Fed: We’re Not Finished Hiking

Fed: We’re Not Finished Hiking

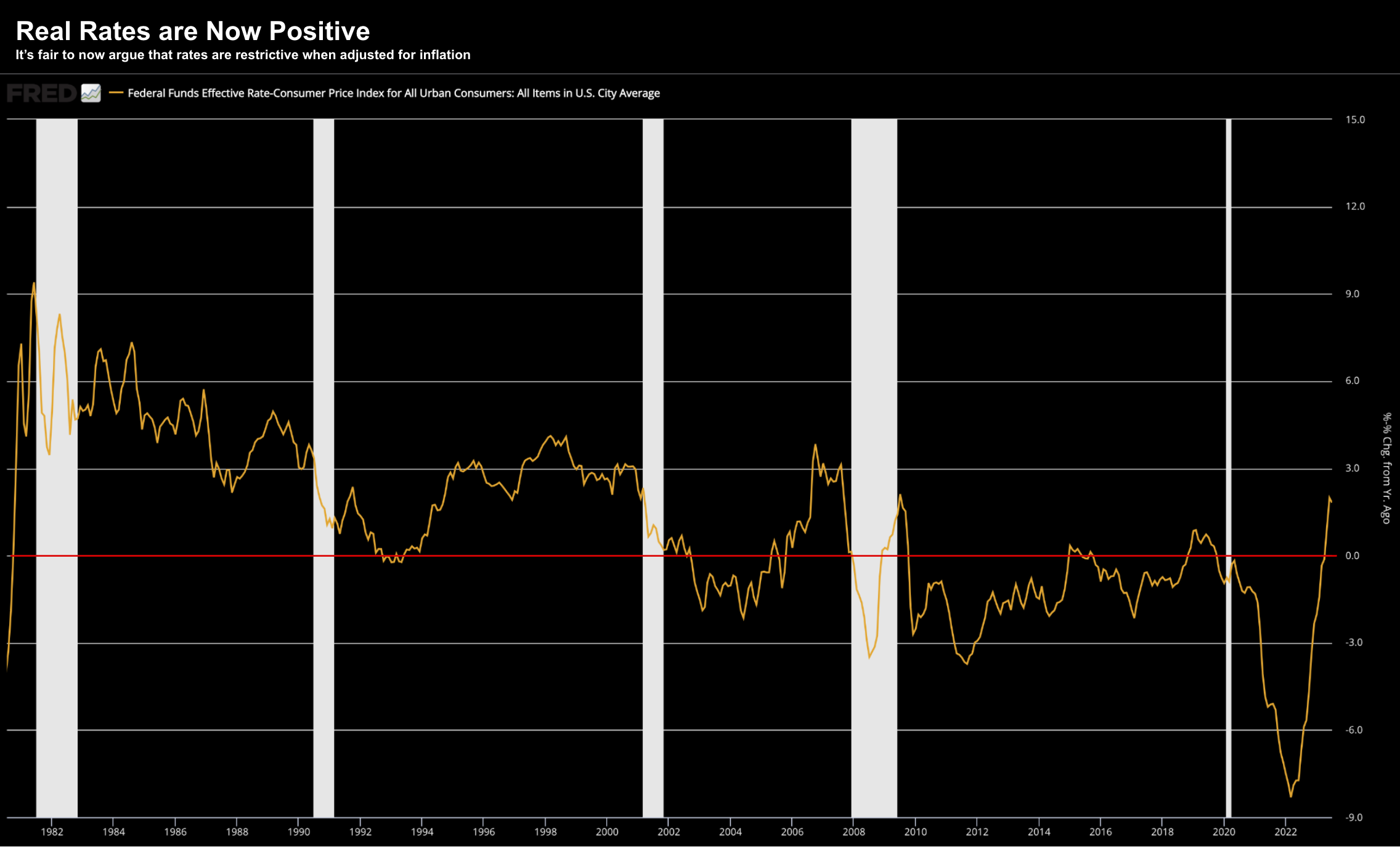

Let's start with a quick quote from yesterday's missive: "From mine, Powell will deliver a hawkish tone leaving the door wide open for further hikes in November or December if needed". That's exactly what he said. From my lens, Powell sounded hawkish today - reminding investors they are are not done hiking. Not yet. And if I'm to be blunt - he has sounded hawkish at every meeting this year. But investors will often choose to hear what they want to hear. Be conscious of what biases you have. The script is higher for longer and the market is yet to adjust. It will.