Thoughts on ’22 with 5 Charts

Thoughts on ’22 with 5 Charts

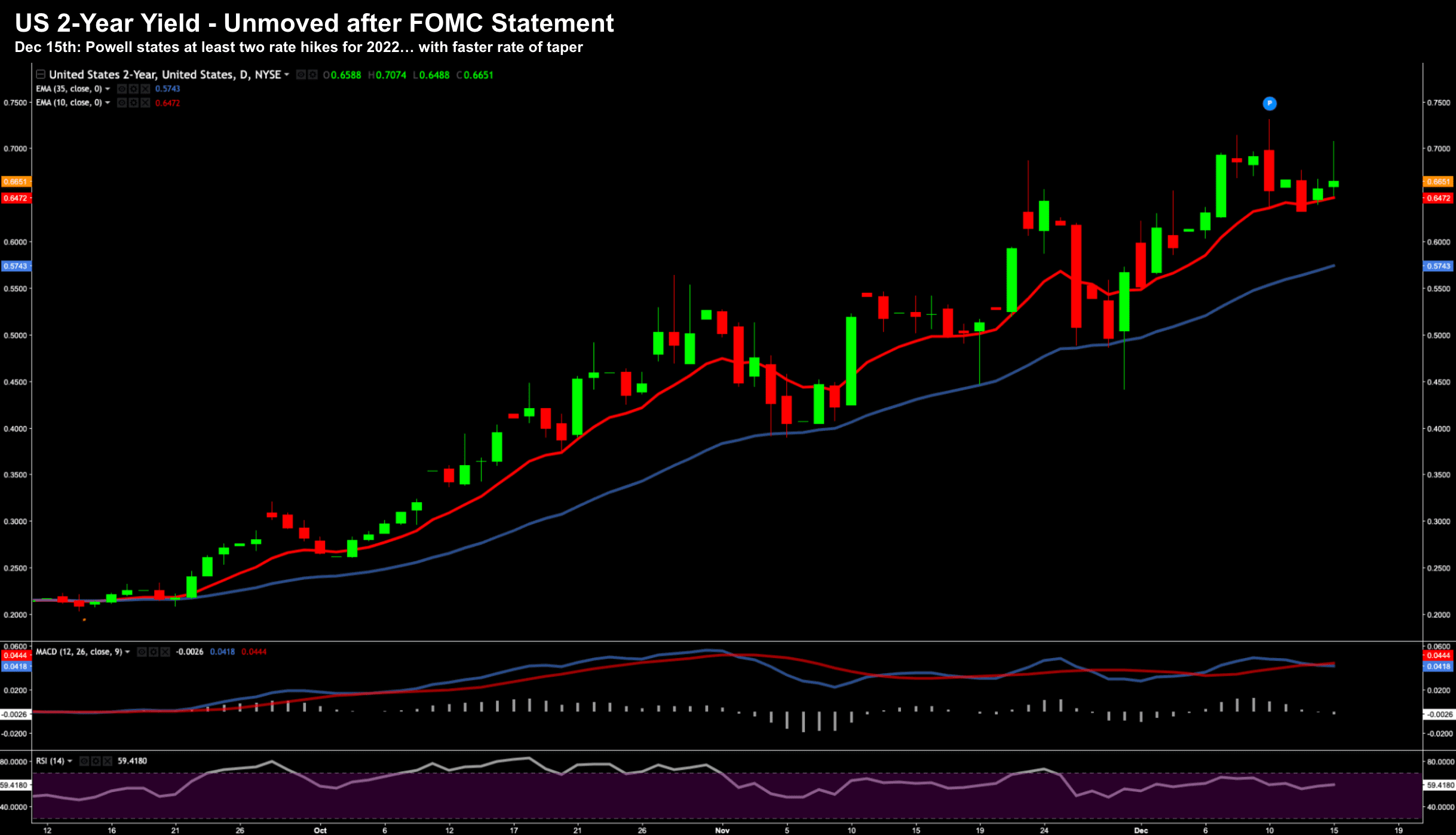

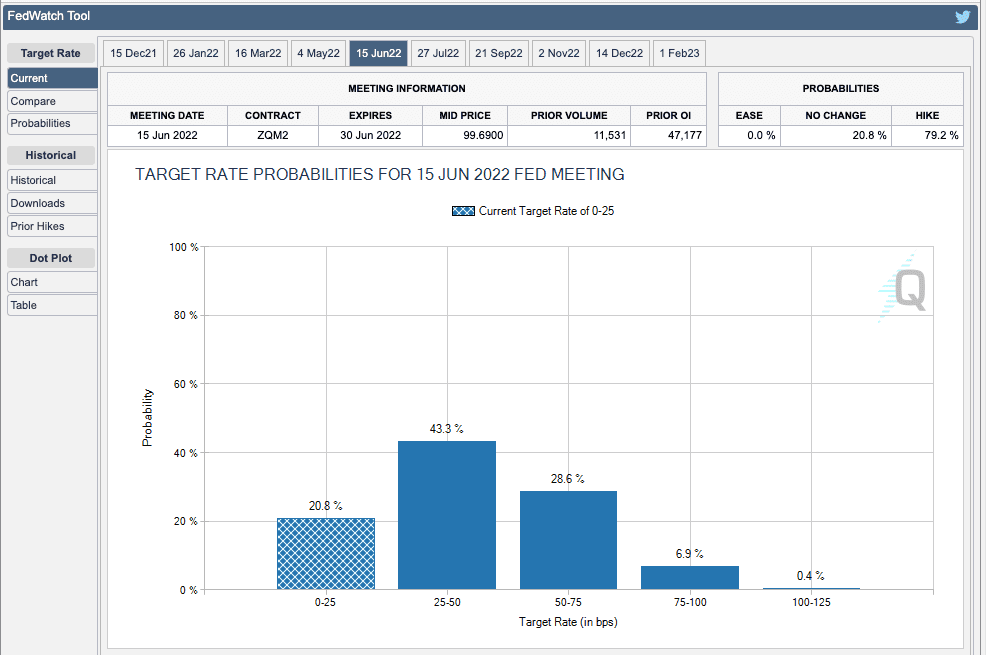

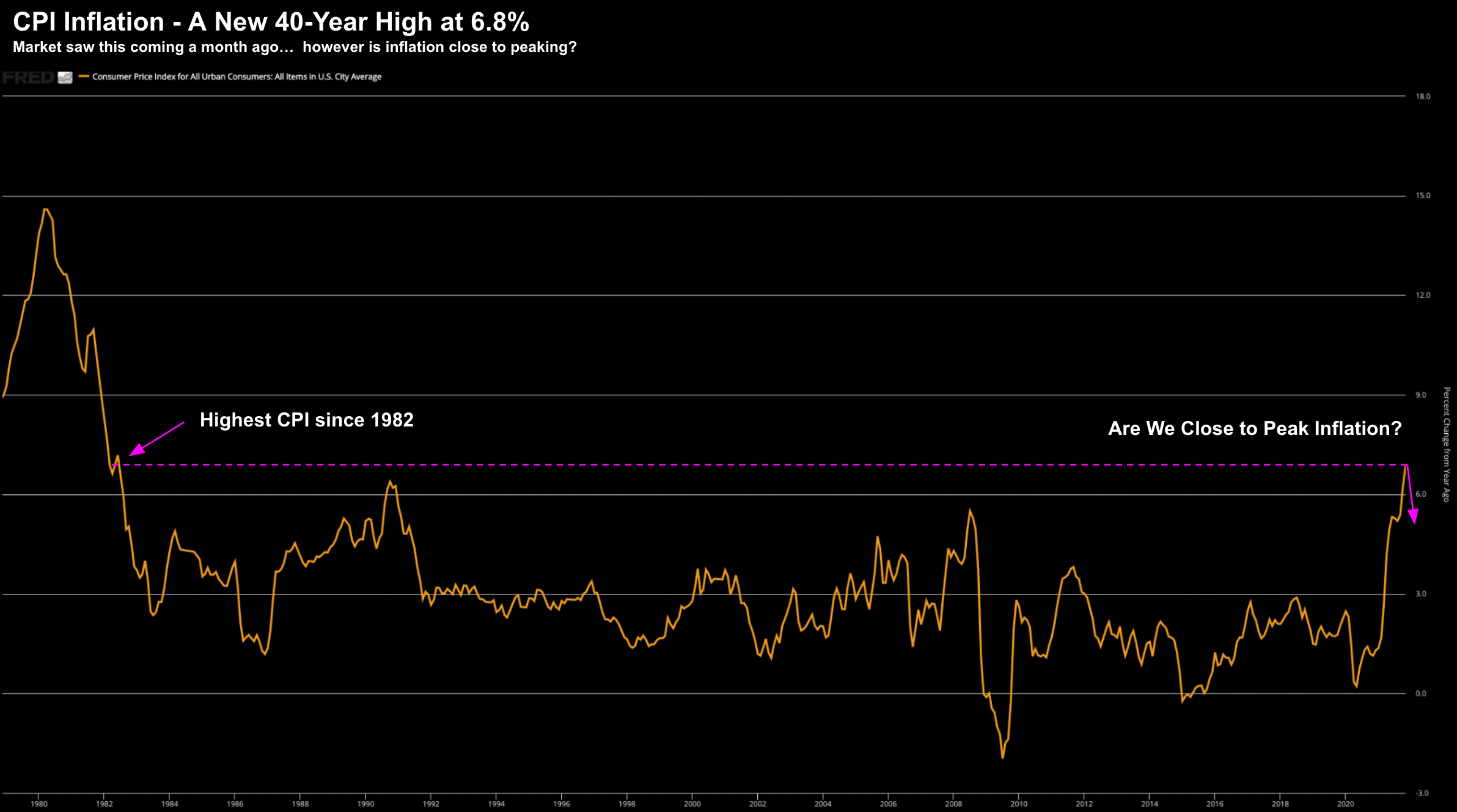

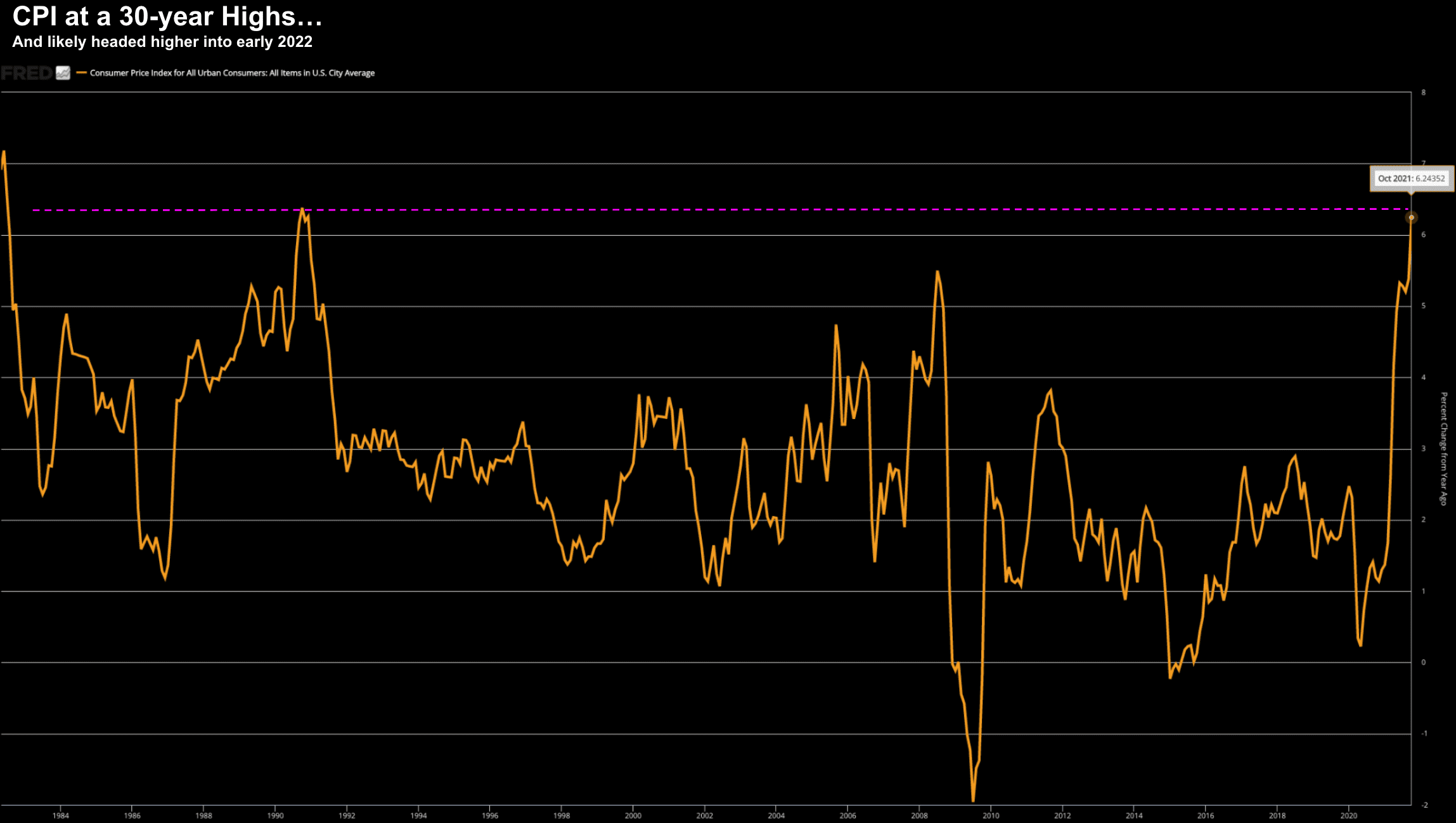

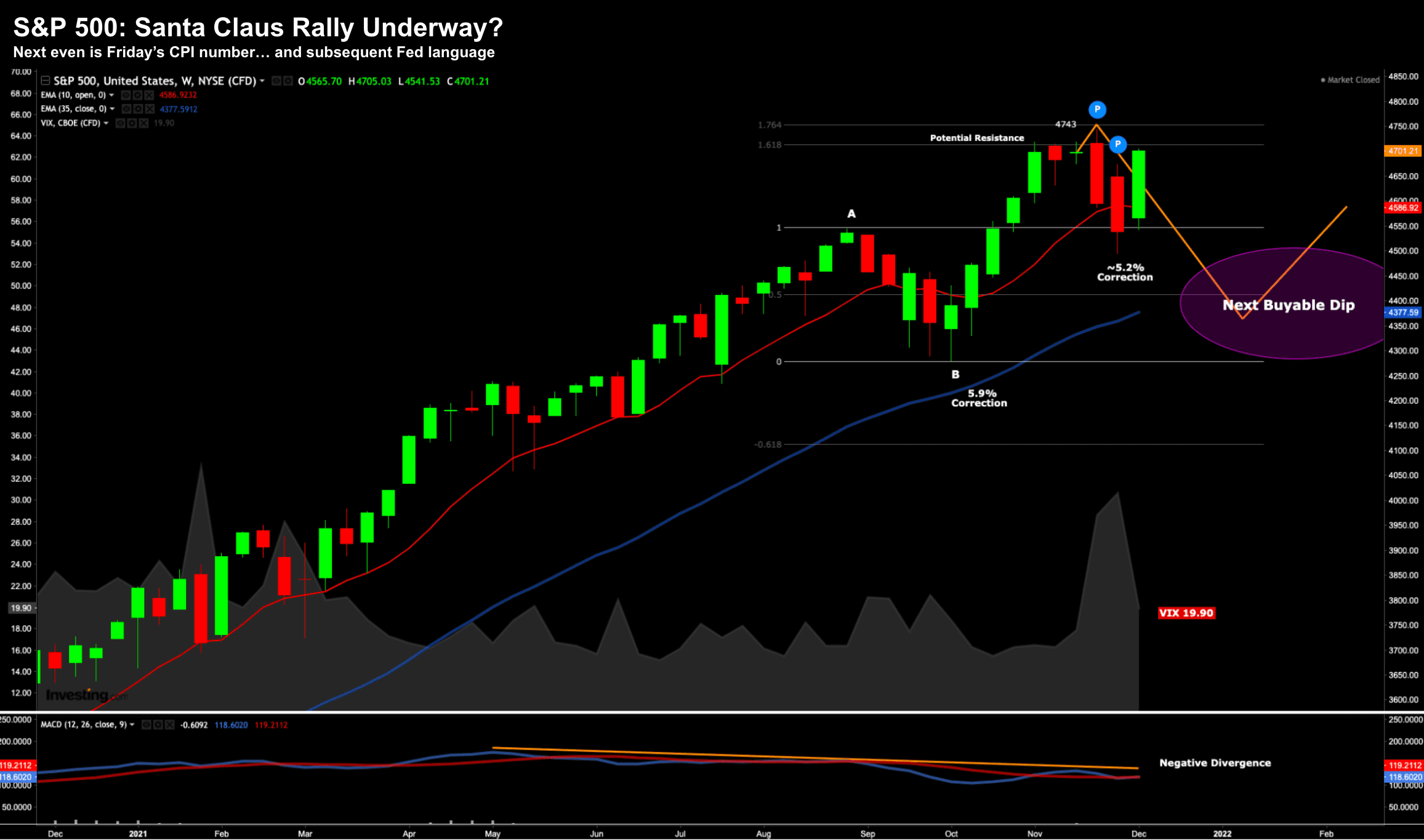

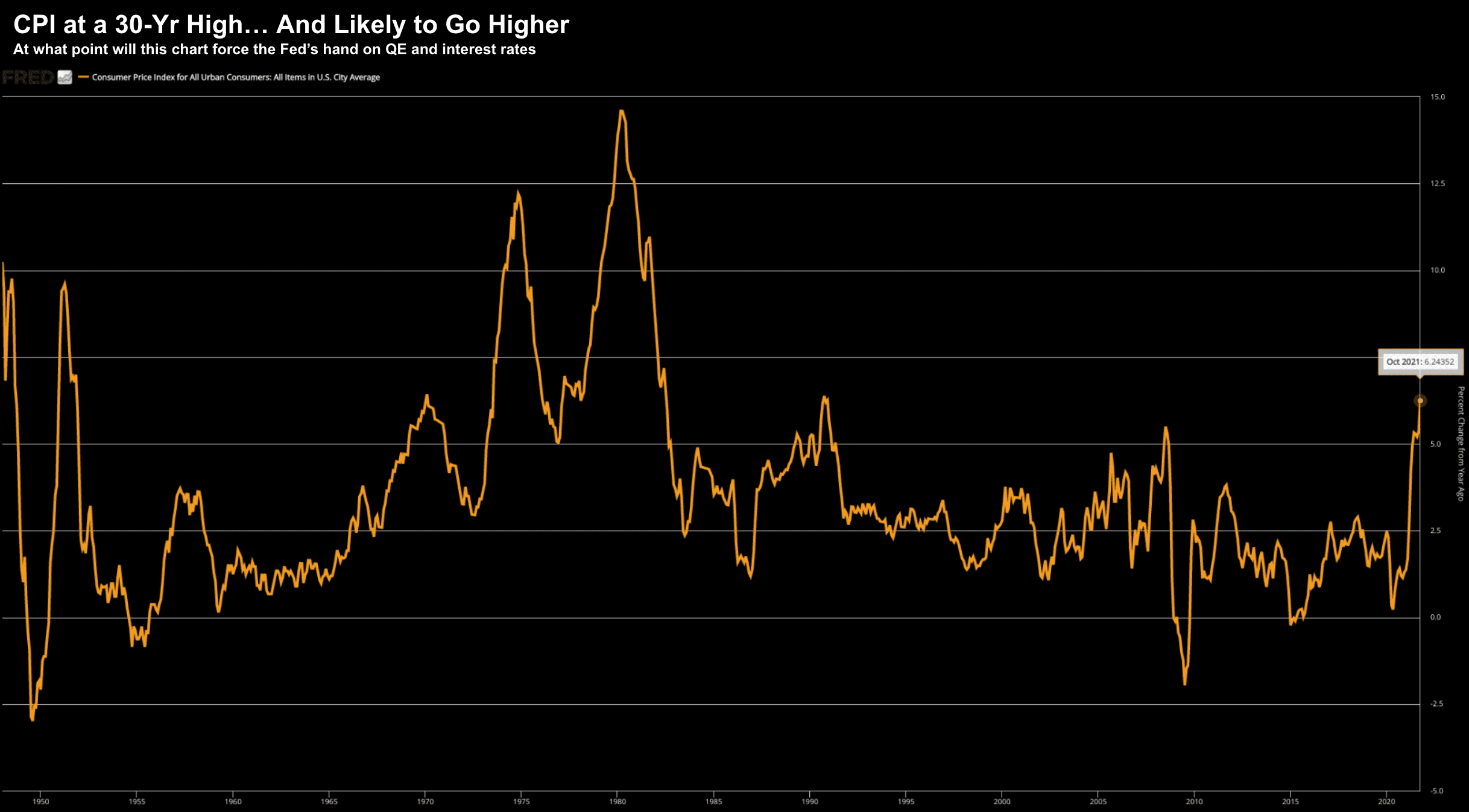

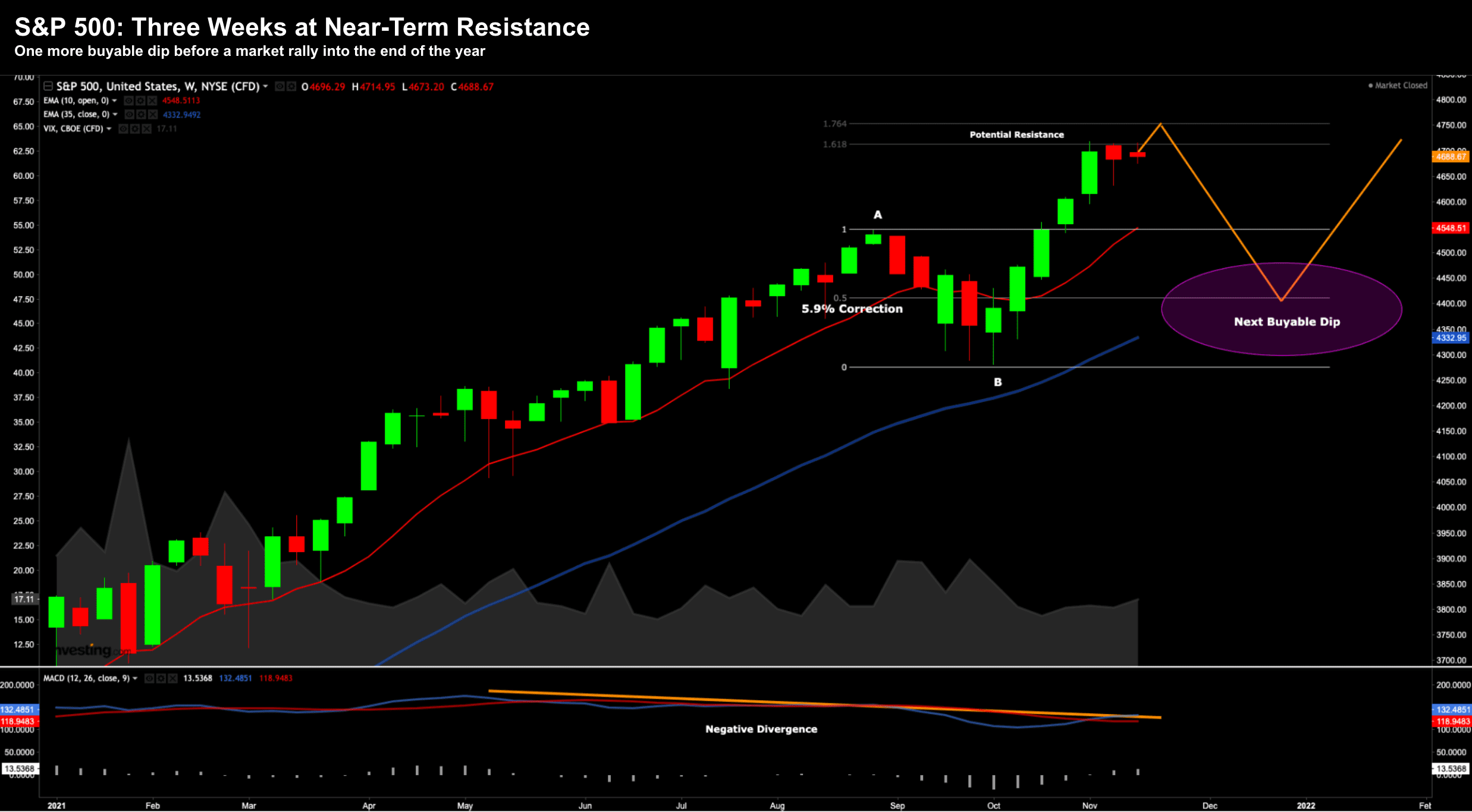

This post looks at what I think will be the most important (or influential) charts for this year. Spoiler alert: much of this centers on crude oil, inflation, rates and of course the Fed...