Remain Vigilant When Adding Risk

Remain Vigilant When Adding Risk

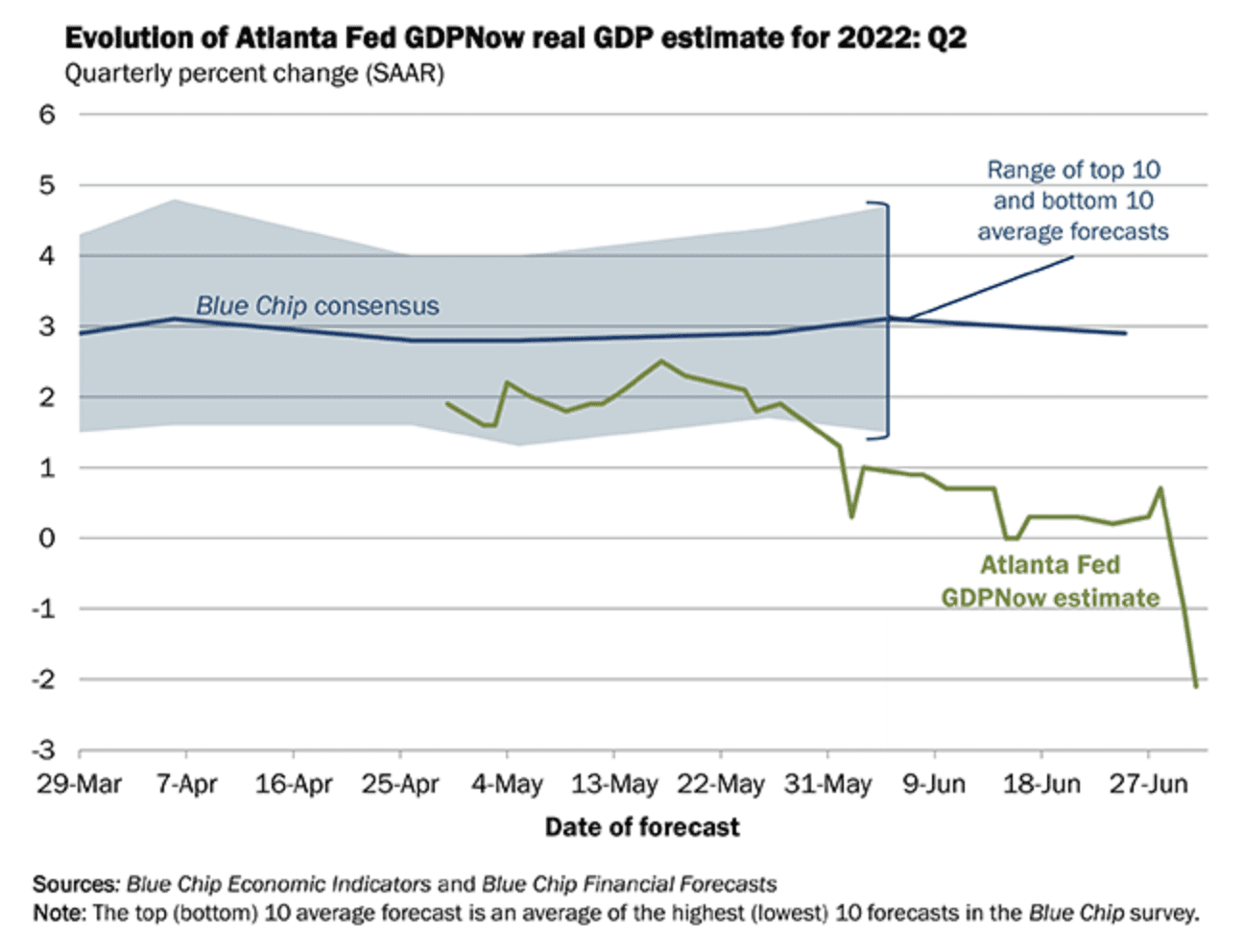

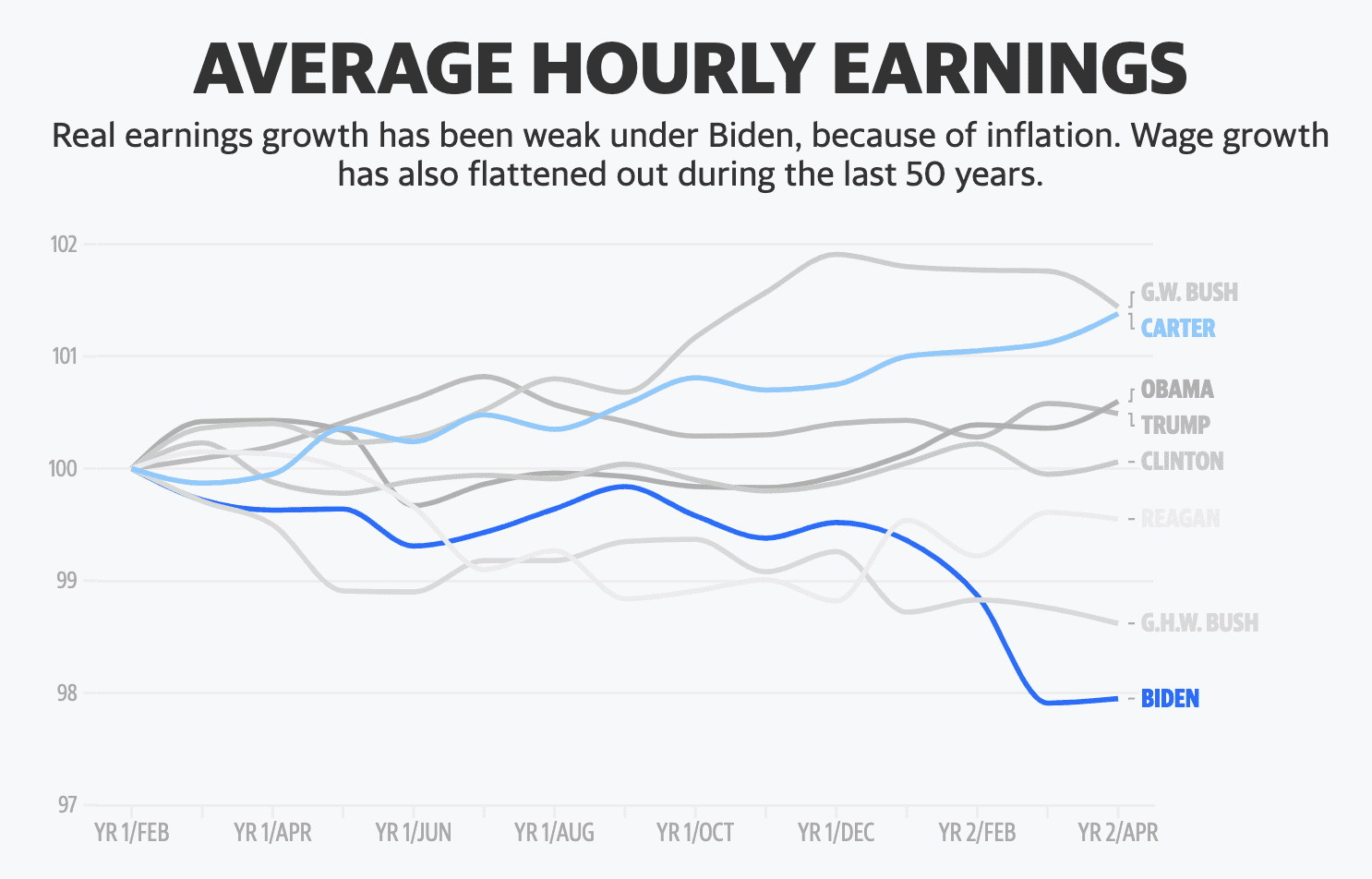

Over the next few weeks we will hear how US companies navigated a difficult Q2. More importantly, we will also receive guidance looking forward. This will lead to analysts lowering their earnings targets... something the stock market is yet to price in.