Idiosyncratic or Systemic?

Idiosyncratic or Systemic?

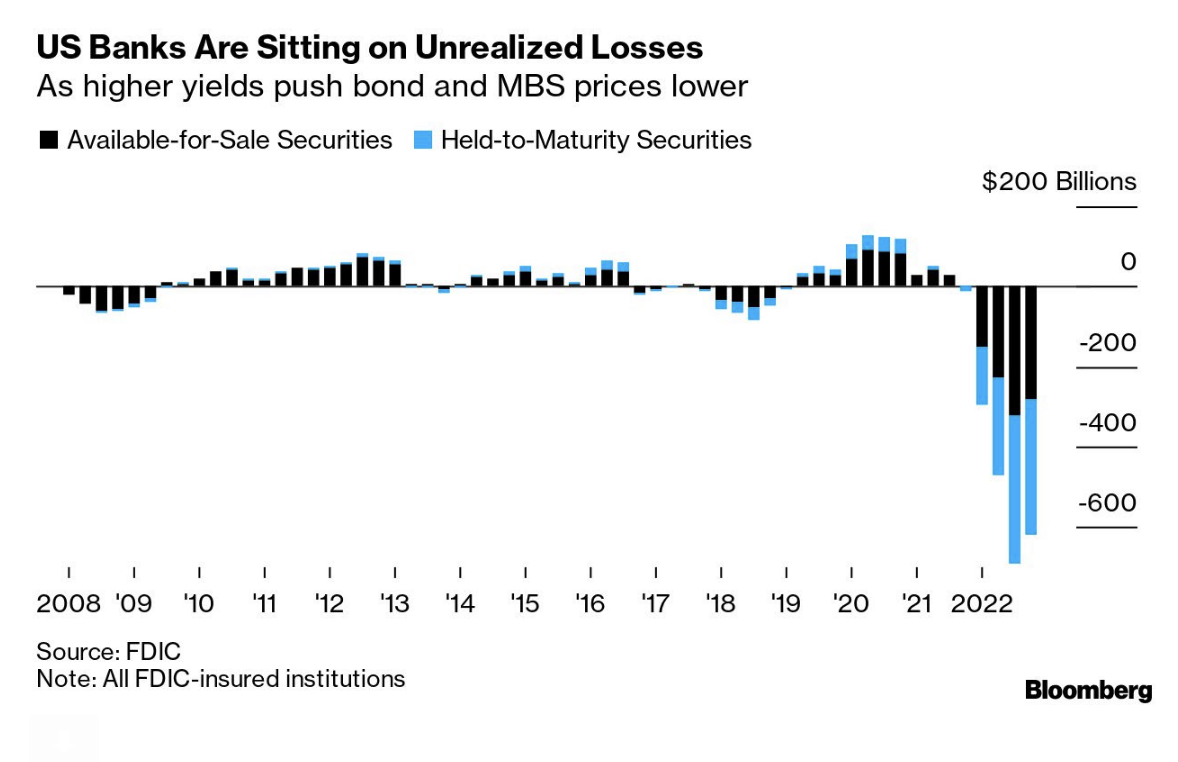

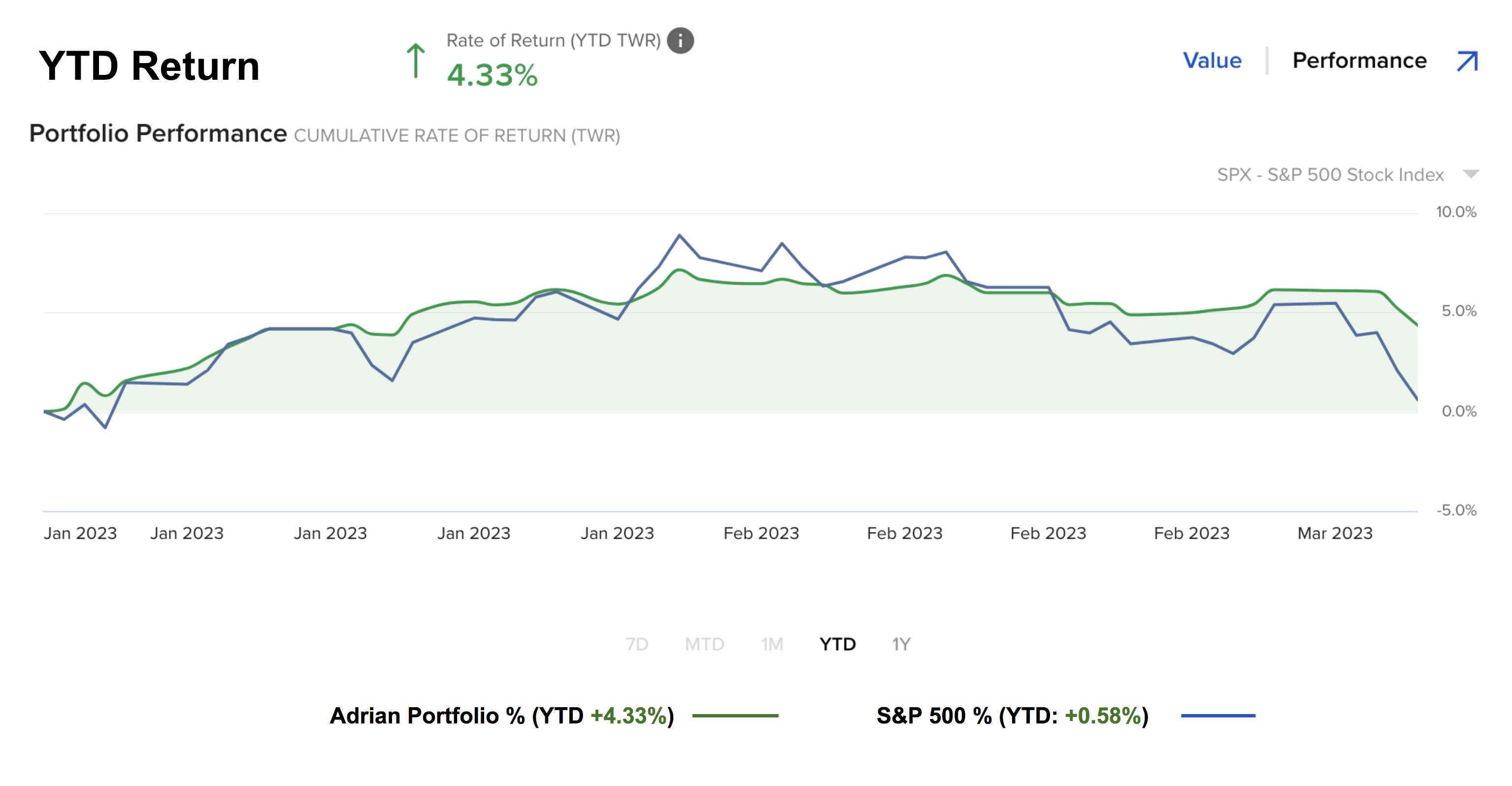

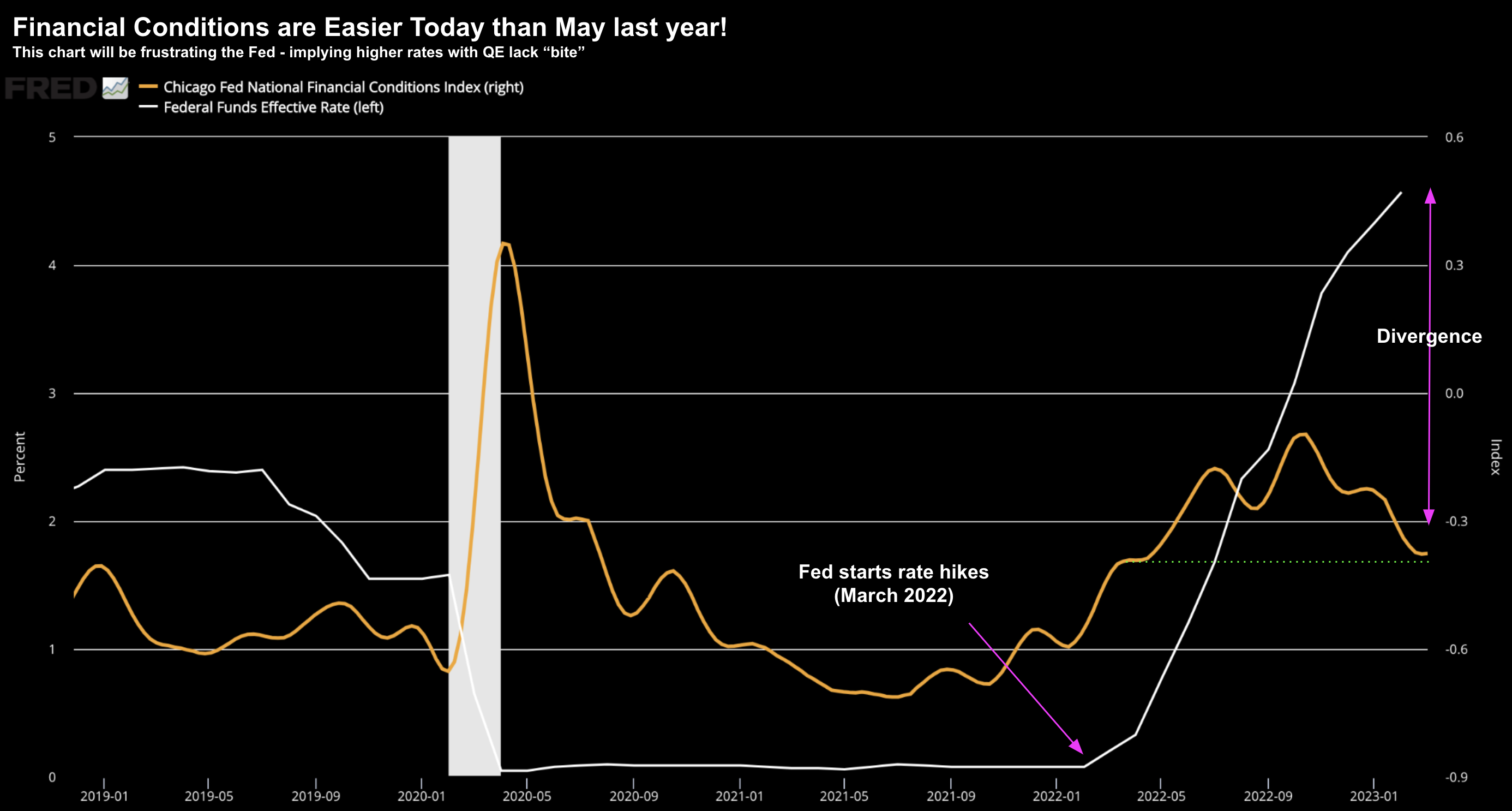

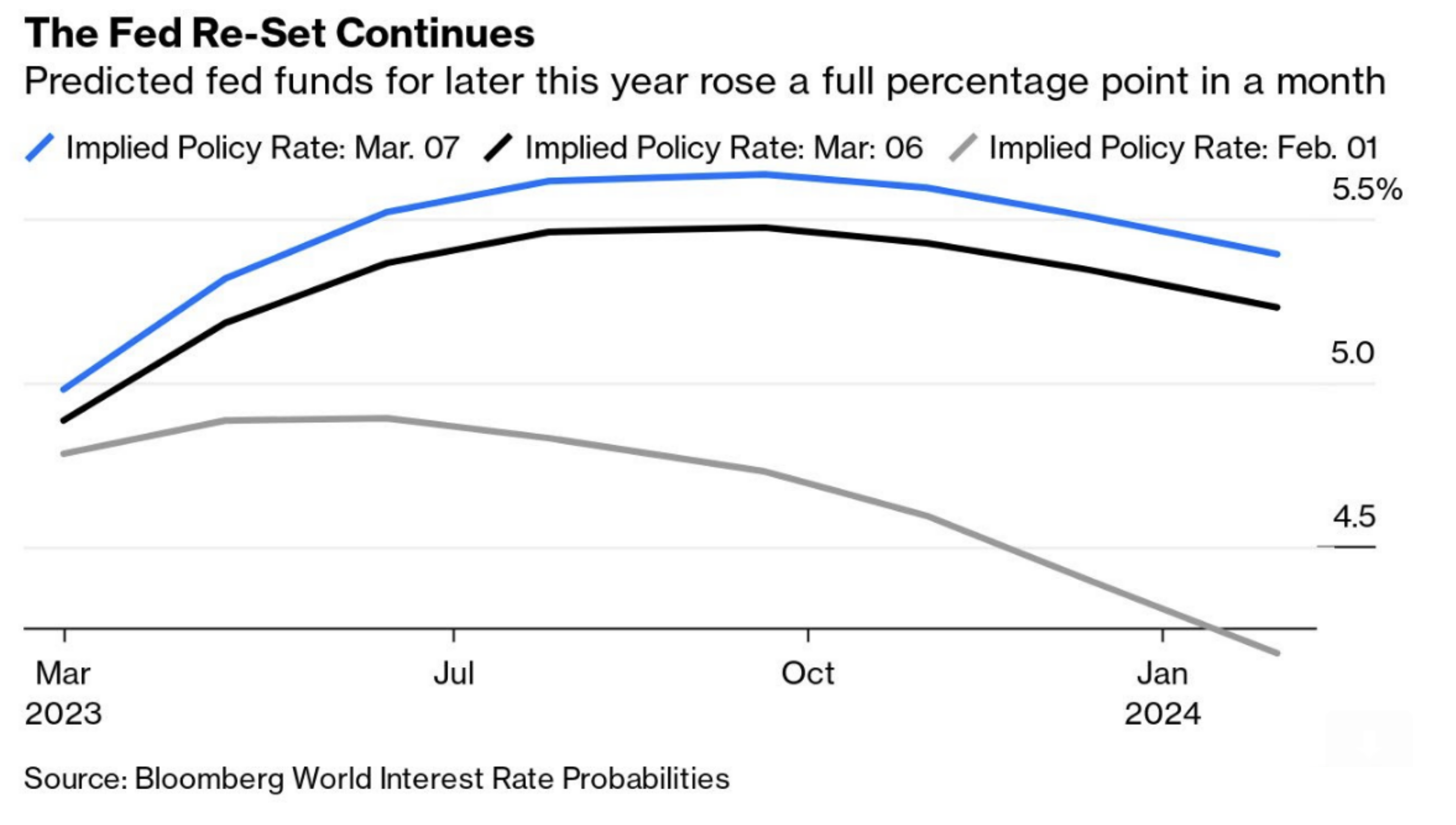

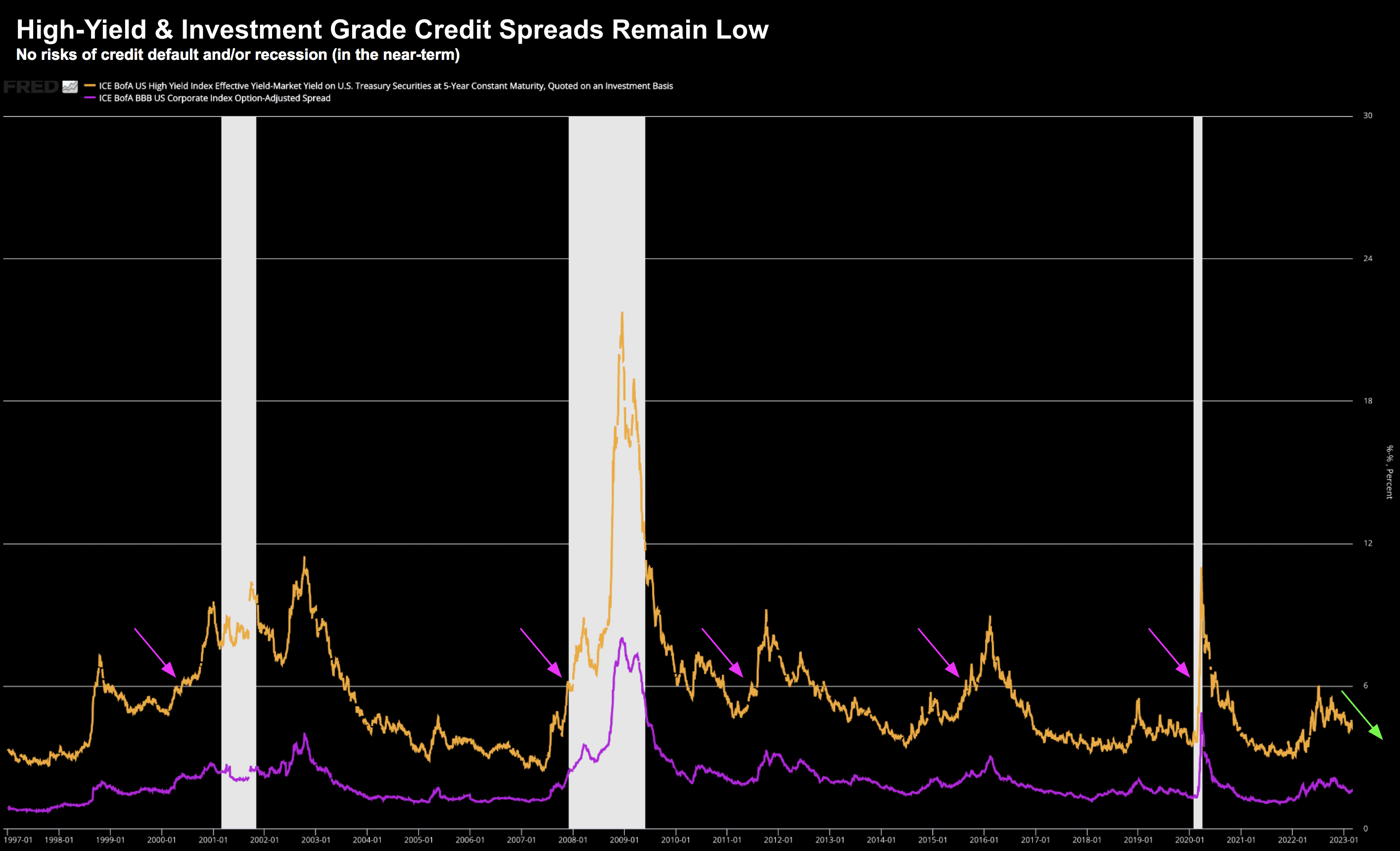

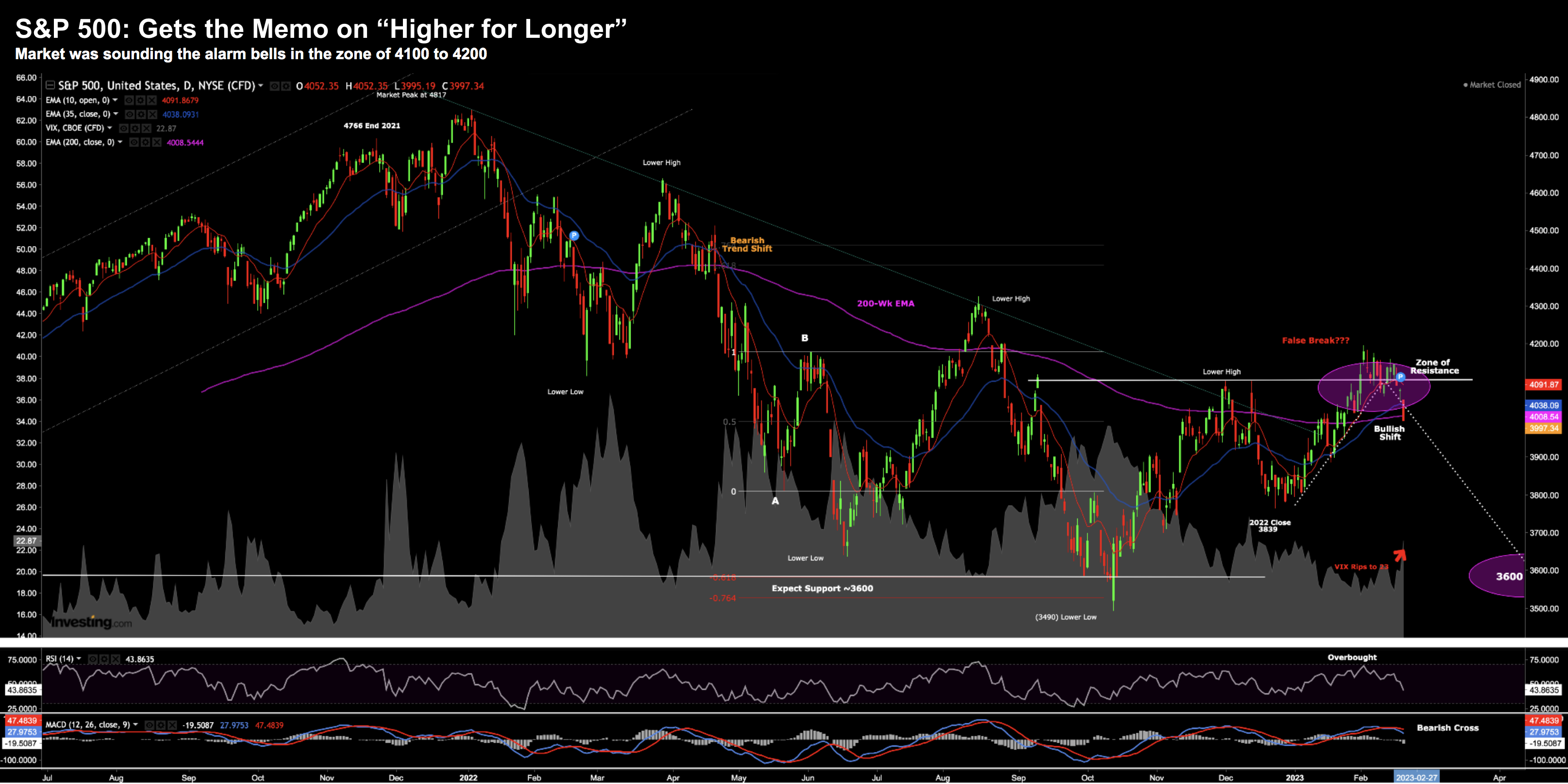

Do you believe the current banking 'crisis' is idiosyncratic or systemic? The short answer is it's still far too early to know. Hopefully it's more of the former and less the latter. Because if it's the latter, that's a problem. Last week's issues will become multiplicative (vs additive). 2008 was a global systemic banking crisis.... this is not 2008. At least not yet...