Fed Likely to Pause (for now)

Fed Likely to Pause (for now)

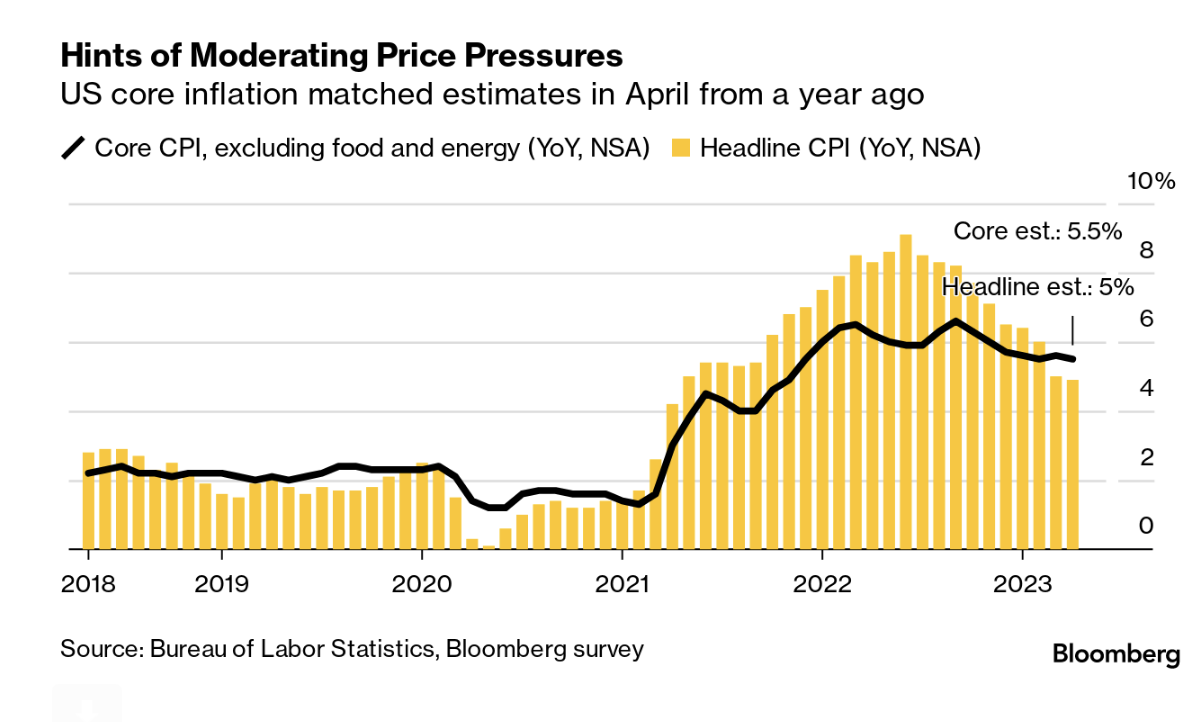

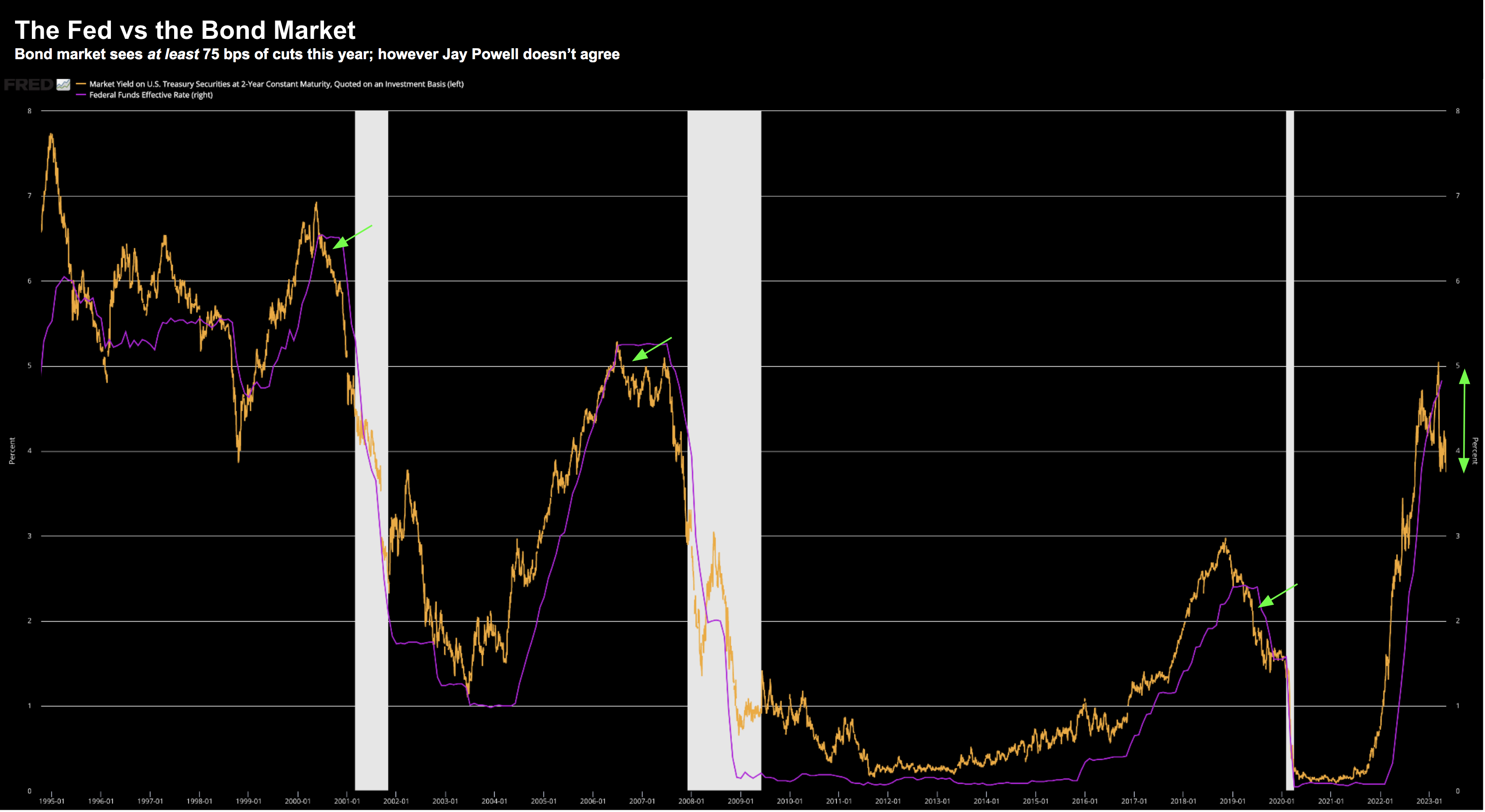

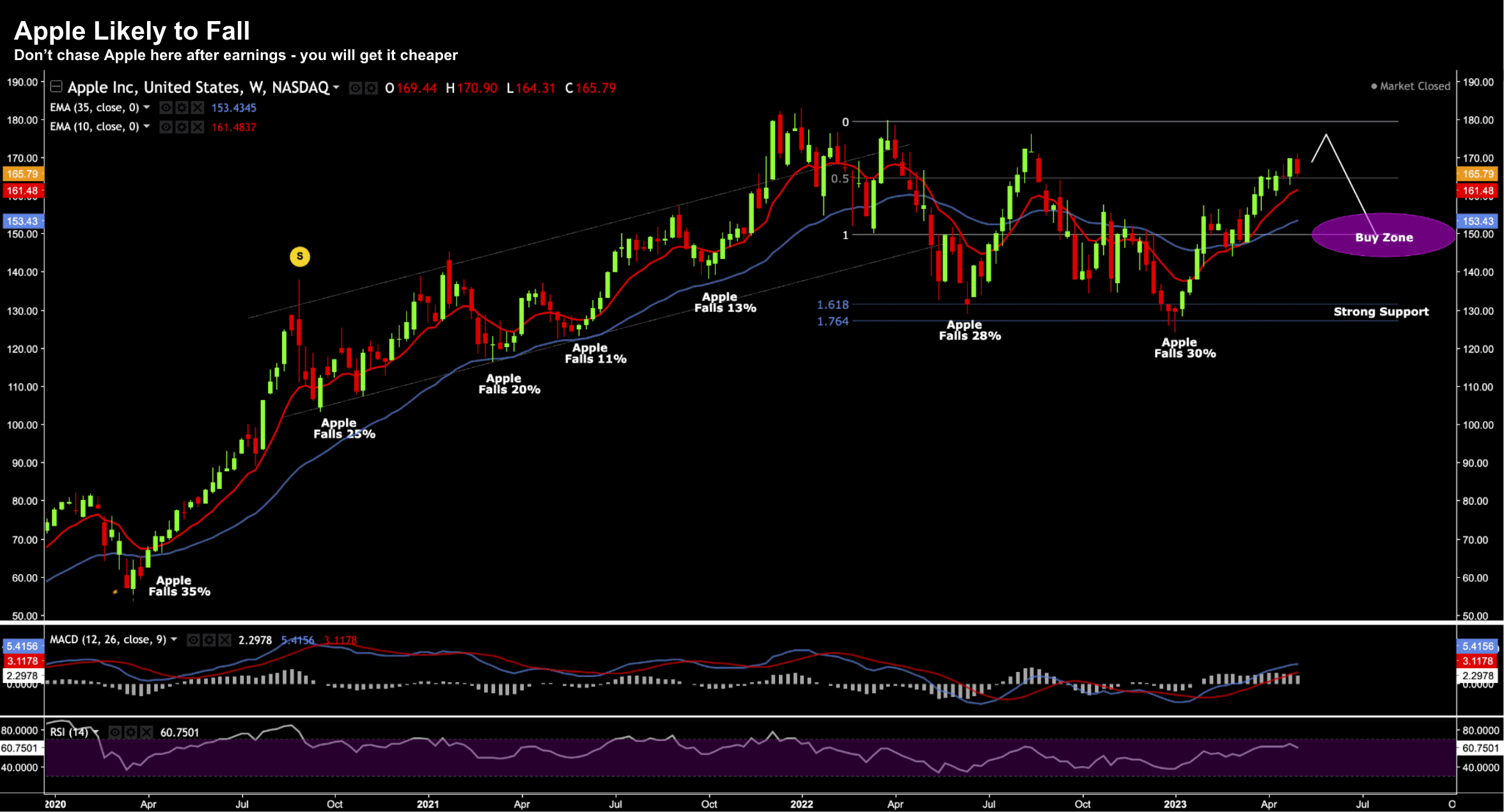

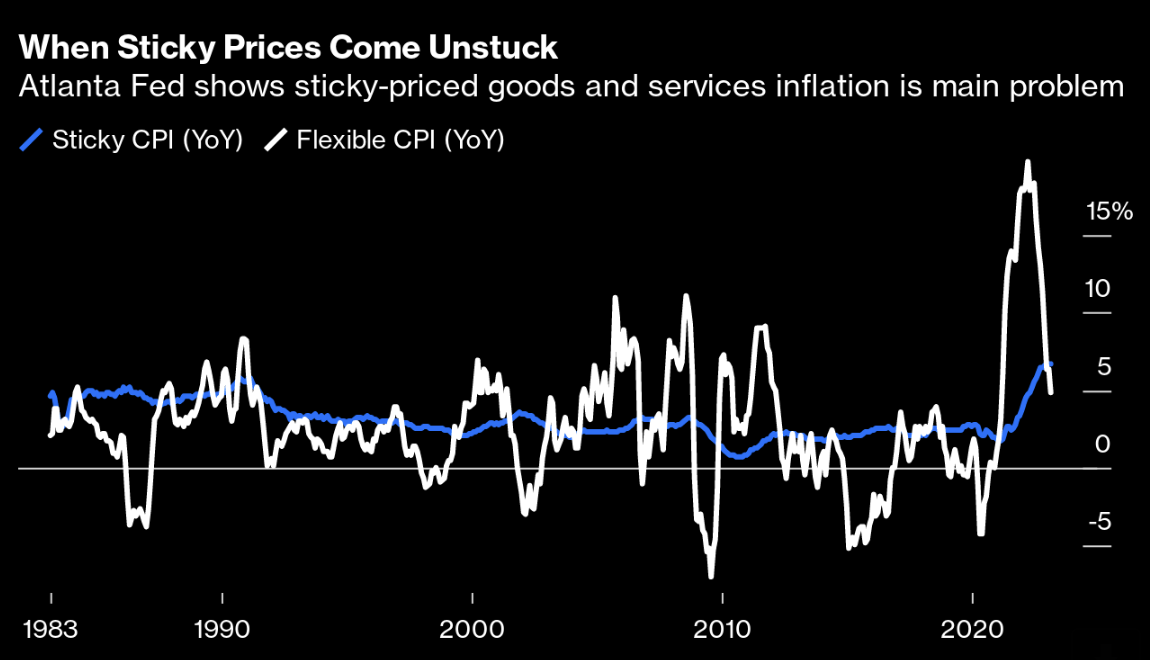

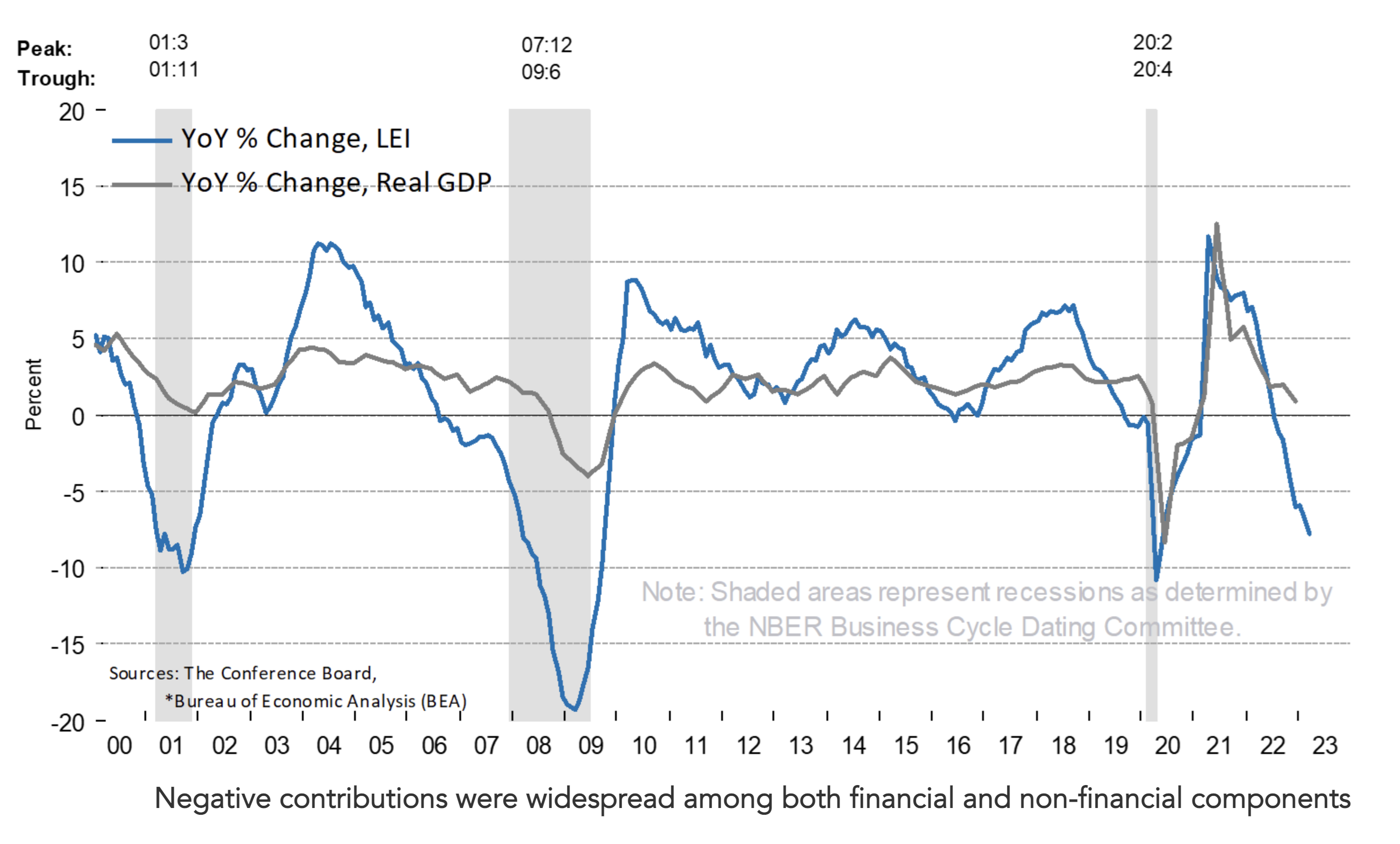

With the debt ceiling deal behind us - markets will now focus on the next FOMC meeting. It's widely expected the Fed will pause on any rate hikes in June - especially given some of the underlying weakness in the jobs data. However, the market is not ruling out further increases later this year. I also take a look at AI boom in the market... call it "BoomGPT". Invest with optimism but do it with your eyes open.