Nvidia Can’t Stop Stocks Wobbling

Nvidia Can’t Stop Stocks Wobbling

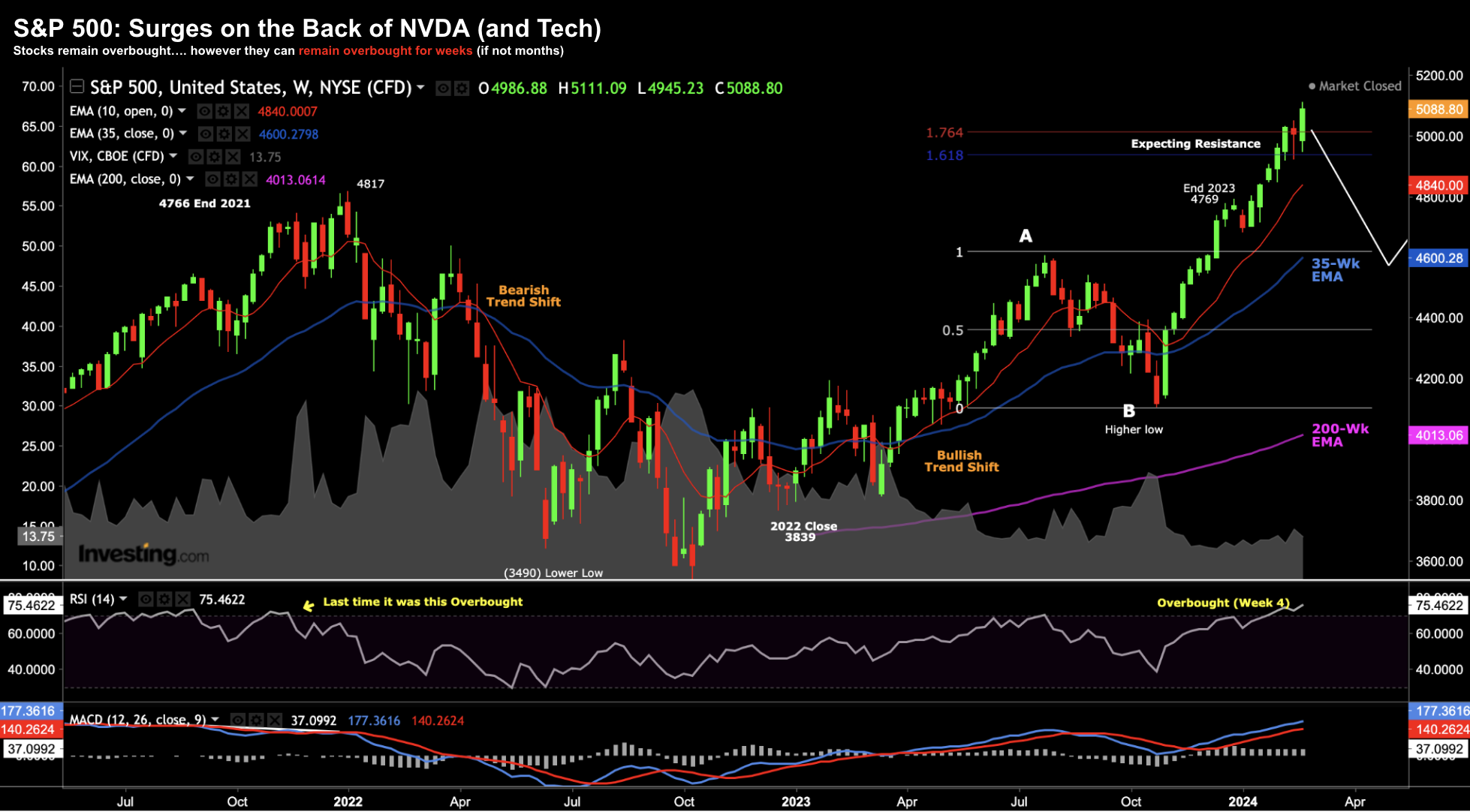

What we've seen from Nvidia the past 18 months reminds me of Cisco in the late 1990's. I wrote about this recently... not much has changed. The path of earnings and the share price have been similar. NVDA's revenues are up over 2.5x on a YoY basis, causing EPS to be up over 4x over the same period. 18% EPS growth in a single quarter is very impressive but here's my question... will we see that in 2 or 3 years from now? We didn't from CSCO - it collapsed. Time will be the judge of that.... not me. Despite the expected "beat and raise" from the AI chip maker - the rest of the market fell sharply. Without NVDA's ~9% share price gain - the S&P 500 would have been down 1.5% for the day. That tells us how narrow this market is - extremely dependent on stellar earnings from a handful of companies like NVDA. That's not a healthy setup.