Worst Week of the Year… Uncertainty Weighs

Words: 2,096 Time: 9 Minutes

- Powell says wait for the signal to emerge from the noise

- Why Trump"s inward looking trade policies are not the key to growth

- Waiting for a "washout" in stocks – where investors start to panic

As an investor – it"s very important to know the rules. If the rules are constantly in flux – it leads to uncertainty. With heightened uncertainty – investors pull back.

Variables in flux include: (i) the direction of monetary policy; (ii) policy shifts from the White House (tariffs, fiscal spend, regulation, immigration); and (iii) questions over investments made in artificial intelligence.

Growing uncertainty makes it harder to commit to stocks with conviction.

These were my opening remarks from this post in early February.

At the time, it felt like markets were starting to hedge their bets.

How could I tell?

Whilst the market was trading near record highs (around 6100) – momentum was fading.

I commented on both the weekly MACD and RSI falling – whilst prices remained high.

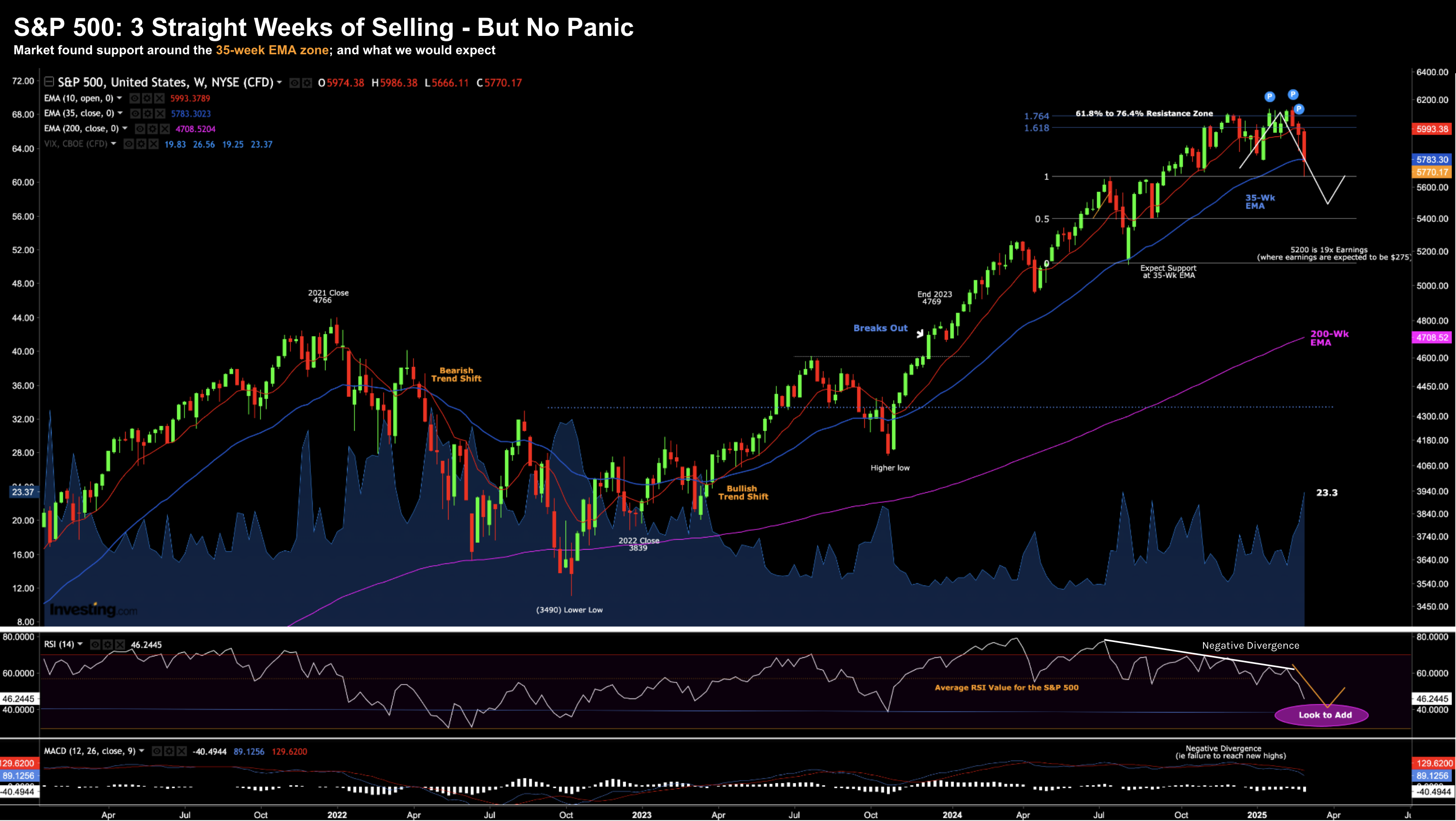

Technicians call this "negative divergence" (see lower two windows in the chart below)

Quite often it suggests prices are at greater risk of easing. Since then they"ve dropped ~6%.

The week ending March 7th was the worst week for the year and the third straight week of losses.

Mar 7 2025

From a technical lens, don"t be too surprised to see stocks catch a small bid from the 35-week EMA zone (blue line).

You often see this in bullish trends.

For example, around 60% of the time when stocks reverse ~5% – they tend to catch a bid shortly after.

But that"s something for traders (which is not me).

From my lens, the uncertainty on issues such as (not limited to) trade and tariffs, regulation, immigration and fiscal policy carries more weight than what happens at some technical price level.

And given the state of flux – markets could easily plunge again.

The VIX is elevated around 23x (implying daily moves of at least 1-2%) – however it"s not yet panicked (as I explained yesterday)

However, when we see a panic, it will result in a "washout".

That"s when I plan to add back to quality names (perhaps some of the same names I was happy selling in recent months)

But we are not there yet…

Tariff Worries

I"ve read many people argue that Trump"s approach to tariffs (and trade) is on the right path.

I don"t agree – as explained in this post.

Tariffs are nothing more than a tax on goods – paid by the consumer.

My hope is we have zero tariffs in both directions.

For example, the US drops its tariffs on foreign imports; and trading partners also drop their tariffs on US goods.

But is that what we will see?

I doubt it.

For the next few weeks (and months) – policy changes are something we"re going to have to navigate. It will be bumpy.

For example, this week we saw Trump remove the 25% tariffs on Mexico and Canada — just three days after he imposed them.

Don"t be surprised if they are back on again next week.

However, the chop and change makes it impossible for businesses to plan long-term and make investments. That hurts growth, confidence and sentiment.

And the impact is starting to show…

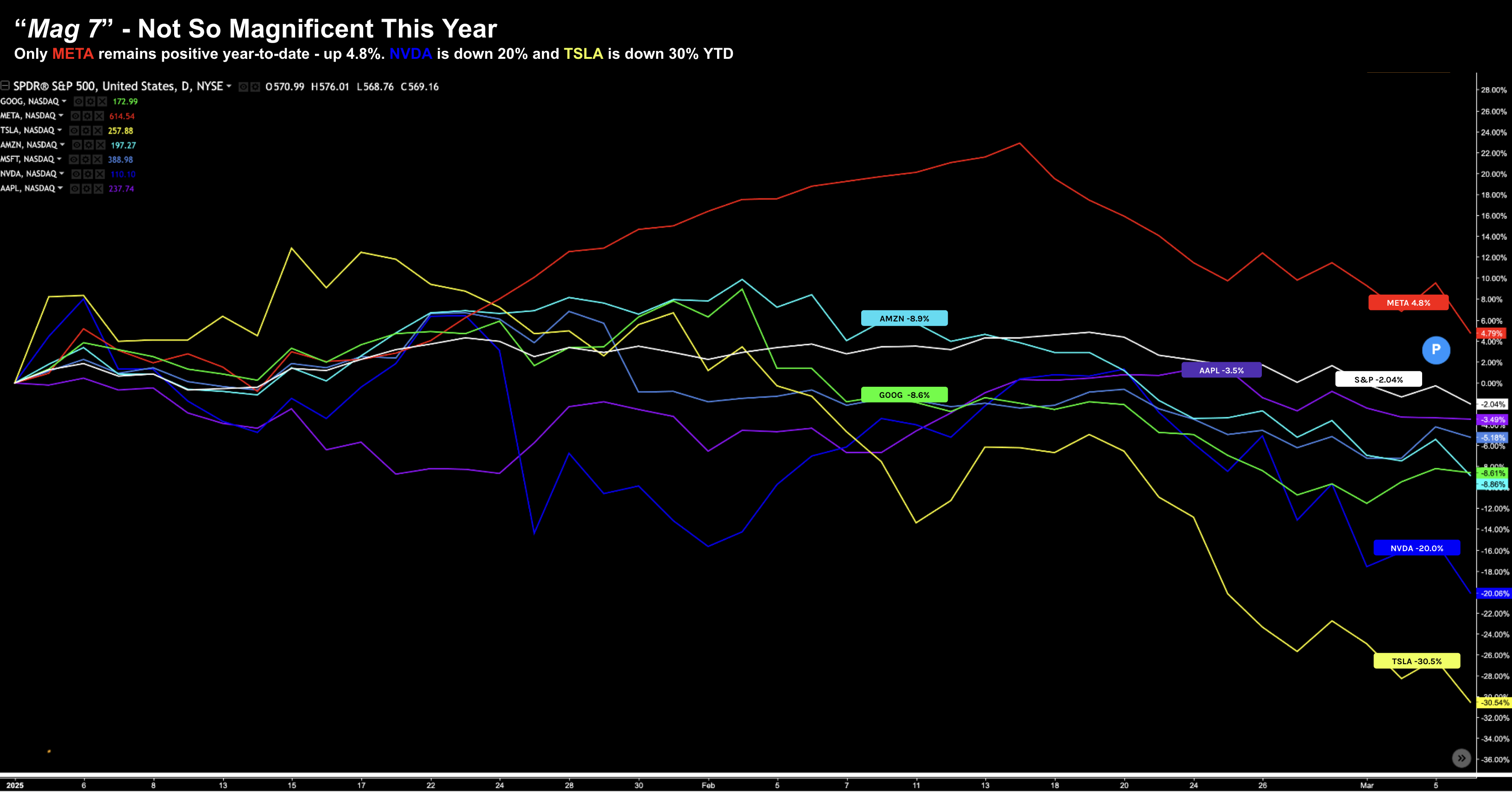

The Magnificent 7 Index is a great example – down 16% year-to-date.

Nvidia (-20%) and Tesla (-30%) have led the losses. Meta is the only Mag7 stock in positive territory YTD.

Mar 7 2025

With respect to Nvidia – despite growing sales 78% YoY at gross margins above 70% – it has lost $1 Trillion in market cap.

If you ask me – it has not recovered since the breaking news of DeepSeek.

Investors now realize that you don"t necessary need "Blackwell" chips to enable high-performing AI services.

I warned on this stock when it traded ~$140… which was against every analyst who maintained either a buy or strong buy rating.

12 month targets were as high as $200. Not one analyst had a sell rating on the stock – despite the stock trading at almost 40x its sales revenue.

Hopefully you took some profits on the Mag 7 names (and others) when they traded at well above their average multiples.

Beige Book Uncertainty

It"s not just markets who are struggling to calibrate what"s happening…

The Fed are equally unsure – expressed via the release of their Beige Book minutes

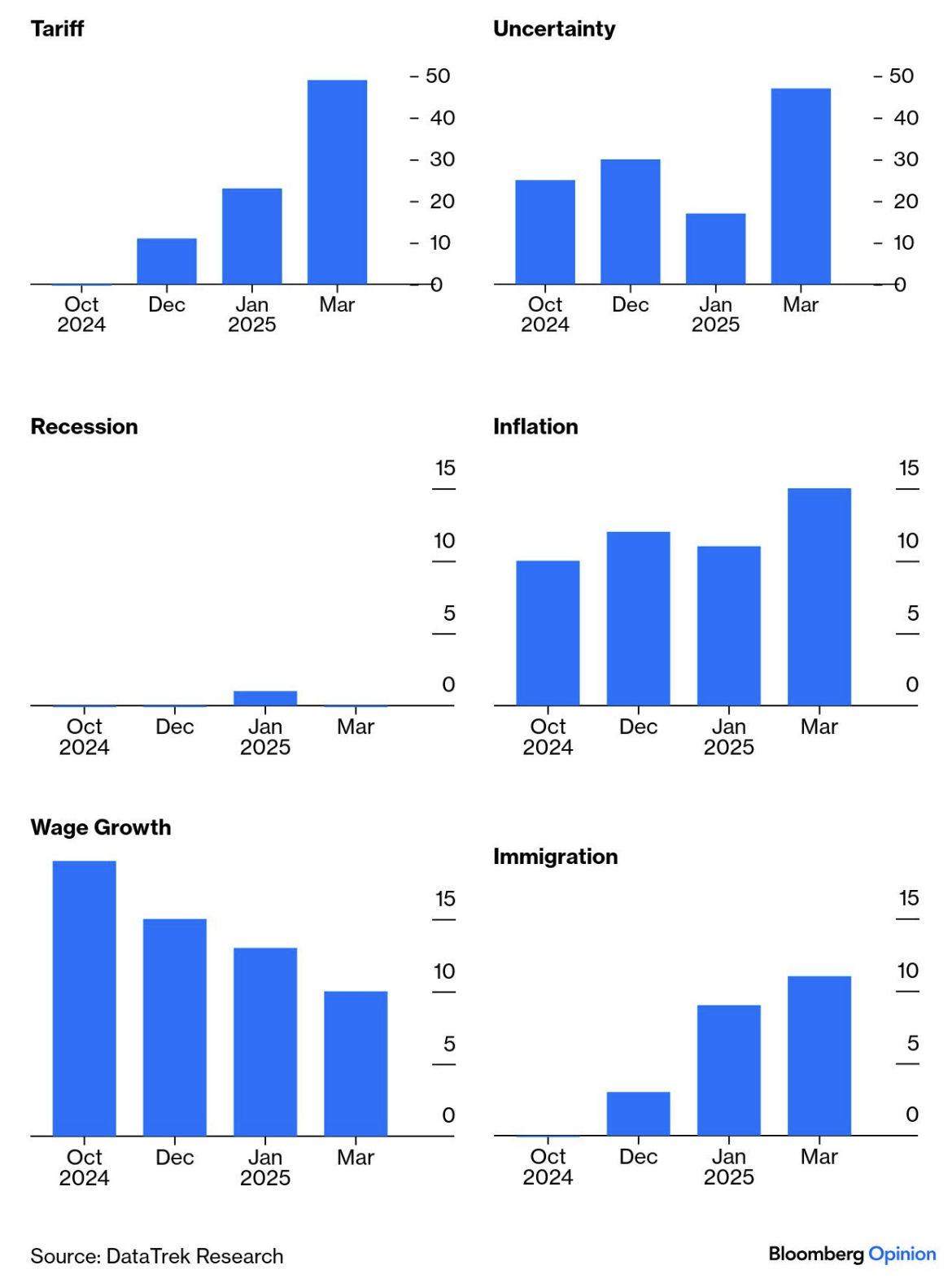

For example, the word "uncertainty" increased in its frequency – coupled with "tariff"

Today some words from Jay Powell soothed the market – saying the economy was just fine.

He said there is no cause for alarm – and we should just wait to see the signal from the noise. Here"s Powell on policy:

Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation.

It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy.

While there have been recent developments in some of these areas, especially trade policy, uncertainty around the changes and their likely effects remains high.

As we parse the incoming information, we are focused on separating the signal from the noise as the outlook evolves.

We do not need to be in a hurry, and are well positioned to wait for greater clarity.

Well said… they don"t need to be in a hurry.

And forget the folly of forecasting — it"s a fool"s errand.

Trade Deficit Surges

Companies however are worried about the future price increases driven by Trump"s tariffs.

Higher prices will impact sales and margins.

As a result, many US companies brought forward purchases to effectively stockpile non-tariffed goods.

If you can effectively get in front of a "25%" price hike – why wouldn"t you?

This also helps explain why the latest US trade deficit was the highest on record.

The trade gap surged 34.0% to an all-time high of $131.4 billion from a revised $98.1 billion in December, the Commerce Department"s Bureau of Economic Analysis (BEA) said on Thursday.

The percentage change was the largest since March 2015.

Adding to the (already high levels) of uncertainty – Trump is now talking of introducing a reciprocal tariff system.

This is where he will match levies one-for-one on imports of the same products to the US.

For example, if say "India" charges (on average) an 8% tariff on US imported goods (which they do) – Trump will slap them with an 8% tariff in return (vs the ~3% today)

On the flip side, Trump will argue that should India remove their taxes on US goods – they would receive the same benefit in return.

Is this good trade policy? And what will the net impact be on trade deficits?

On this, Bloomberg reported that UBS conducted extensive research on the trade between the US and 30 of its largest trading partners, analyzing 96 categories and 86,000 product/partner pairs.

Here"s the TL;DR

- Reciprocal tariffs wouldn"t raise that much money, or have that big an economic impact.

- Lifting US tariffs to the level of its partners would only equate to a weighted average increase of 1.65% (0.8% for developed markets and 2.2% for emerging)

- It will generate only about $18 billion to $32 billion in annual revenue.

- Reciprocity will often mean raising tariffs on goods that the US doesn"t import anyway.

- If a trade partner is exporting a product, UBS argues, it"s unlikely to be importing it.

UBS"s summarized it this way:

"Closing tariff gaps at the product-trading partner level amounts in tariff terms to a blanket tariff increase of 1.65% by the US. This is roughly an order of magnitude smaller than the 10% blanket tariff that candidate Trump was threatening to impose on the world."

Is it worth the pain for an extra maybe $18B to $32B per year?

Not from my lens.

From mine, I would focus on growing the overall pie rather than trying to take more of one that shrinks.

After all, has the US done well the past ~80 years under the existing trade policies? I think it"s done pretty well.

The bigger picture is these policies simply don"t work.

Let me explain why…

Mercantilist Policies Don"t Work

Clearly I"m not a fan of Trump"s mercantilist policies.

Tariffs are a zero sum game

From mine, inward focused policy is a recipe for slowing growth.

Protectionist based policies shrink the global pie – they do not expand it.

And it"s not how you grow the wealth of a nation.

To help support my economic argument – this was the dominant economic theory of the 16th to 18th centuries and during the Great Depression.

However, it failed (both times)

Let me offer six reasons:

- Trade barriers reduce economic efficiencies: If policy relies on high tariffs, quotas, and subsidies – this has the effect of distorting free markets. When countries prioritize exports and restrict imports, it raises costs for businesses and consumers, reducing overall economic output and slowing growth

2. Retaliatory Trade Wars: If one country imposes tariffs or trade restrictions, others often retaliate with their own protectionist measures (we are seeing tit-for-tat already). This leads to reduced global trade, harming businesses that rely on international markets

3. Reduced Specialization and Productivity: Free trade allows countries to specialize in producing goods and services where they have a comparative advantage. For example, Switzerland and their high quality watches. Germany and Japan on cars. India and their textiles etc etc. Trump"s policy will disrupt this efficiency by forcing domestic production of goods that could be imported more cheaply, reducing global productivity

4. Lower Consumer Spending and Investment: Import restrictions make goods more expensive for consumers, leading to lower demand and slower economic activity. Uncertainty from protectionist policies discourages investment, reducing business expansion and innovation – slowing growth.

5. Global Demand Imbalance: Since Trump is focused more on exporting than importing, that will also reduce global demand. Put it this way – if every country tries to export more while limiting imports, global trade shrinks, leading to slower worldwide economic growth.

6. Stifles Competition and Innovation: Finally, such protectionist policies shelter domestic industries from global competition, leading to further inefficiencies, lower quality products, and less innovation. In contrast, open trade encourages businesses to improve efficiency and innovate to stay competitive. For example, if the US can make a better quality car than Germany at a lower cost – then consumers will choose that car.

During the Great Depression – the US turned inward (like Trump is advocating) and adopted protectionist policies like the Smoot-Hawley Tariff Act.

This led to retaliatory tariffs worldwide.

What happened?

Naturally it severely reduced global trade and worsened the economic downturn – for all countries.

The Act raised U.S. tariffs on over 20,000 imported goods, aiming to protect American farmers and industries.

In response, many countries imposed their own tariffs, drastically reducing U.S. exports.

Global trade plummeted by more than 60% between 1929 and 1934.

The tariffs raised prices on many imported goods, hurting American consumers who relied on cheaper foreign products.

And U.S. manufacturers that relied on imported raw materials faced higher costs, making them less competitive.

Now someone should ask Trump whether he felt the Smoot-Hawley Tariff Act was a roaring success and why?

Have they? I don"t think so.

Putting it All Together

I think Trump is betting on two things with his trade policy:

- Steep tariffs will force the world"s leading companies to build factories in the US to avoid paying tariffs; and/or

- Force them to drop existing (high) tariffs on US goods

I have no doubt Trump will secure a few wins in the short term with these policies.

He"s using his weight to push around smaller countries (like the bigger kid in the school yard)

But longer-term they will more likely be a losing bet.

The head of the German Car Association (VDA) – Hildegard Müller, commented in February that Trump"s tariff threats of 25% on the European Union were a "provocation".

Here"s Müller:

"Tariffs are the wrong negotiating tool. The risk of a global trade conflict with negative effects on the world economy is high."

According to simulations undertaken by the Kiel Institute for World Economy, increased tariffs would lead to economic losses and inflation in both the EU and the US.

That"s the same point I made here.

From mine, I still think we are at risk of a growth scare. And perhaps the biggest risks are:

- Loss of investor and consumer confidence;

- Lower business investment; and

- Overall greater uncertainty.

During these times – don"t rush into any big investing decisions.

Powell was right to suggest waiting for the signal to emerge from the noise.

Today we don"t know the rules of the game. They shift day-to-day.

The good news is some higher quality stocks are getting closer to more reasonable value. We are not there yet – but we"re getting closer.

Don"t be surprised to see stocks catch a short-term bid next week… however the risks have not abated.