Bonds Realign with the Fed… Not Equities

Bonds Realign with the Fed… Not Equities

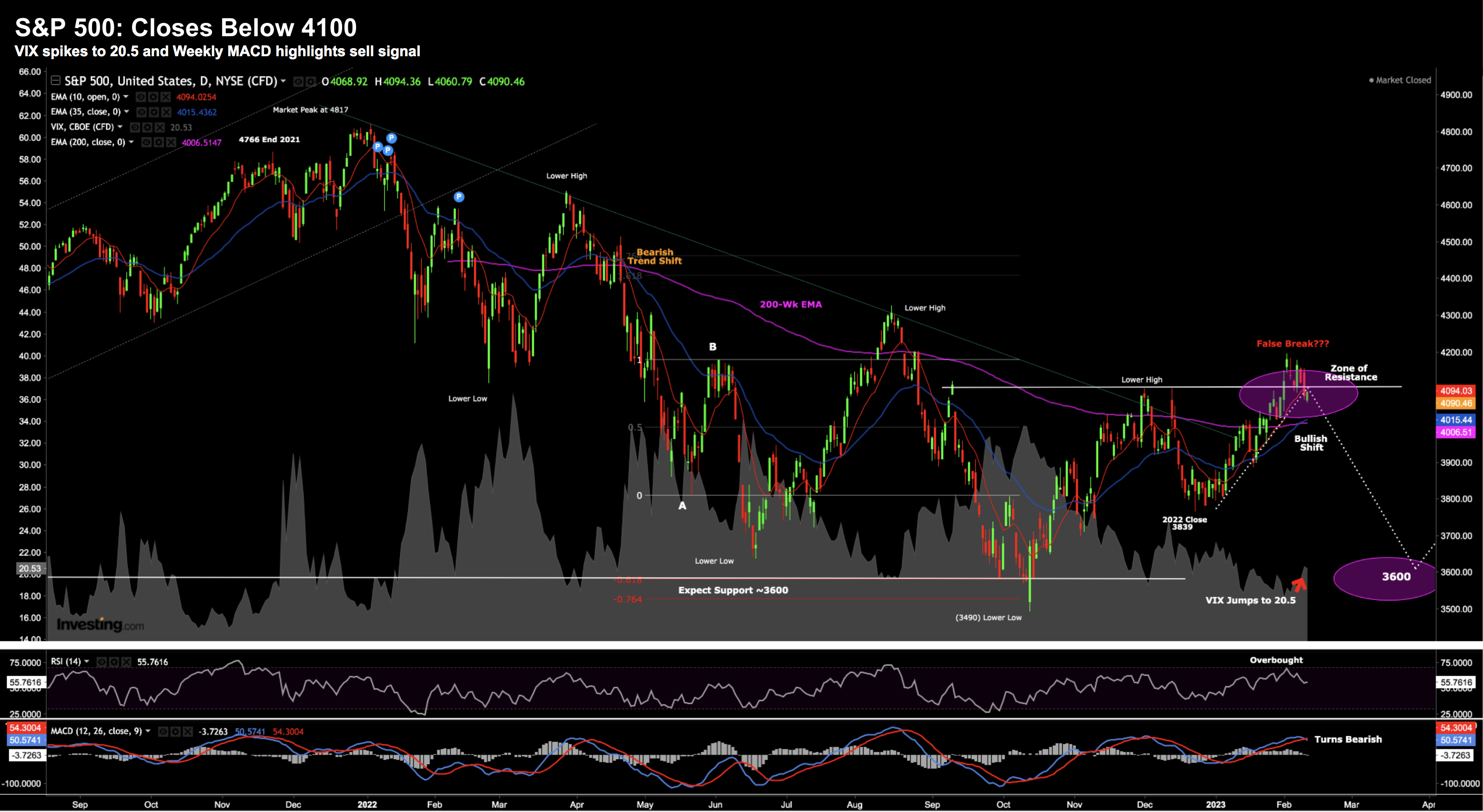

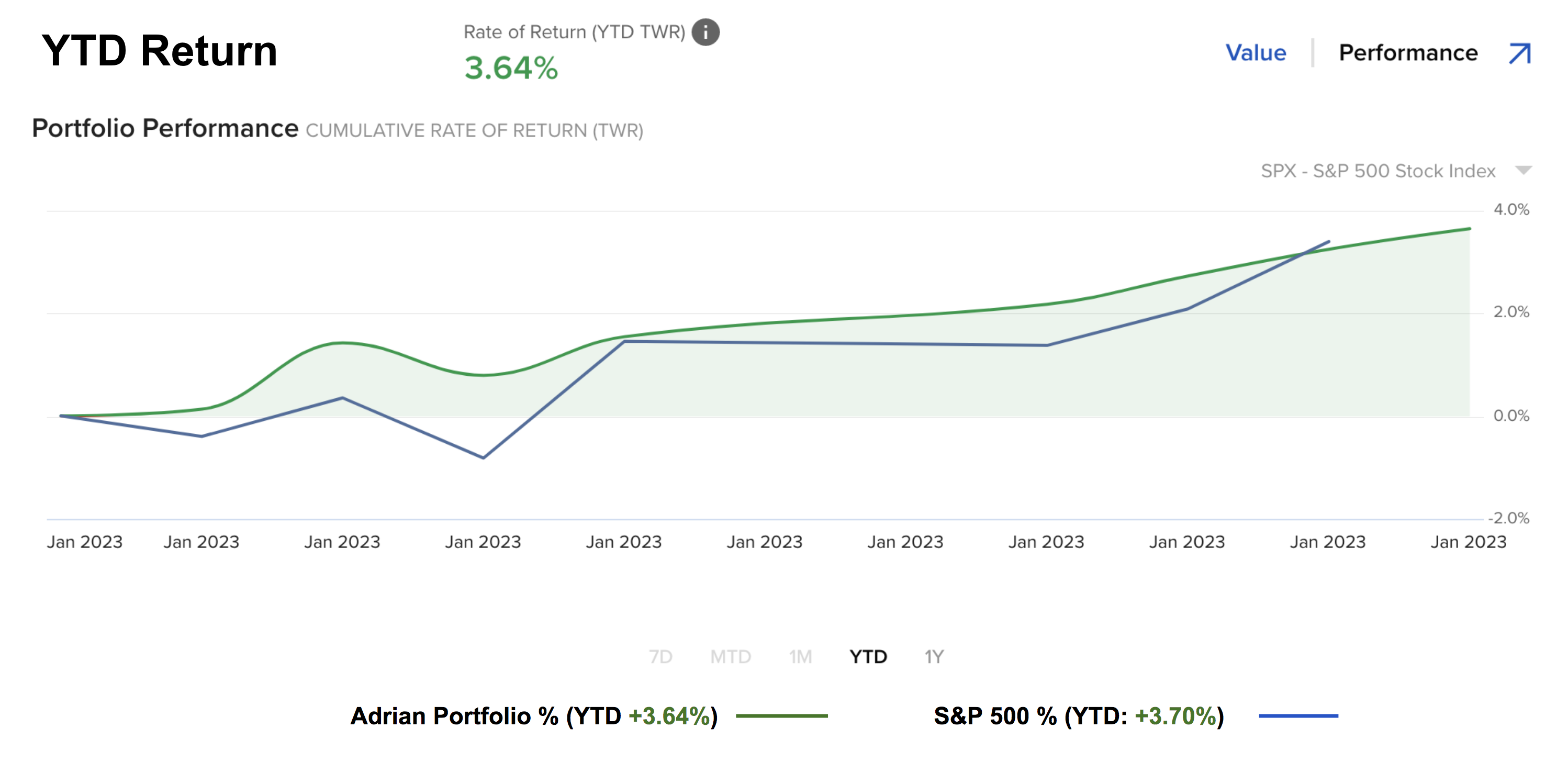

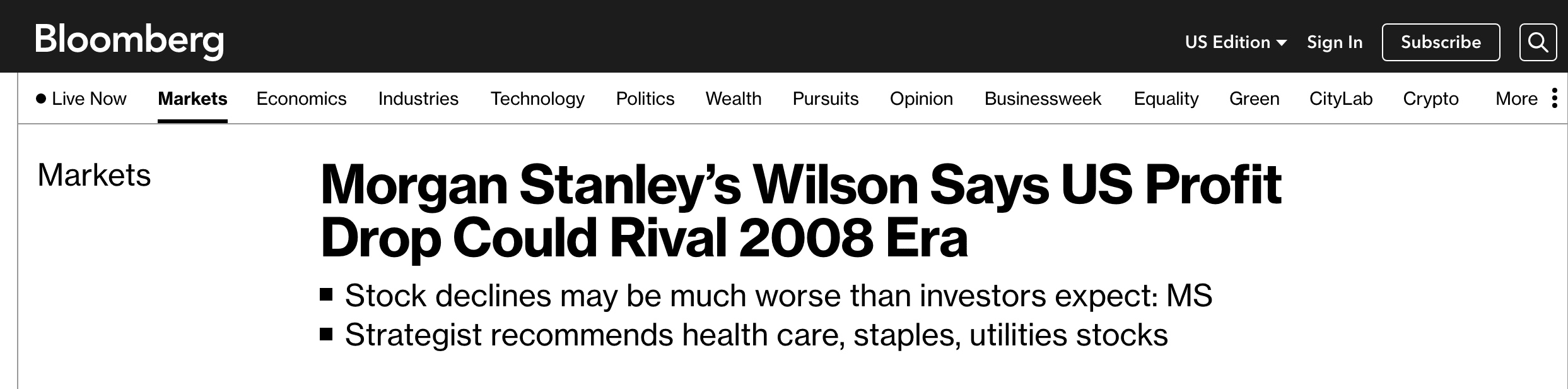

From the first week of 2023 - bond markets were at odds with the Fed. For example, yields on the 2-year treasury plunged from 4.50% to barely above 4.0% over the past 6 weeks. And yet - the Fed were resolute in their resolve to keep raising rates. Something was amiss. Turns out that bond markets have pivoted and now see 'eye-to-eye' with the Fed that rates are staying higher for longer. Go figure. However, equities are yet to get the memo.... that's risky.