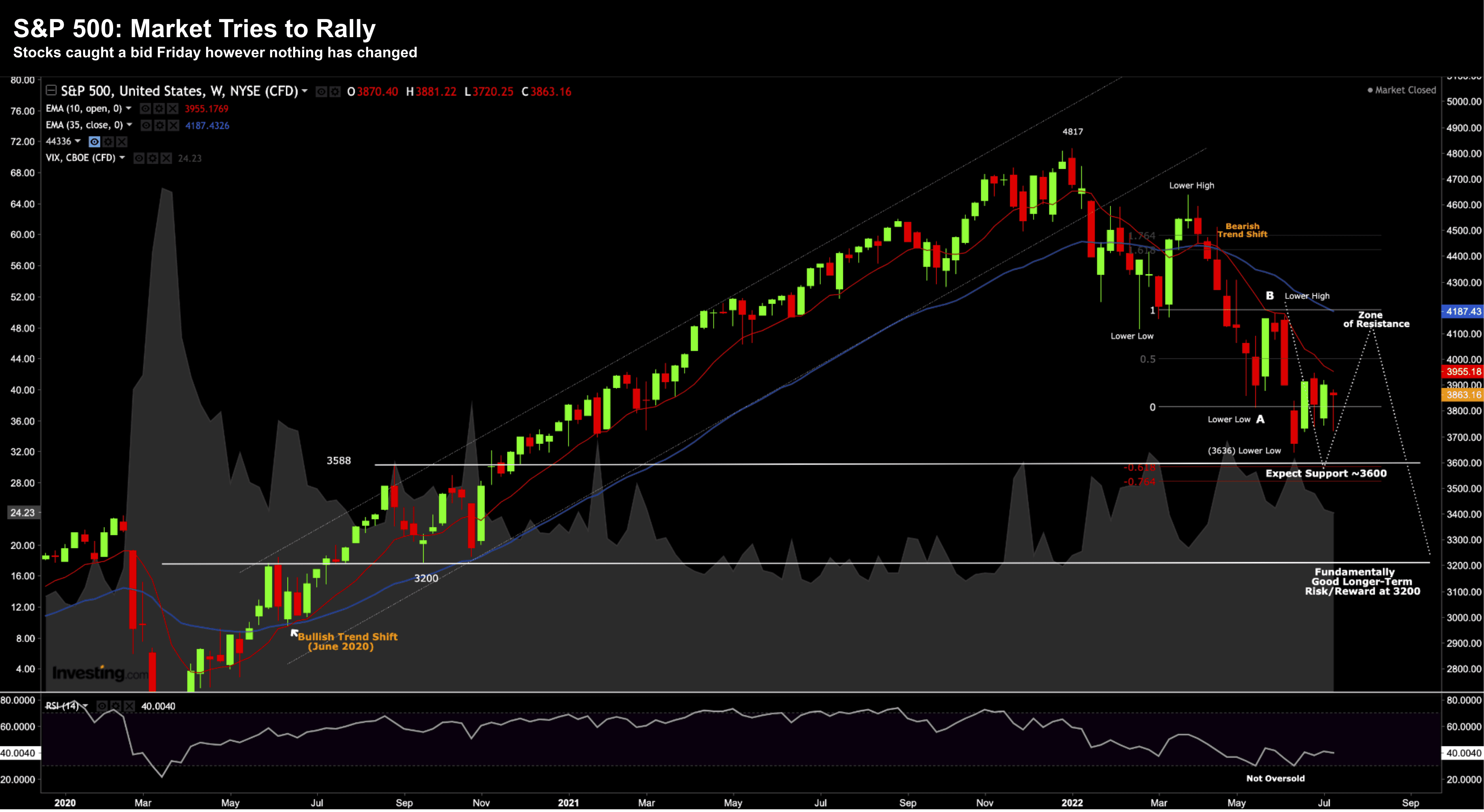

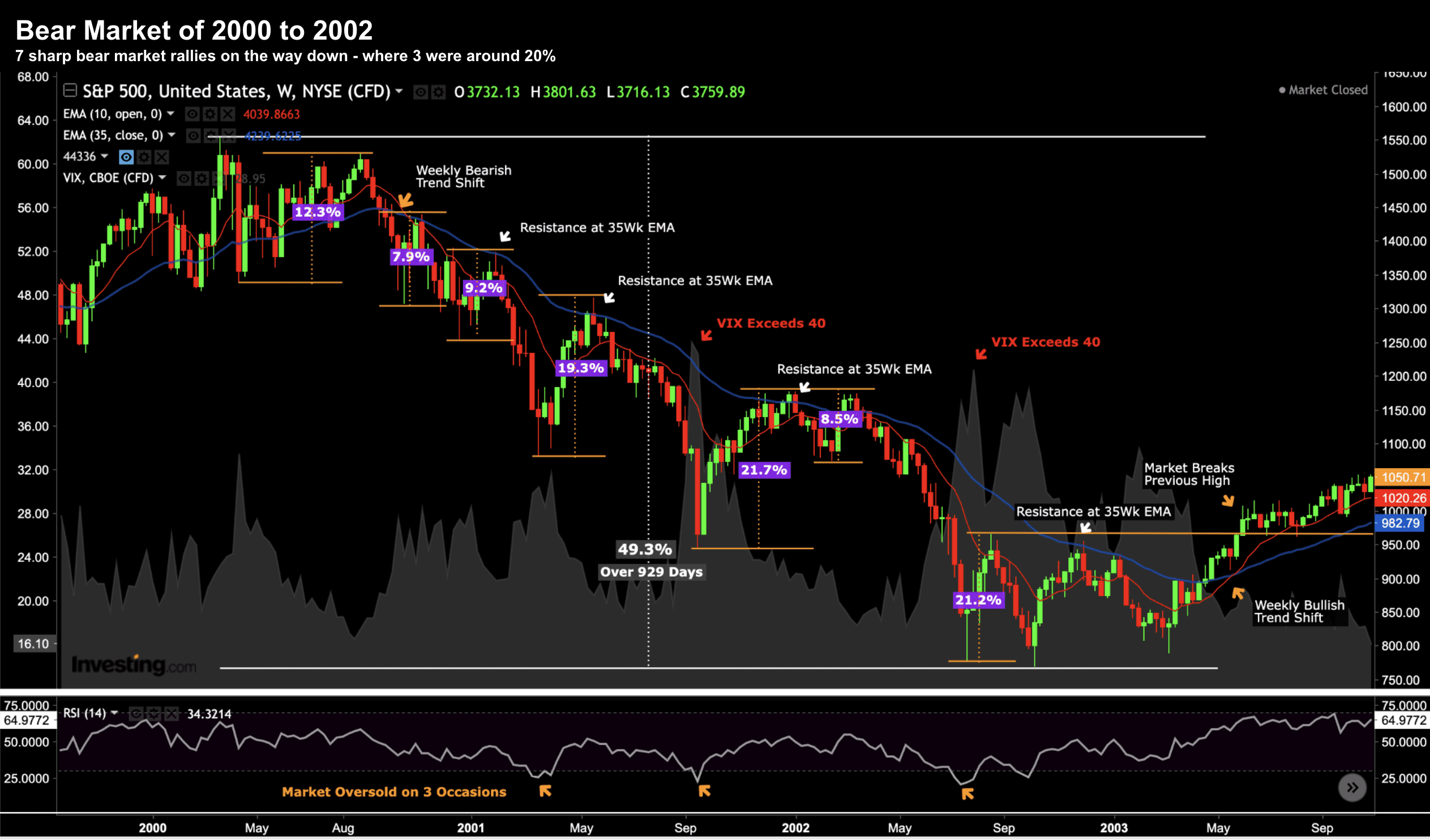

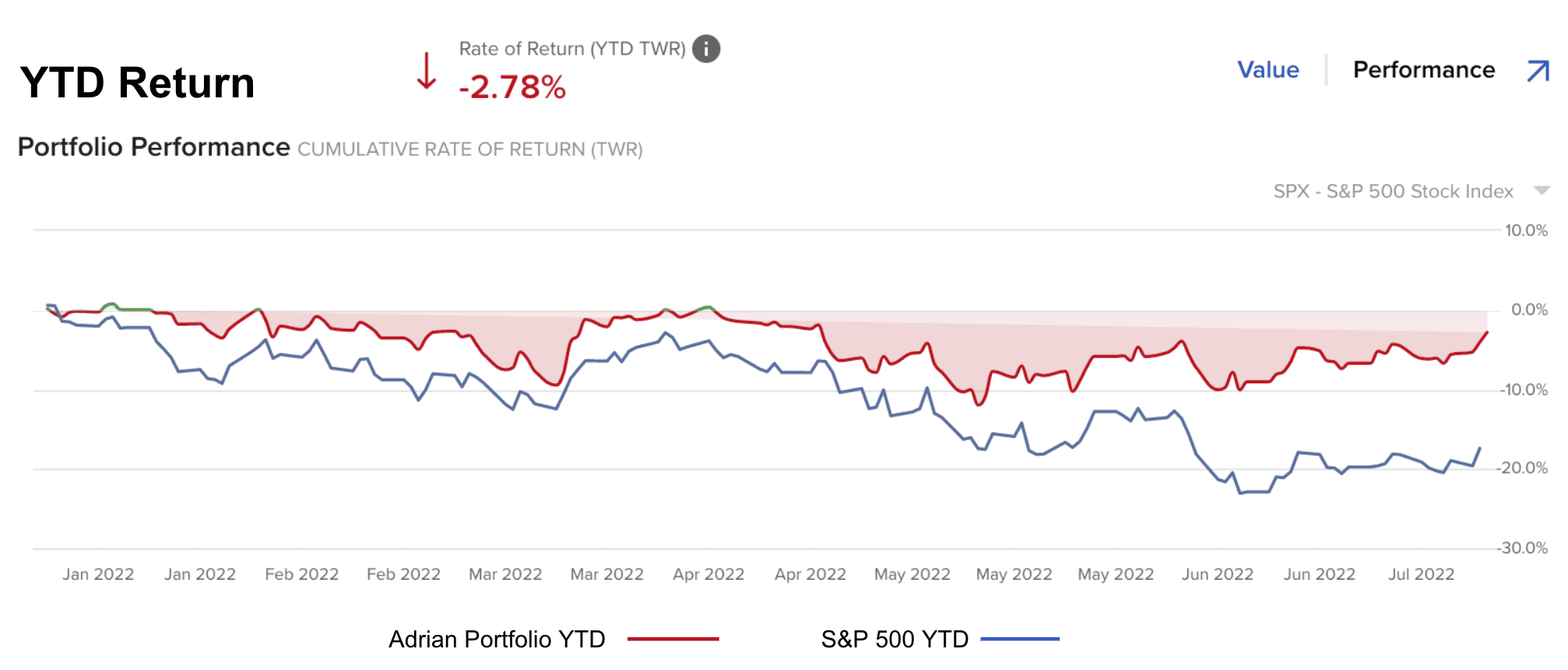

Stay Patient – Pullback Coming

Stay Patient – Pullback Coming

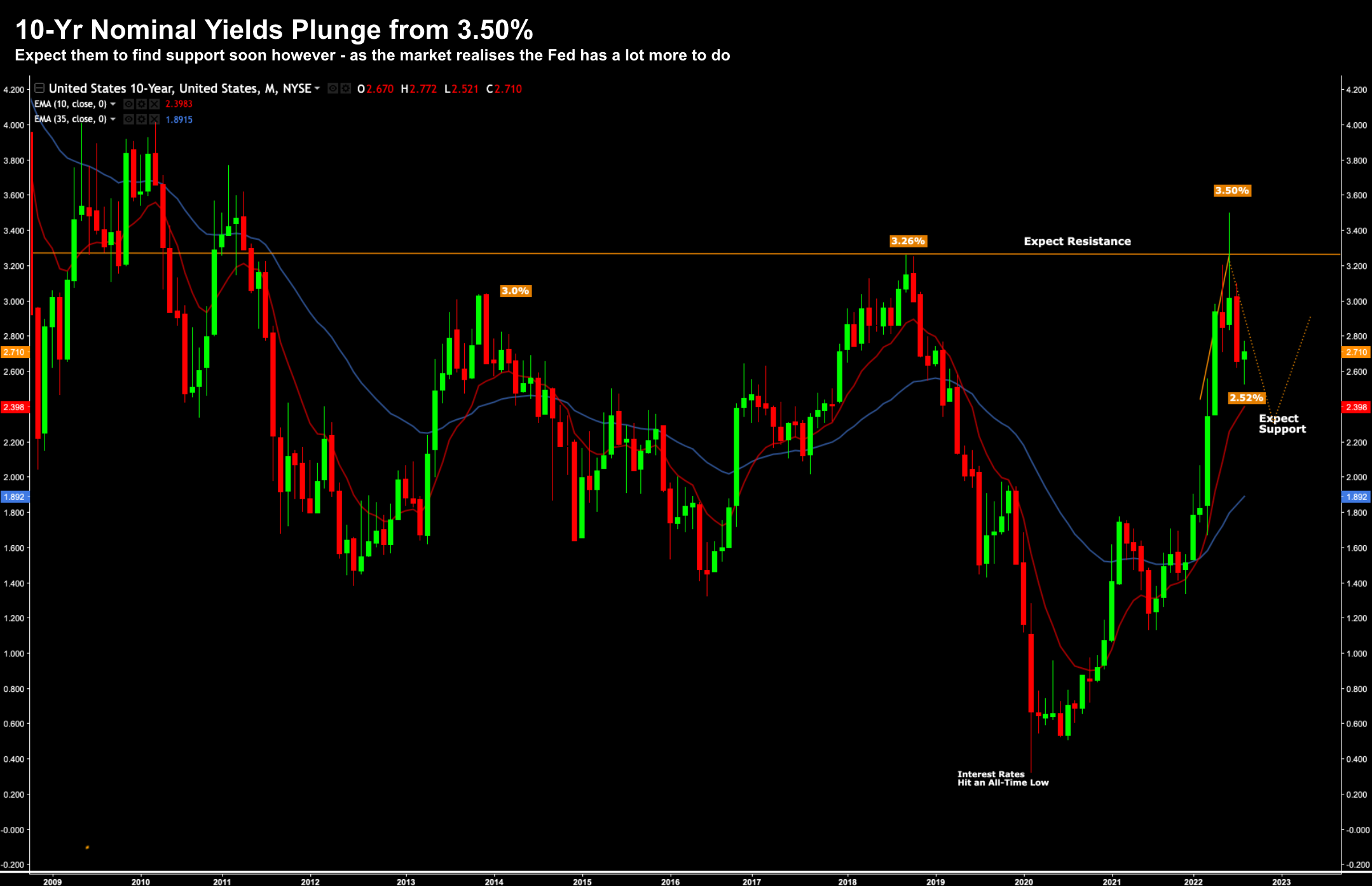

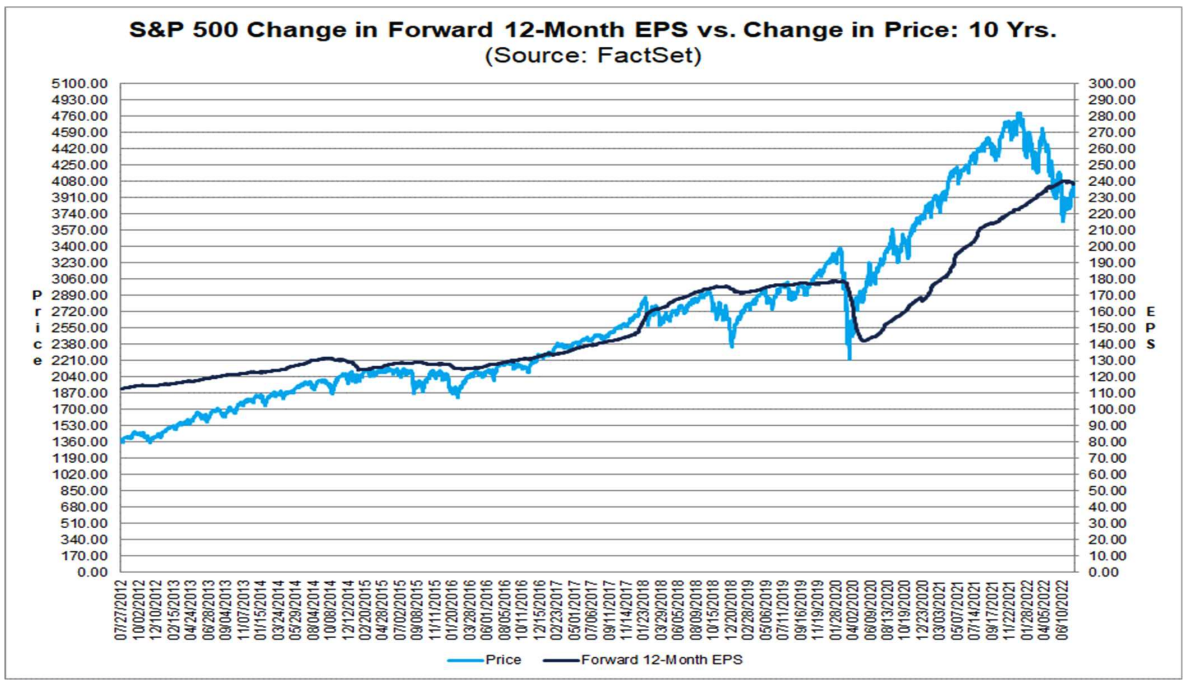

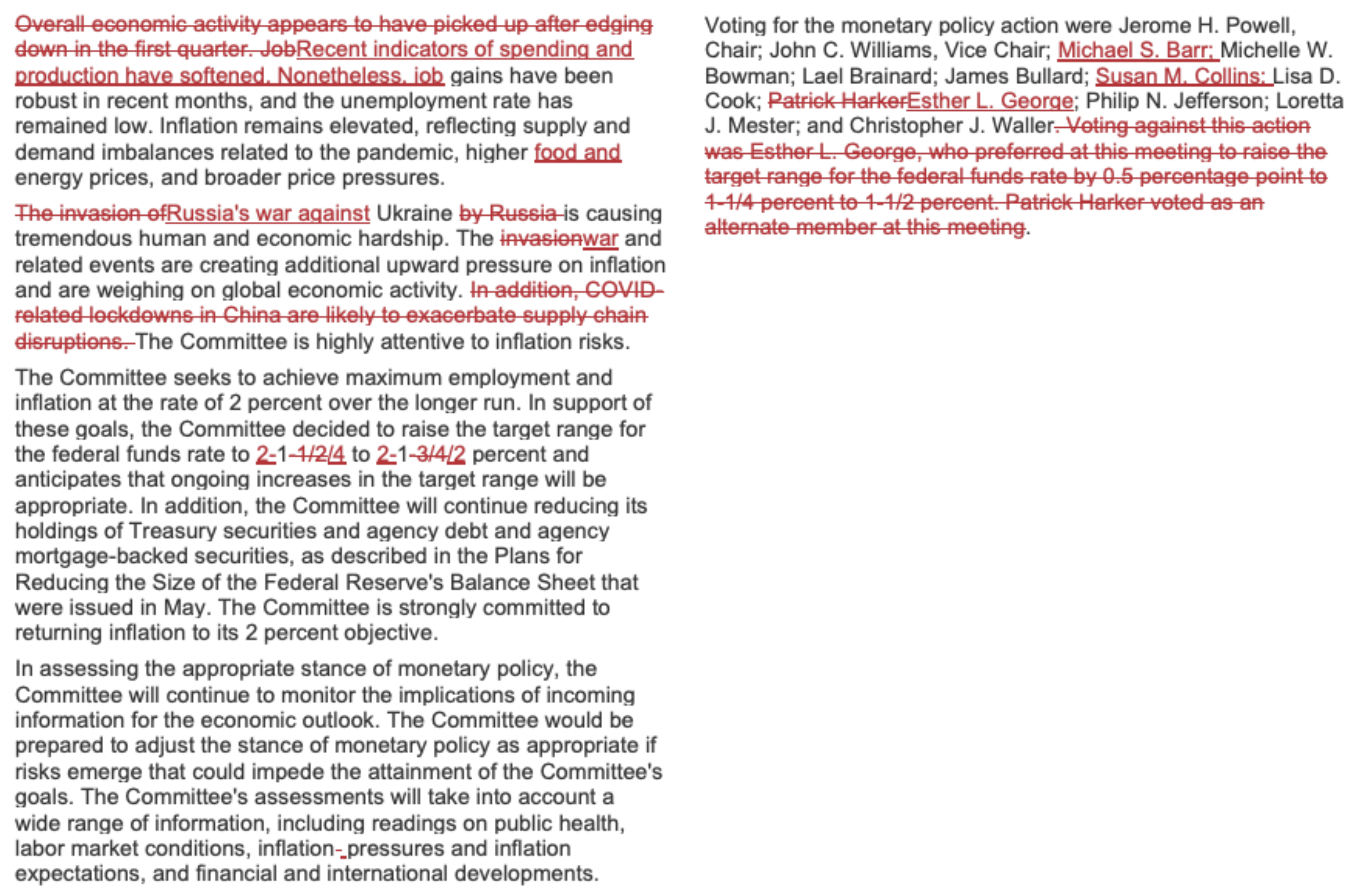

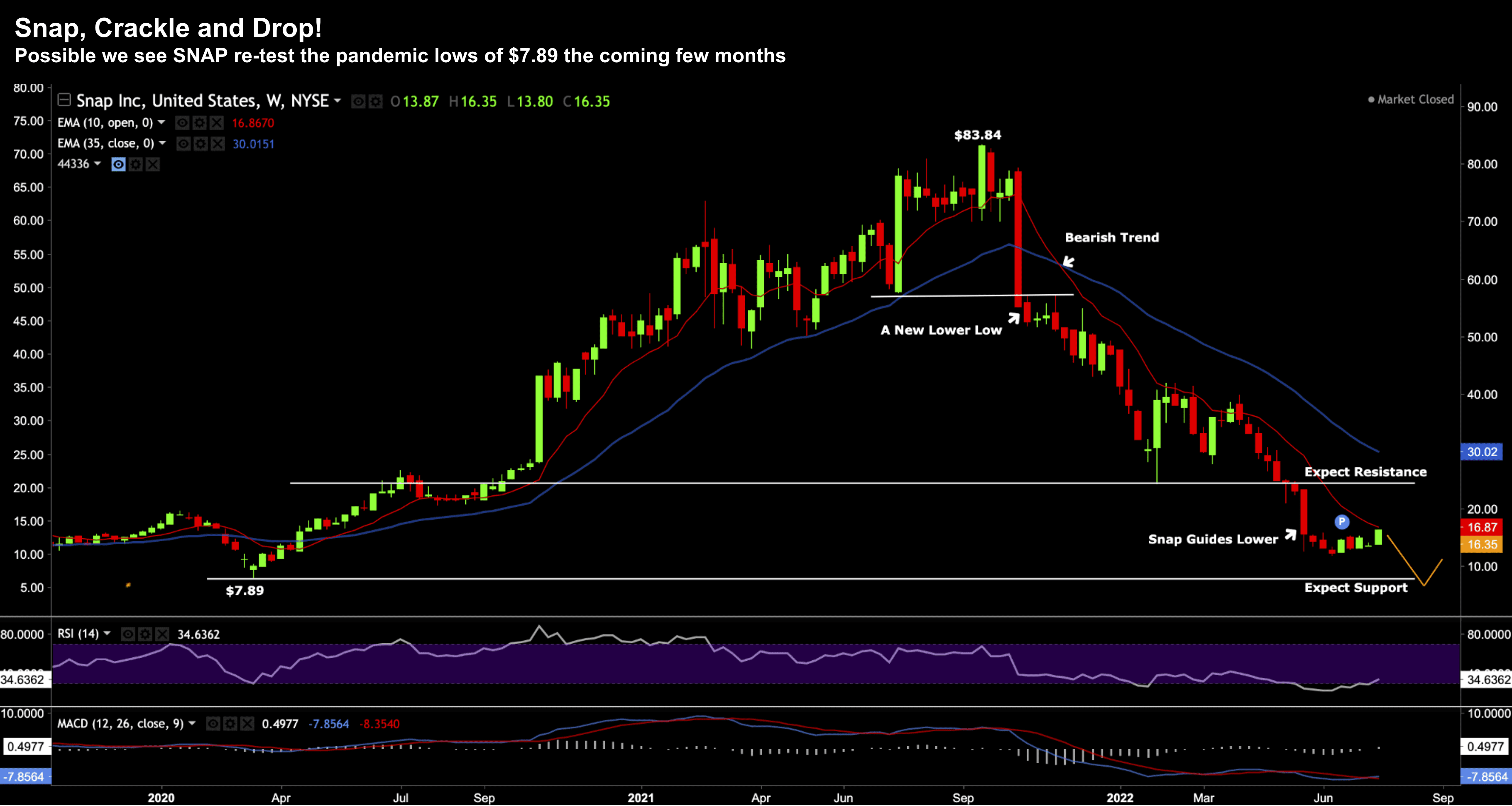

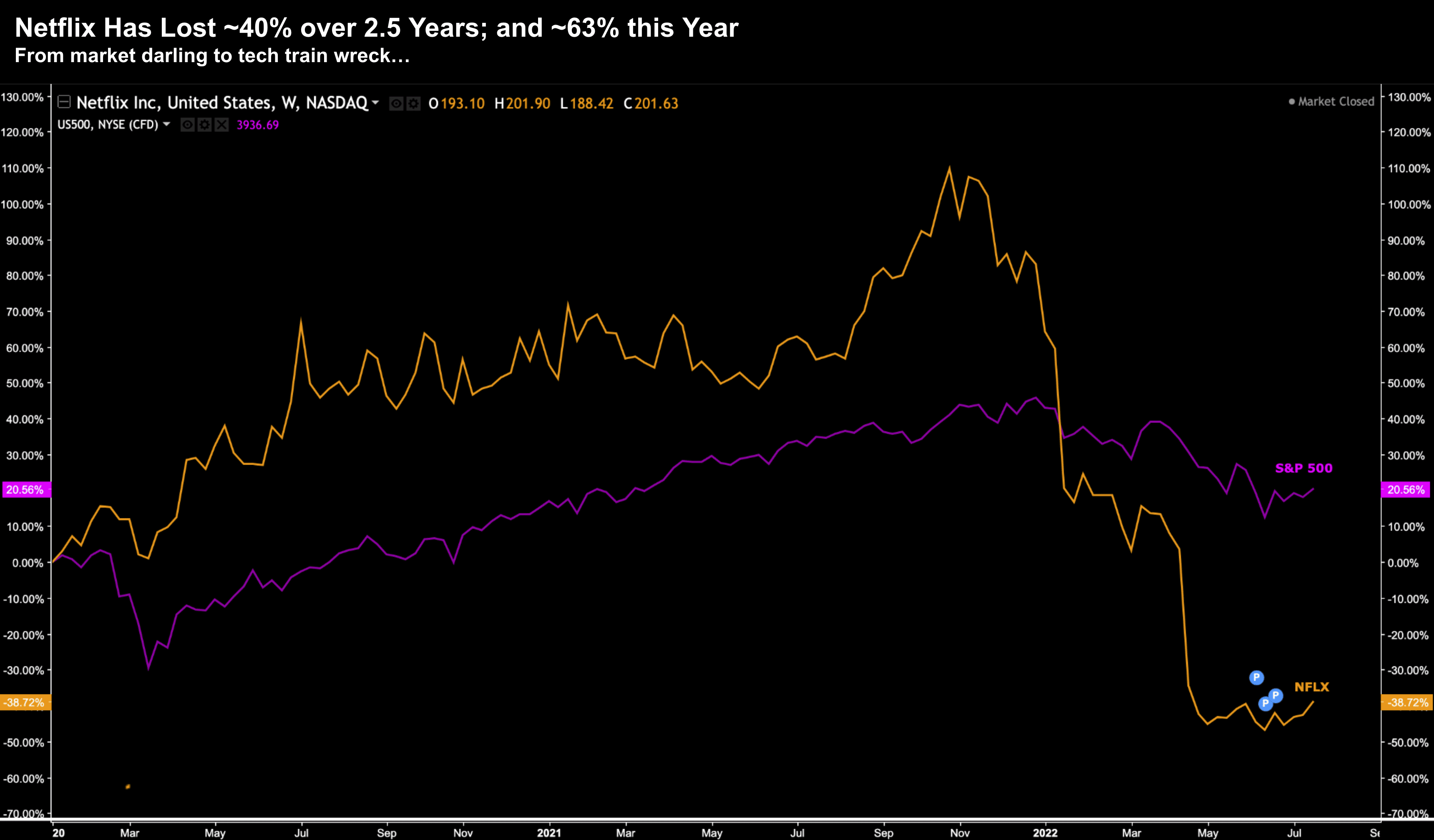

When prices are rising (as they are today) in a bear market -- all too often sentiment will shift prematurely. It's called a bear-market trap. And I think this is what we are seeing...