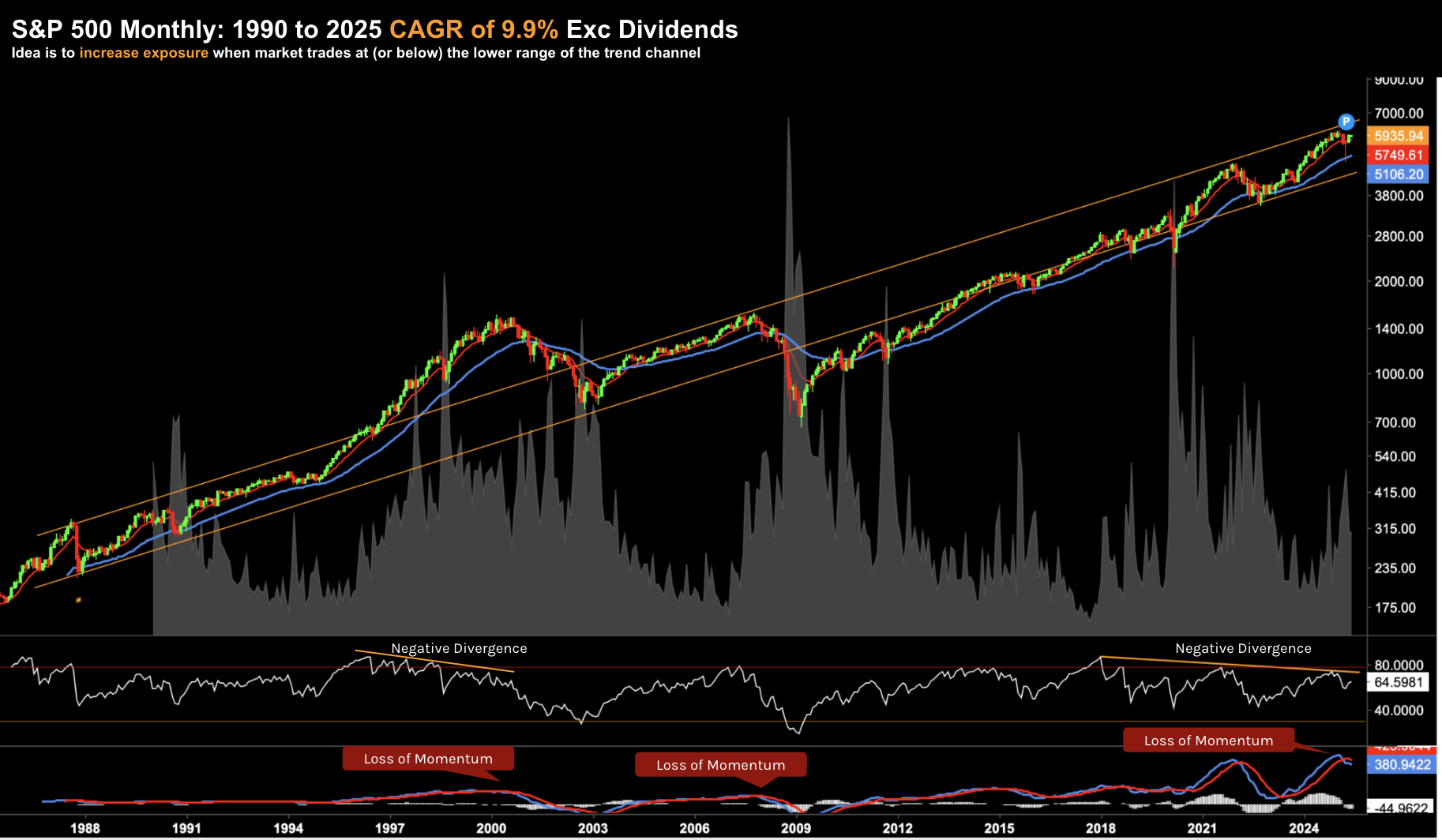

S&P 500 Faces a Litmus Test

S&P 500 Faces a Litmus Test

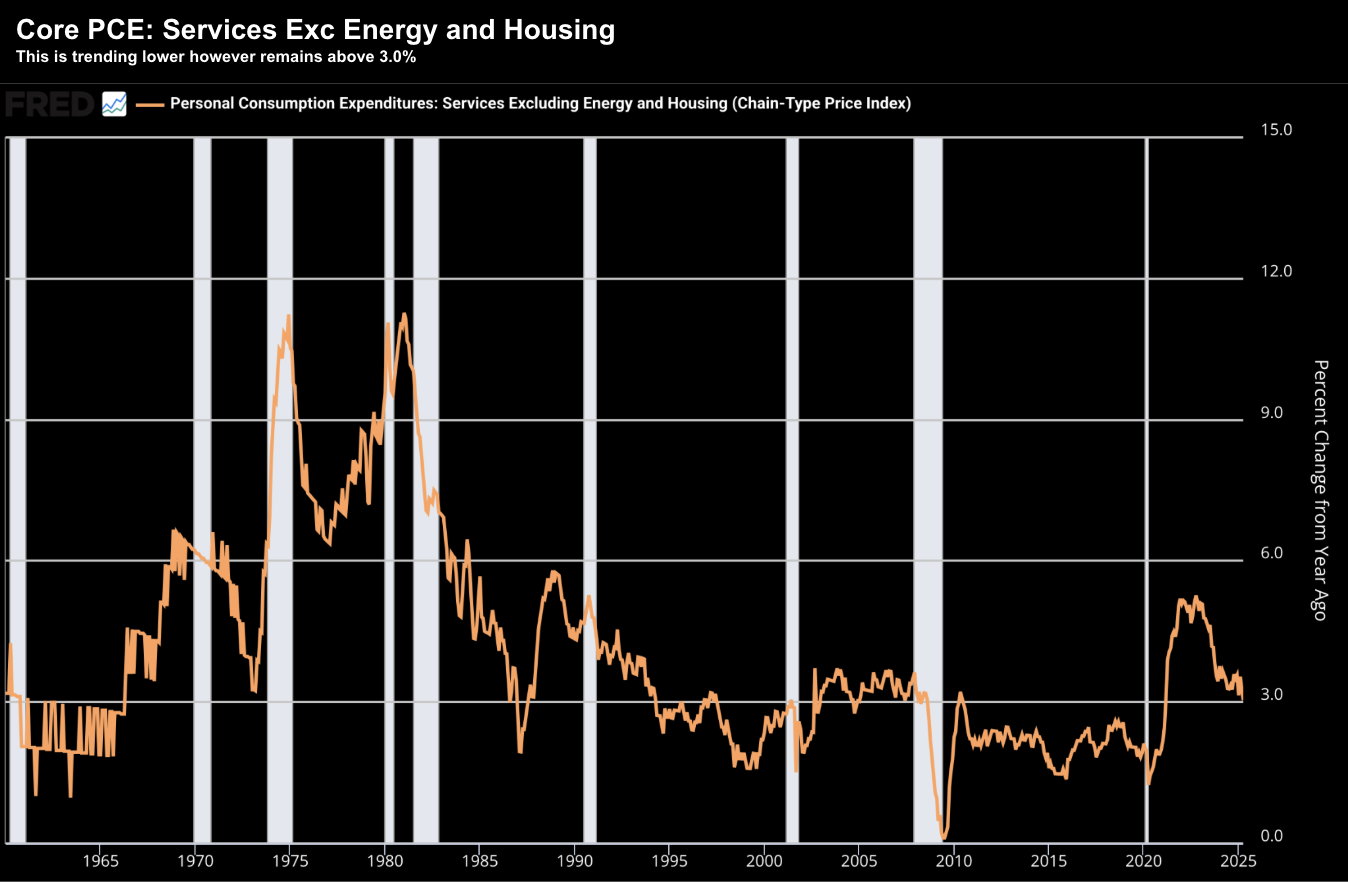

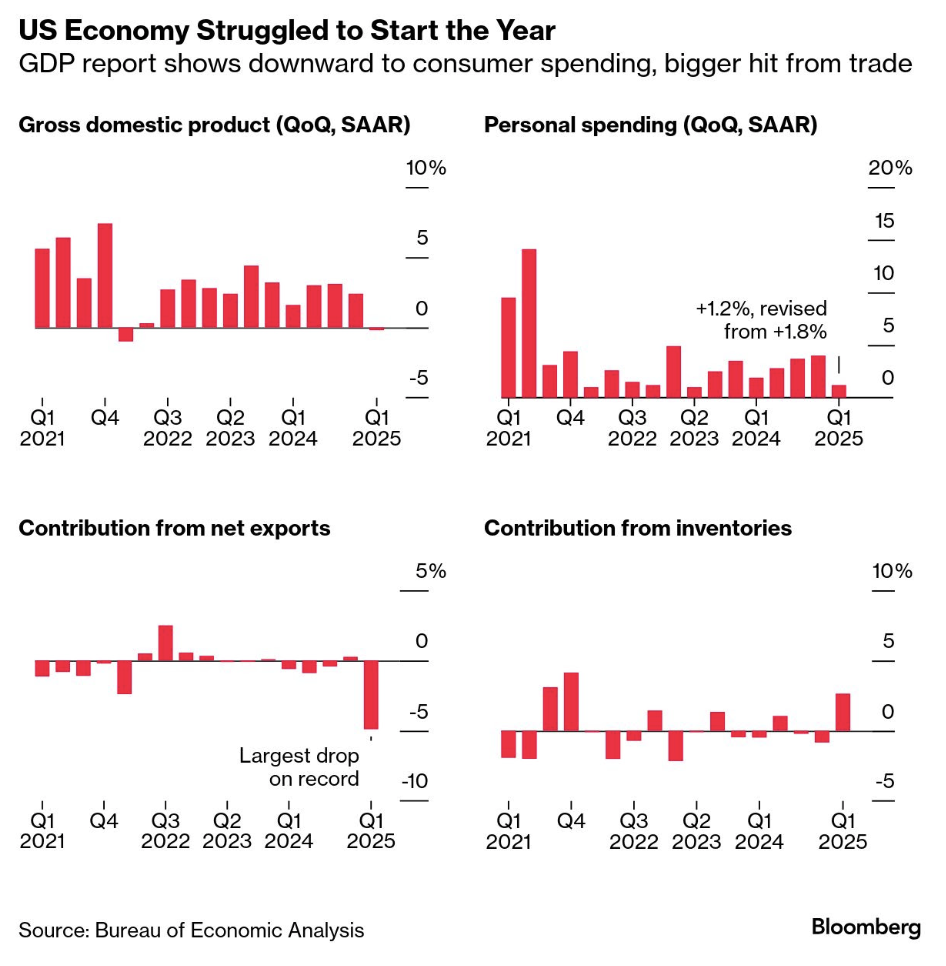

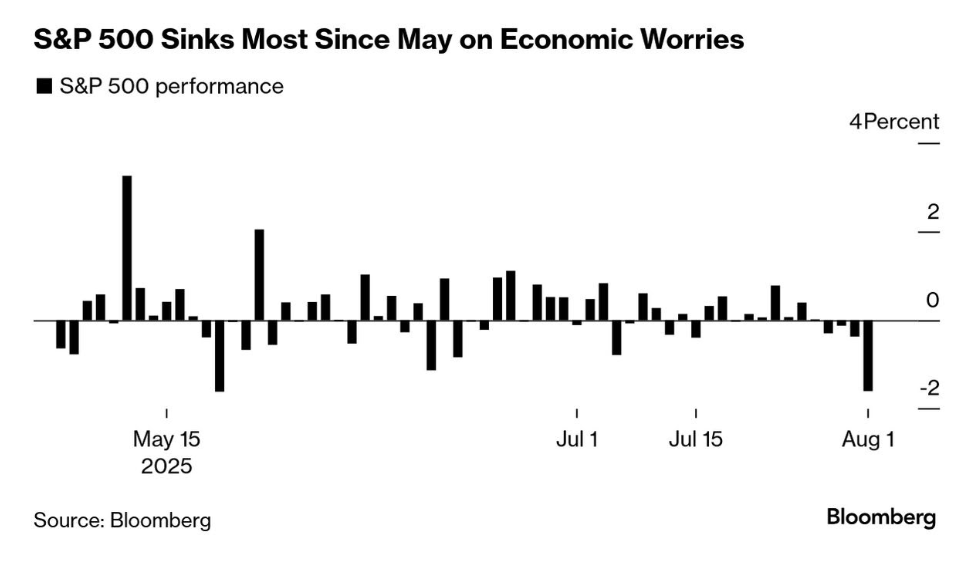

The labor market is clearly slowing. The "stag" in stagflation is here - what's less clear is the "flation" component. With respect to growth - we see slowing in housing, consumer spending and now job creation. The payrolls data was nothing shy of a disaster. And whilst the headlines will report on the dismal 73,000 jobs added (well below the ~140K job additions expected) - the massive 258,000 negative revisions over May and June is cause for concern.