Will This Market Rally Continue?

Will This Market Rally Continue?

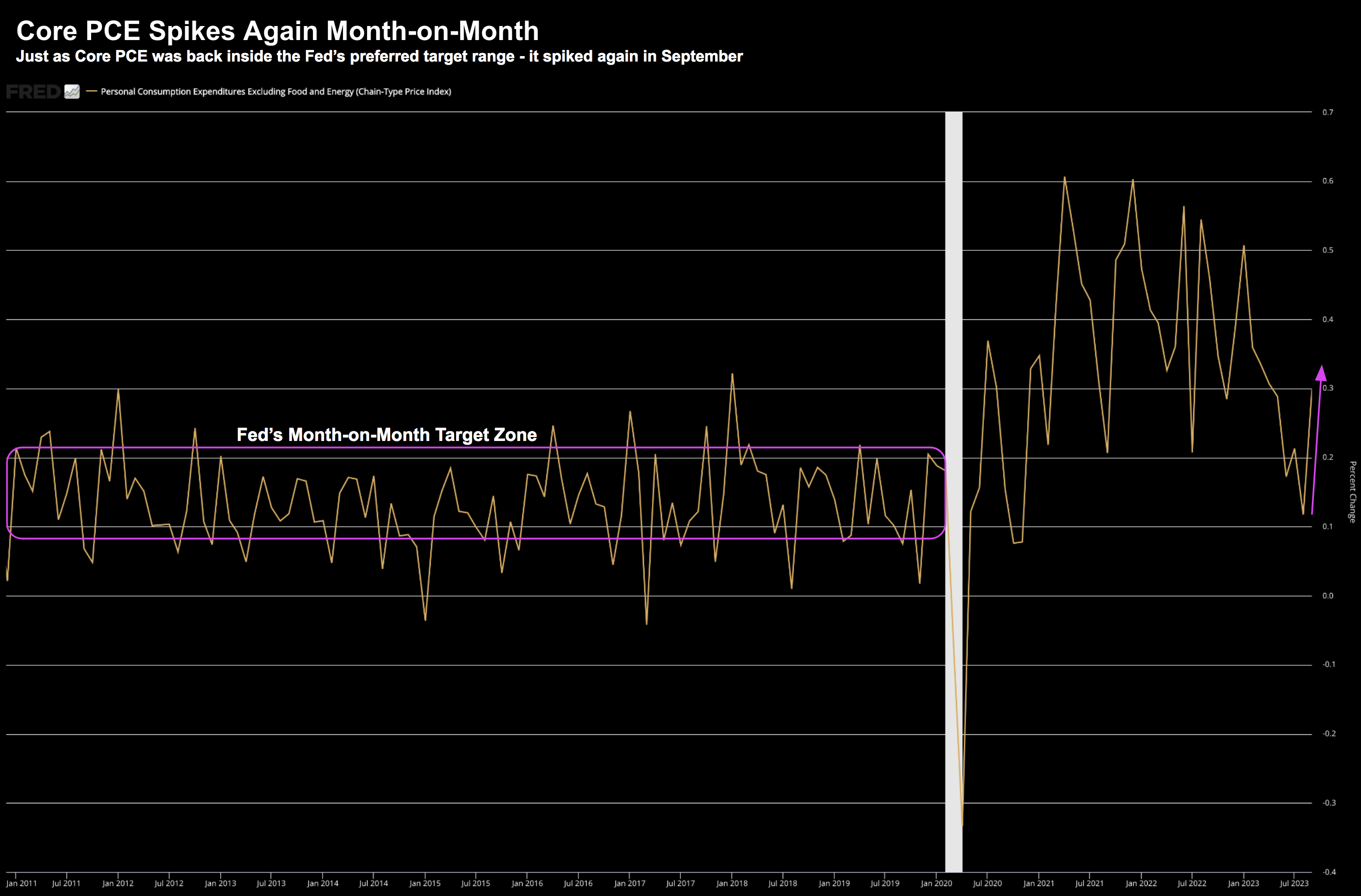

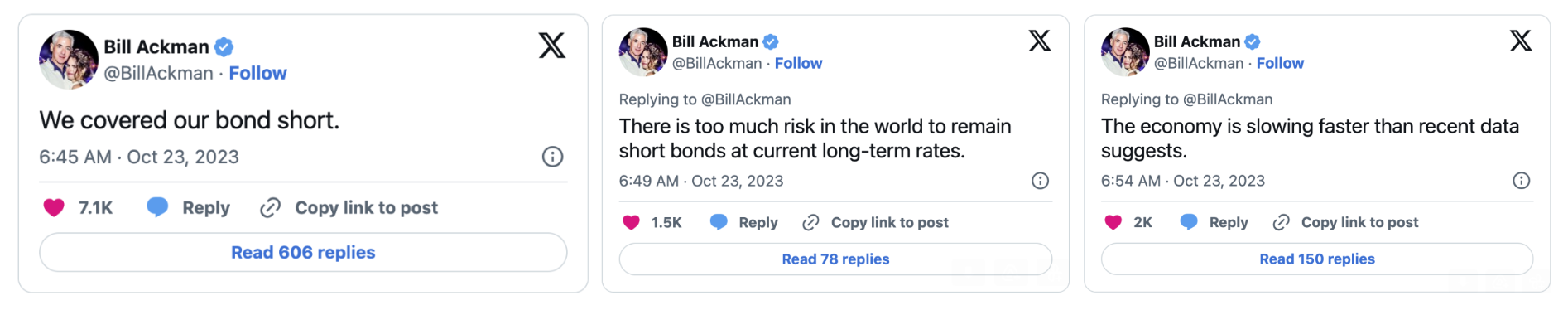

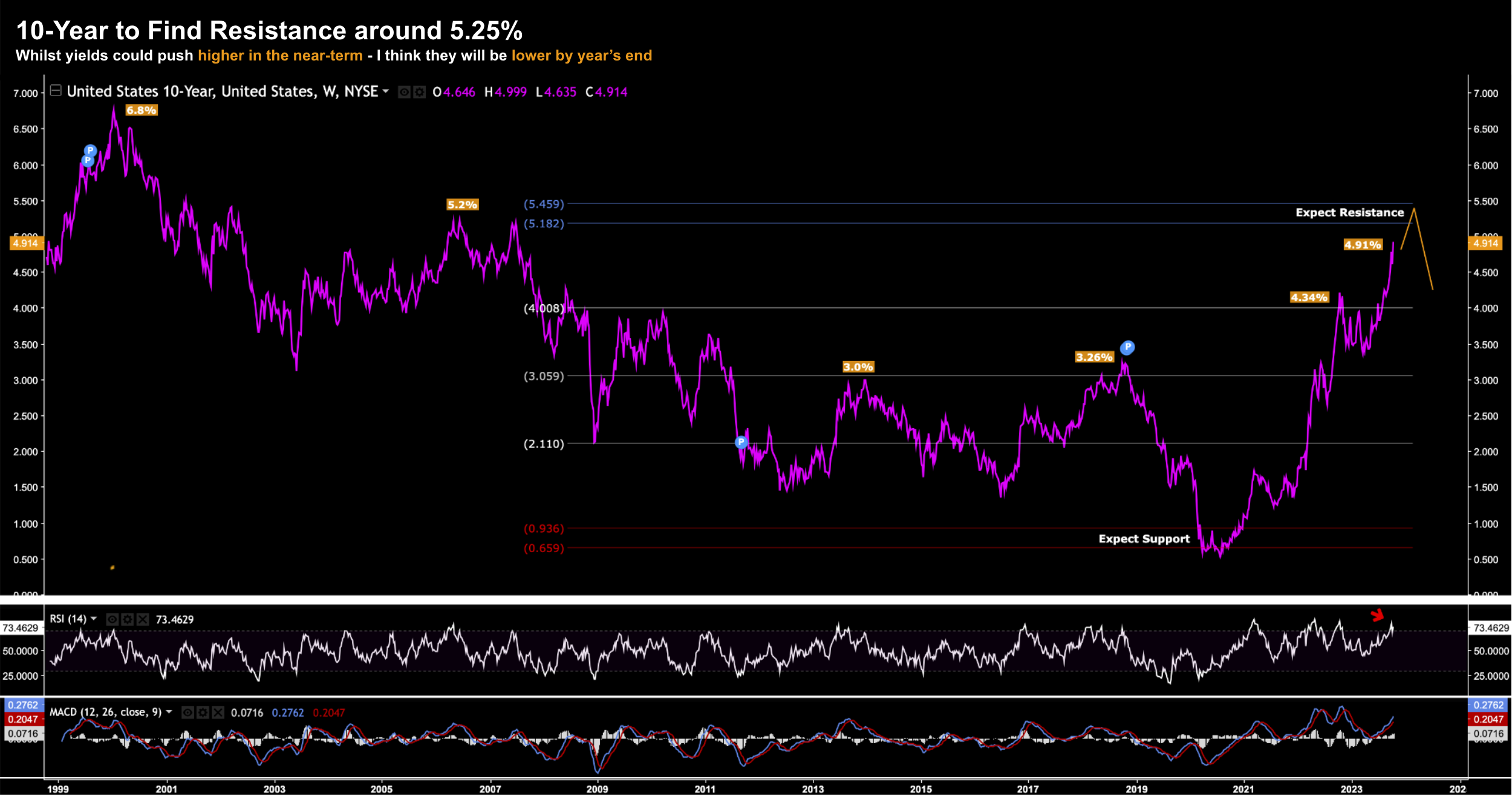

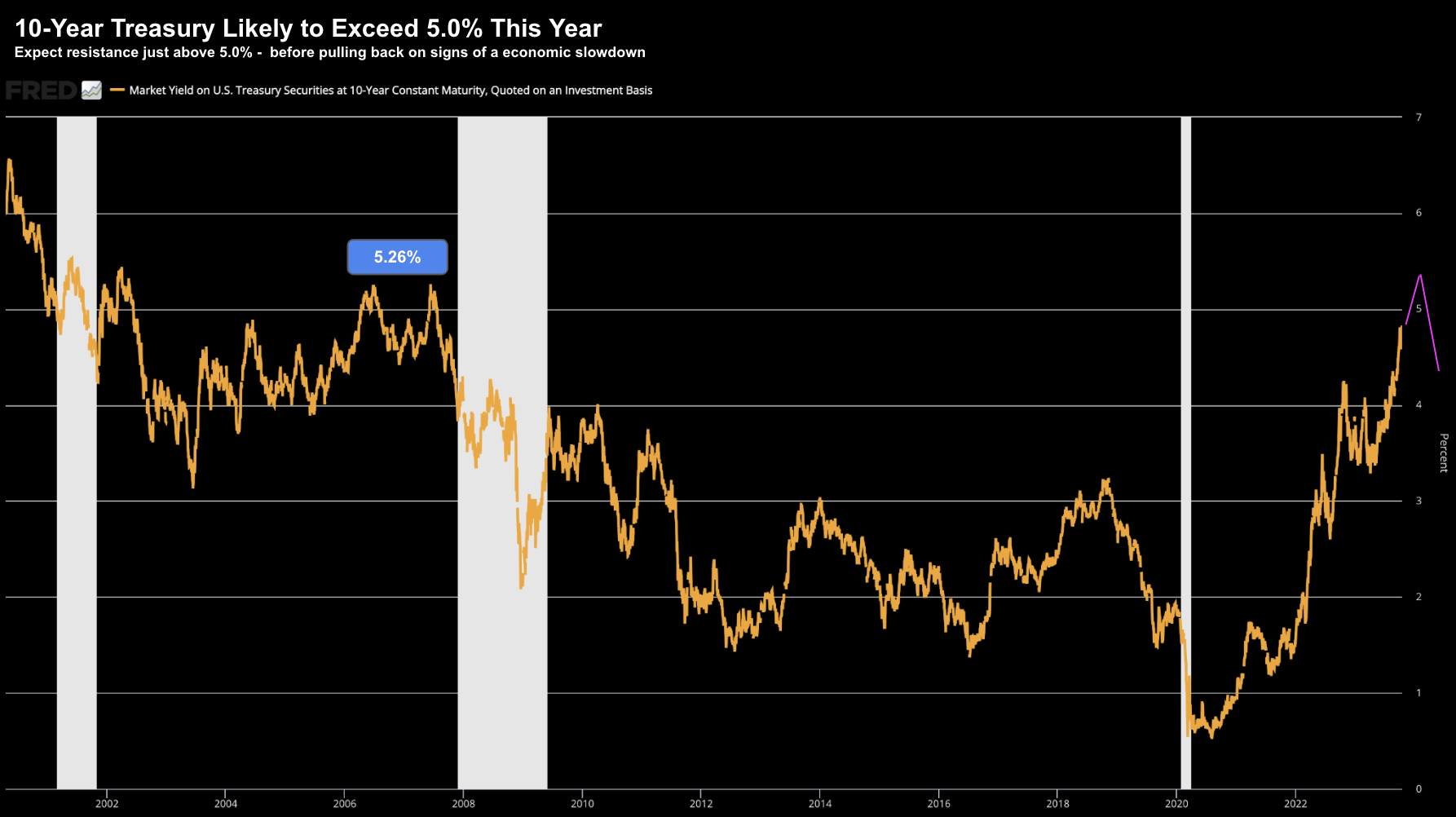

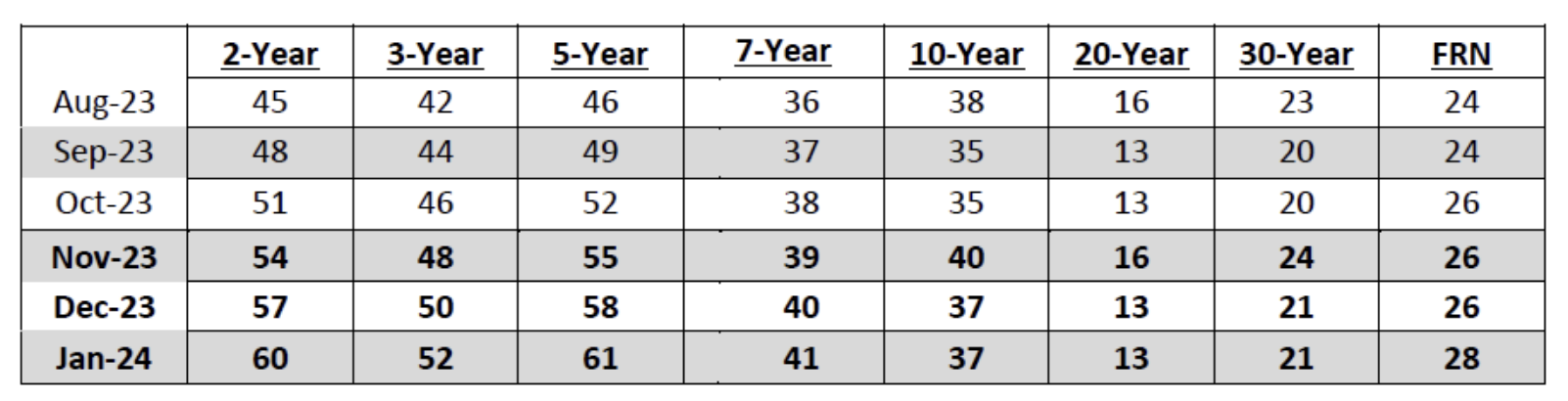

Did we finally hear a 'less hawkish' Jay Powell yesterday? For the first time in months the Fed Chair may have slightly lowered his guard. But barely... as Powell is far from being a dove. A dovish Fed is one that is (a) cutting rates; and (b) ending quantitative tightening. Neither of those things are happening soon. But it wasn't just Powell's language which fired up the bulls. Janet Yellen also played a role - suggesting the government plans to sell less debt than expected... sending bond yields lower.