Why You Should Avoid Paying Too Much

Why You Should Avoid Paying Too Much

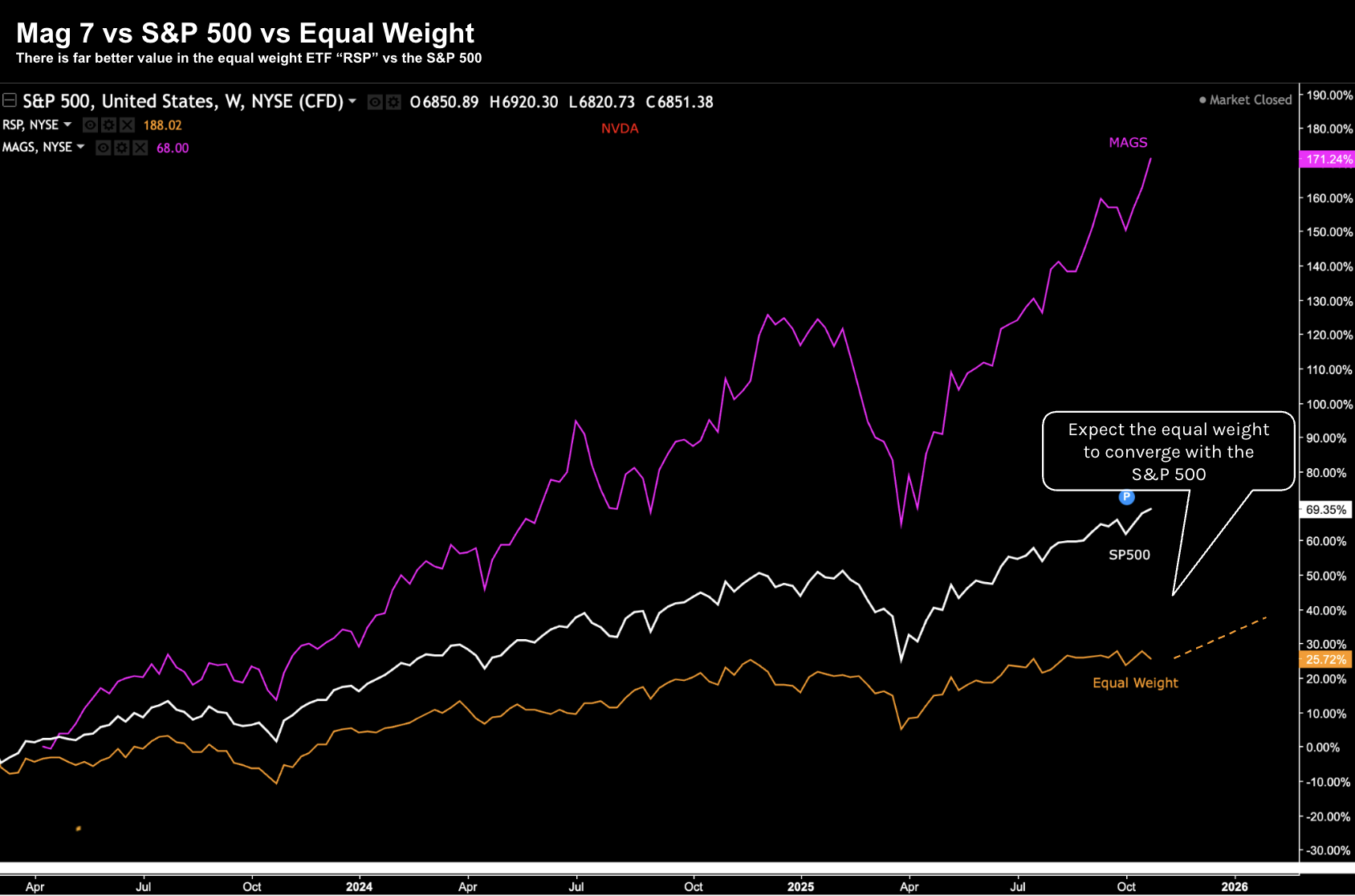

It’s very tempting to chase AI and "Mag 7" gains, but your long-term returns are ultimately determined by the price you pay. With the S&P 500 trading near 25x forward earnings and the Shiller CAPE ratio flashing warnings similar to the 2000 dot-com bubble, the market is lofty territory. History is clear: investing at such elevated valuations drastically lowers subsequent 5 and 25-year returns. While FOMO is powerful, be cautious. As a long-term investor, focus on the risk of what you could lose, not just what you might miss