Fed’s Task in Changing Times

Fed’s Task in Changing Times

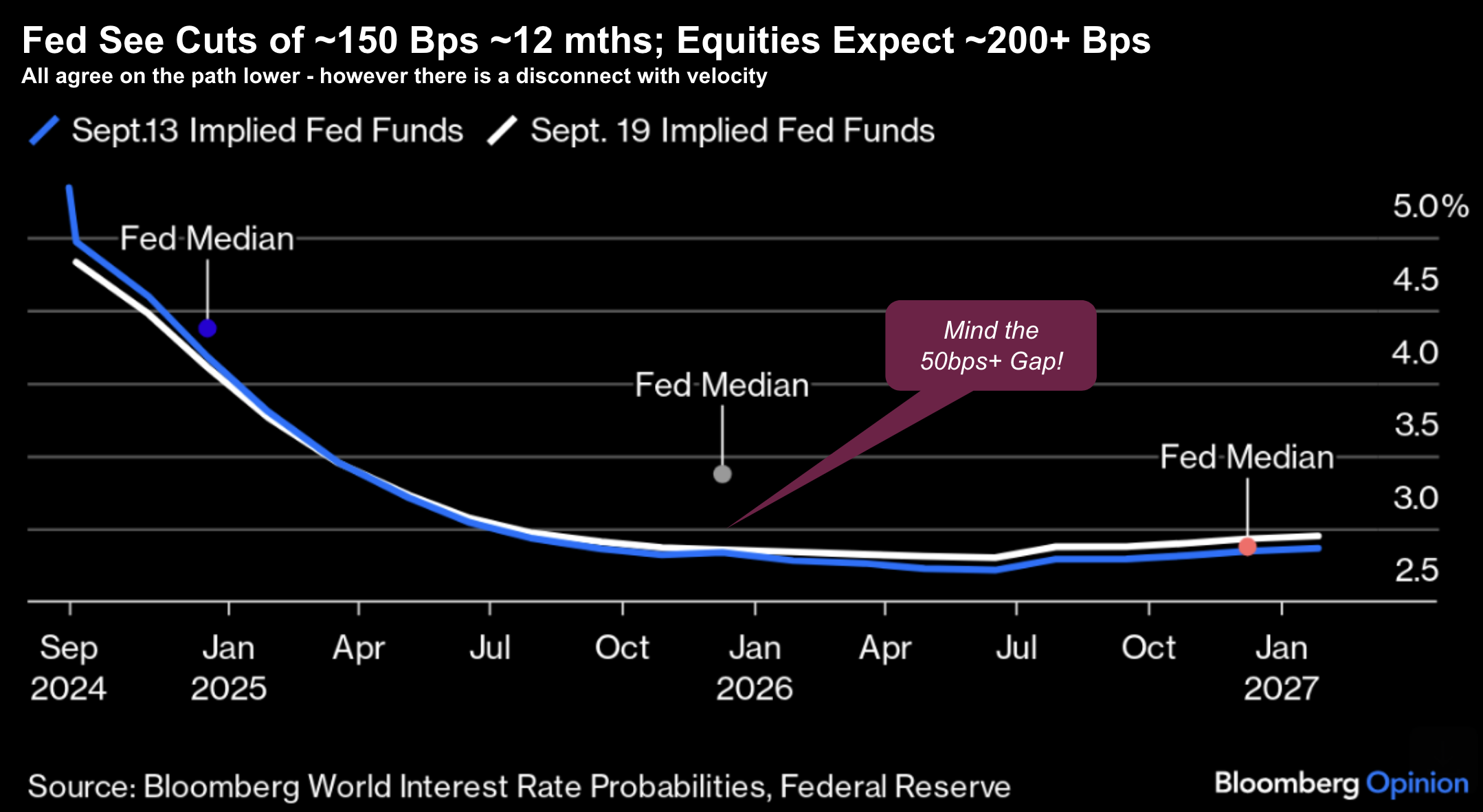

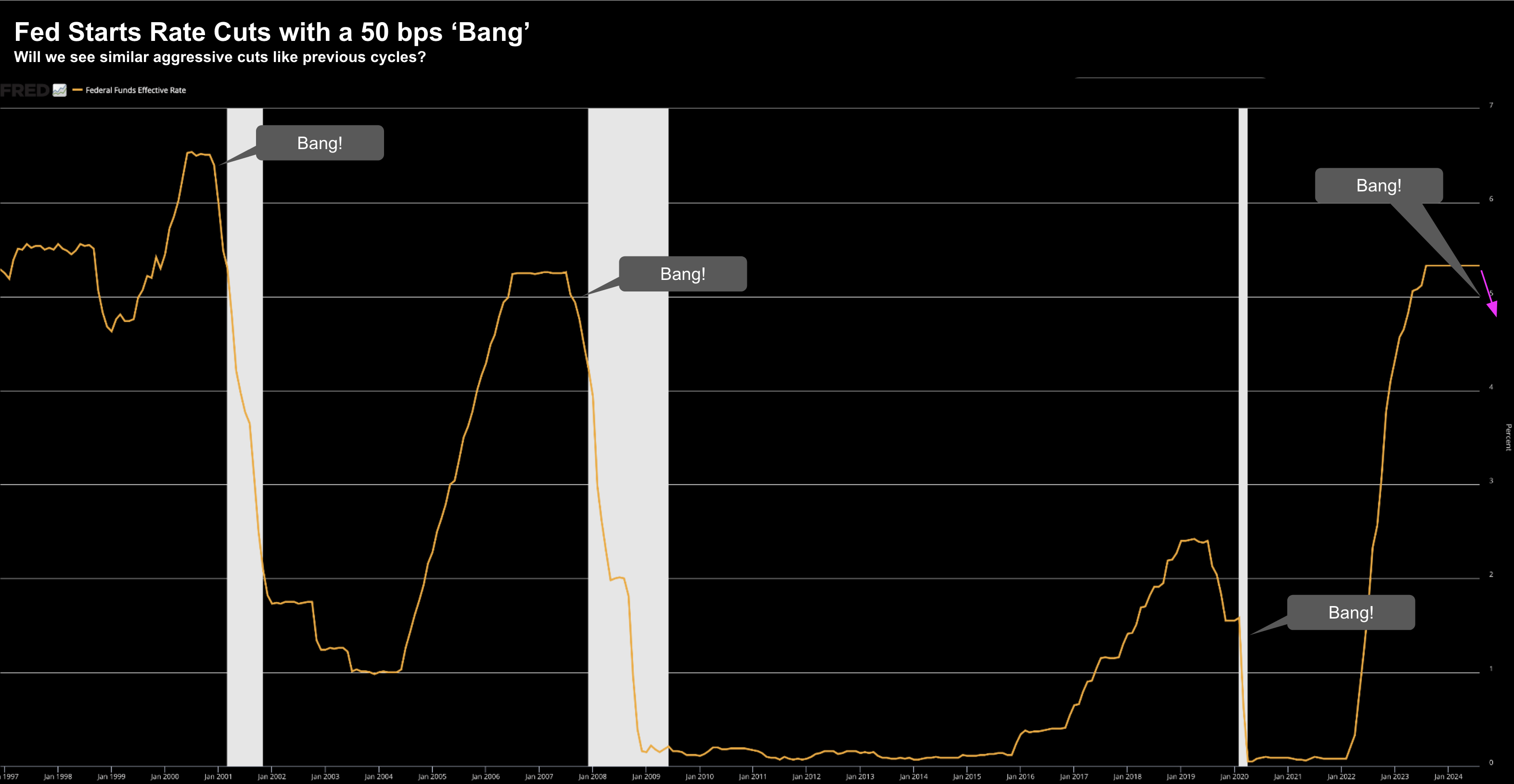

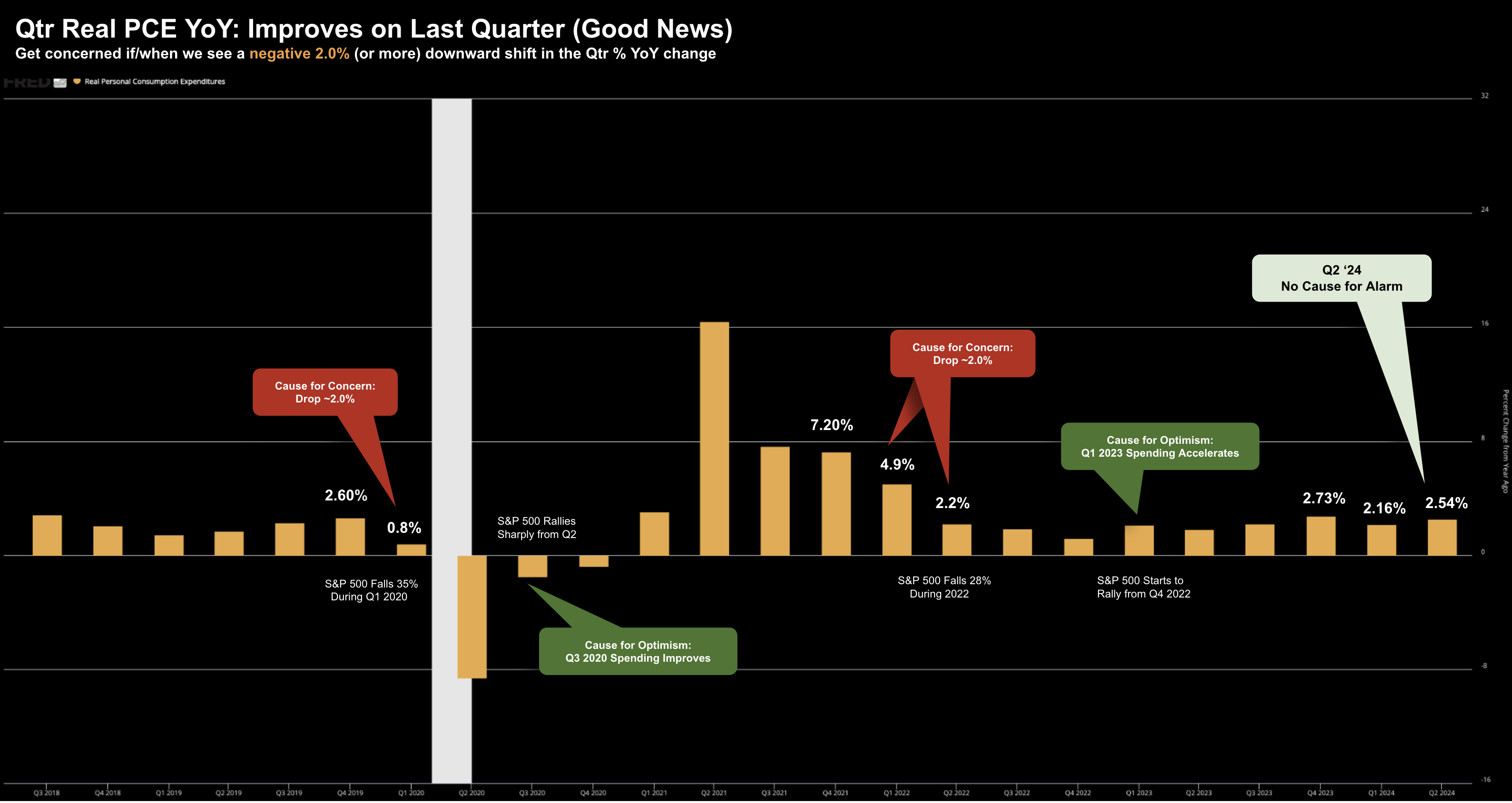

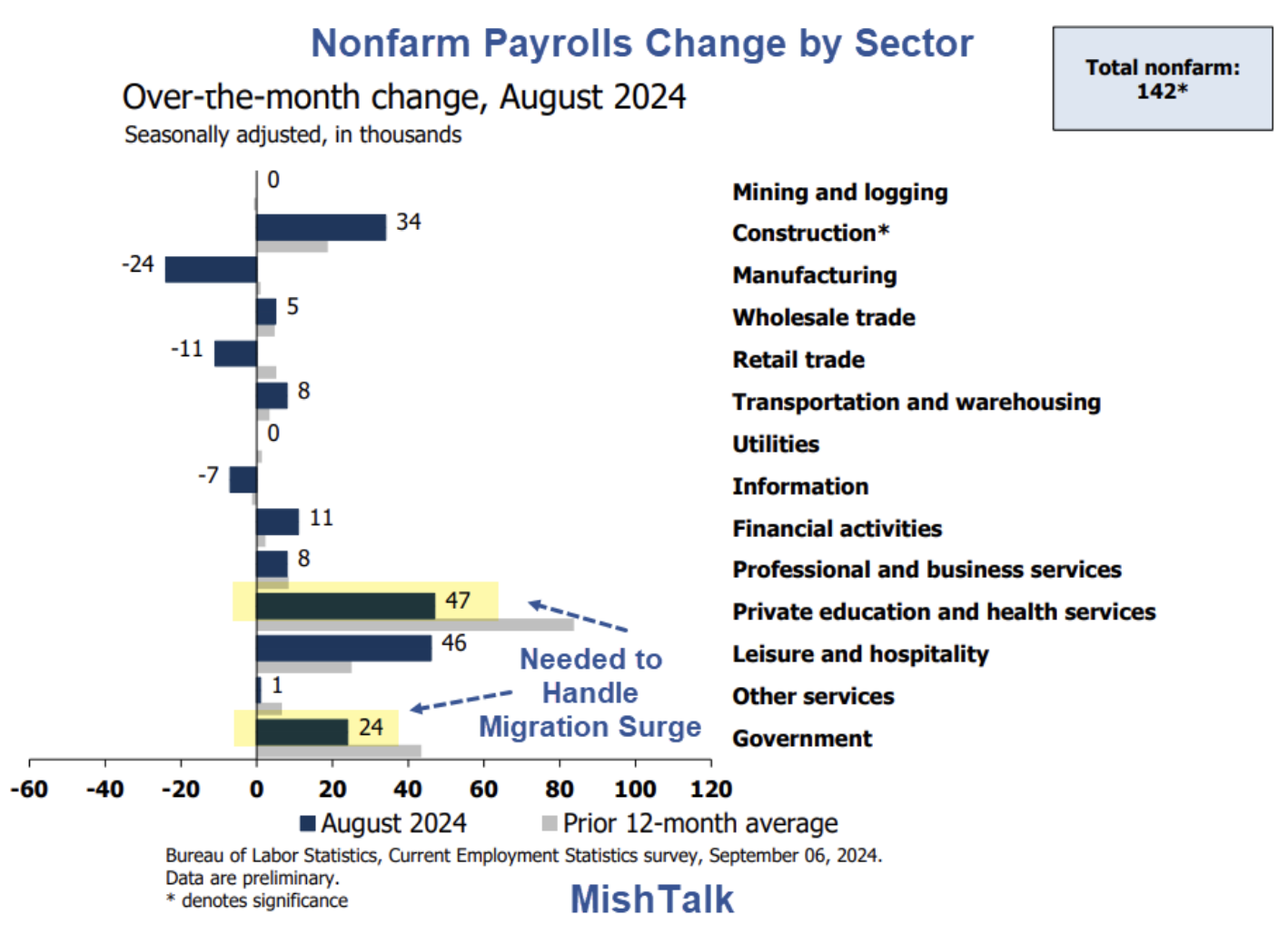

How aggressive can the Fed be in the coming months? The economic data doesn't suggest a material slowdown - surprising to the upside in most cases. Therefore, are markets pricing in too many rate cuts? Maybe... longer-term yields are rallying post rate cuts. What's this mean?