to cut rates.

In combination with various geopolitical developments and aggressive government spending cuts from the Department of Government Efficiency (DOGE) – this has pushed policy uncertainty to its highest levels since late 2020.

Additionally, weakening consumer and business confidence added to the cloudy economic outlook.

This saw investors return to the safety of bond markets.

US 10-year treasury yields were pushed well below 4.50% as investors sought shelter in fixed income. What"s more, the US dollar appreciated – further highlighting the cautious mood.

In summary, investors are (finally) starting to worry about the potential downside risks I flagged at the start of the year.

Stocks were not cheap at 22x forward earnings.

It"s not a multiple which offers the luxury of things going wrong.

For example, if Trump"s proposed tariffs stay in place (and I don"t think they will) – they will both slow economic growth and raise prices.

And whilst a recession is still an outlier – slowing growth will result in less consumer spending and reduced earnings.

As I said the other week – we don"t need to experience a recession for stocks to give back ~20% or so when trading at historically high multiples. We saw this a couple of years ago.

Measuring Uncertainty

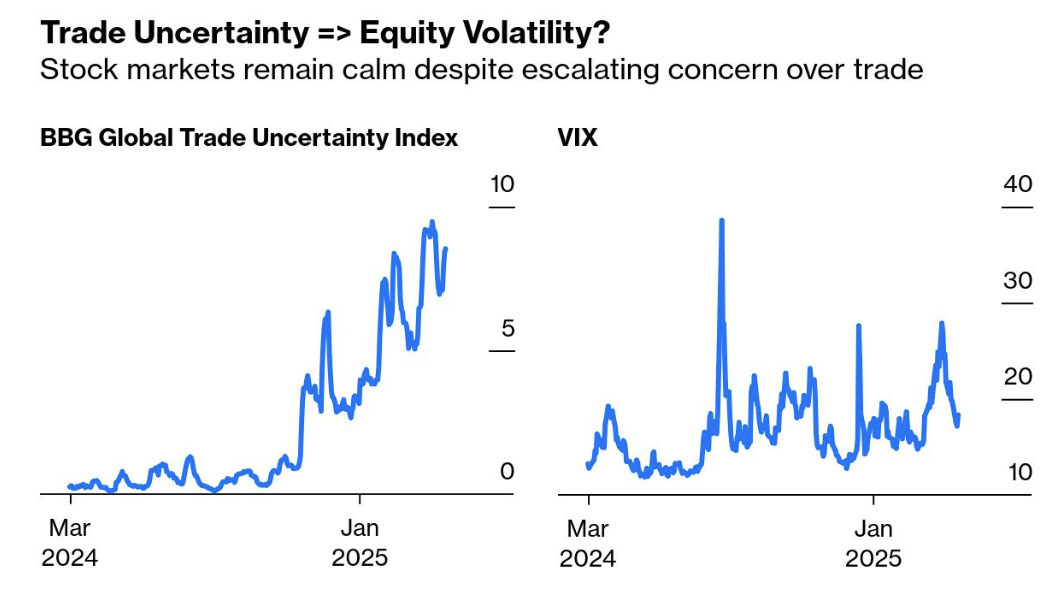

One way to measure that is to compare the global trade uncertainty index, compiled by Bloomberg from news, with the VIX index of equity volatility as derived from options trading.

Here"s what we find (from Bloomy)

This offers a curious divergence.

Bloomberg Option quoted Steve Sosnick from Interactive Brokers – who suggests thinking of VIX as a proxy for institutions" demand for volatility protection, rather than a sentiment indicator. He said:

"The uncertainty may not have decreased… but the demand for protection might have."

So what does this suggest?

It"s possible that investors have already lightened their exposure… therefore there is less of a need for insurance.

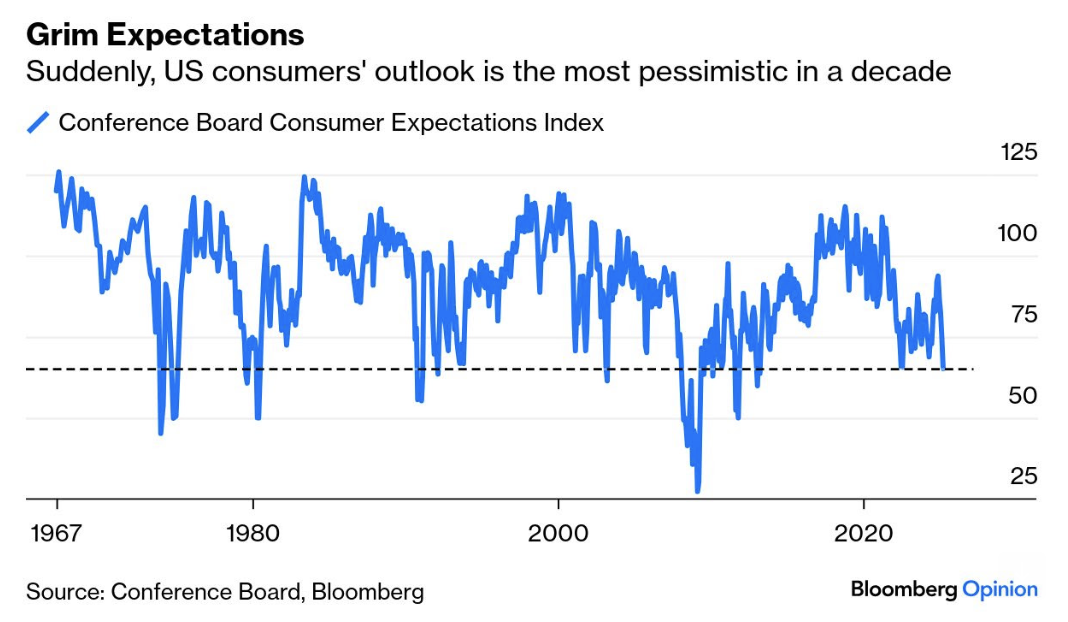

Grim Expectations

Sentiment has swung sharply since Trump won office.

Markets have gone from being extremely optimistic to very concerned.

The latest survey of consumer sentiment by the Conference Board found expectations dropping to their lowest level in a decade (a period that includes both the pandemic and the inflation spike):

From mine this chart suggests that consumers are increasingly worried about losing their job and prices rising.

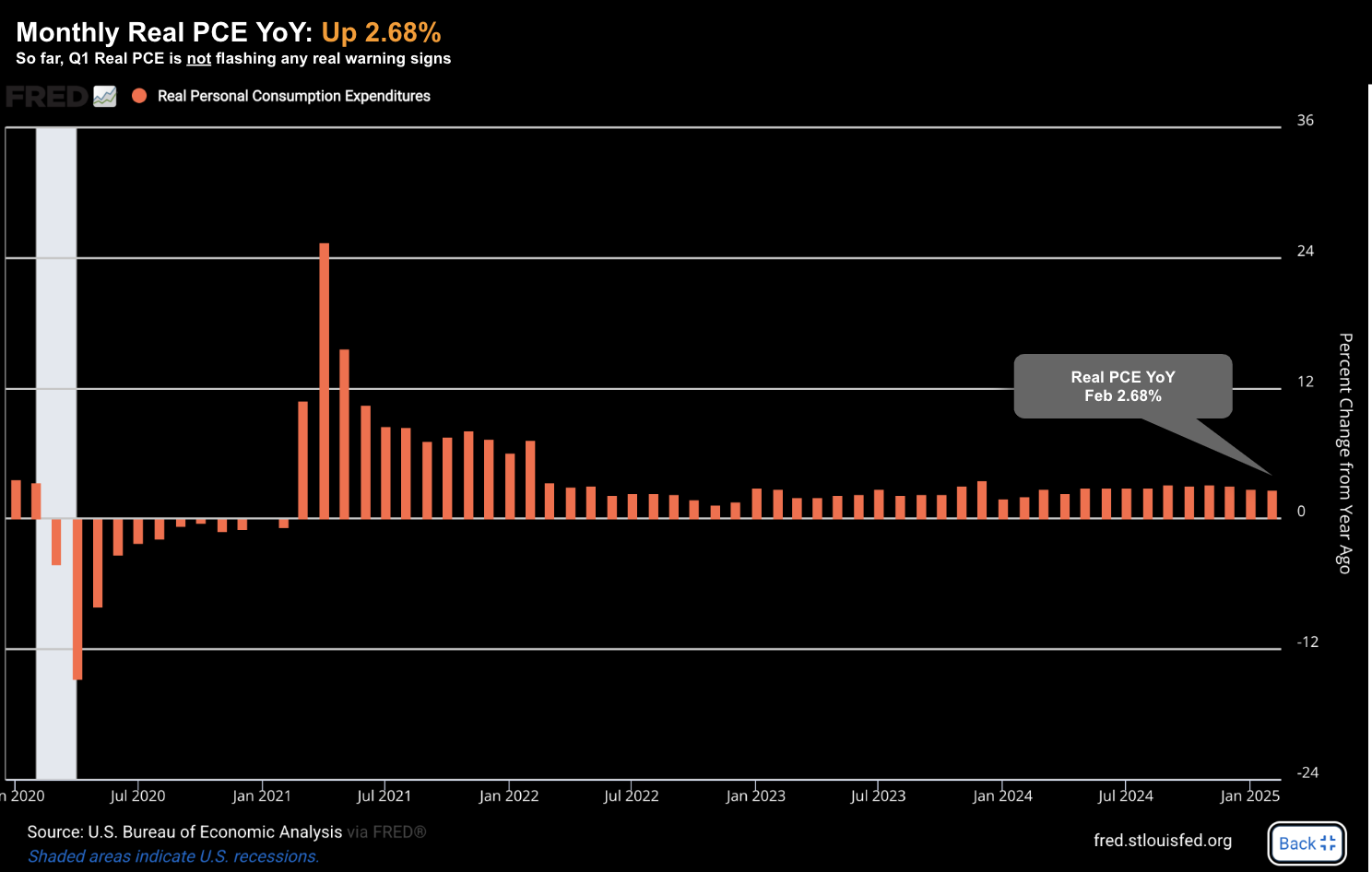

Now with respect to expenditures – this week we received the latest Real PCE report for the month of February.

The good news – is consumers are hanging in there – with the monthly number up 2.68% year over year (however slightly lower on the month prior)

March 29 2025

Whilst this gives us a snapshot of the quarter in progress – I will be very interested to see what March delivers.

As regular readers know, I am most interested in the quarterly change year-over-year (vs the change from the preceding period).

This allows us to remove noisy monthly data.

For now, I don"t see any strong signs of a material slowdown.

Stocks Resume Their Correction

The market continues to "trade per the tape". For example, last week I suggested:

Technically I think it could rally to the 35-week EMA zone – or around 5800 (see white line). But I think this is where stocks may struggle to go further; i.e. I expect any strength to be sold

Stocks managed a brief rally to a high of 5787 during the week – where they were met with a wall of selling.

March 29 2025

The most recent (red) candle shows the high point was right around the 35-week EMA (blue line).

And that"s where the buying stalled…

After last week"s (small) rally – some commentators were saying "the bottom was in" for the year.

It was premature. My feeling was we still needed to see follow through.

We didn"t get it (not yet at least).

What will be interesting this week is whether we see the selling continue.

Selfishly, I am hoping we see a lot more selling (e.g., closer to 5200 or below) – even if that means watching my own portfolio go into the red.

I say that because I am looking to buy back quality stocks at more reasonable multiples.

For example, earlier this year I sold 25% of my GOOG position near ~$200. And late last year – I exited all of my AAPL shares at $254.

At the time, I did not know if this was going to be a mistake.

All I knew was these stocks were trading at exceptionally high multiples... therefore it was a good time to reduce exposure.

Friday I bought back half of the GOOG position ~$157.00

For example, if we assume Alphabet (GOOG) will earn ~$10.25 per share next year (the average estimate) – you"re picking up the stock for ~15x forward (2026) earnings.

That"s a reasonable bet.

What"s more, it"s ~24% cheaper than the S&P500 (which trades ~21x forward)

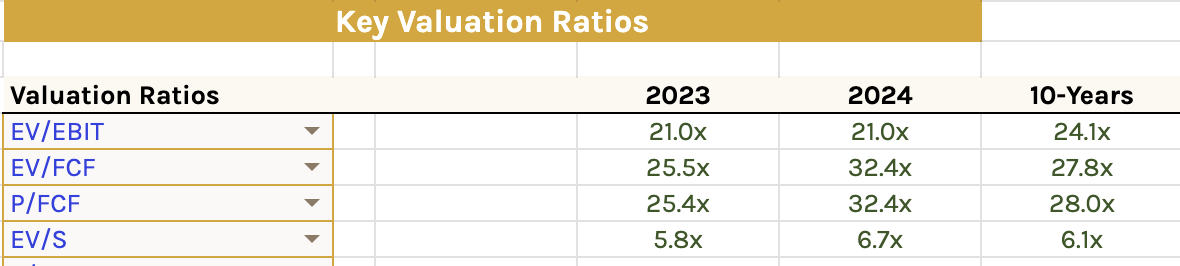

In terms of its EV/EBIT ratio (a valuation metric which I prefer vs PE) – its trading ~21x – which is about "3 turns" lower than its 10-year average of 24x (see below)

Again, for a stock of GOOG"s quality – that is not unreasonable.

The one problem I have with the valuation is the Price to Free-Cash-Flow. It"s elevated at 32x. I would rather this be lower.

But it"s the quality of GOOG which appeals….

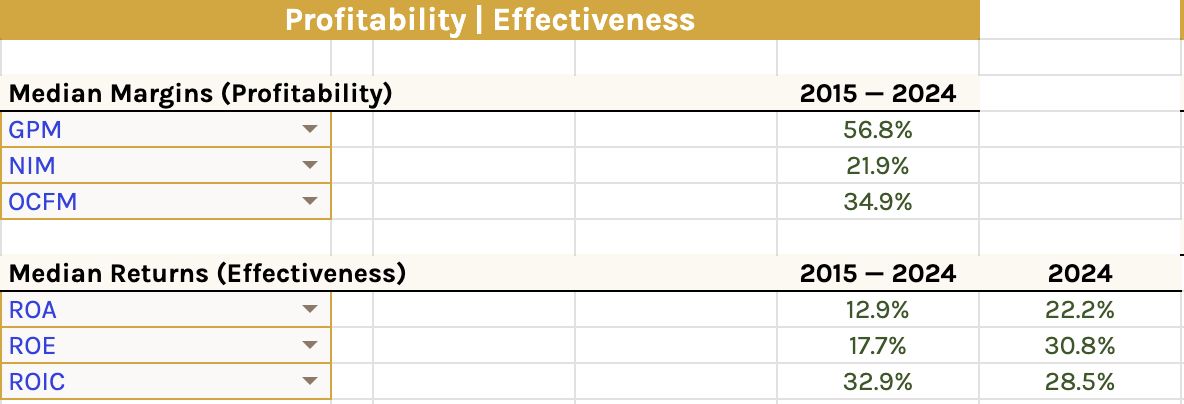

For example, over the past 10-years – its average 10-year ROIC is over 30%

Very few companies offer returns on invested capital of this magnitude. For example, as outlined in this post – the S&P 500 averages an ROIC of ~12%

For the most recent year, GOOG posted an ROIC of ~28.5%

In addition, it generates a ton of free cash flow.

For example, it has operated at an Operational Cash Flow Margin (OCFM) of around 35% the past 10-years.

And whilst this is likely to be under pressure this year given its $80B capex investment in AI ; and recent acquisition of cyber security company Wiz for $32B… the company remains a cash generation machine via its ads business.

From mine, if you can pick up GOOG anywhere around $150 to $160 – this offers an attractive risk/reward over the next 3 years.

To be clear, today"s price of around $156 is unlikely to be the bottom (I don"t pretend to know where that is) – however this feels like a reasonable bet.

** Full Disclosure – I work at Google **

Similarly, I"m carefully watching the price action of stocks such as (not limited to) Apple, Amazon, Microsoft, Nvidia and Meta for more attractive levels.

I"m not quite there yet with their valuations (they"re all outstanding quality) – however things are trending in the right direction (i.e., they"re getting closer).

Putting it All Together

It pays to be patient with investing…

This game is a lot of sitting and doing nothing.

However, when the opportunity presents, you want to be in a position where you can strike.

For example, those who lowered their exposure to stocks last year (or earlier this year) will be sharpening their pencils.

Valuations are starting to look a little more attractive in some names (not all).

That said, I would not be surprised to see the S&P 500 work its way lower (e.g. somewhere between 5,000 and 5,200)

If you don"t have time to analyze stocks (e.g., like I did with GOOG) – this would be a good area to add some exposure to the Index.

However, I would not make it a full position.

For example, if we assume earnings next year are likely to come in ~$270 per share (which is lower than the ~$275 consensus) – and apply a forward multiple of 19x – that gets us to 5130

19x forward earnings is not cheap. It"s above the 10-year average of 18x.

That"s why I would not make it a full position.

I would consider getting more aggressive when (not if) we find the forward multiple trade between 16x and 18x.

Before I close, I"m about to board a plane to Australia for a month"s holiday.

It"s been well over a year since I"ve been home… and I"m really looking forward to the break.

I plan on playing lots of golf, catching up on some overdue reading… and visiting family and friends.

There"s nothing like coming home…