Stocks Pause on ‘Less than Magnificent’ Earnings

Stocks Pause on ‘Less than Magnificent’ Earnings

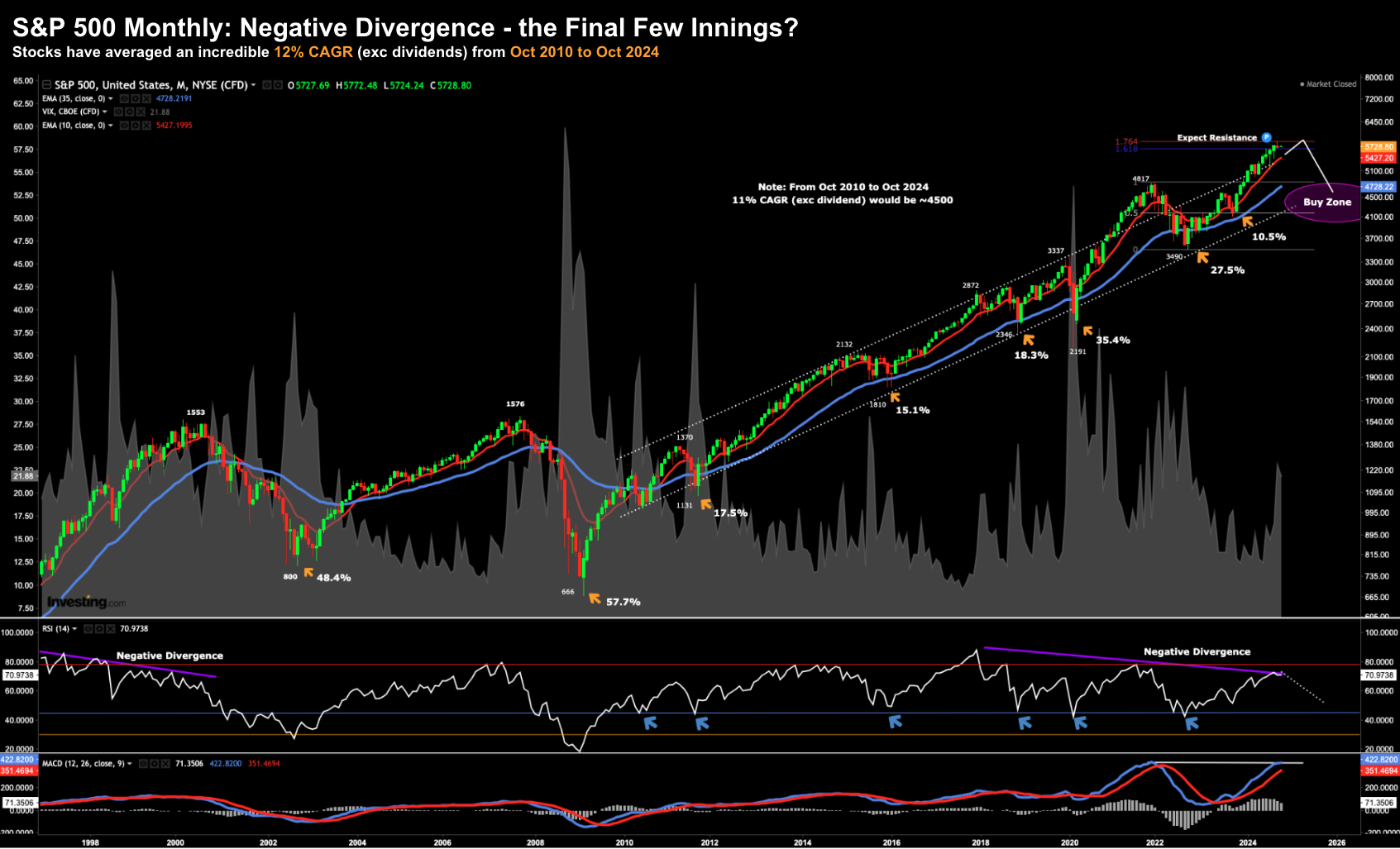

October - synonymous for delivering market jolts - passed with barely a whimper. However, it was the market's first negative month since April. Are stocks losing their mojo? In short, large cap tech earnings from five of the 'Mag 7' were less than magnificent. Meta, Apple and Microsoft all dropped post earnings. Google managed a small 5% rise initially - but gave it all back. Amazon managed hold gains of ~3%. This post talk to what the market expects from the nearly $1 Trillion in AI capex... and how their patience could be starting to wane...