Why ‘Soft Landings’ Deserve Scrutiny

Why ‘Soft Landings’ Deserve Scrutiny

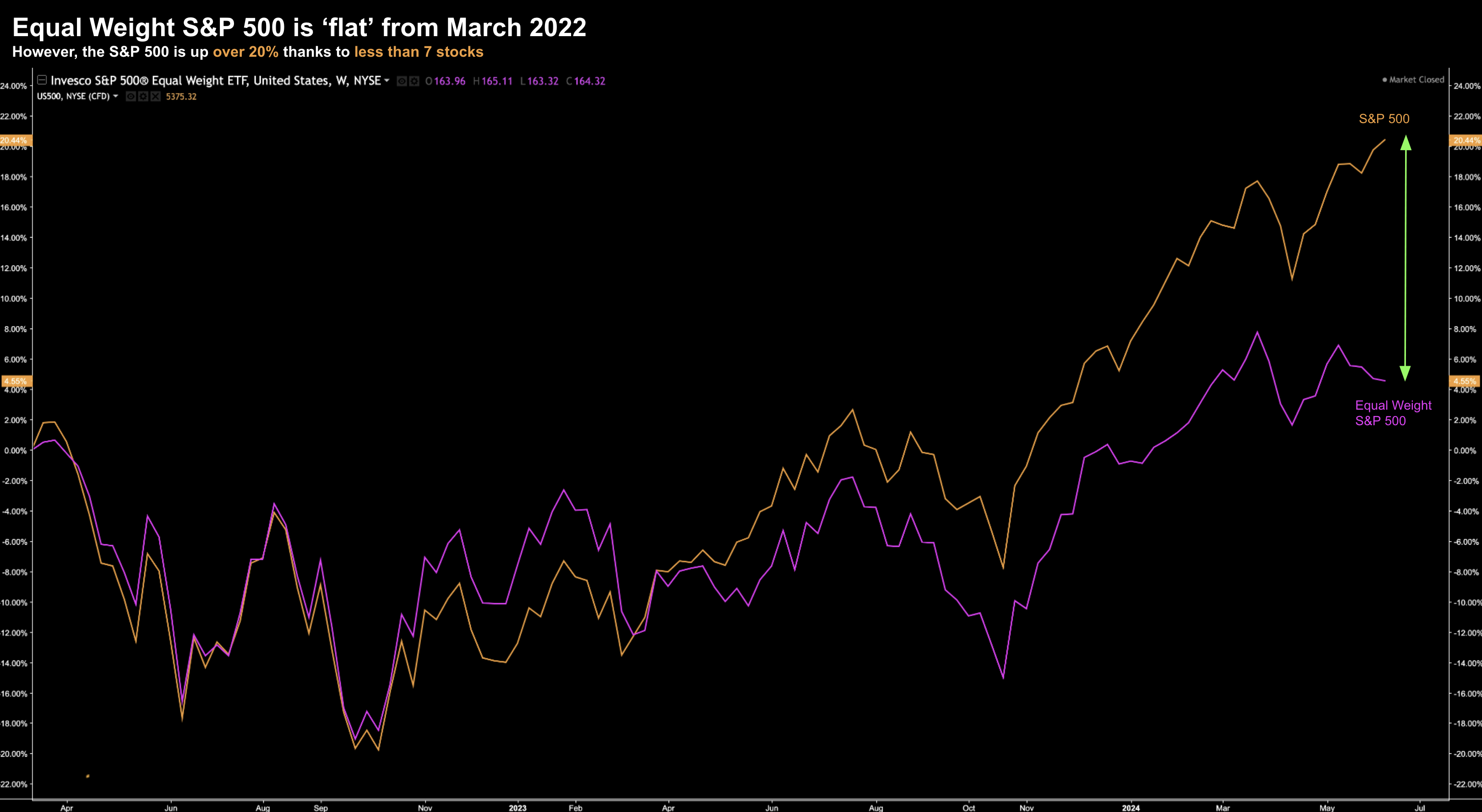

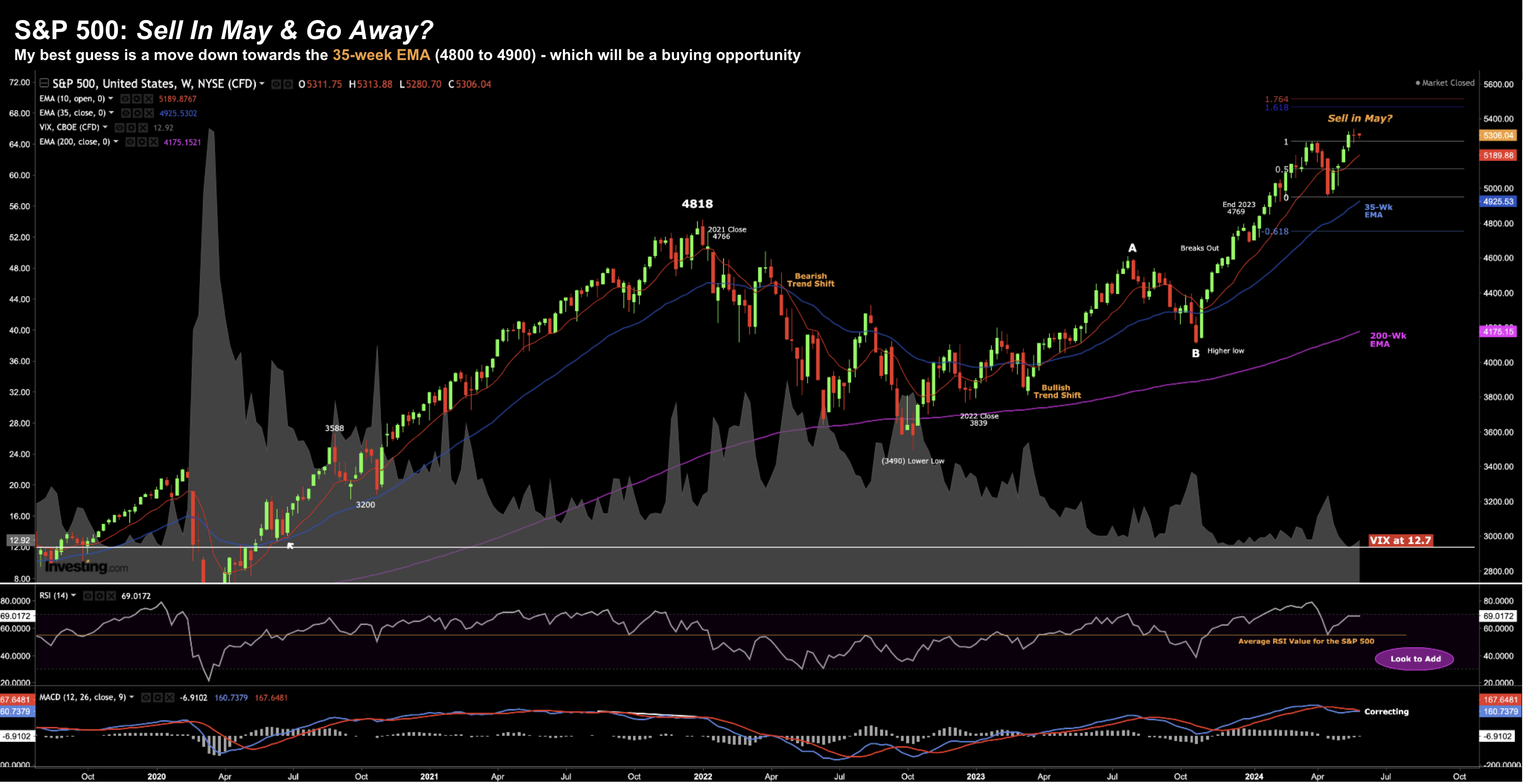

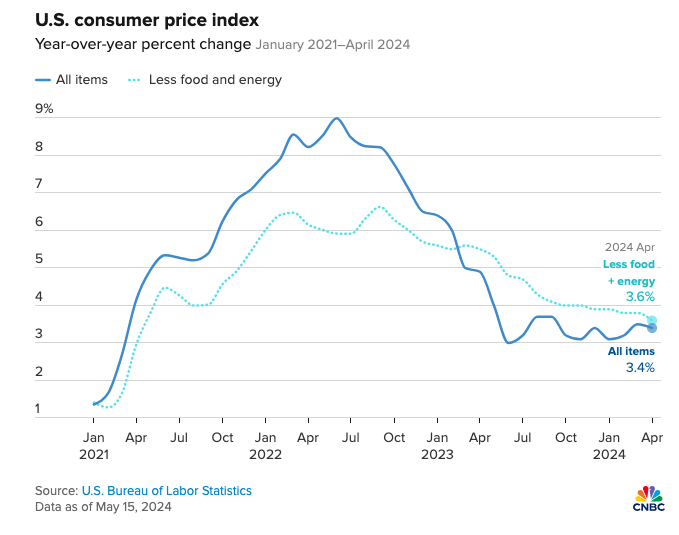

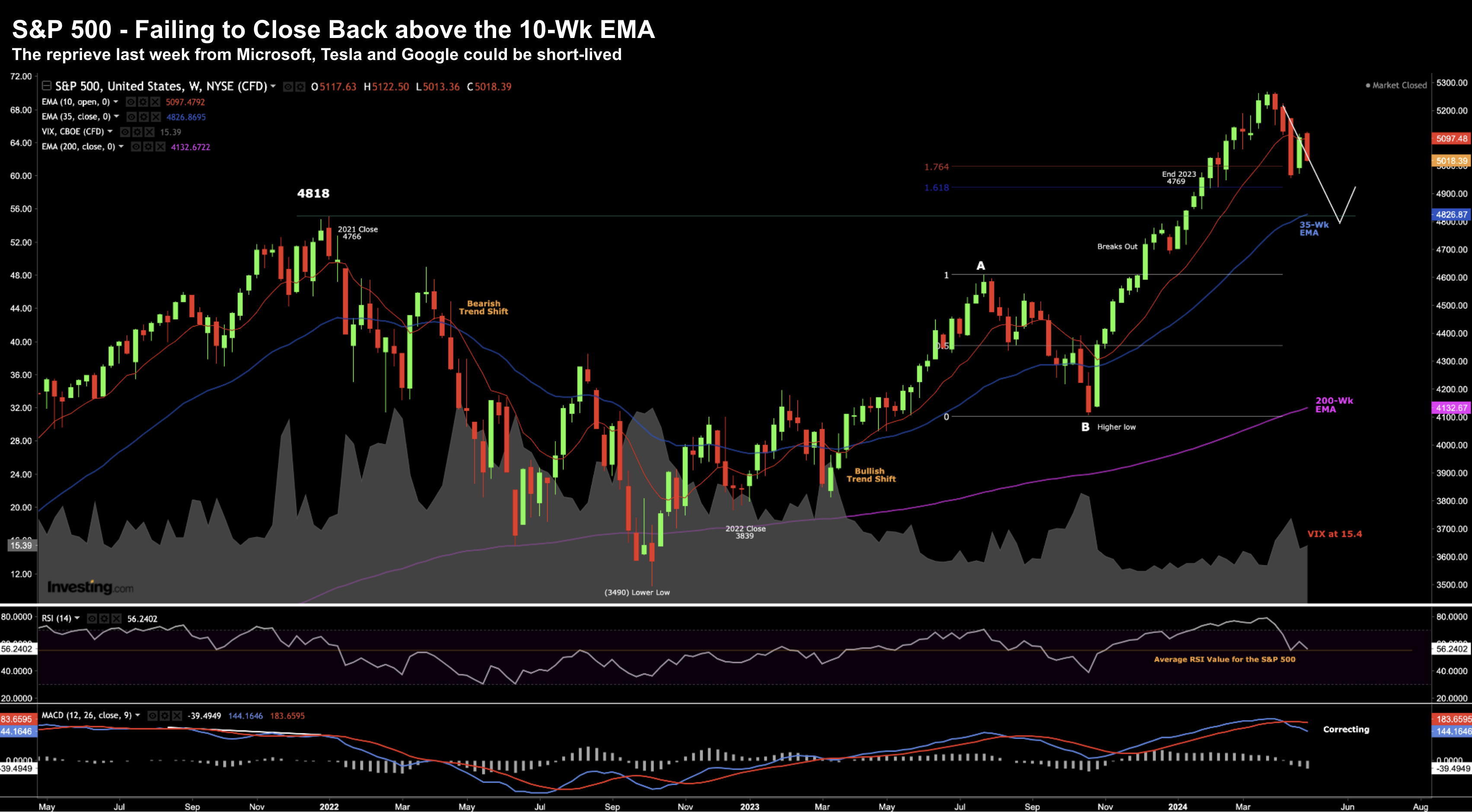

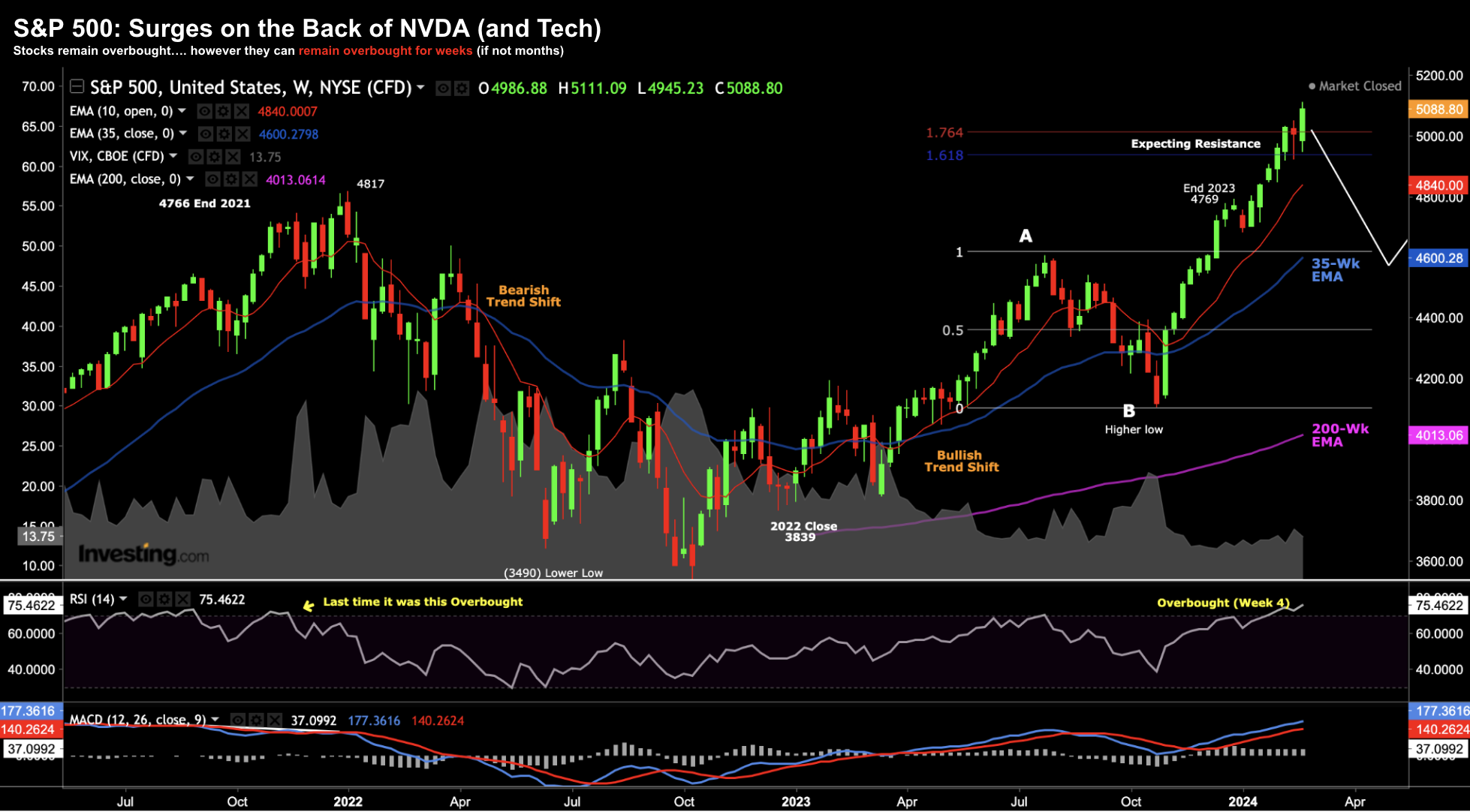

What impact will a 'soft-landing' have on current stock valuations And does there need to be a recession to experience a meaningful (e.g. 12%+) decline? My short answer is no. The gist of this post is to remind investors that you don't need a definitive line-of-sight to a potential recession before protecting gains. I say that because recessions are lagging events - which come at the very end of the cycle. By the time they arrive - the economic damage is already done. Therefore, we need to be in front of the curve. Typically in the 9-months leading up to a recession - stocks continue to trade at or near highs - as analysts raise their outlooks. Unemployment and earnings are usually strong - as GDP keeps its head above zero. But those who are able to understand where we are in the business cycle will pay careful attention to what's happening shortly after peak economic growth.