Weighing Risk(s) More Useful than Forecasting a Number

Weighing Risk(s) More Useful than Forecasting a Number

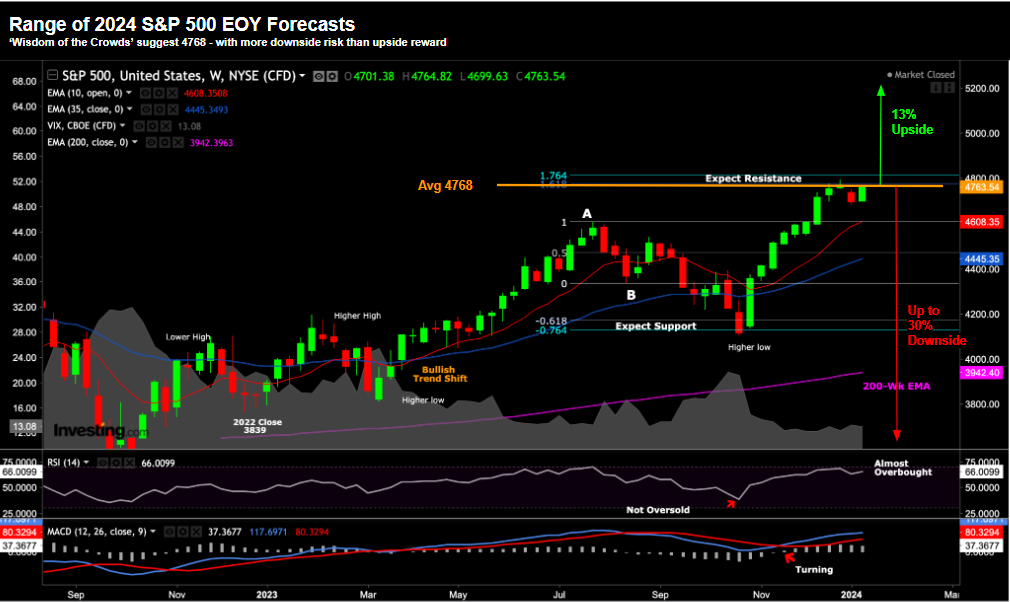

Around this time of year - a wrath of 'experts' forecast where they believe the S&P 500 will finish the year. For me it serves little purpose. For one, most of the time forecasts are typically wrong (and by a wide margin). Second, as time goes by, more information will come to hand which often changes our view. From there, forecasts should be updated. Third, there are almost always random events which reset the game. What happens to forecasts then? They are typically tossed out the window. With that, let's look at what the market "experts" believe we will see this year - and I will offer my approach.