Munger on Intelligent Investing

Munger on Intelligent Investing

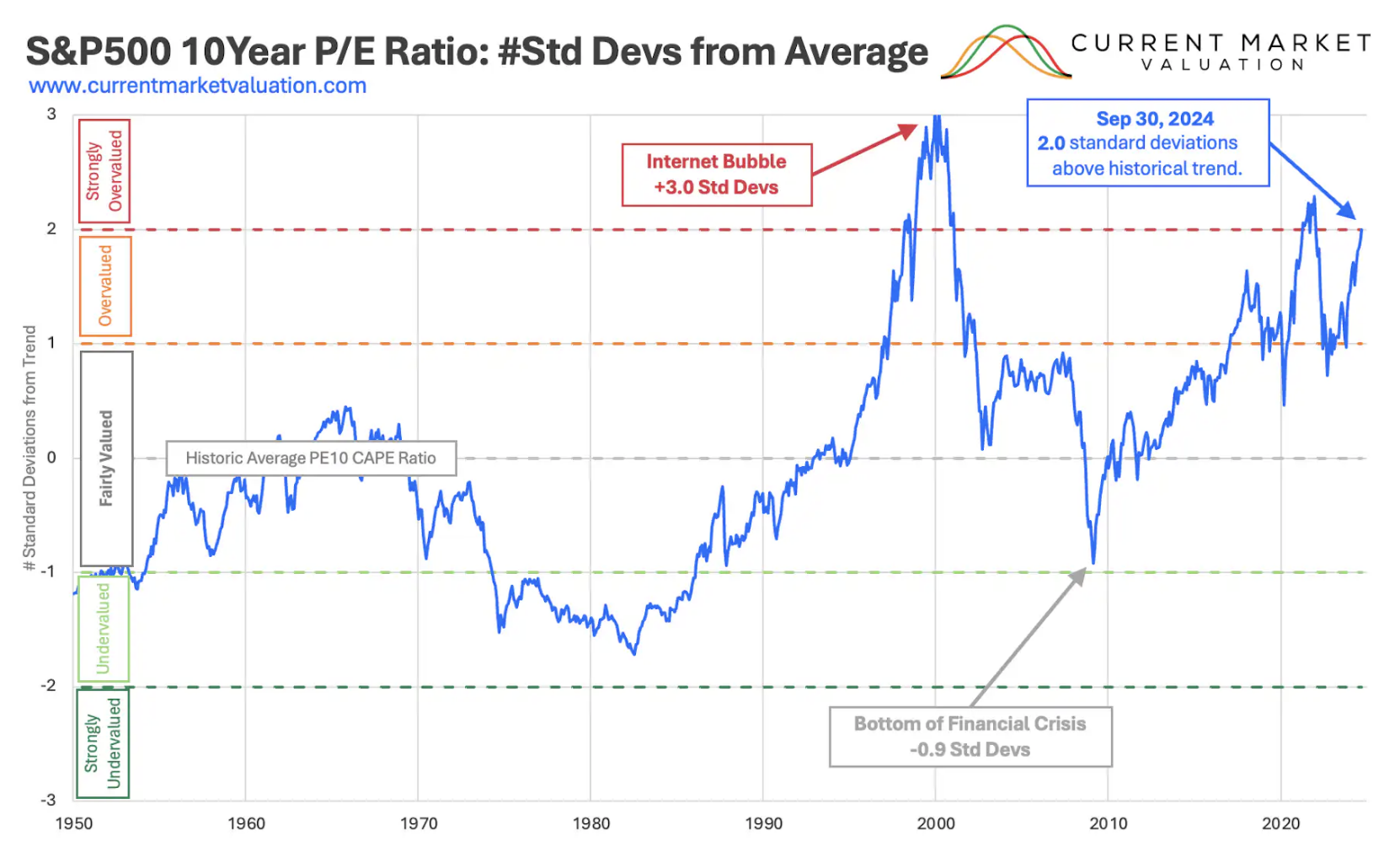

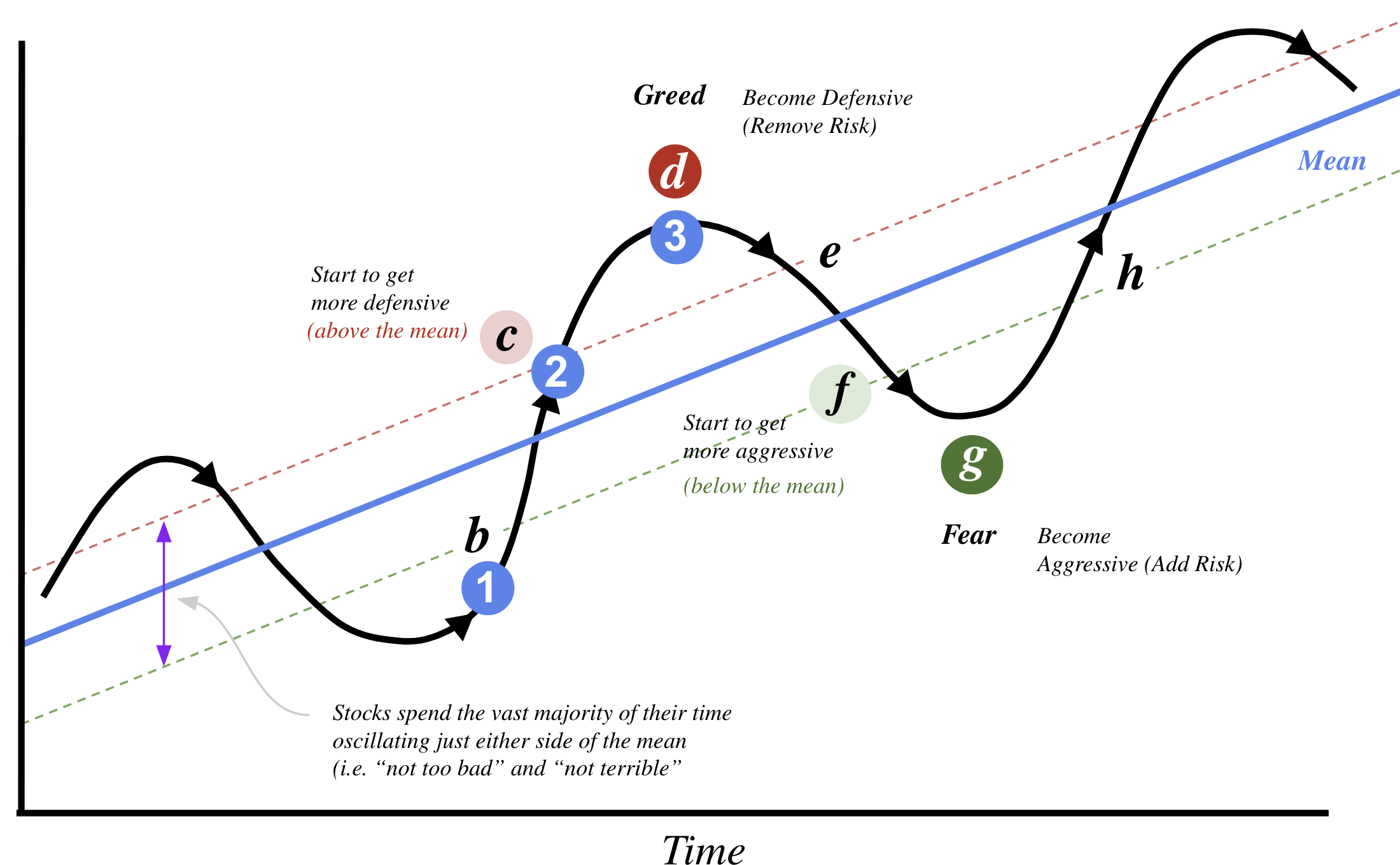

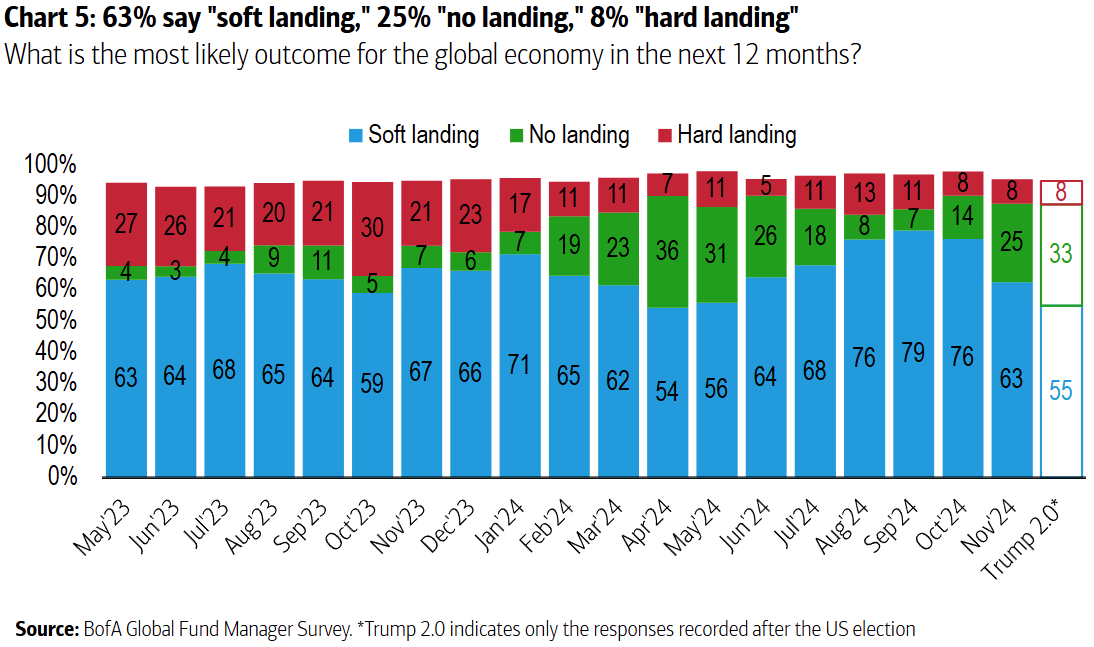

With markets at record highs - trading at very high valuations - I felt it was timely to revisit investing lessons from Charlie Munger. Sadly, Charlie passed away late last year - just shy of his 100th birthday. Whilst Charlie was an incredible investor - what I loved most was his ability to draw insights from many disciplines - which included the study of psychology, economics, physics, biology, history, architecture among other things. This enabled Charlie to develop a lattice of “mental models” to cut through difficult problems. Over the years, I've found Charlie's insights into investing, business and life not only rare but generally correct. What's more, they stand the test of time.