Thoughts on 2026…

Thoughts on 2026…

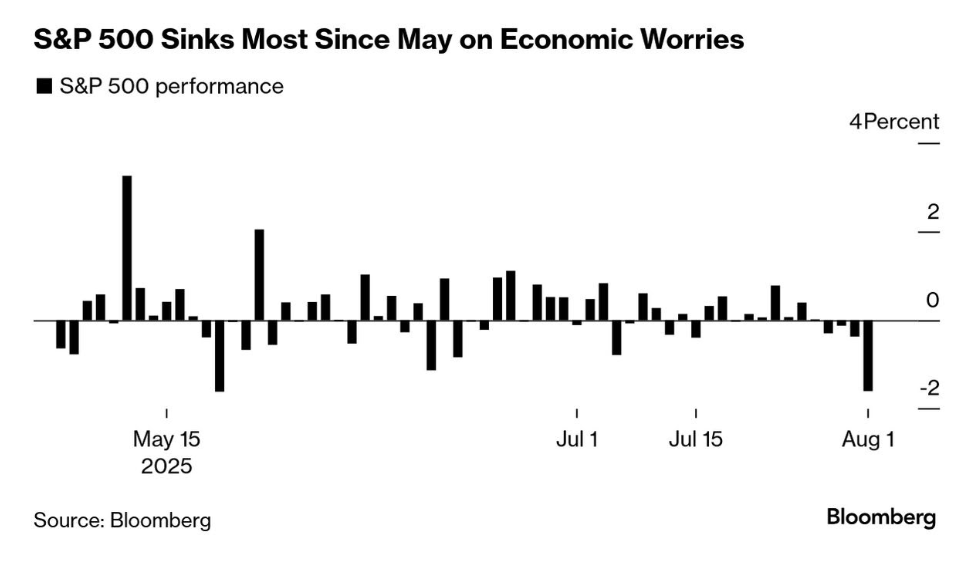

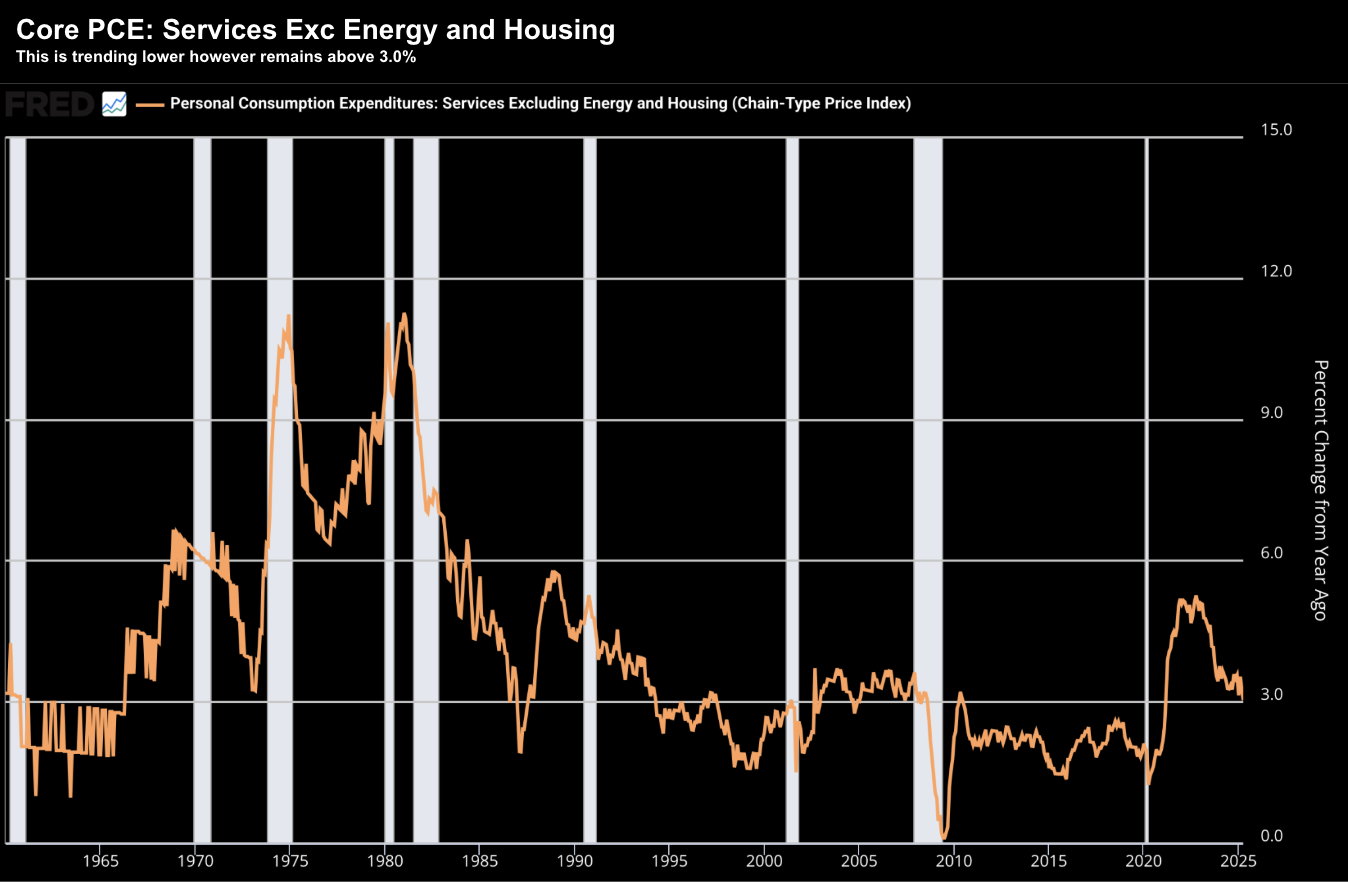

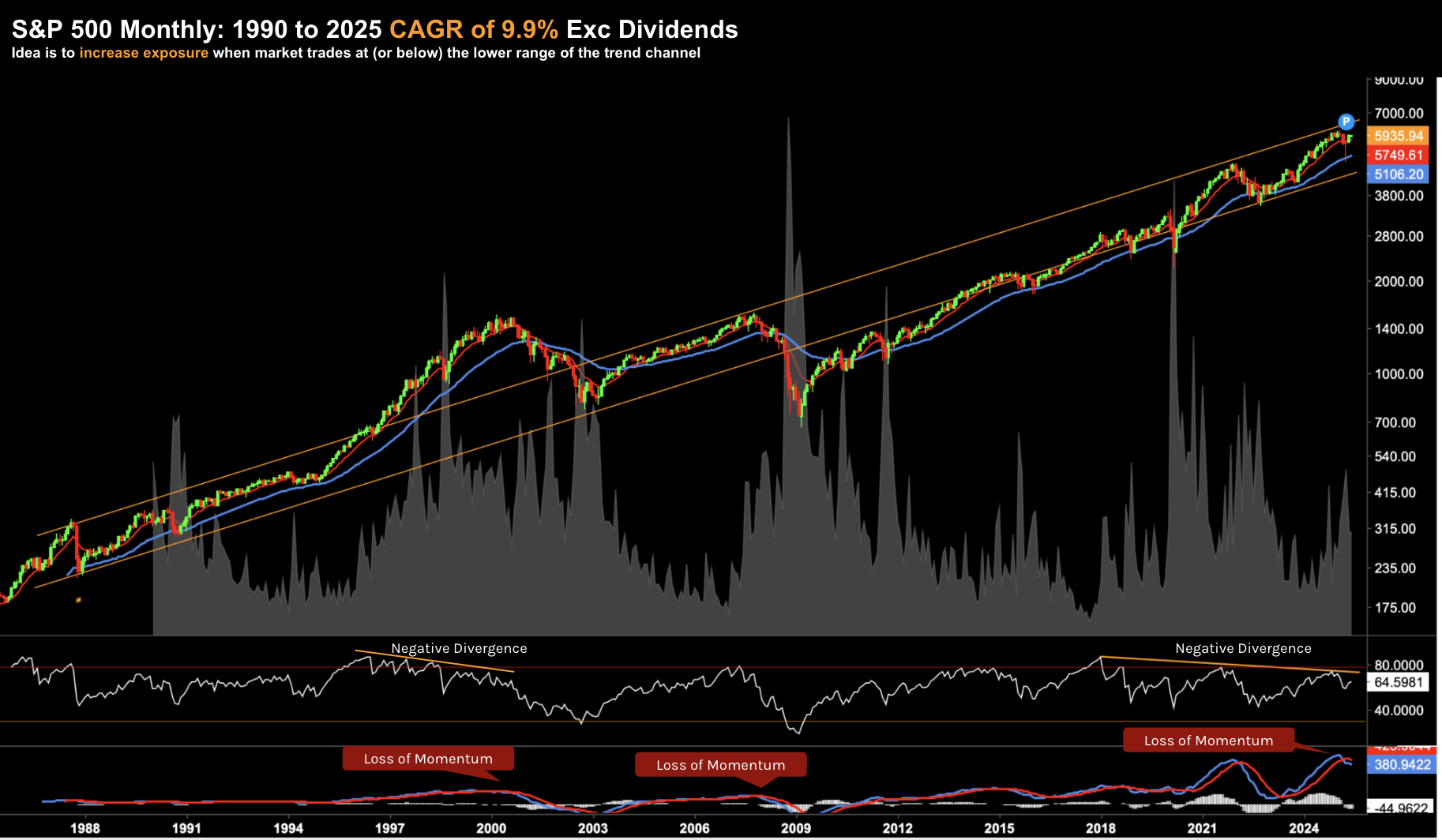

After three years of spectacular gains, 2026 demands a strategic pivot. I outline five critical themes determining market direction: rising unemployment risks, sticky inflation, a hawkish Fed, AI capex scrutiny, and a steepening yield curve. With valuations stretched, the easy money is gone. Investors should prioritize high-quality assets and cash optionality, preparing for a potential 15–20% correction. The focus now shifts from chasing momentum to preserving capital and awaiting reasonable valuations.