Why Core Inflation Will Remain Sticky

Why Core Inflation Will Remain Sticky

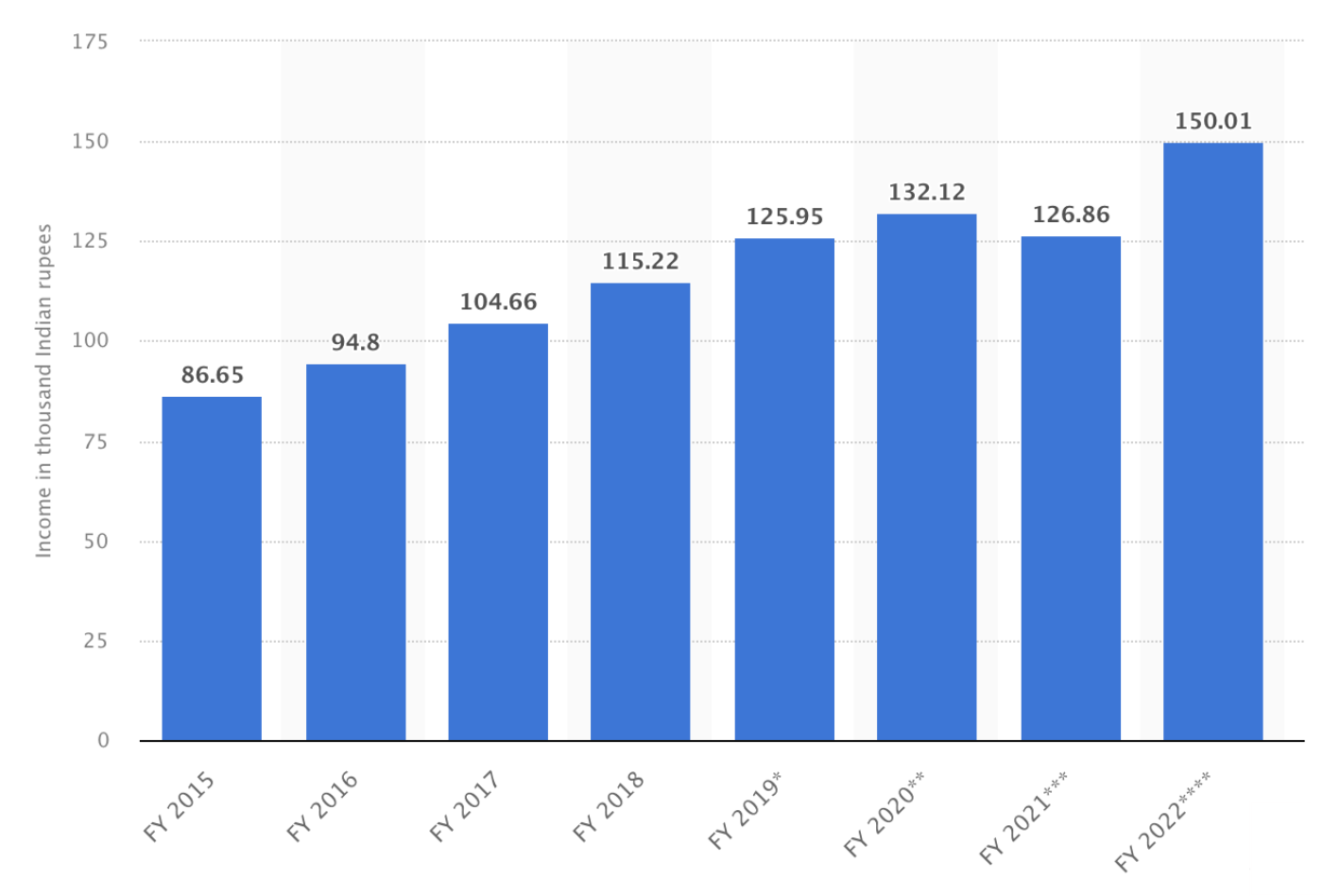

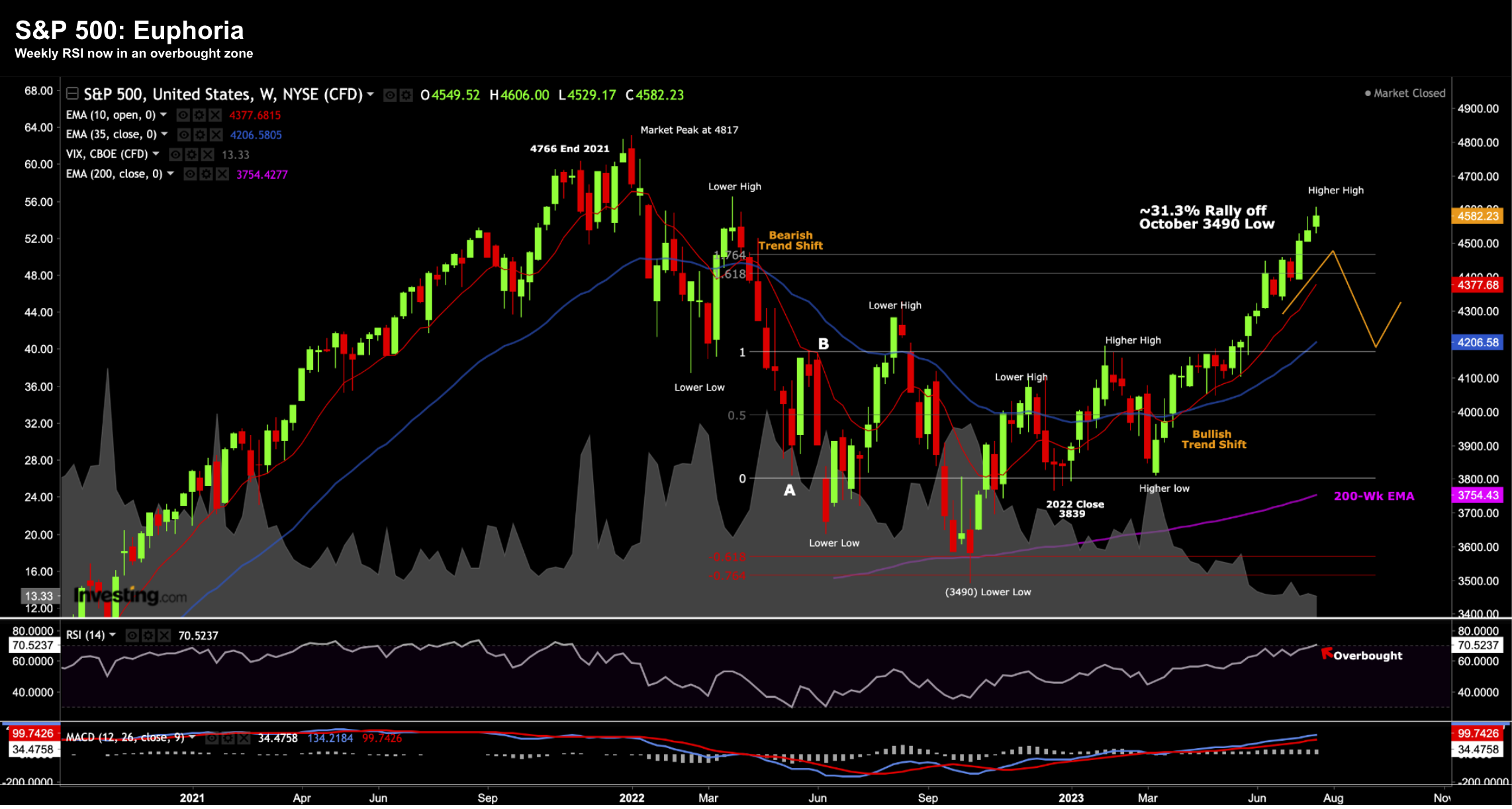

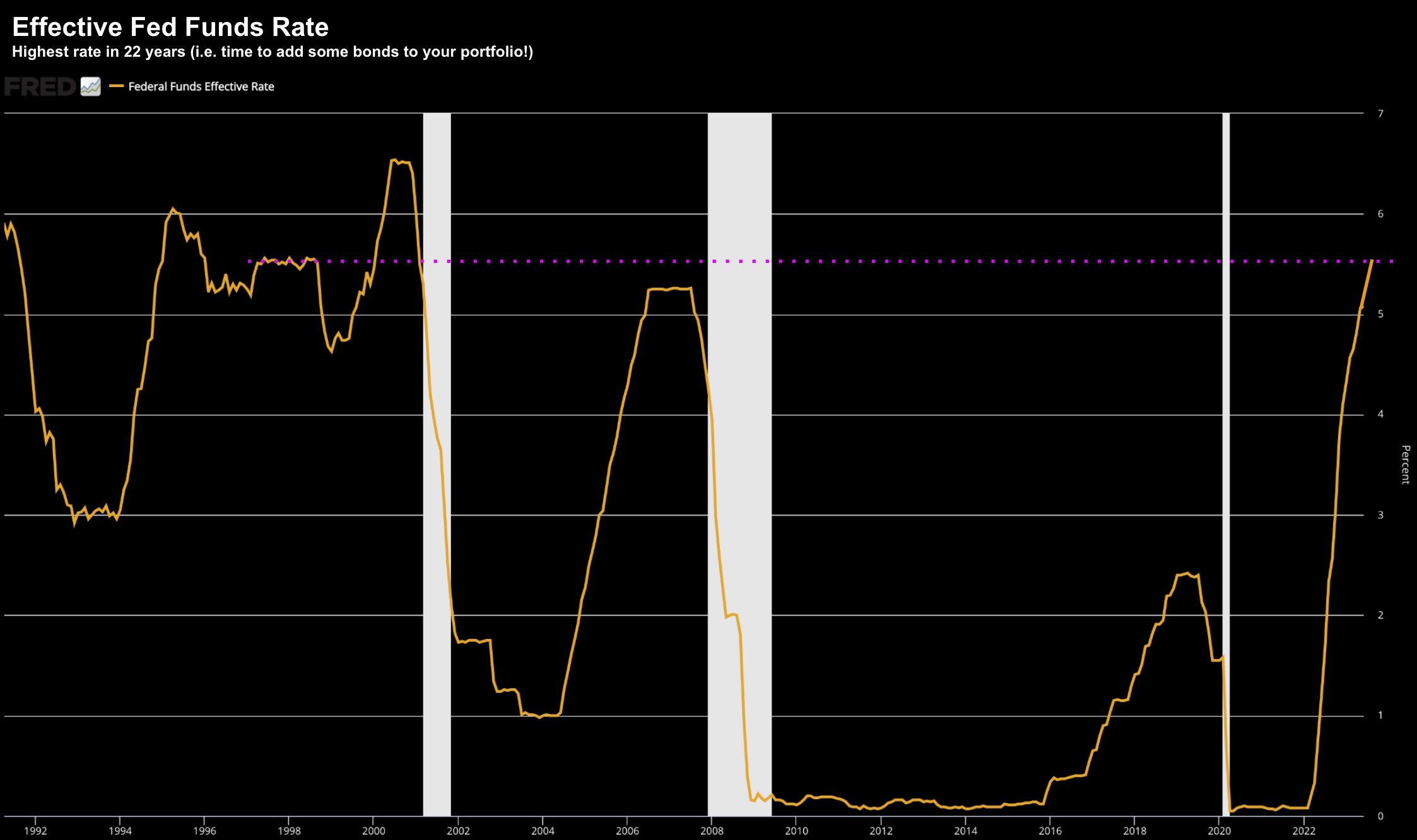

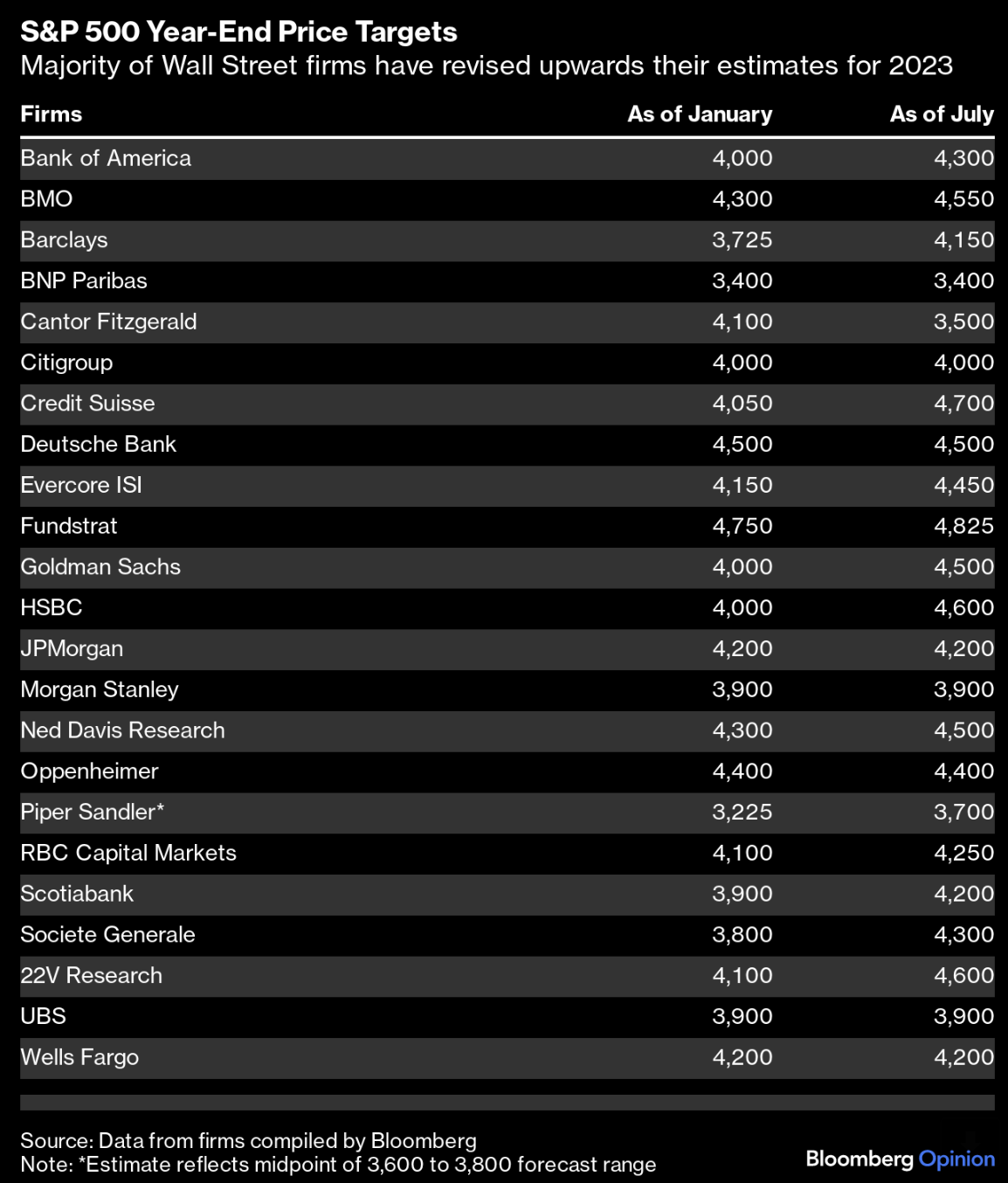

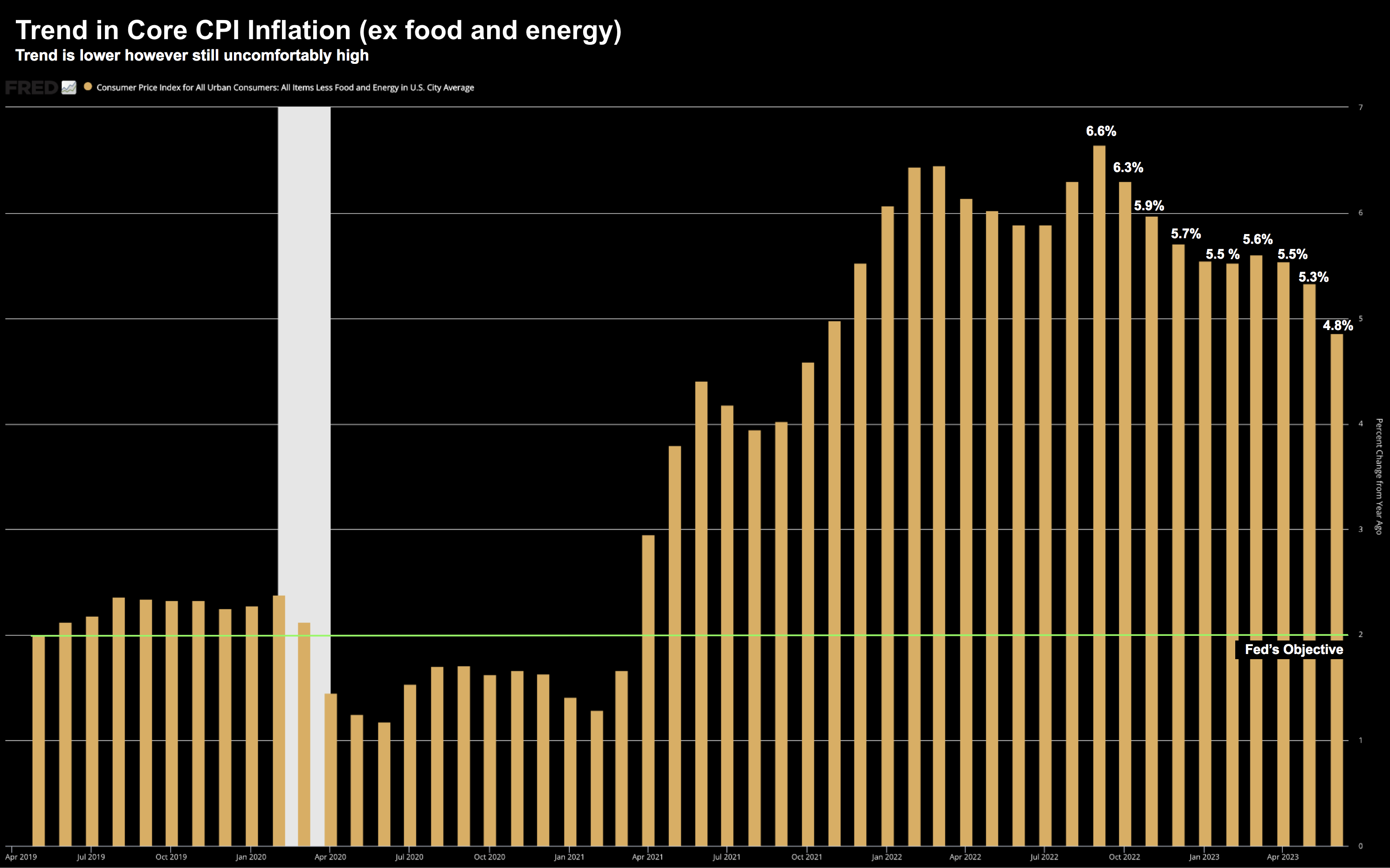

Markets got excited on news of the softer-than-expected CPI headline print today. Headline inflation came in at 3.2% YoY vs expectations of 3.3%. However, what deserves closer scrutiny is not the headline number - it's Core CPI at 4.7% YoY and shelter costs. For e.g., two-thirds of the monthly inflation increase came from shelter - where rents rose 0.4% MoM. This is now the 18th straight month the price of shelter has risen at least 0.4% MoM. But here's the thing - there isn't. much the Fed can do with monetary policy to change this.