Things Looking Better – But More to Do

Things Looking Better – But More to Do

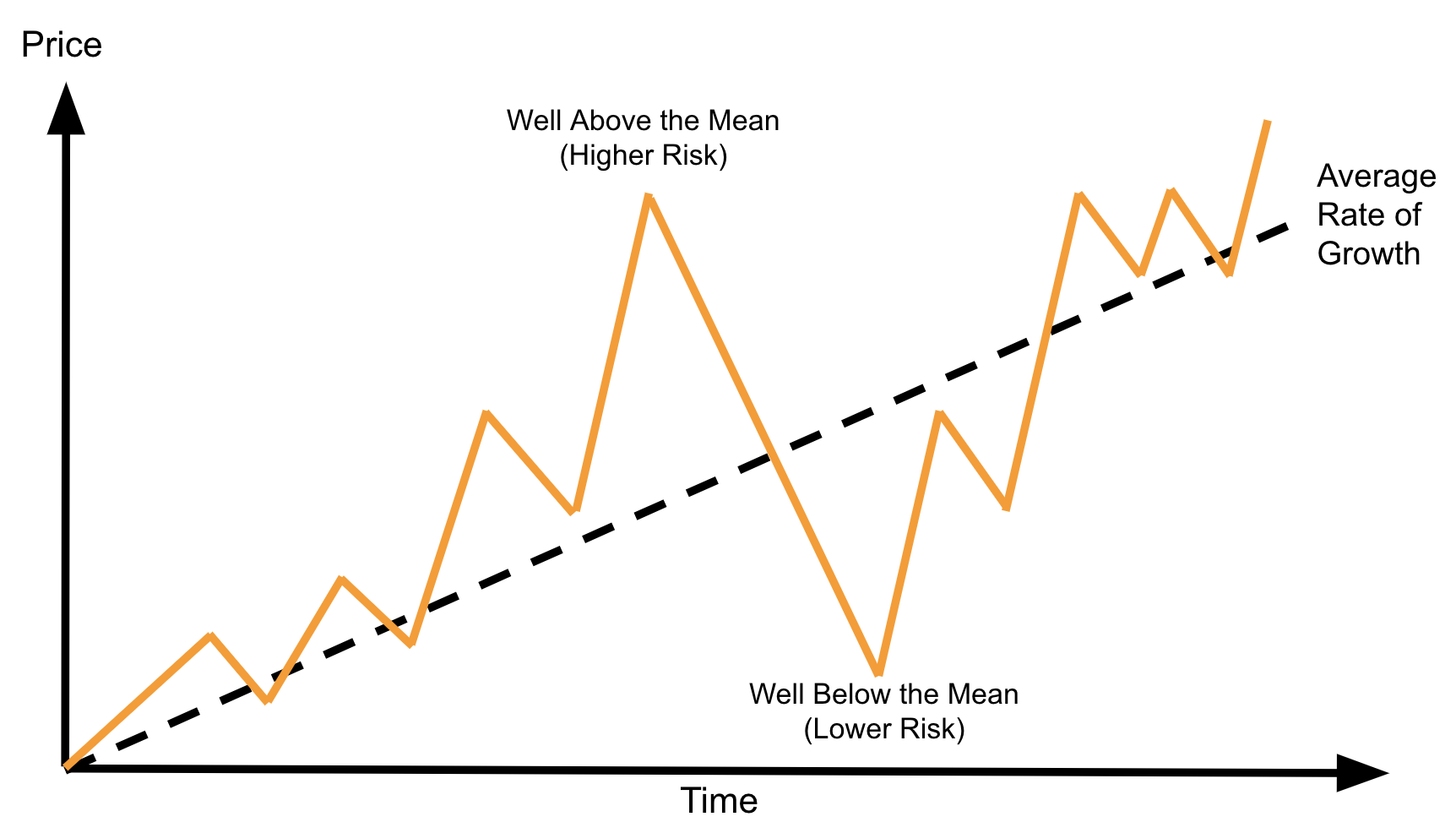

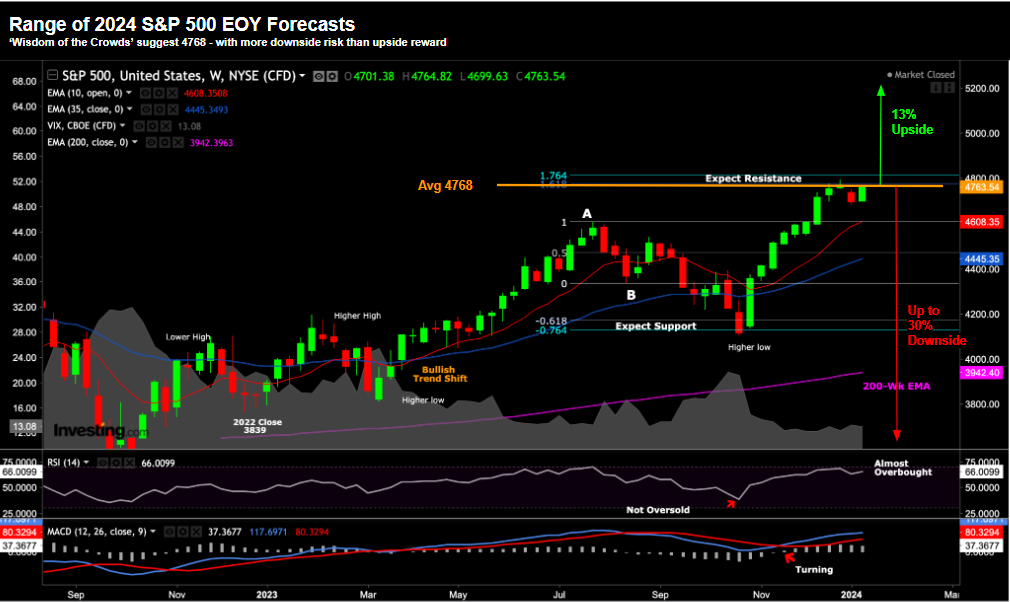

For 23 straight weeks (from late October) - the market has effectively gone straight up. It added ~$12T in market cap with barely a pause - a rally for the ages. Now for ten of those weeks, it was in overbought territory - where the (weekly) Relative Strength Index (RSI) traded above 70. I cautioned readers of a likely (technical) correction. And whilst I stressed the market can remain overbought for several weeks (and it did) - it's also an area to be cautious. This is where sell-offs start. And it seems we could be seeing the start of a 7-10% correction... however it's still early.