Consumer Confidence Sinks… Can the Market Rebound?

Consumer Confidence Sinks… Can the Market Rebound?

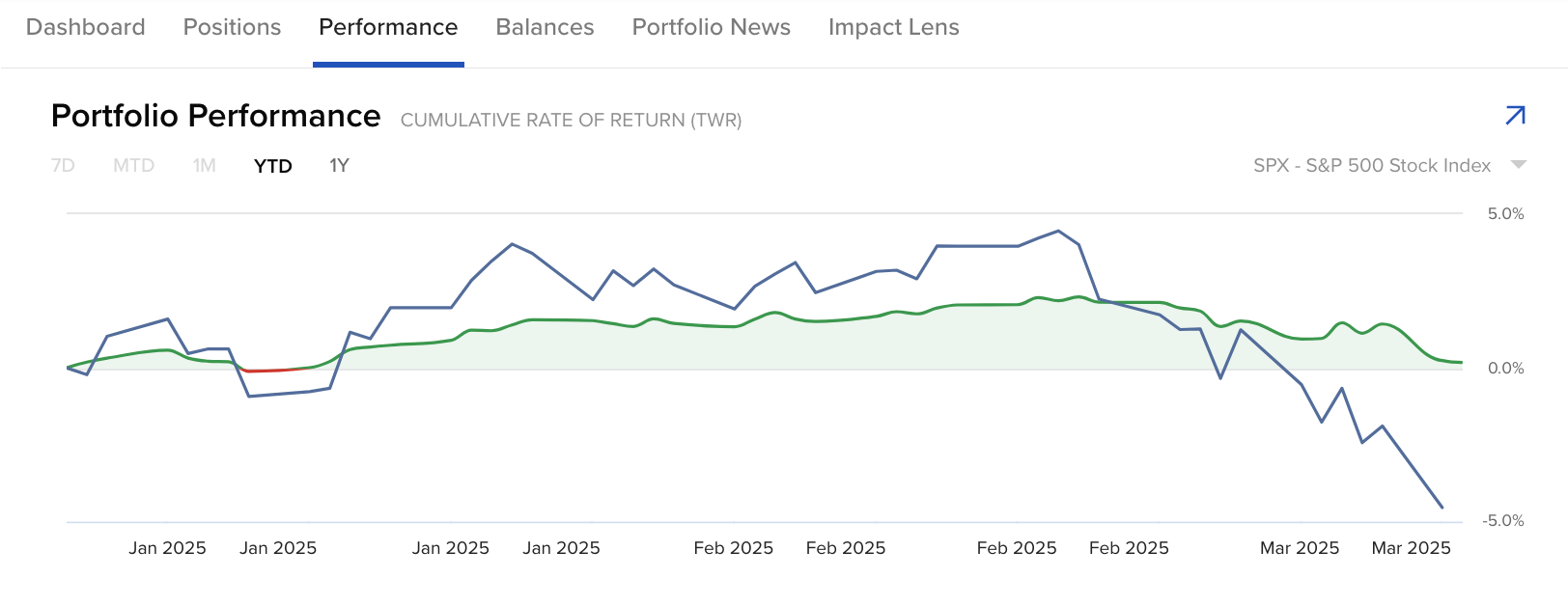

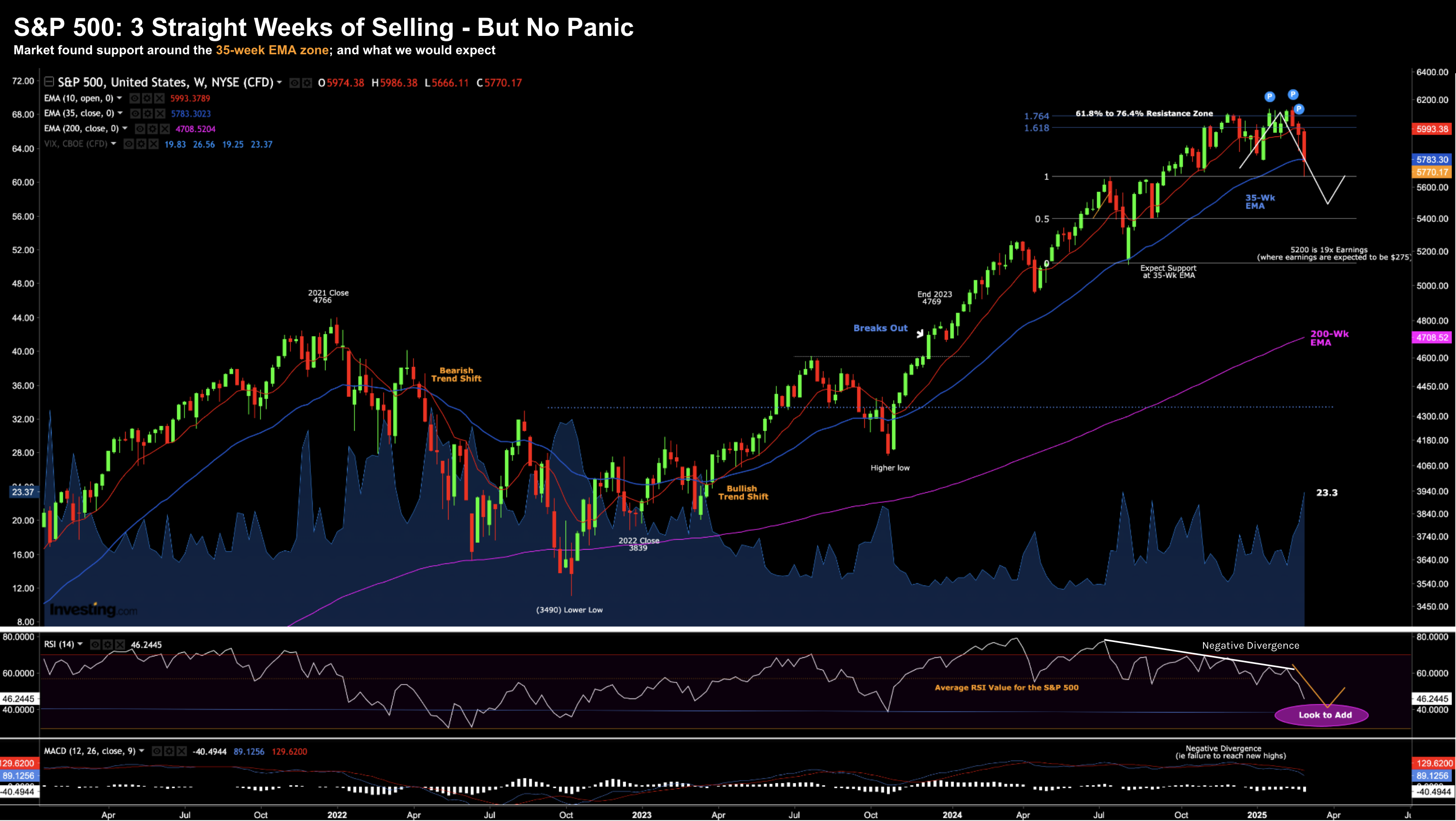

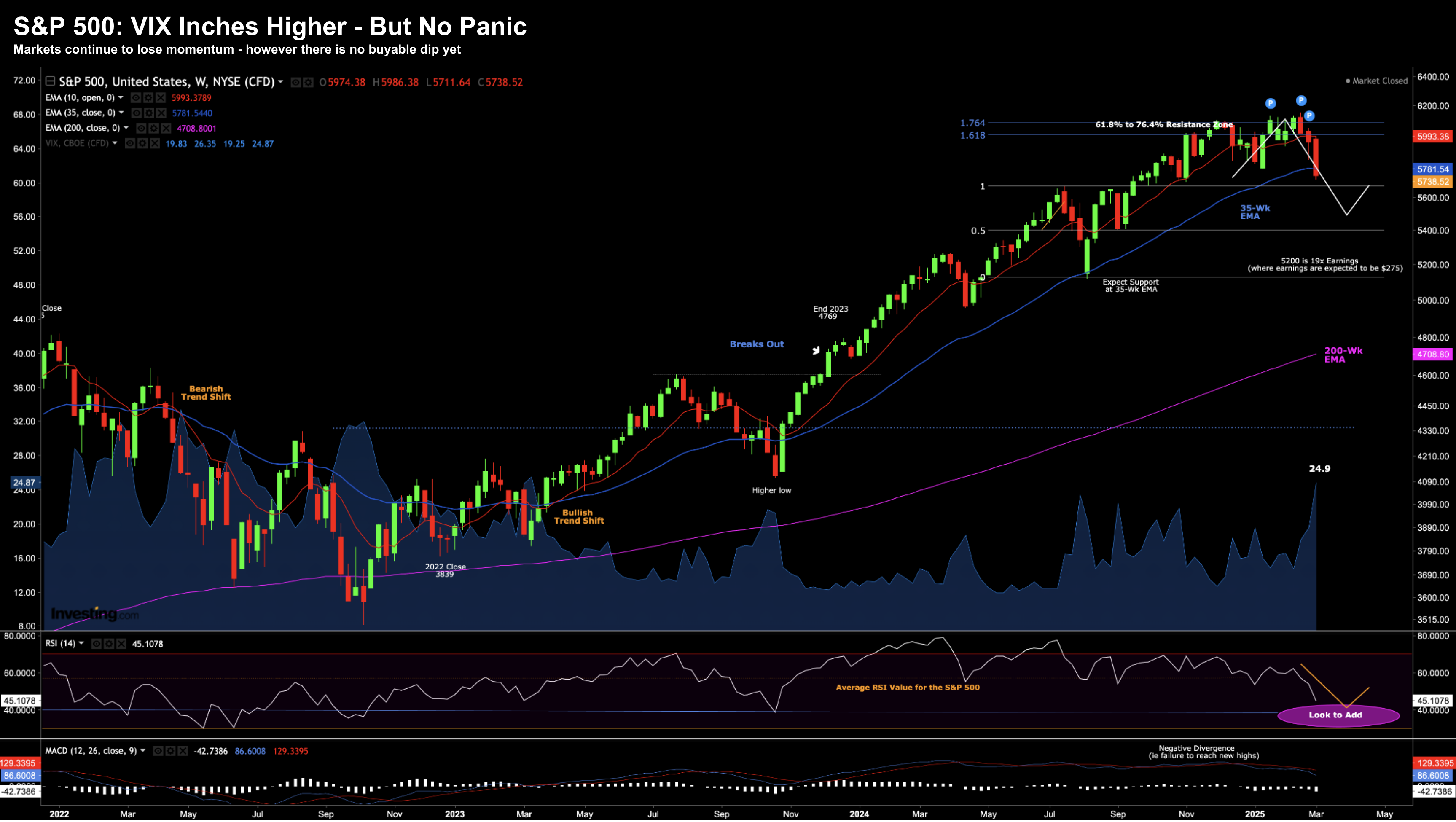

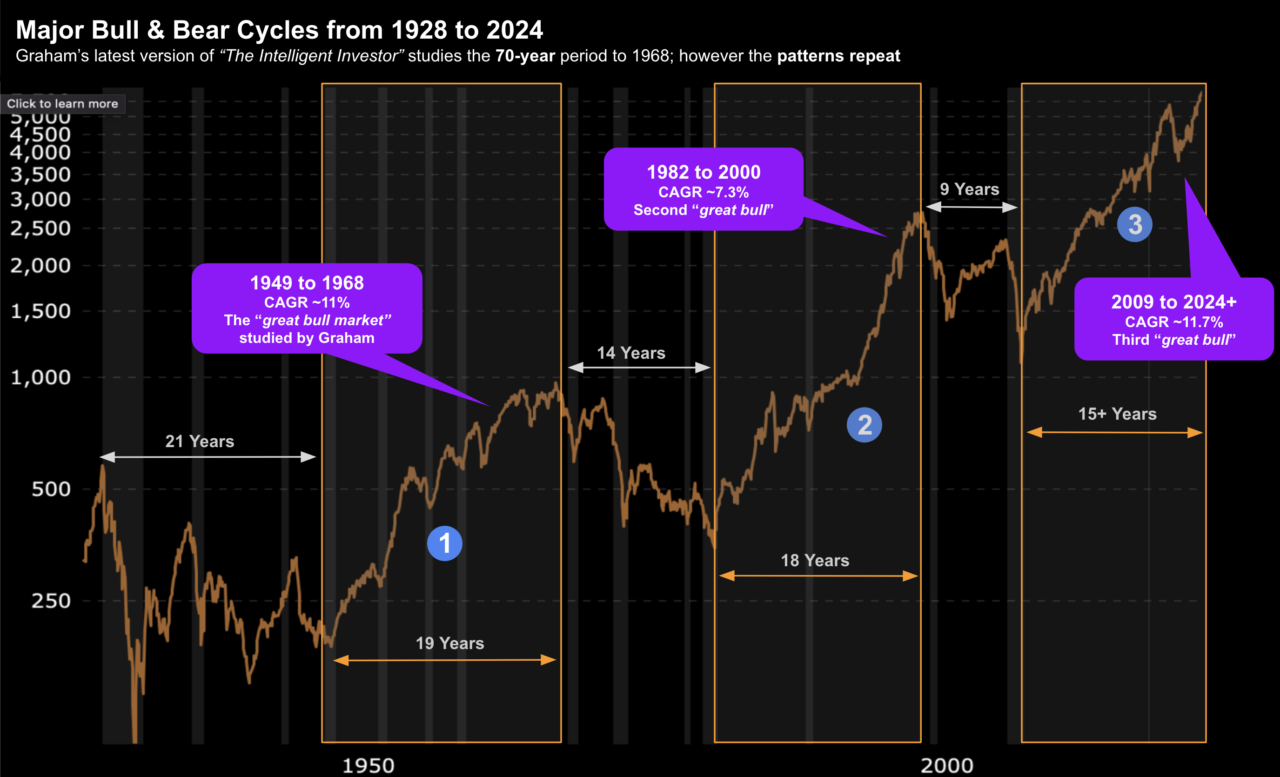

It was a roller-coaster week for stocks... maybe a hint of things to come? From mine, in the very short term, markets were deeply over-sold looking at its Relative Strength Index (RSI). Often when you see the RSI below a value of 30 - buying isn't too far away. The last time stocks sank ~10% over a few days was 2020. However, in the absence of any crisis, generally this will see both short covering and/or bargain hunting. The bigger question is whether stocks can follow through? I don't think we draw that conclusion yet...