Are Semi’s Set to Cool their Gen-AI Heels?

Are Semi’s Set to Cool their Gen-AI Heels?

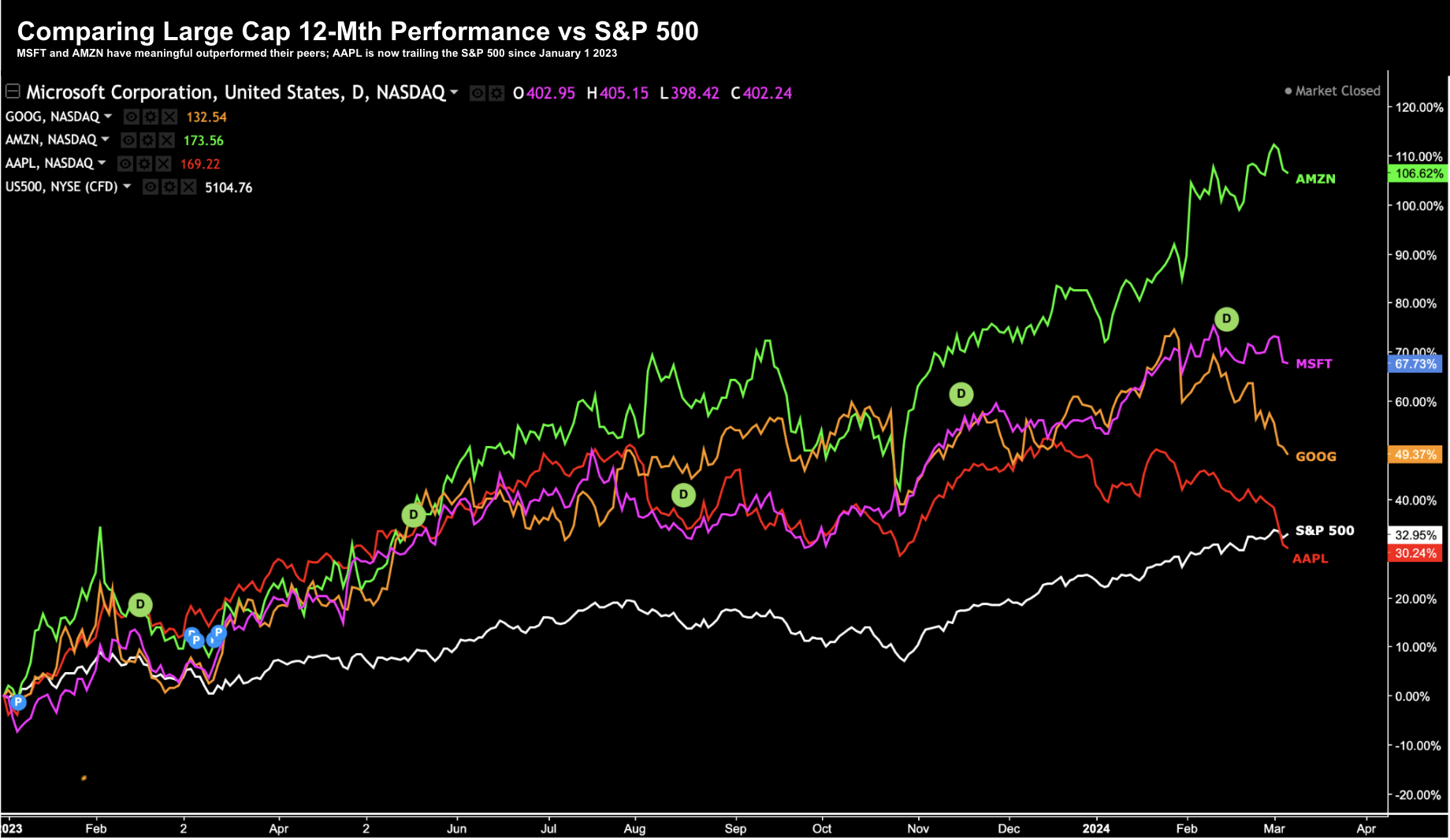

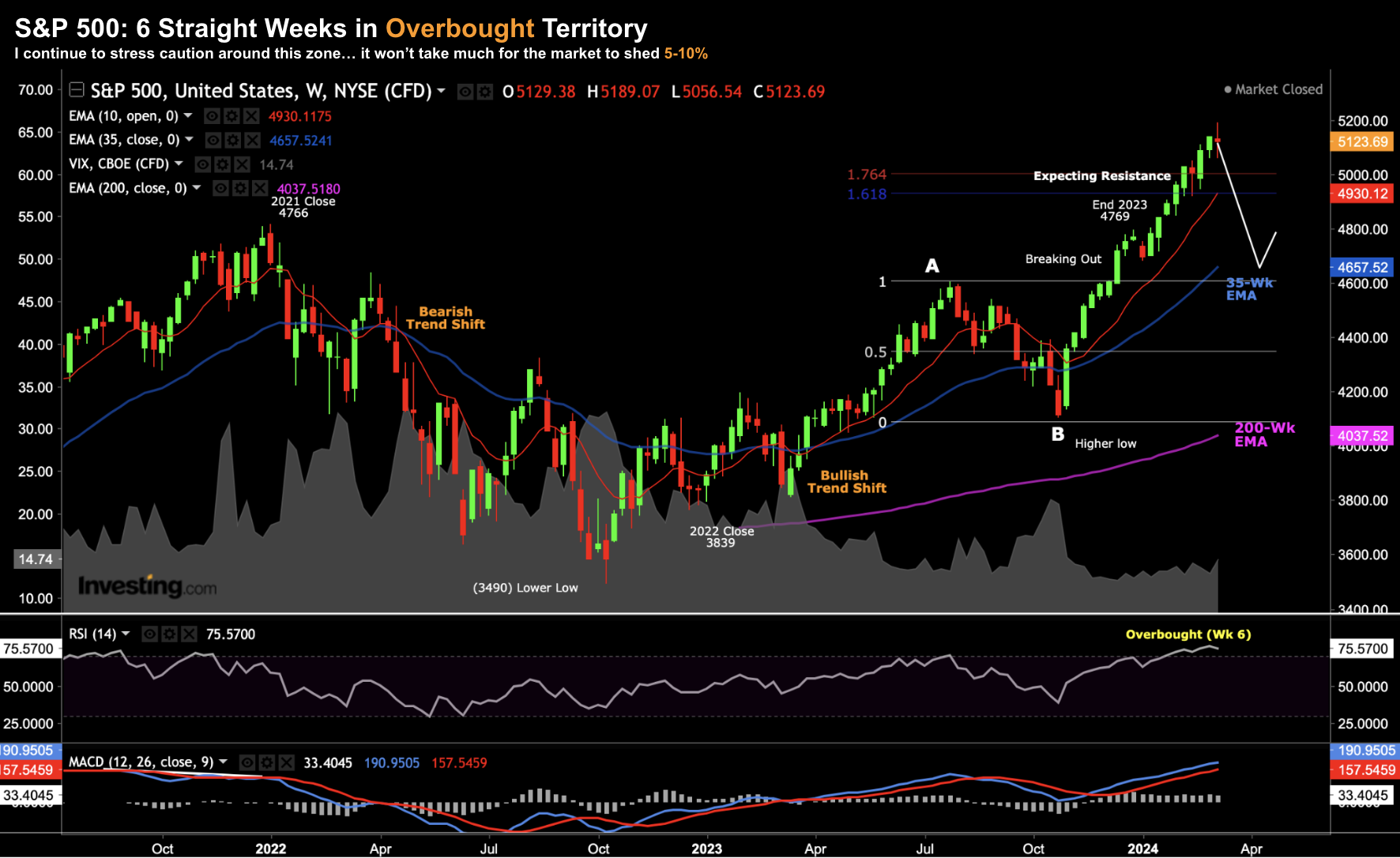

Whilst the technology sector is outperforming the benchmark index this year -- semiconductor stocks have done the bulk of the heavy lifting. And it's not difficult to explain investor FOMO. It's entirely due to the hype around "AI" and specifically something called "Generative AI". For example, in a report by Grand View Research, they valued Gen-AI at ~$13B last year. However, its anticipated CAGR is estimated to be ~36% - which puts the industry hitting $109B by 2030. That's a sharp ramp higher from basically zero two years ago. And today - there a very few chipmakers who produce the GPUs required to meet the insatiable demand. However, is the demand semis are seeing today (and revenue) sustainable long-term? That's unlikely.