A Rational Response or Pavlov’s Dog?

A Rational Response or Pavlov’s Dog?

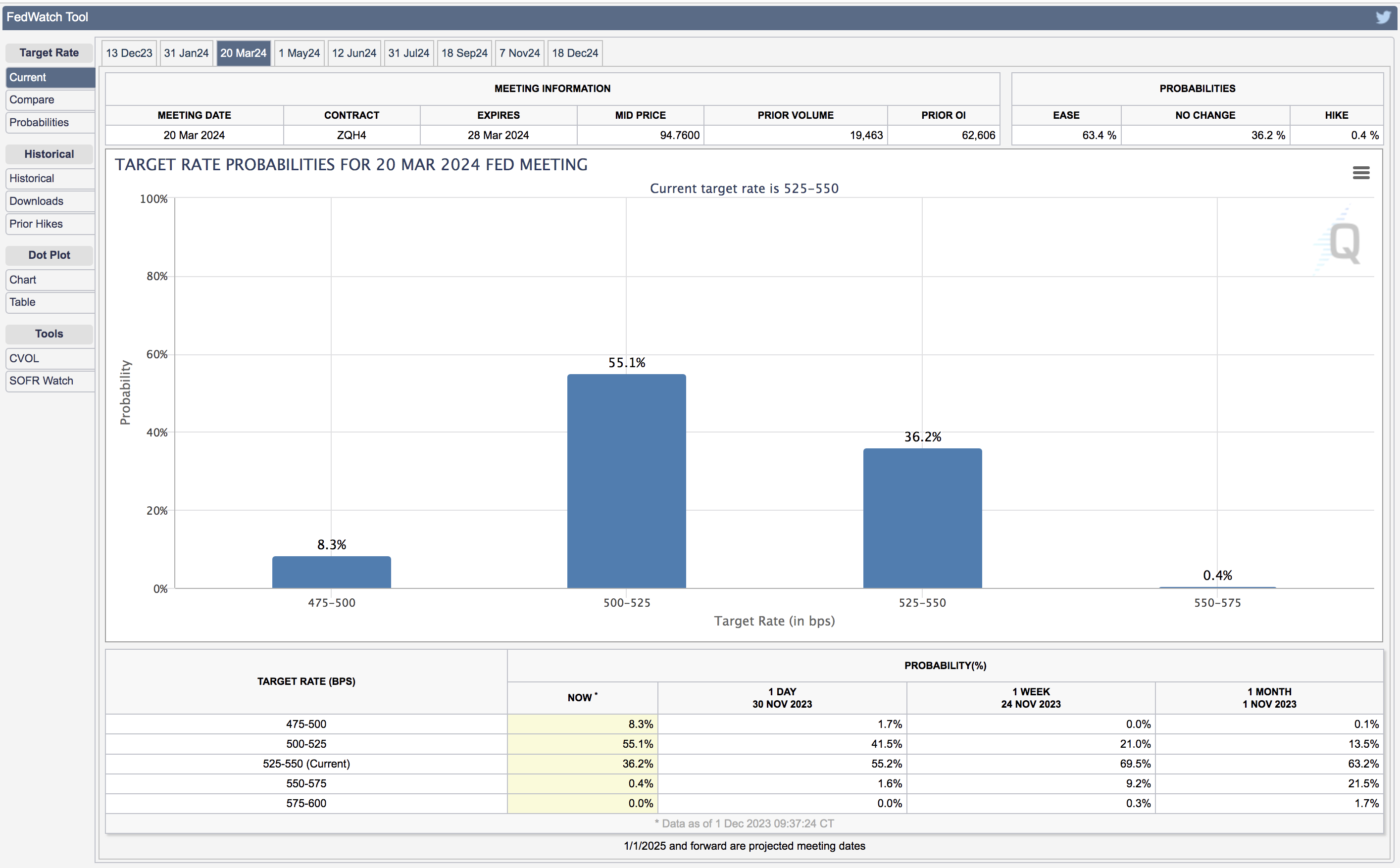

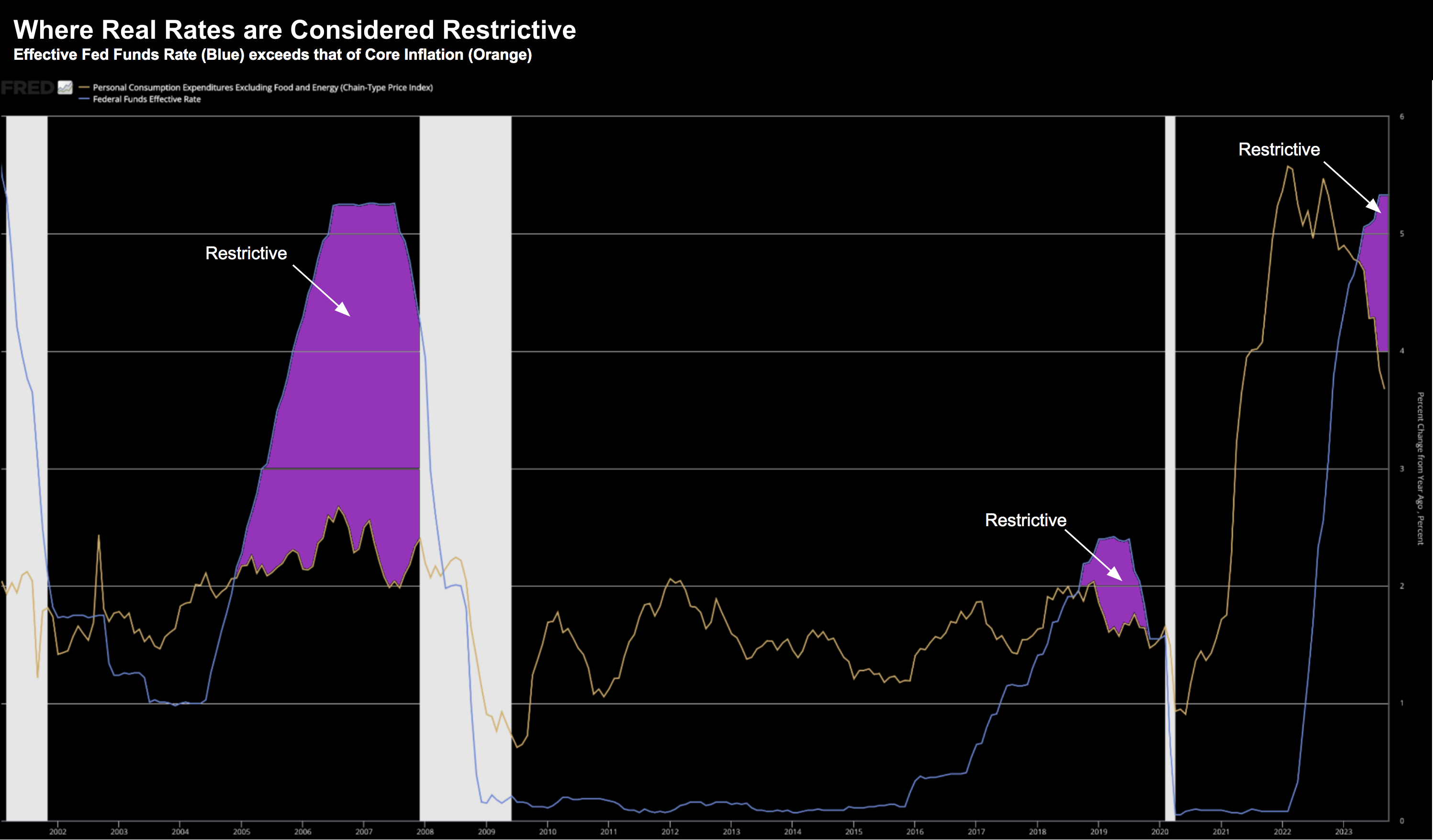

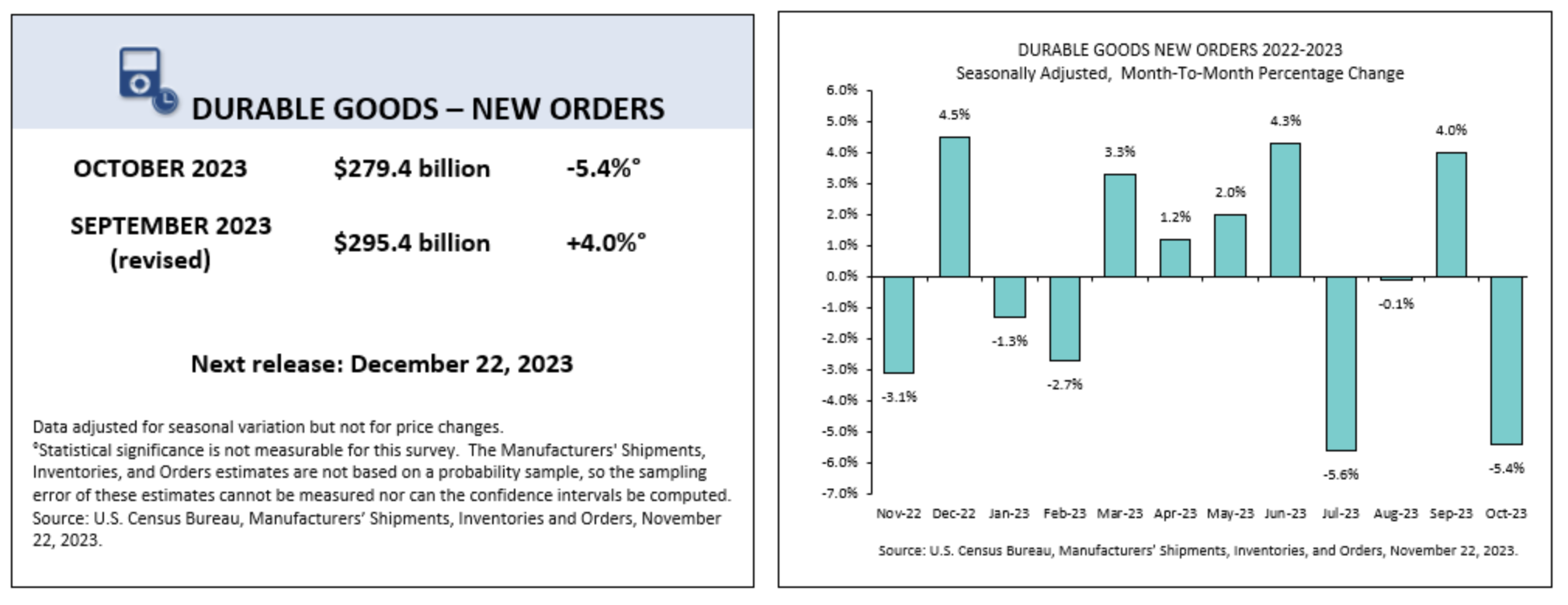

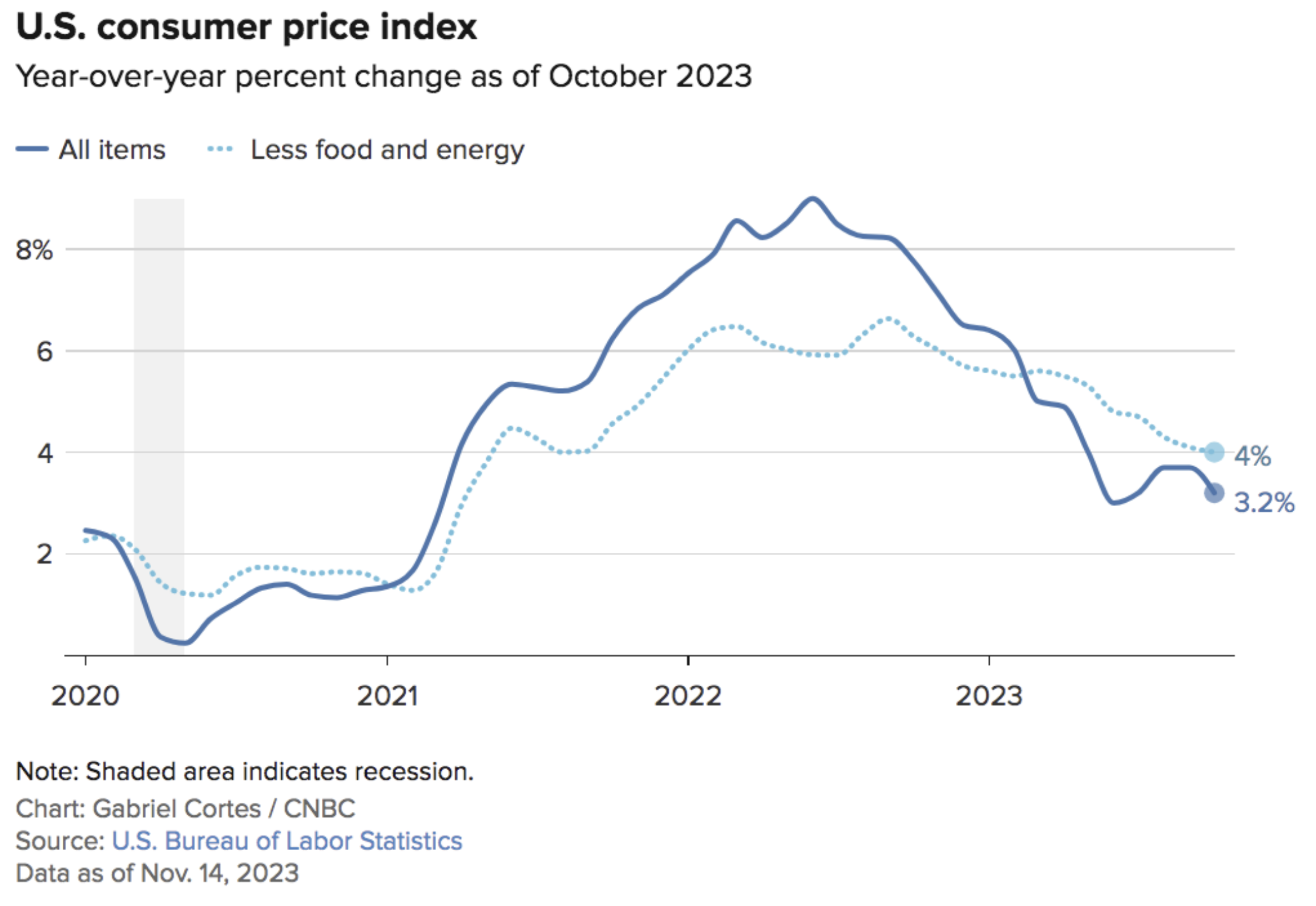

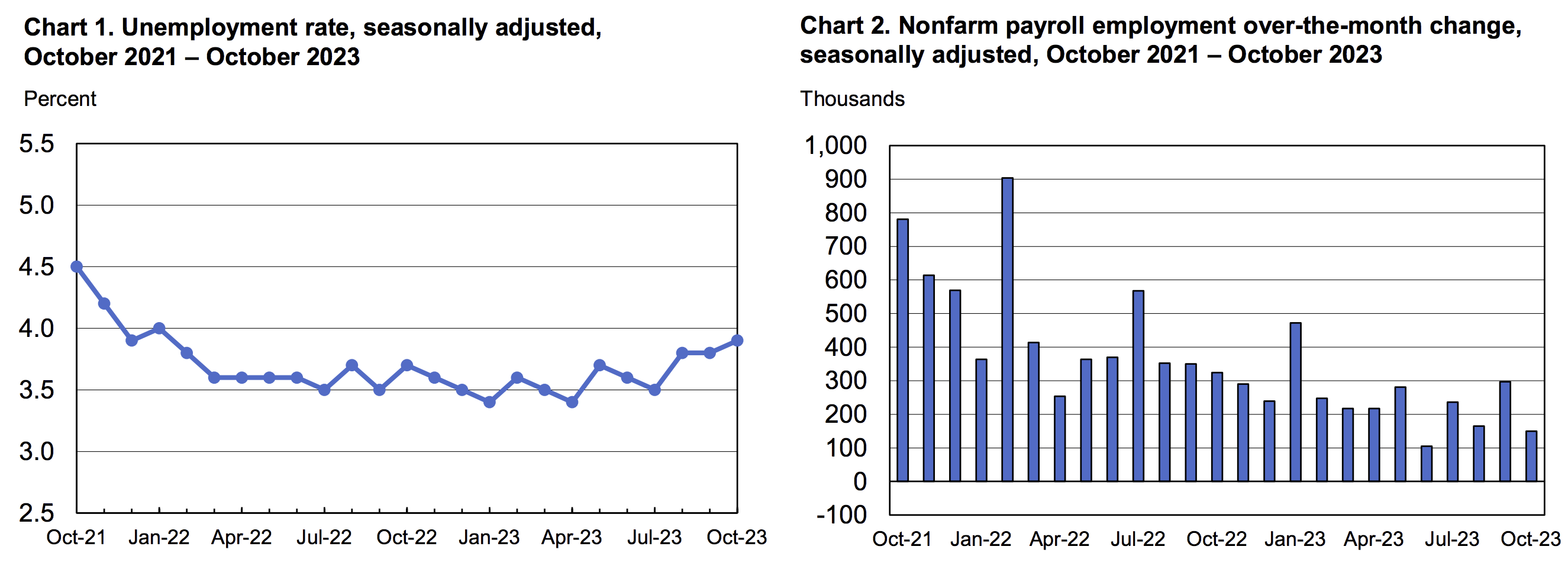

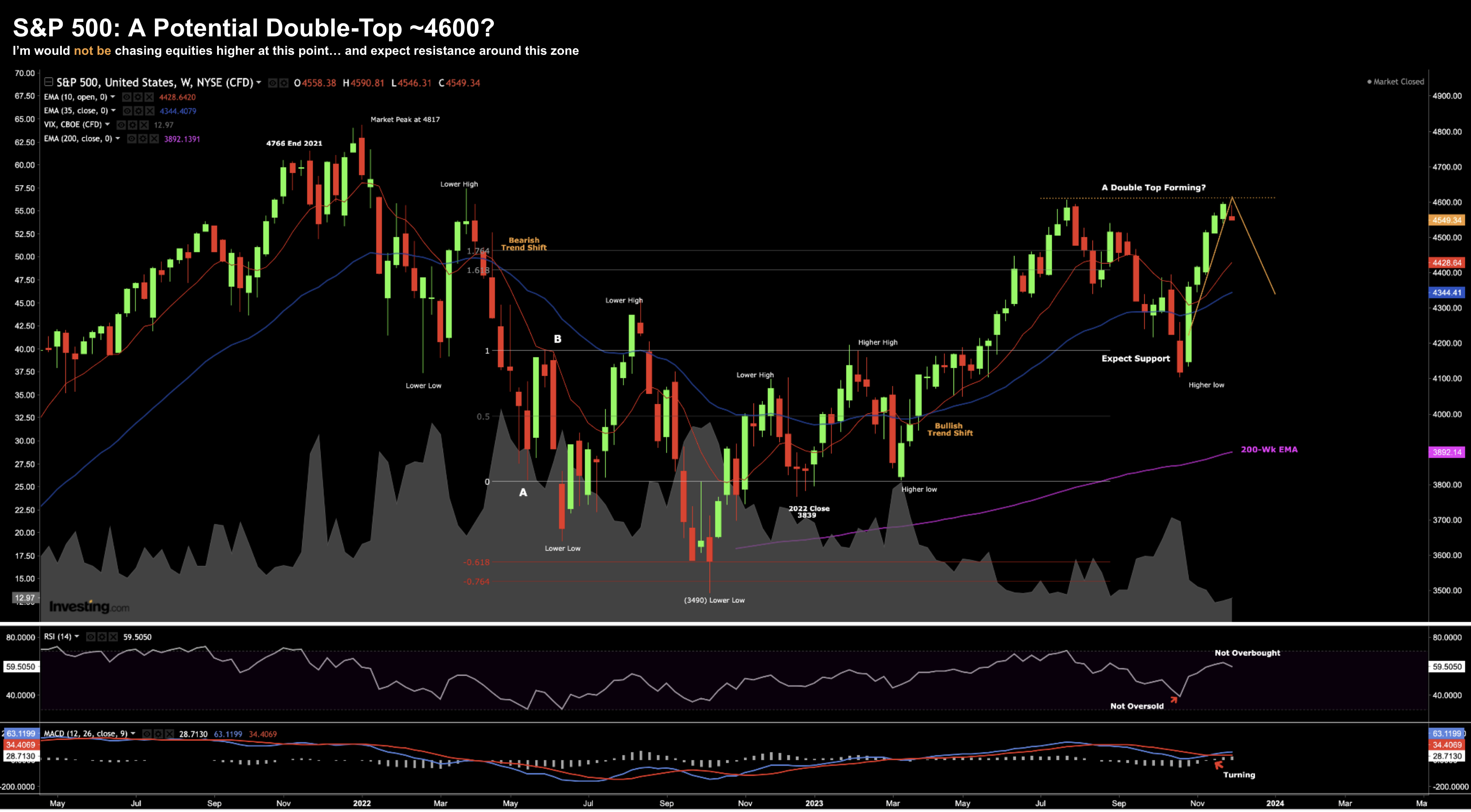

Market consensus is for a soft-landing with at least three rate cuts next year. The market does not expect a recession.This may prove correct (I don't pretend to know) - but there are some chinks in the armor. Readers will know I don't subscribe to a soft-landing. Typically in the lead up to a recession - spectators will generally lean towards it being "soft". Few ever forecast 'hard landings'. For example, if you have unemployment below 4% and positive GDP growth - it's hard to see anything else. But very rarely do things land softly. We've seen one over the past five decades. That's not a high ratio. What's more, soft landings are exceptionally rare after 550 basis points of rate hikes (not to mention over $1 Trillion in quantitative tightening - of which we have no parallel).