Some Things Just Take Time

Some Things Just Take Time

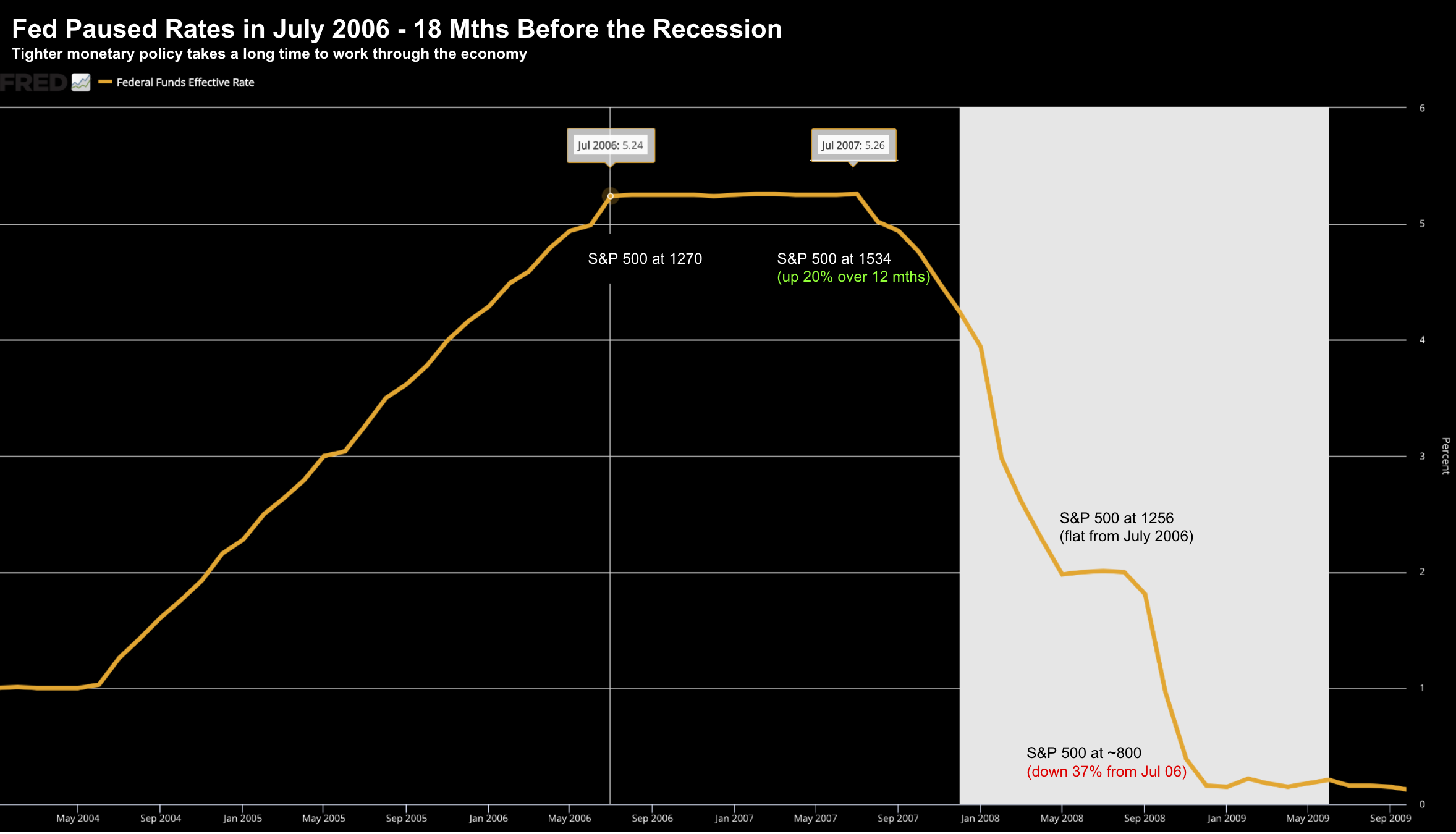

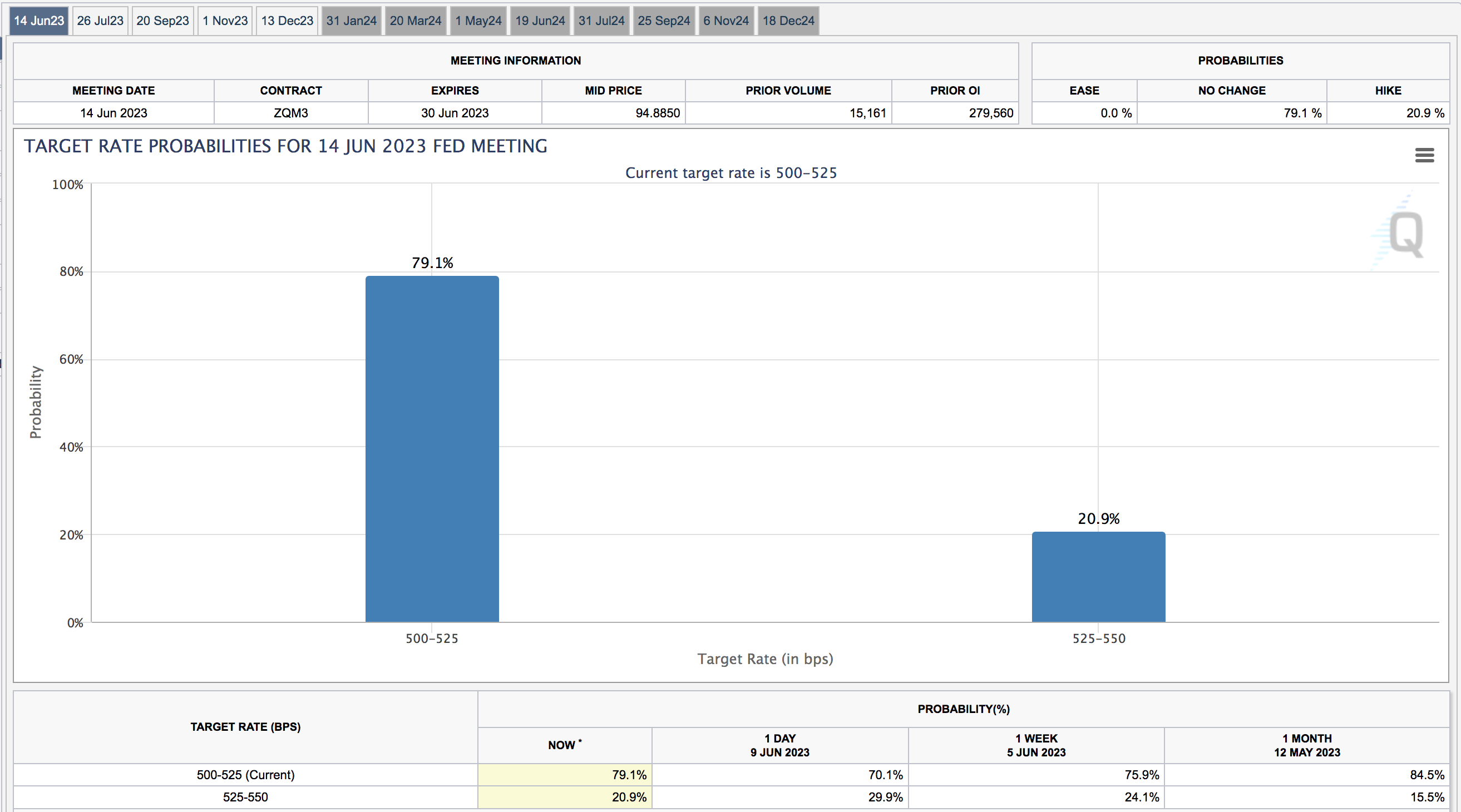

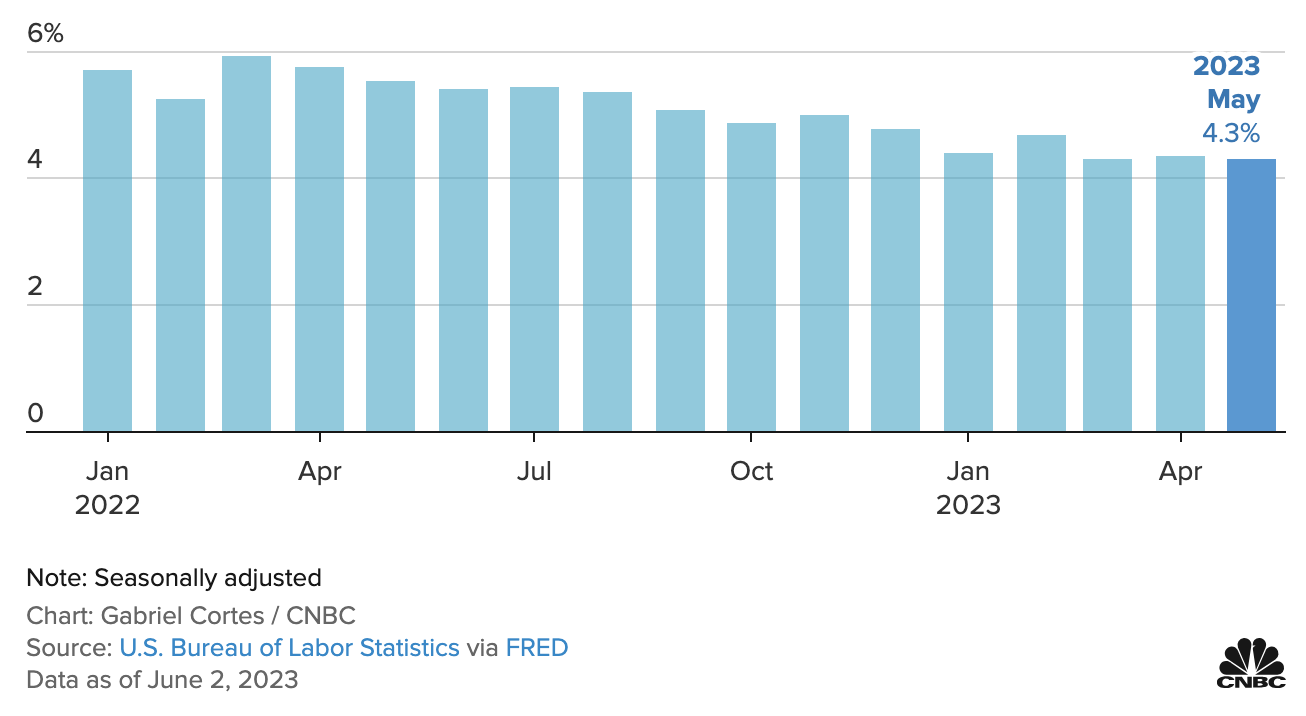

This week we received the latest monthly payrolls data. US employers added 209K jobs - a little lower than expected. However, the job market appears robust. One metric that deserves closer inspection are weekly hours worked. That is trending lower and could be a precursor to what's ahead. From my perspective, what we're seeing is the "Fed lag" effect of higher rates slowly tighten its vice. But these things take time and we may not see the full effects on the labor market for another 6-12 months (at a guess).