The Trump Trade Stalls

The Trump Trade Stalls

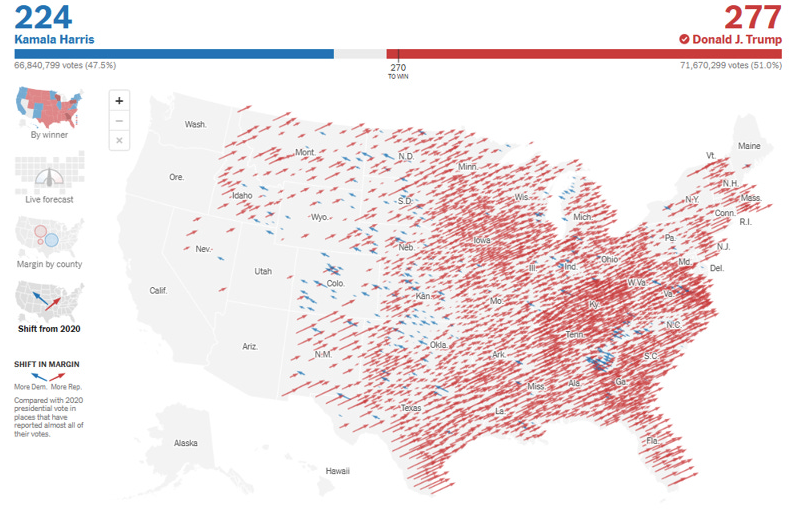

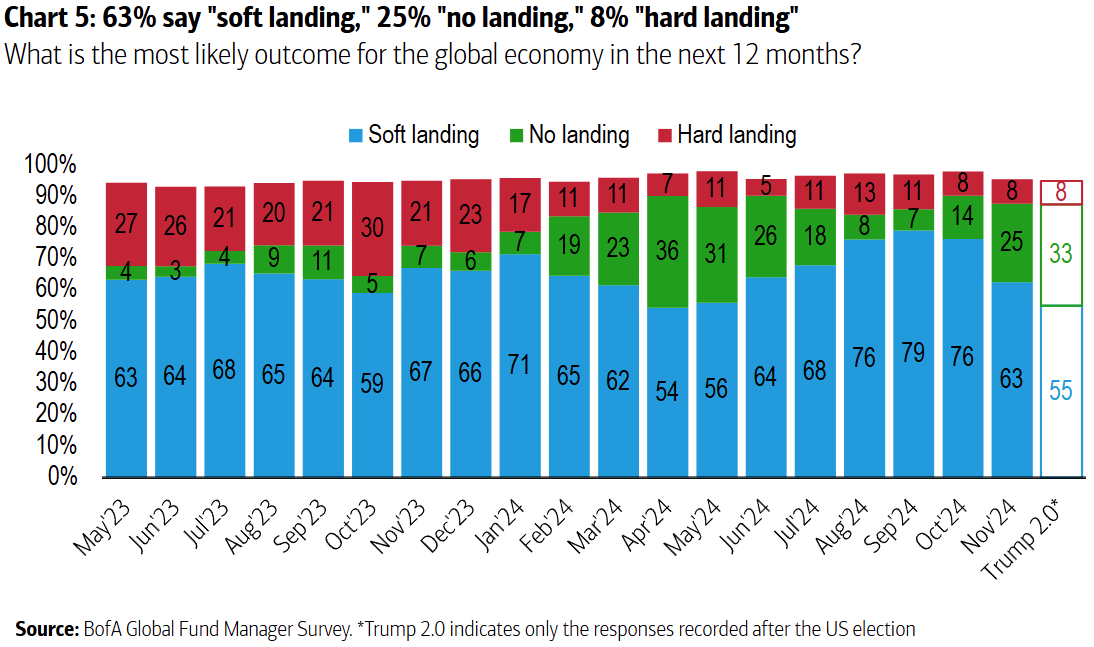

Last week when assessing the surge in markets - I offered examples of how market (sector) dynamics shifted. Adding to that theme - I was not overly surprised to read how institutional investors are putting money to work. For example, Bank of America Corp.’s monthly survey of global fund managers indicates that Trump's decisive win is perceived as a potential turning point for investment strategies. And whilst that could be true - it pays to look at history... what can we gauge from Trump 1.0 (and the impact on markets).