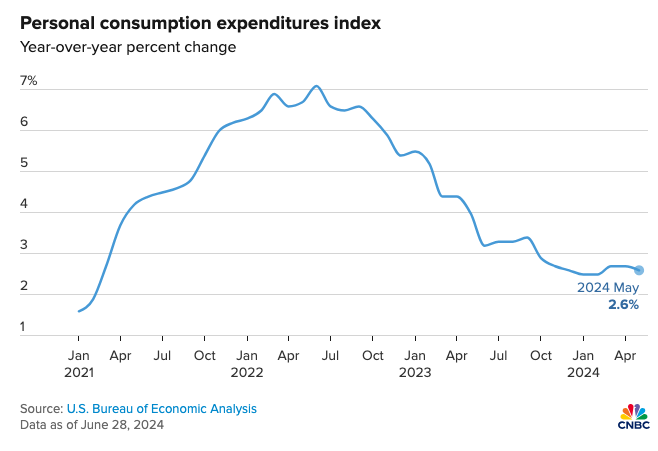

Back to the Scene of the Crime.. And a Warning from PCE

Back to the Scene of the Crime.. And a Warning from PCE

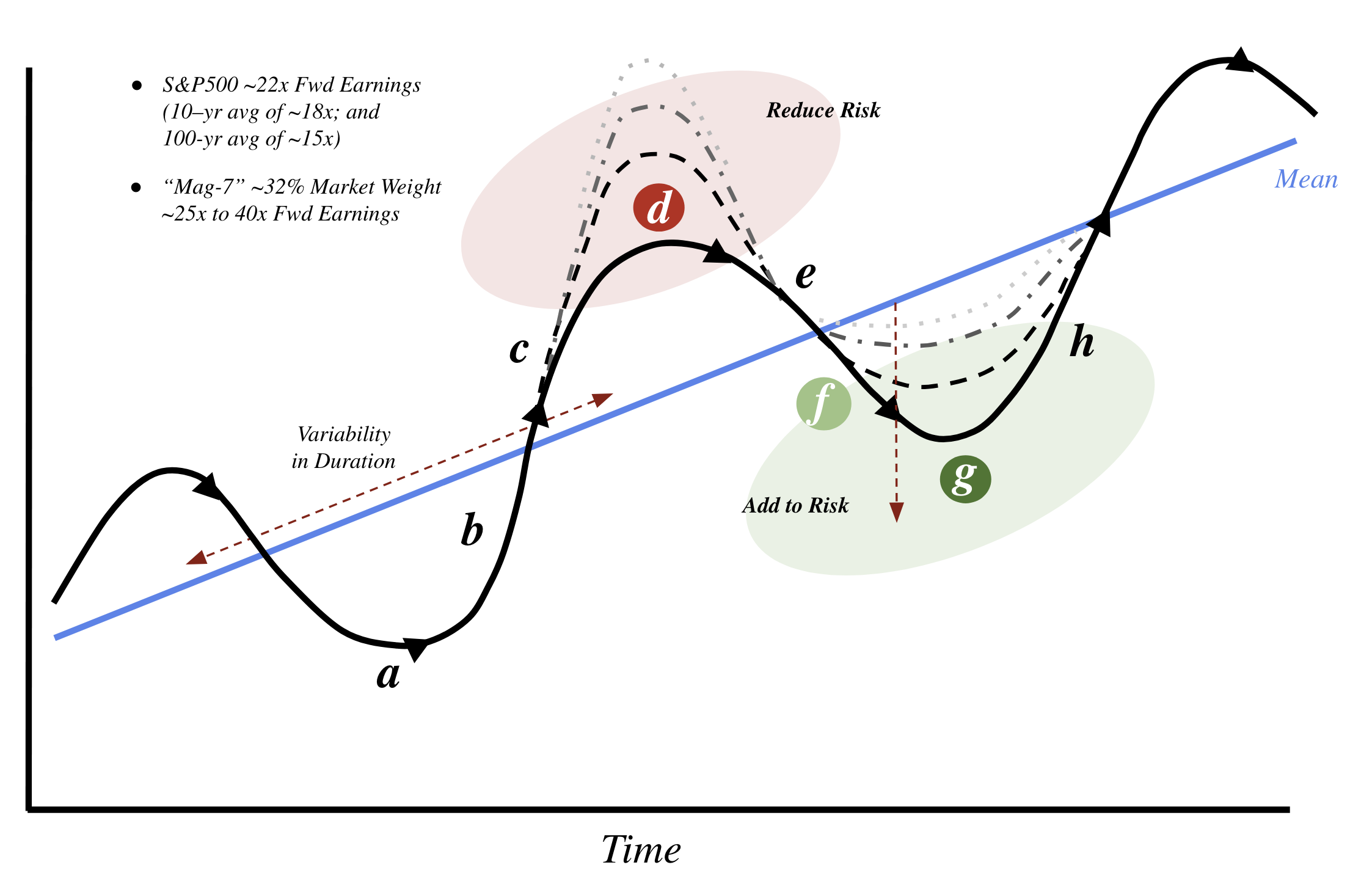

Eight months down. Four to go. After shedding almost ~10% to start the month - the bulls managed to close the market at its highs. Whiplash anyone? The S&P 500 is back to the point where the markets panicked on a growth scare - however it raises a question: (i) can it break through previous resistance (the all-time high of 5669); or (ii) will it perform what traders call a "back and fill"? My guess is the latter - as we head into one of the weaker months of the year.