Are We in an AI Bubble?

Are We in an AI Bubble?

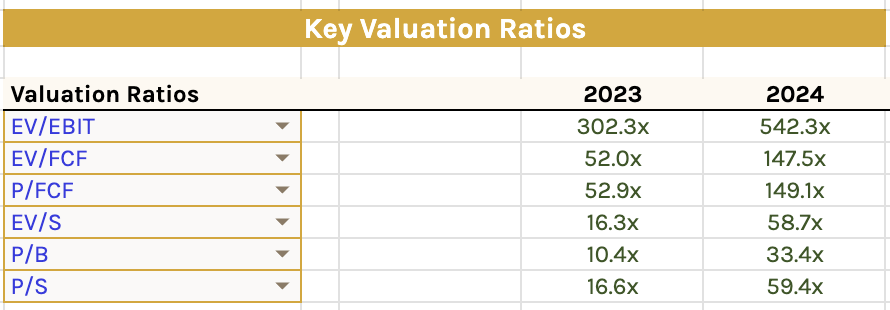

Investor enthusiasm for AI is reminiscent of the Internet boom circa 1995. Having worked at Google, I've seen AI's profound impact firsthand, from computer vision to self-driving Waymo vehicles that have achieved 10M rides. But as an investor, the focus must shift to economics: business models, monetization, and valuation. Billionaires like David Einhorn are sounding the alarm: spending hundreds of billions on AI infrastructure may lead to massive capital destruction if CapEx vastly exceeds consumption. History shows that while the technology transforms society, an oversupply creates painful market corrections. The question isn't if AI is the future—it's what price you pay for it.