Market Still has Work to Do

Market Still has Work to Do

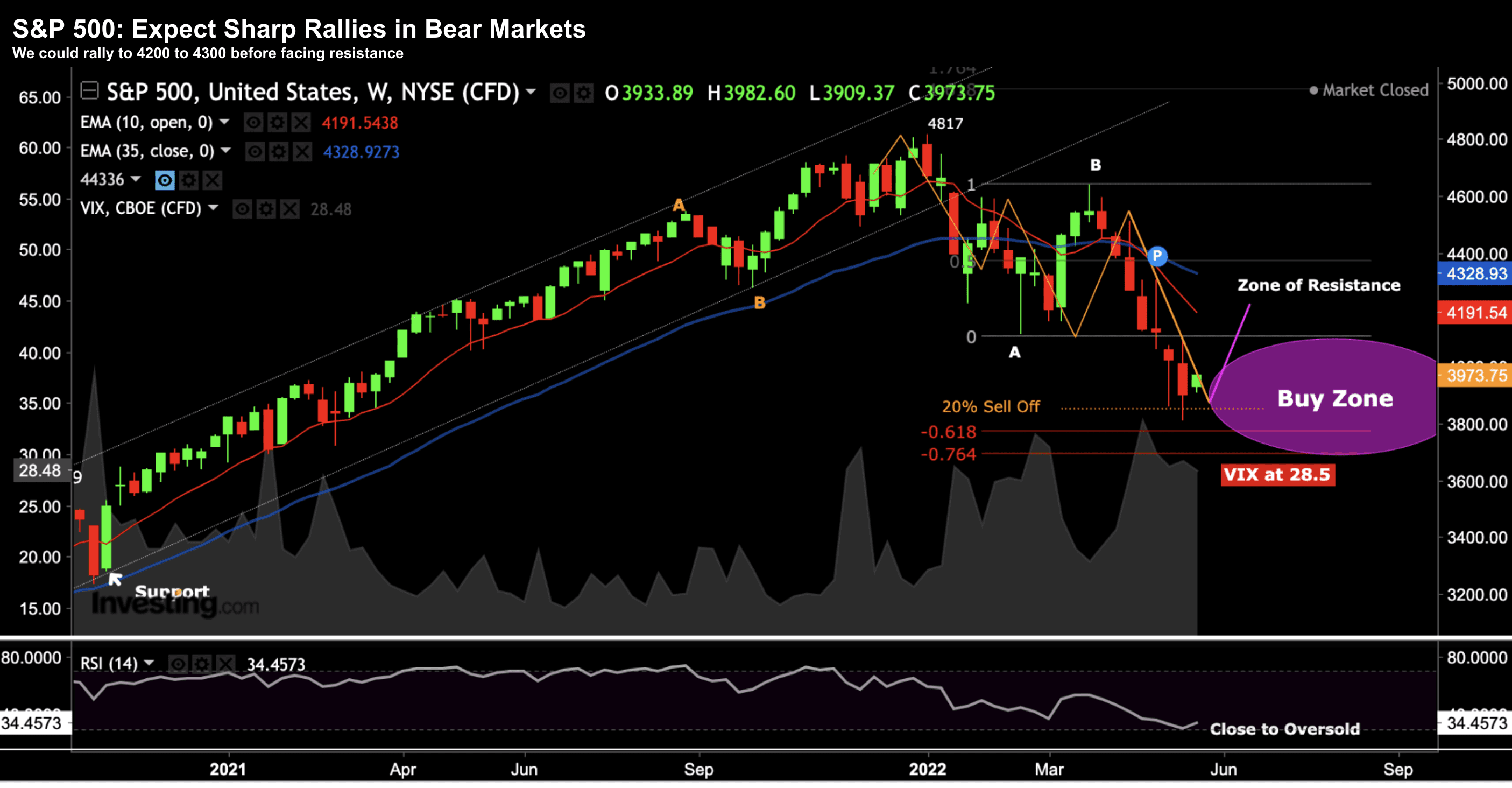

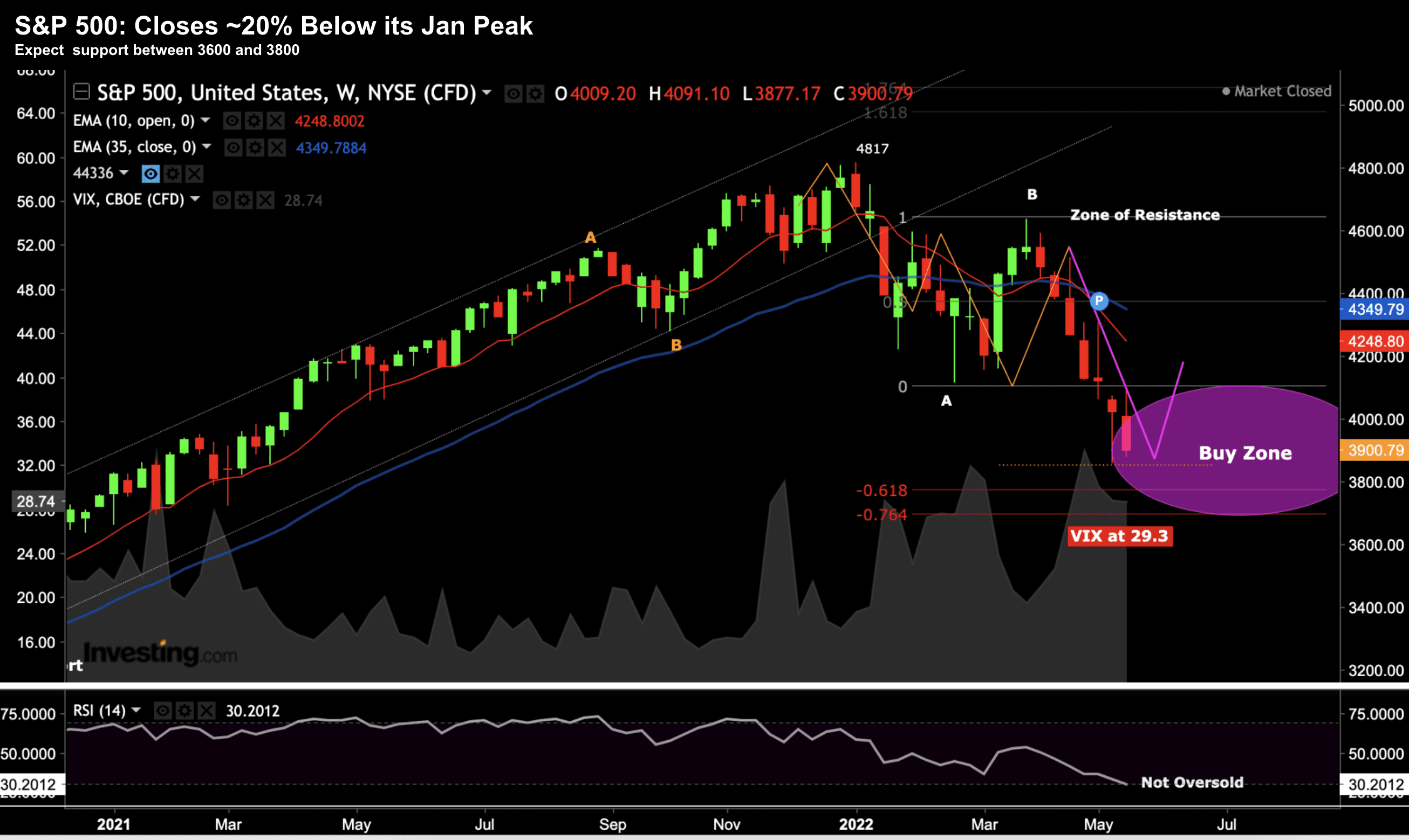

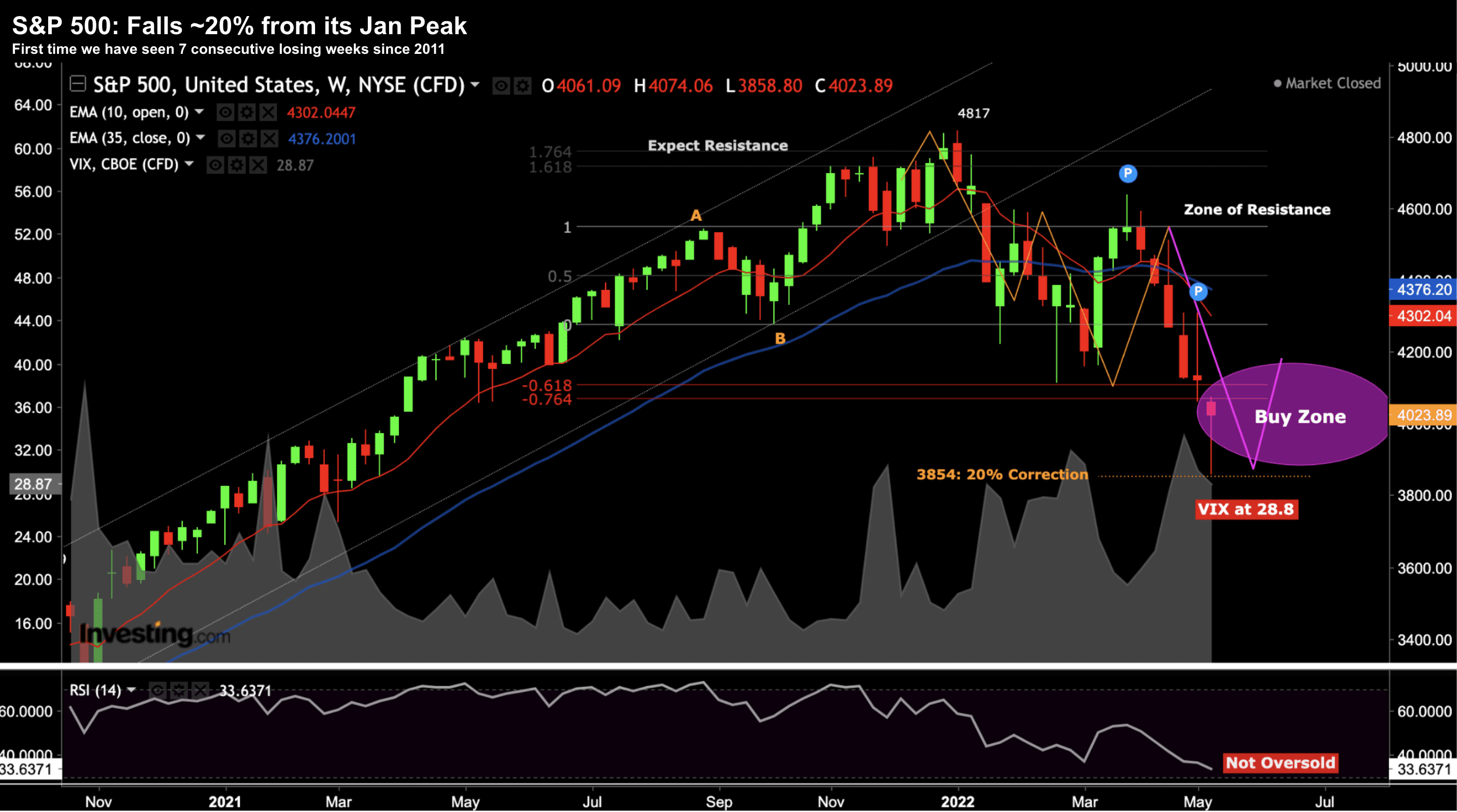

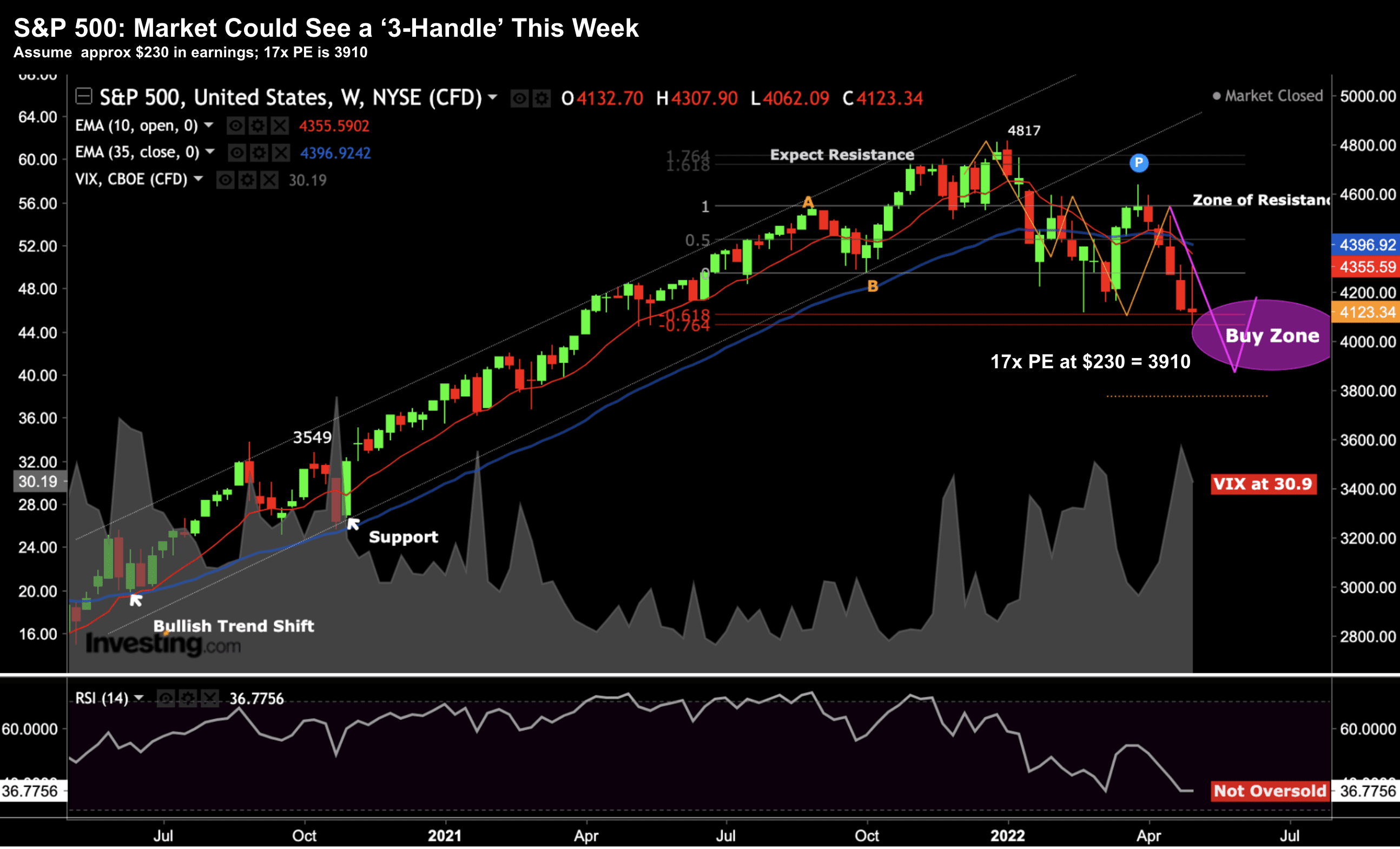

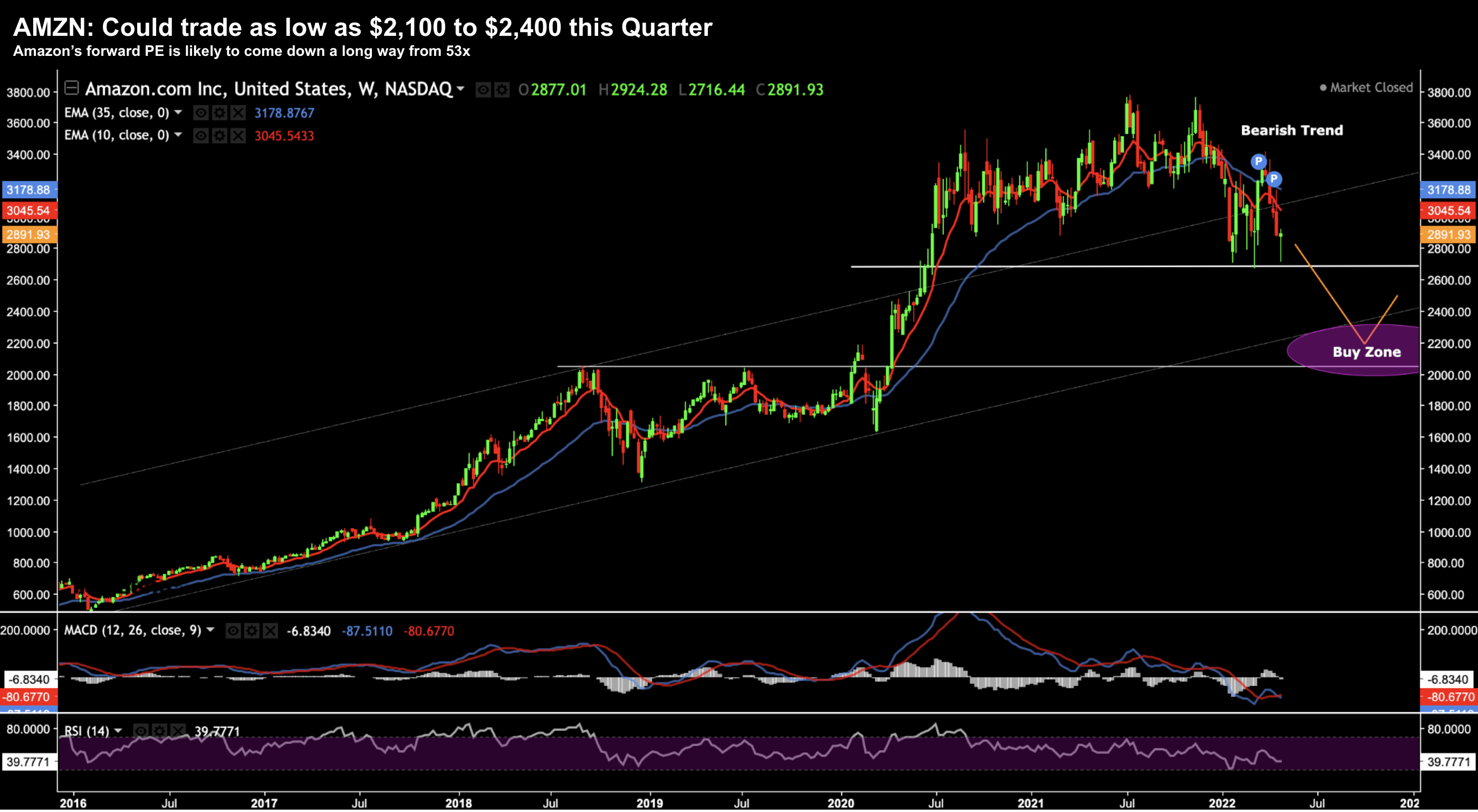

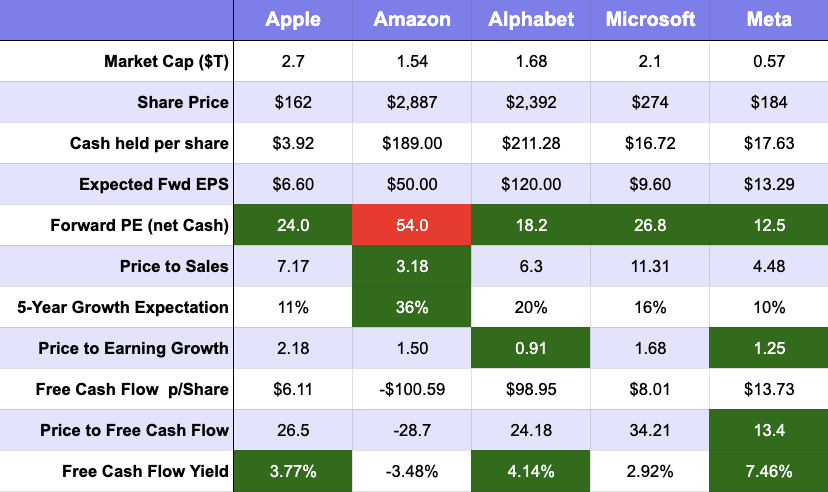

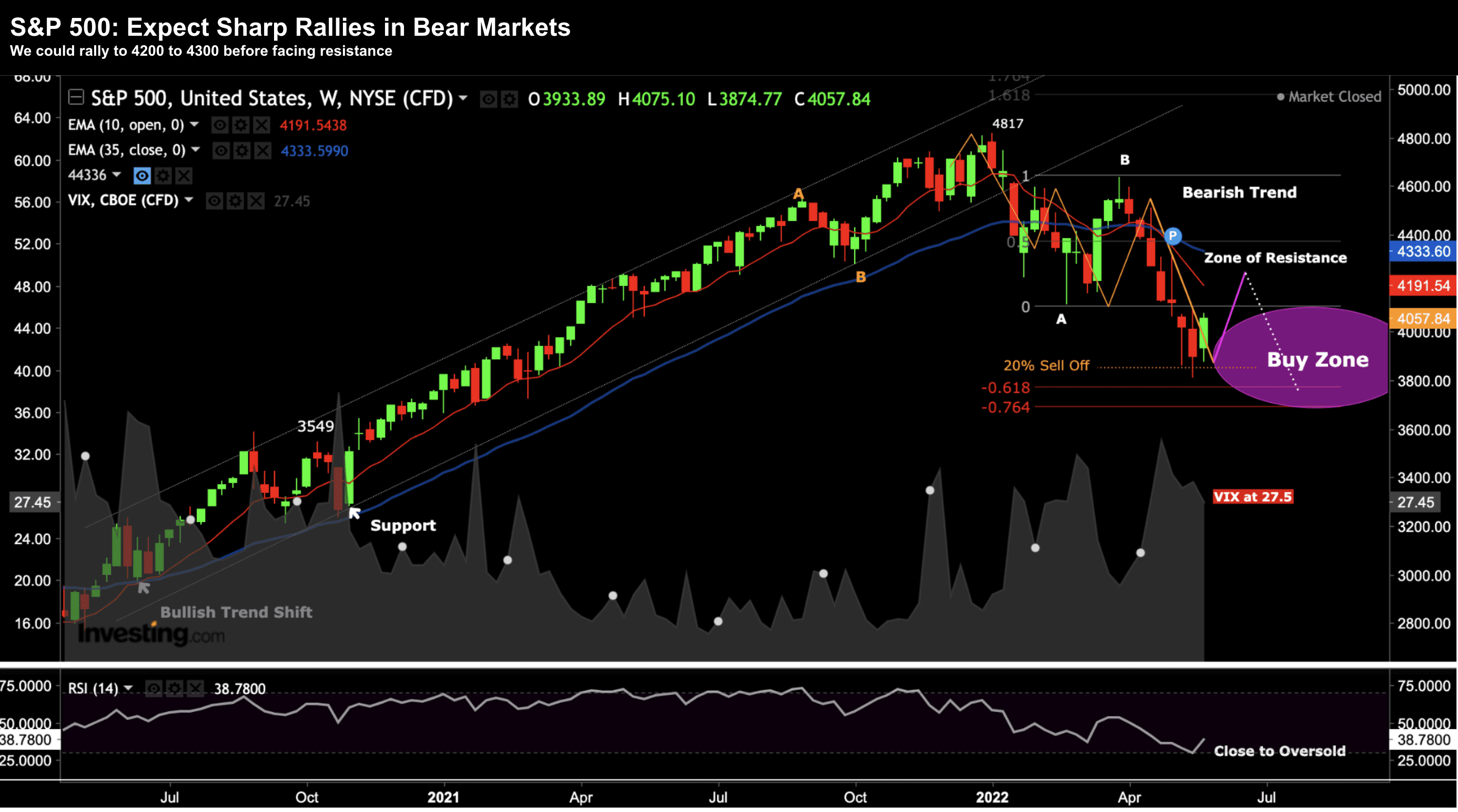

The market is likely to experience a technical short-term bounce. But don't expect it to be sustained. Whilst we may have formed "a low" - I don't think it's "the low" for 2022... here's why