A Bad Day for the Fed

A Bad Day for the Fed

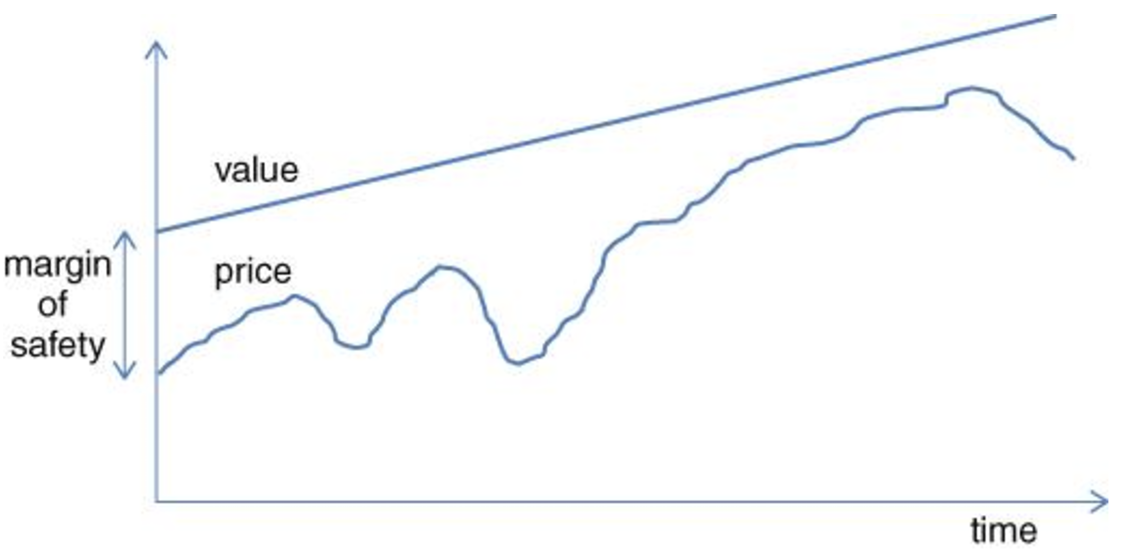

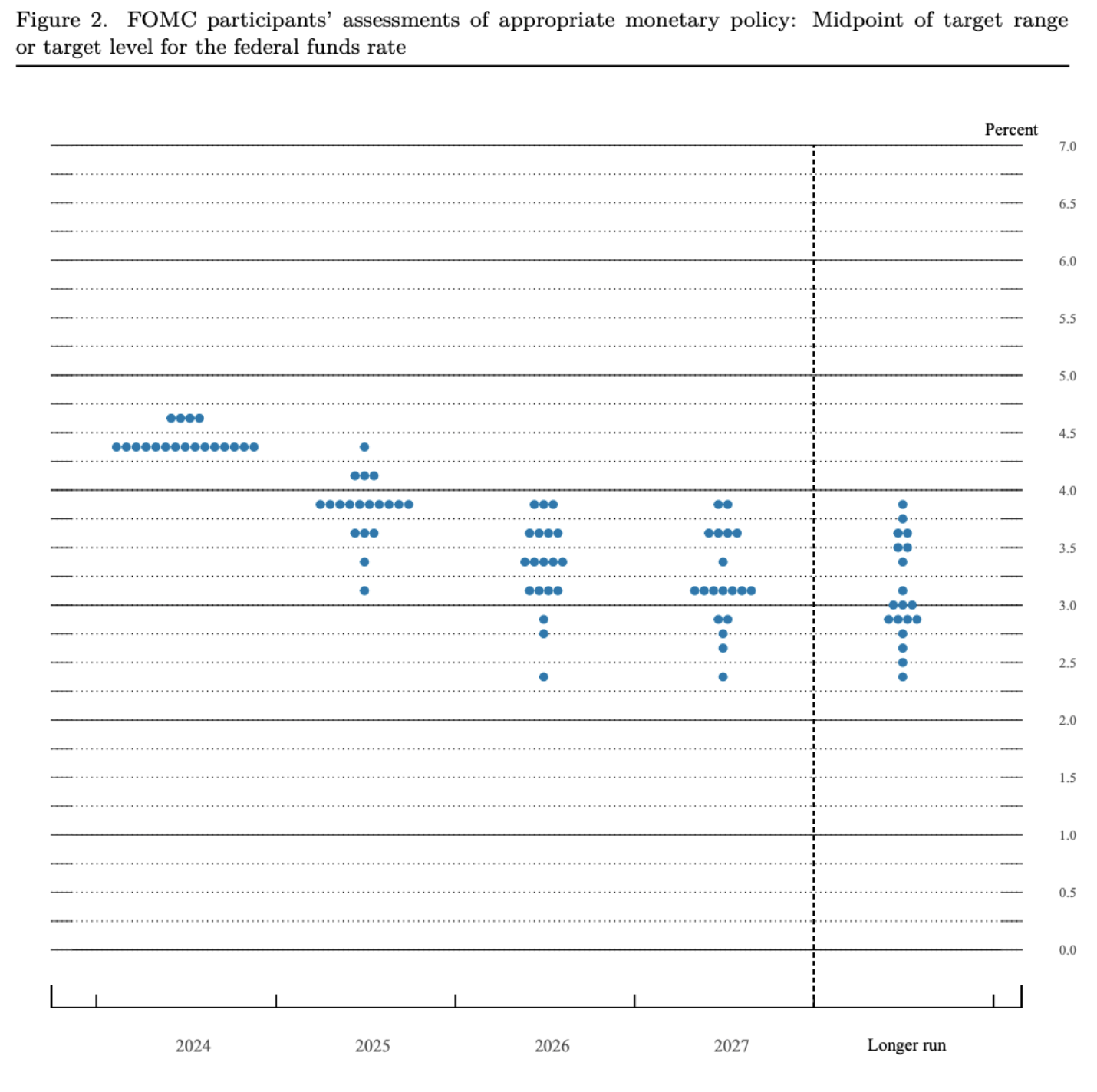

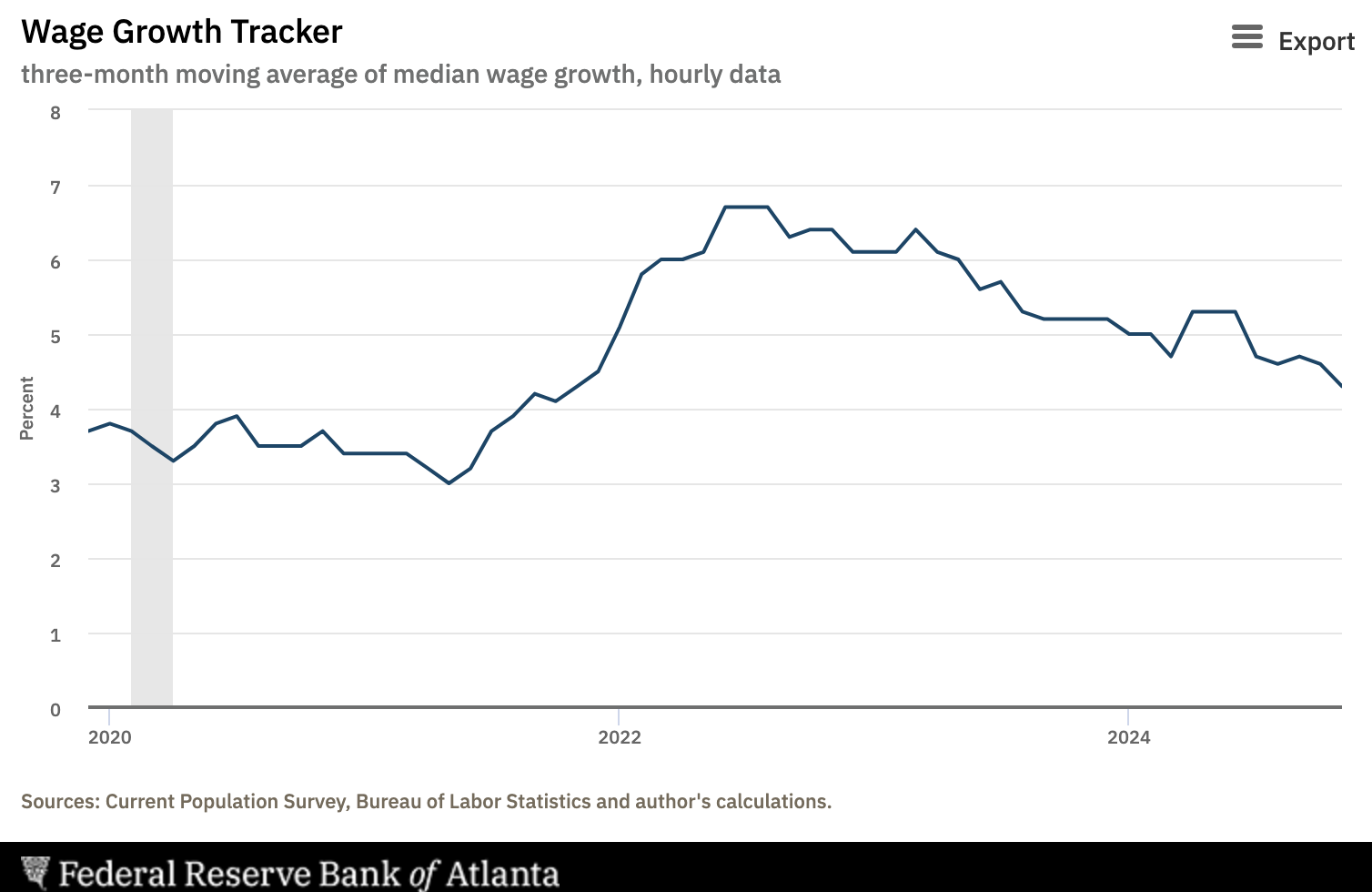

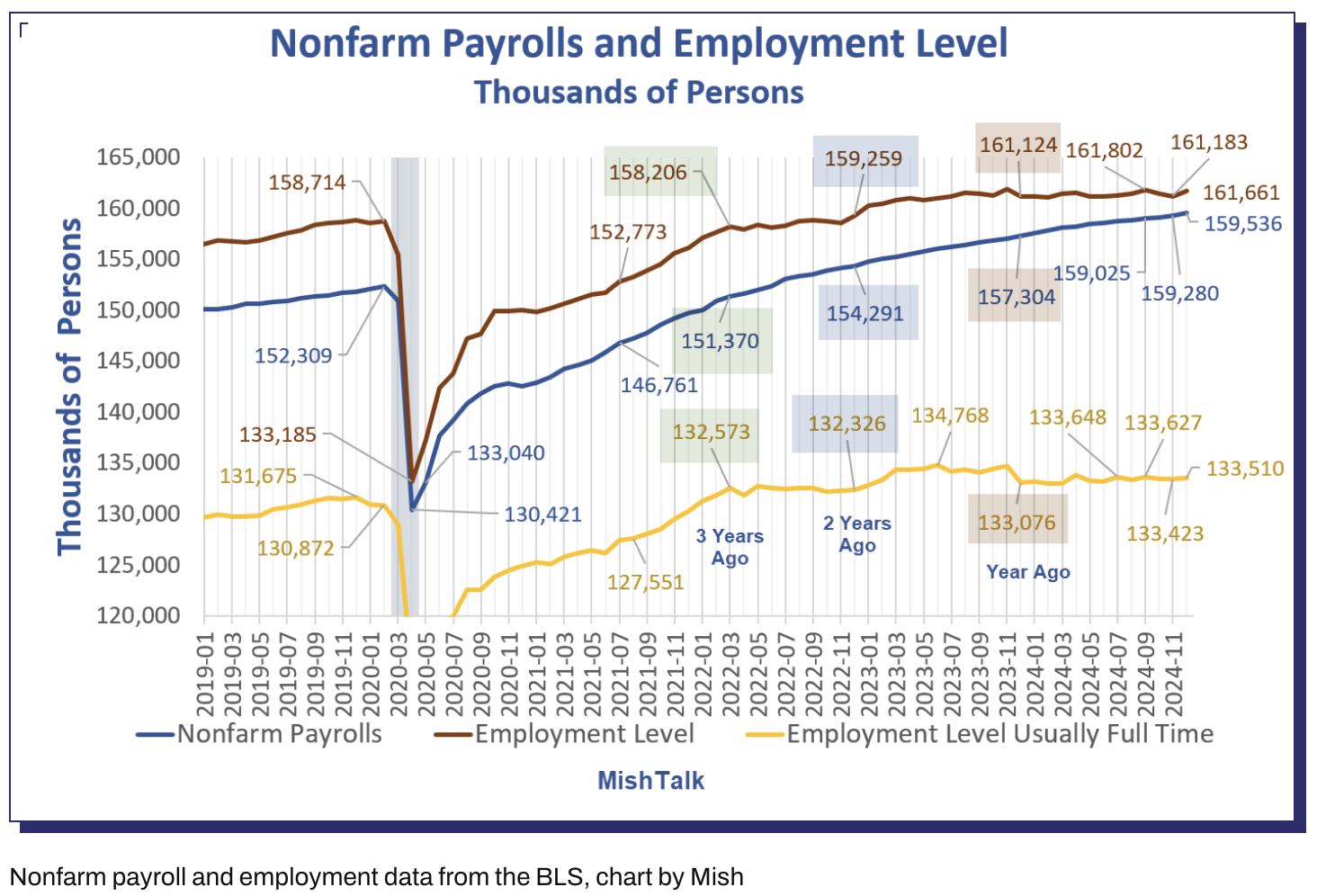

A few months ago Jay Powell claimed victory. Last Sept he said words to the effect of "the time has come to start easing rates". He initially cut rates by 50 points - followed by two more cuts of 25 basis points. Markets were thrilled at the thought of more cheap money - pricing in as many as 6 or 7 rate cuts over the next 12 months. However, at the time I asked why the need to cut? The data simply didn't support it. Jobs were fine. The economy was growing. Inflation was not yet at its desired level. Why cut? However, whilst the Fed was busy running a victory lap - the bond market was less convinced. The US 10-year yield went the other direction -- and appears likely to retest 5.0% in the next few months. What does this do to valuations?