Markets Hedge as Momentum Wanes

Markets Hedge as Momentum Wanes

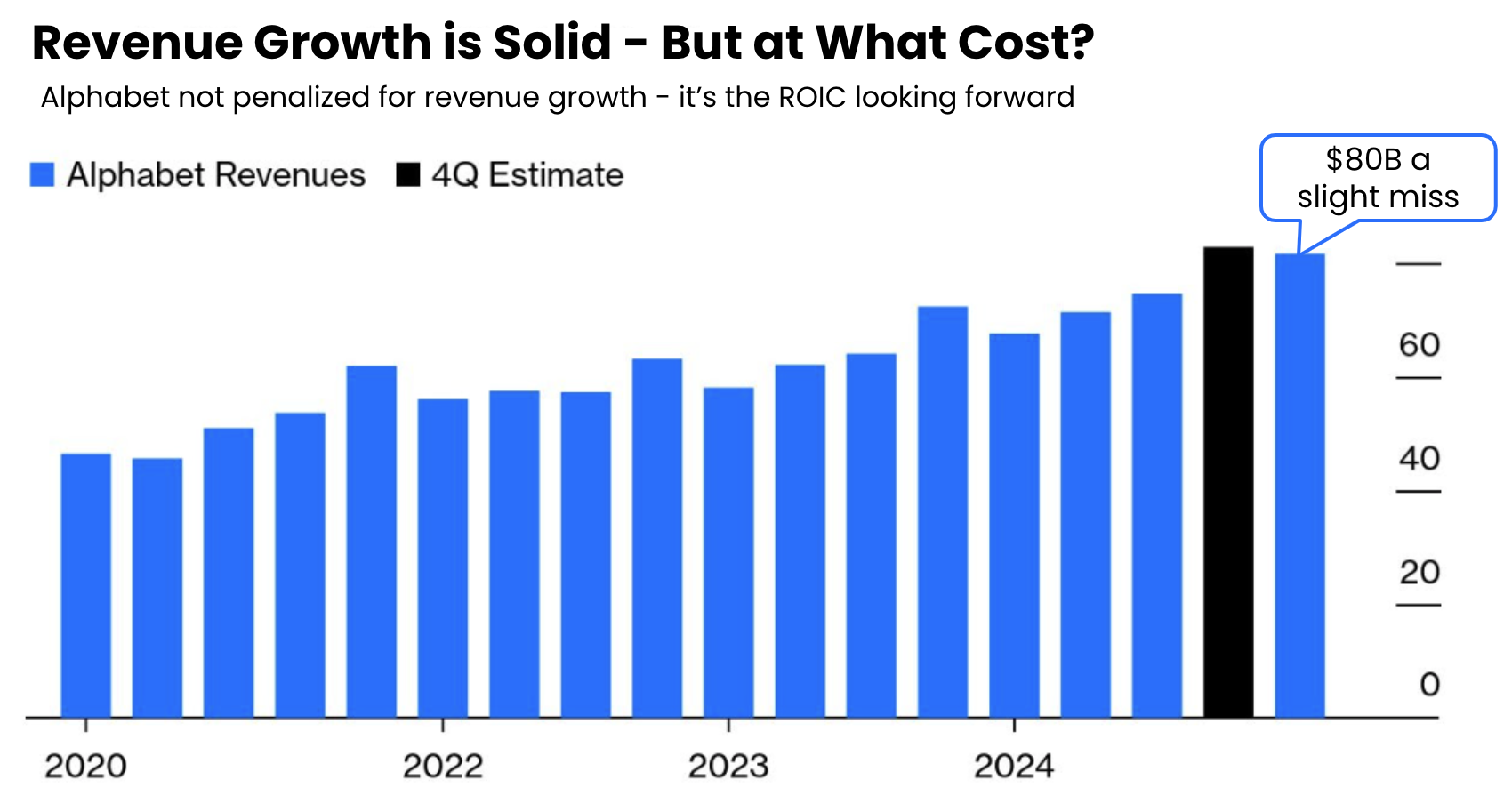

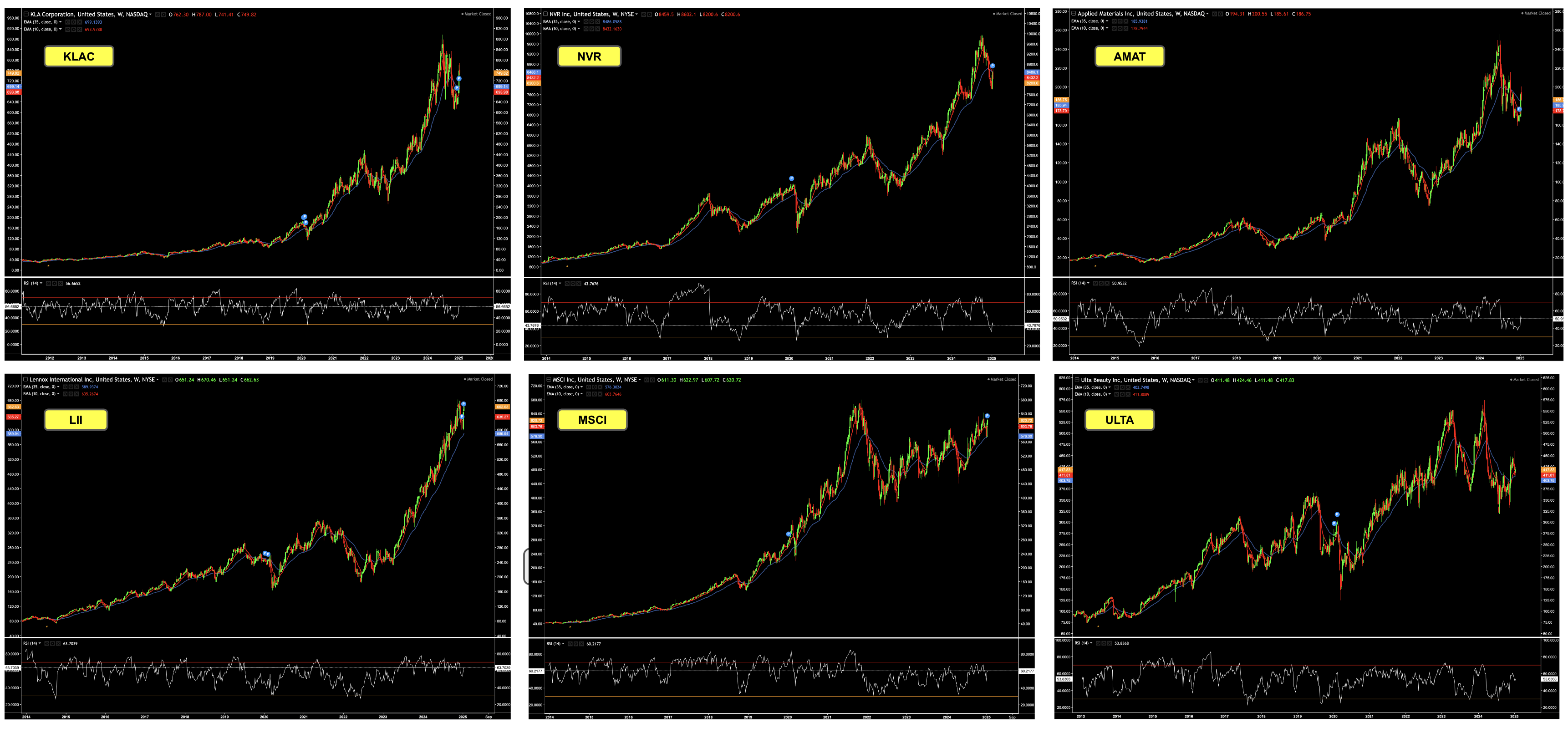

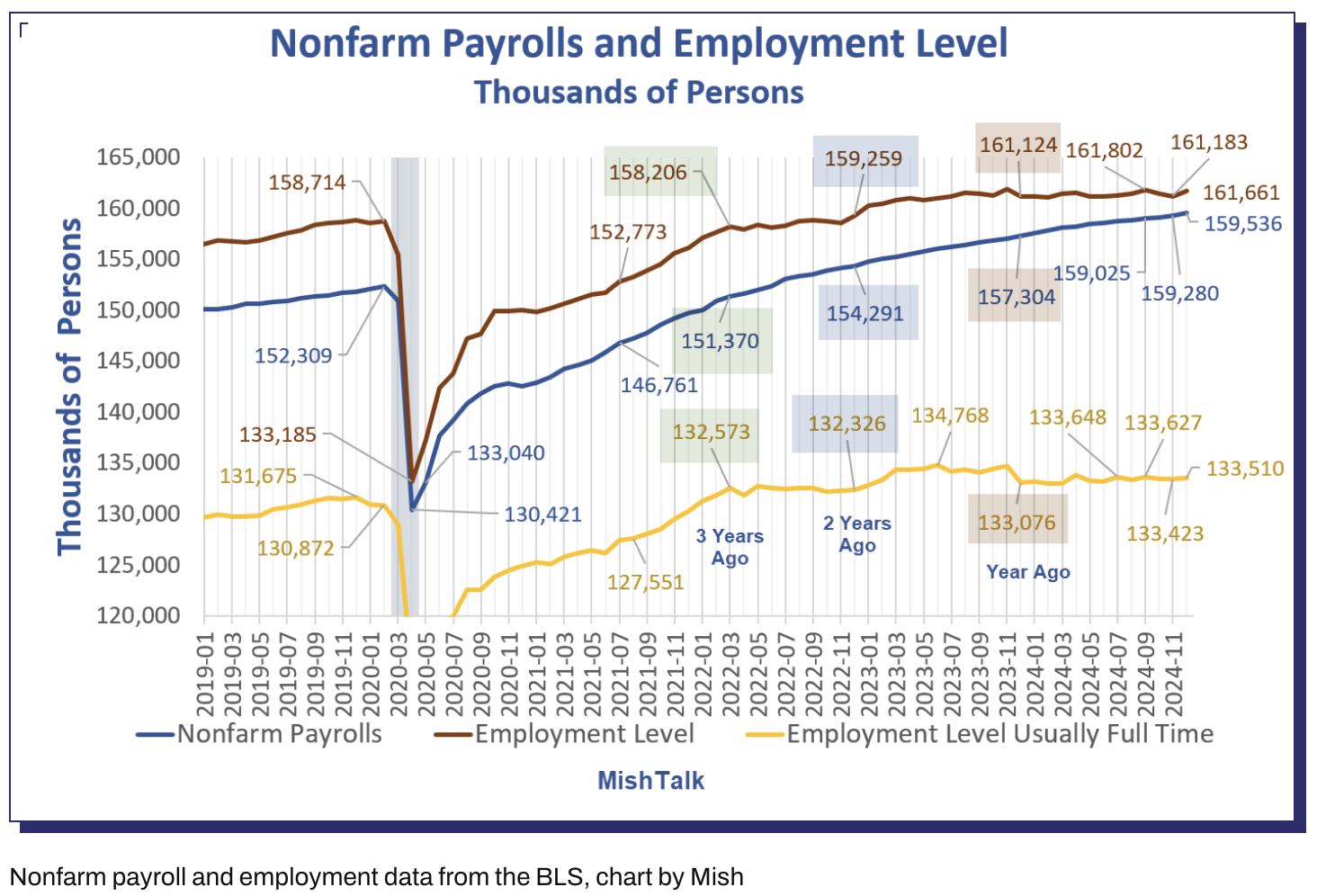

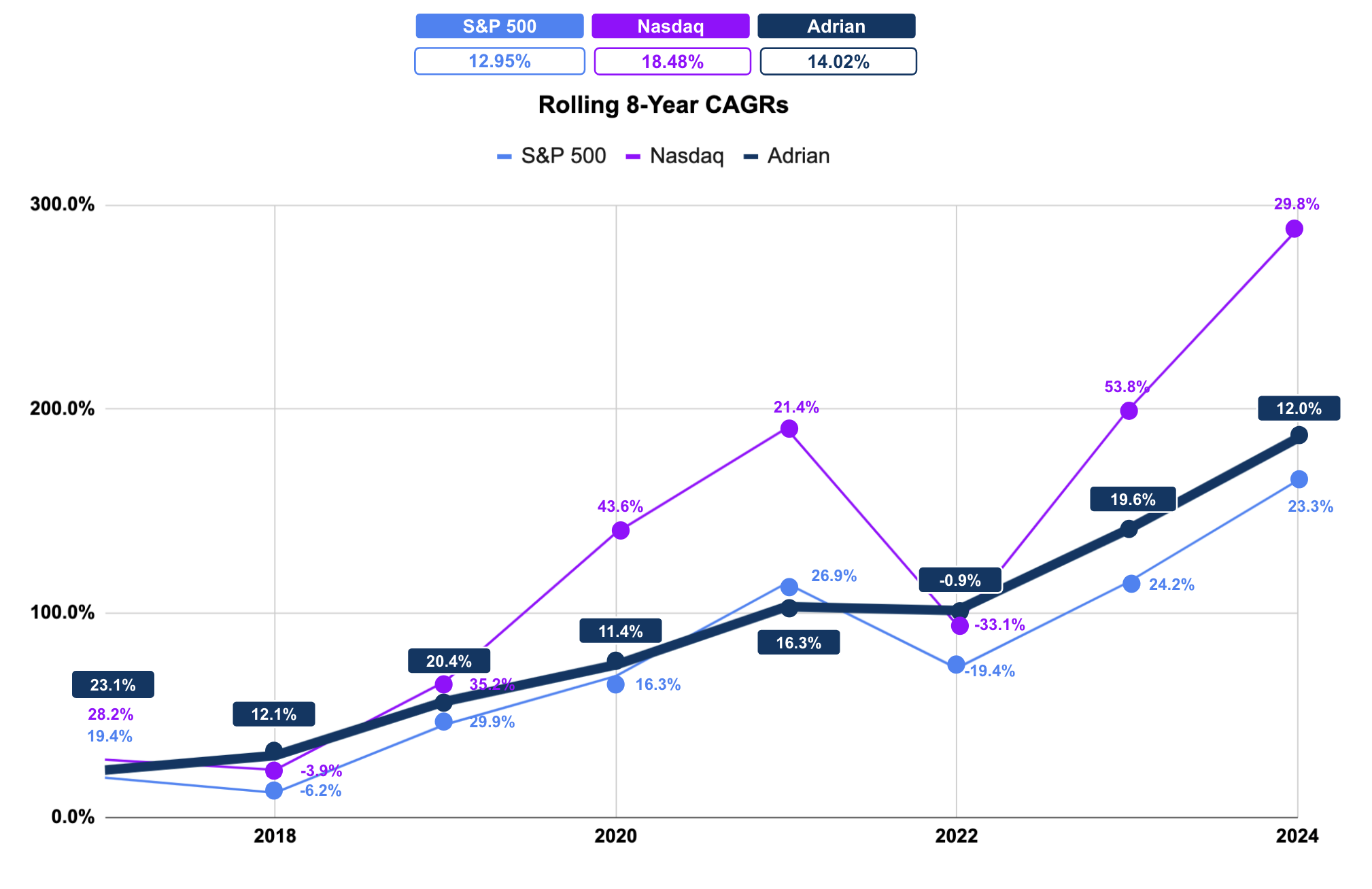

As an investor - it's very important to know the rules. For example, if the rules are constantly influx - it leads to uncertainty. With heightened uncertainty - you pull back. That's what faces investors. For example, consider the following: (i) direction of monetary policy (e.g., as Powell raised concerns on inflation); (ii) A torrent of policy shifts from the White House; and (iii) major disruption with artificial intelligence - as investors question return on capital invested. Uncertainty in each of these buckets makes it hard to commit to stocks with conviction.